2021 was, without a doubt, a huge year for cryptoassets.

During the year, we saw a number of major developments in the crypto space including a $1.5 billion Bitcoin purchase from Tesla, the launch of the first Bitcoin exchange-traded-fund (ETF), and the arrival of PayPal’s crypto checkout service.

We also saw major financial institutions such as Goldman Sachs and JP Morgan show more interest in digital assets, and companies such as Coca-Cola and Dolce & Gabbana launch non-fungible tokens (NFTs).

All of these developments helped pushed cryptoassets to record highs, making crypto the best-performing asset class for the year.

5 top cryptoassets to watch in 2022

This year, we can expect to see plenty more exciting developments in the crypto world. With that in mind, we have put together a guide on some of the top cryptoassets to watch in 2022. The cryptoassets covered in this guide include:

- Ethereum (ETH)

- Polygon (MATIC)

- Solana (SOL)

- Decentraland (MANA)

- The Sandbox (SAND)

All of these digital assets are available on eToro and can be found under the ‘Crypto’ section of the platform.

Ethereum

- Ethereum (ETH) is a programmable blockchain technology that enables highly secure, decentralised blockchain-related applications to be built and run. When people talk about trading Ethereum, they’re actually talking about trading ‘Ether’ (ETH) – a token designed to fuel the Ethereum ecosystem. Ether is currently the second largest cryptoasset by market cap behind Bitcoin.

- Ethereum has the potential to be an incredibly disruptive technology because it allows smart contracts to be written into the code on the blockchain. Smart contracts are digital agreements that make a wide range of applications possible, including NFTs (cryptoassets representing digital items such as images, videos, or even virtual land) and decentralised finance (DeFi) apps.

- While Ethereum has an enormous amount of potential, it does have its flaws. One is that it’s not as fast as some other blockchain platforms. Another is that transaction fees (gas fees) are also high. As a result of these flaws, newer, more efficient blockchains such as Solana and Cardano have gained adoption.

- However, Ethereum is currently in the process of upgrading its platform. This upgrade involves switching from a ‘proof-of-work’ model to a ‘proof-of-stake’ system. The first phase of this major upgrade has already been completed. The next phase is set to be completed this year before the final phase is completed in 2023.

- When this network upgrade is completed, Ethereum will be substantially faster, cheaper, and more scalable. Post upgrade, the network should be able to handle up to 100,000 transactions per second (TPS)1, versus around 65,000 for Solana and around 250 for Cardano. This should make it significantly more attractive to developers.

- One thing that could boost Ethereum in 2022 is the continued growth of NFTs. Last year, we saw several major corporations embrace this exciting new technology. Coca-Cola, for example, raised $575,000 in an NFT auction to benefit charity. Meanwhile, Nike made headlines when it bought a virtual shoe company that makes NFTs. Overall, NFT sales hit $21 billion2 in 2021, up from just $95 million the year before. In 2022, we’re likely to see further growth in the NFT market as the technology becomes more mainstream.

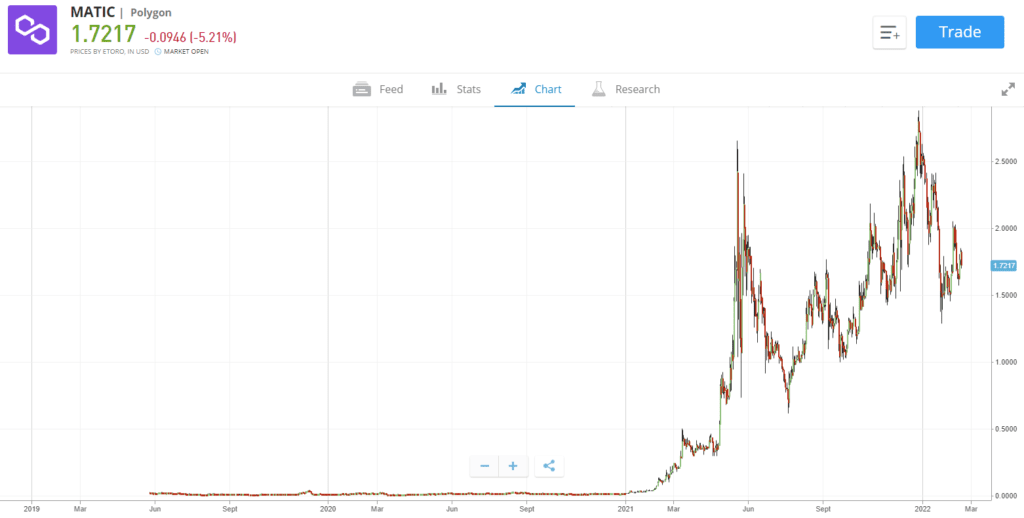

Polygon

- Polygon (MATIC) is a platform for building and connecting Ethereum-compatible blockchain networks. It has been designed to solve some of the problems associated with other blockchains such as slow speeds and high gas fees, without sacrificing security. It is a ‘Layer 2’ solution meaning that it has been built on top of the Ethereum blockchain.

