The digital asset market enters 2026 amidst a significant shift in maturity. While early years were defined by retail speculation, the current landscape is increasingly shaped by institutional adoption, regulatory clarity, and the integration of blockchain technology into traditional finance.

As the “four-year cycle” theory is tested by consistent demand from spot ETFs and corporate treasuries, investors in 2026 are looking beyond mere price action toward the underlying utility of these networks.

Bitcoin (BTC)

Past performance is not an indication of future results.

Bitcoin continues to solidify its role as “digital gold” in 2026, serving as a primary alternative store of value for both individuals and institutional portfolios.

- The asset has increasingly decoupled from tech stocks, with analysts noting its growing resilience as a hedge against fiat currency debasement and rising public sector debt.

- Spot ETFs remain a dominant driver of interest, with institutional vehicles now purchasing a significant portion of the newly issued supply following the 2024 halving.

- Use cases have expanded via Layer-2 solutions, allowing for more complex financial applications to be built directly on top of the most secure blockchain.

- Major Wall Street institutions, including Standard Chartered and Bernstein, have issued bullish 2026 outlooks, with price targets ranging from $150,000 to $200,000 in optimistic scenarios.

- Risks for 2026 include regulatory shifts in major economies and the potential for macroeconomic volatility to impact high-risk asset appetites.

Your capital is at risk. Not investment advice

Ethereum (ETH)

Past performance is not an indication of future results.

Ethereum remains the undisputed leader in smart contract functionality, powering the vast majority of the decentralised finance (DeFi) and NFT ecosystems.

- The Fusaka upgrade, completed in late 2025, has significantly improved the network’s efficiency and scalability, making transacting on the mainnet more cost-effective.

- Staking participation has reached new heights in 2026, with over 30 million ETH now locked to secure the network, creating a “yield-bearing” asset class for institutions.

- The growth of Layer-2 rollups like Arbitrum and Optimism has moved the bulk of retail traffic to faster, cheaper environments while maintaining Ethereum’s base-layer security.

- In 2026, the Glamsterdam upgrade is the primary technical focus, aiming to further decentralise block building and improve operational load handling.

- Risks to watch include increased competition from other high-speed Layer-1 networks and the technical complexity of maintaining a multi-layered roadmap.

Your capital is at risk. Not investment advice

Solana (SOL)

Past performance is not an indication of future results.

Solana has established itself as the premier high-performance blockchain, favoured by developers for its sub-second transaction finality and negligible fees.

- The Alpenglow upgrade, slated for early 2026, promises to replace proof-of-history validation with a process that reduces outage risks and improves network “liveness”.

- Institutional interest has surged following the full launch of Firedancer, a new validator client that significantly boosts the network’s theoretical throughput.

- Solana is now a primary hub for Real-World Asset (RWA) tokenisation, attracting billions in stablecoins and tokenised treasury products.

- The network’s low barriers to entry have made it the dominant platform for consumer-facing apps, from mobile-native dApps to high-frequency decentralised exchanges.

- Primary risks for Solana stakers include validator centralisation concerns and the historical challenge of maintaining network stability during periods of extreme traffic.

Your capital is at risk. Not investment advice

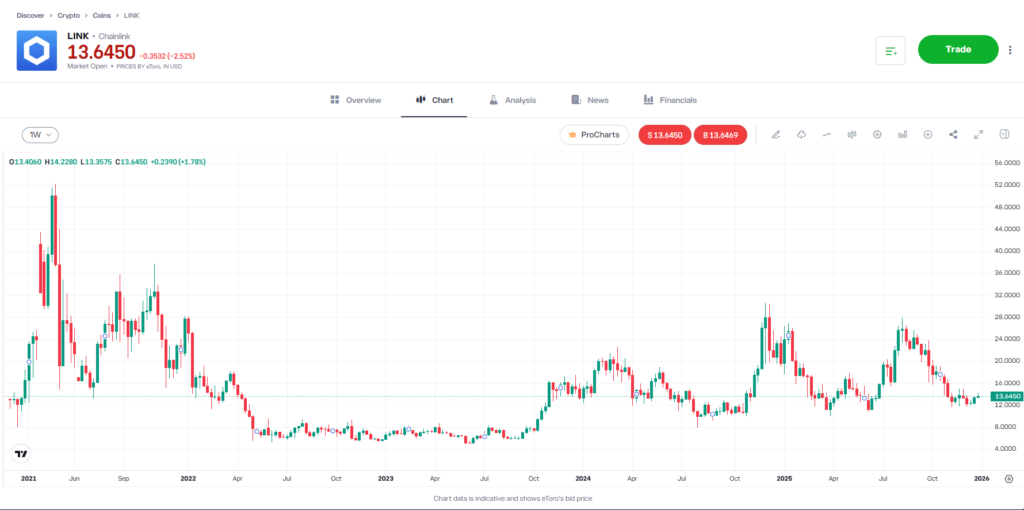

Chainlink (LINK)

Past performance is not an indication of future results.

- Chainlink acts as the essential “connective tissue” for the blockchain industry, providing secure, verifiable data to smart contracts via its oracle networks.

- The Cross-Chain Interoperability Protocol (CCIP) has become the industry standard for moving value and data between different blockchains in 2026.

- Chainlink is a key beneficiary of the institutional tokenisation trend, with global banks using its infrastructure to verify the backing of tokenised funds and real estate.

- The launch of the Chainlink Runtime Environment (CRE) has accelerated the development of institutional-grade smart contracts, reducing build times from months to weeks.

- A breakthrough confidential compute service, planned for early 2026, is set to unlock private smart contracts for sensitive financial transactions.

- Risks include competitor oracle services offering lower-cost (though often less secure) data feeds and the technical risk of maintaining cross-chain security.

Your capital is at risk. Not investment advice

Polygon (POL)

Past performance is not an indication of future results.

- Polygon has completed its transition to Polygon 2.0, successfully migrating from the MATIC token to the more versatile POL token.

- The AggLayer (Aggregation Layer) is a major 2026 driver, unifying liquidity across an ecosystem of interconnected ZK-powered chains.

- The “Gigagas” upgrade roadmap aims to scale Polygon’s throughput toward 100,000 transactions per second, specifically targeting enterprise-grade applications.

- Polygon remains the top choice for major brand partnerships, with global firms like Google Cloud and Reddit continuing to build infrastructure on its stack.

- The POL token now offers expanded utility, allowing holders to stake and earn rewards across multiple chains within the aggregated Polygon network.

- Risks for the 2026 outlook include intense competition within the Ethereum Layer-2 sector and the technical difficulty of unifying state across fragmented networks.

Your capital is at risk. Not investment advice

Final thoughts

As we progress through 2026, the crypto-asset market is no longer a fringe experiment but an increasingly legitimate component of the global financial system.

The projects listed above represent different “pillars” of this ecosystem—from Bitcoin’s store-of-value proposition to Chainlink’s essential data infrastructure. While the potential for growth remains significant, the digital-asset market is characterised by higher-than-average volatility and a rapidly shifting regulatory landscape. Investors should approach crypto with a long-term perspective, ensuring that any exposure is part of a well-balanced and diversified portfolio.

Learn more about crypto and other assets at the eToro Academy.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.