- One of the big advantages of Polygon, relative to Ethereum, is its scalability. Polygon works alongside Ethereum and can process Ethereum-based transactions, however, it can handle transactions way faster because they are processed on a separate blockchain. Transaction fees are also significantly lower compared to Ethereum. This scalability makes it attractive for developers looking to create decentralised applications.

- As a result of its scalability, Polygon is seeing rapid adoption and last year, a number of well-known companies embraced the technology. Fashion giant Dolce & Gabbana, for example, launched an NFT collection using the Polygon platform. Meanwhile, consulting firm Ernst & Young (EY) said that it would use Polygon’s protocol and framework to deploy its own blockchain products on the Ethereum blockchain. In 2022, we are likely to see more partnerships with major corporations.

- In December 2021, Polygon announced that it had partnered with Reddit co-founder Alexis Ohanian and his venture capital firm Seven Seven Six to launch a $200 million dollar fund to invest in social media, gaming, and Web 3.0 projects on the Polygon network. This investment could potentially help to boost network adoption in 2022 and beyond, especially if some of the projects are highly successful.

- Recently, it was announced that Ryan Wyatt, head of gaming at YouTube, will be leaving YouTube and joining Polygon Studios as CEO. In his role at Polygon, he will be focused on growing the developer ecosystem through investment, marketing, and developer support, and bridging the gap between Web 2.0 and Web 3.0. This is an exciting development as Wyatt has had a lot of success at YouTube.

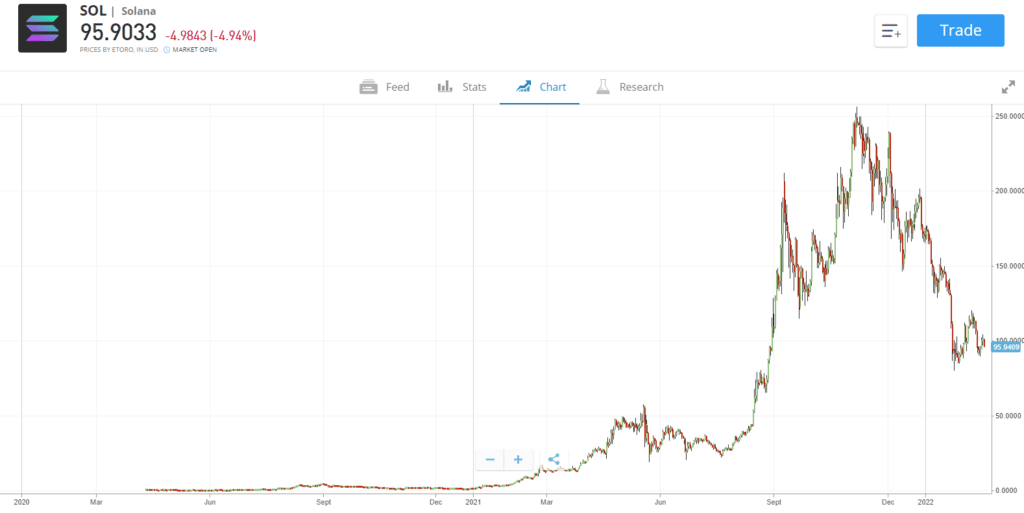

Solana

- Solana (SOL) is a blockchain platform that aims to provide high transaction speeds at a low cost without sacrificing decentralisation. Like Ethereum, it can support smart contracts. Solana’s native cryptocurrency is SOL, which is used to pay transaction fees on the network.

- Solana aims to improve blockchain scalability by using a combination of proof-of-stake and ‘proof-of-history’ technology. Using this combination, it can handle up to 65,000 TPS3. To put that number in perspective, payments company Visa can handle around 1,700 TPS while Ethereum can only handle 15 to 45 TPS.

- As well as being faster than Ethereum, it is also much more economical. At times, Ethereum can charge up to $100 per transaction. By contrast, the average transaction on the Solana ecosystem costs around $0.00025.

- As a result of Solana’s speed, affordability, and scalability, it’s rapidly gaining traction with developers. Currently, more than 400 projects4 are being developed within Solana’s ecosystem including Solanart – one of the major NFT marketplaces. This figure is likely to rise in 2022 and beyond.

- 2022 could be a big year for Solana. According to Bank of America crypto analyst Alkesh Shah, Solana’s cost advantages could see it steal market share from Ethereum in areas such as micropayments and gaming. Shah believes that Solana’s advantages in blockchain-based payments are so strong that it may eventually become the ‘Visa of the digital asset ecosystem.

Decentraland

- Decentraland (MANA) is a 3D virtual world platform that’s powered by the Ethereum blockchain. Its cryptocurrency, MANA, can be used to purchase land in this virtual world as well as in-world goods and services.

- One thing that differentiates Decentraland from other popular blockchain-based games is the fact that it’s not controlled by a centralised organisation. Instead, there’s a Decentralised Autonomous Organisation (DAO) that governs the policies determining how this virtual world operates.

- Decentraland, which is quite similar to gaming platform Roblox, is one of the major ‘metaverse’ cryptoassets and it received a lot of attention in November last year, around the time Facebook announced that it would be focusing heavily on the metaverse going forward and changing its name to ‘Meta Platforms.’

- Since November, users have rushed to buy virtual land in Decentraland. And according to artificial intelligence start-up NWO.ai – which uses machine learning and human metadata to identify global shifts early – the virtual land grab is likely to persist in 2022 as the metaverse gains momentum and investors realise that they can potentially monetise their virtual assets.

- Decentraland has announced a number of partnerships with well-known companies and organisations. For example, it recently collaborated with electronics giant Samsung, which launched a virtual replica of its New York store in Decentraland. In 2022, we can expect to see more partnerships like this.

The Sandbox

- The Sandbox (SAND) is a metaverse game built on the Ethereum blockchain. In its metaverse play space, users can create or buy assets on the blockchain using SAND tokens.

- The Sandbox brings the advantages of blockchain technology to gaming. Users are considered owners of the assets they create, and they can set a price for their assets and sell them at any point.

- Interest in The Sandbox is rising. This is illustrated by the fact that in 2021, its user base grew five-fold, reaching 500,000 wallets5. It now has over 30,000 monthly active users, about half of which spend more than an hour per day in its virtual world. Like Decentraland, The Sandbox has been a big beneficiary of Facebook’s name change to Meta.

- The Sandbox has partnered with celebrities including rapper Snoop Dogg. Last year, the artist bought virtual land in its metaverse and he is currently building a mansion there. It has also partnered with Adidas, which has purchased a plot of virtual land inside its world. Further partnerships in 2022 could boost the popularity of this metaverse platform.

- In 2022, The Sandbox plans to launch its first virtual concert featuring Snoop Dog and other artists. It also plans to make its metaverse available to mobile users. These developments could help the cryptoasset gain momentum.

How to invest in cryptoassets

Interested in learning more about cryptoassets and how to invest in them? Our ‘Guide to Trading and Investing in Cryptocurrency’ could be a great place to start. This guide has been designed to walk you through the basics of crypto and explain how you can invest in crypto with eToro.

Sources

- https://www.thestreet.com/crypto/ethereum/ethereum-2-upgrade-what-you-need-to-know

- https://www.reuters.com/markets/europe/nft-sales-hit-25-billion-2021-growth-shows-signs-slowing-2022-01-10/

- https://www.binance.com/en/news/top/6737303

- https://solana.com/news/solana-ecosystem-news

- https://www.marketing-interactive.com/softbank-leads-us93m-funding-into-nft-gaming-firm-the-sandbox

Charts sourced from eToro platform 17/02/2022.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk. Tax on profits may apply.

This publication is considered a marketing communication and as such, it does not contain and should not be taken as containing, investment advice, personal recommendation, or an offer or solicitation to buy or sell any financial instruments. This publication has not been prepared in accordance with the legal and regulatory requirements to promote independent research. In producing this material, eToro has not taken any particular investment objectives or financial situation. Any references to past performance of a financial instrument, a financial index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilising publicly-available information. This communication must not be reproduced without consent from eToro.