The Daily Breakdown takes a closer look at Amazon, as the stock’s valuation has come down and amid strong earnings growth.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Friday’s TDLR

- Analysts expect strong growth

- AMZN’s valuation has fallen

- But can the stock gain enough momentum?

Deep Dive

Many investors think of Amazon as an online retailer, but it’s become a behemoth in the cloud computing space — with its Amazon Web Services unit — and has formed into a digital advertising juggernaut. Of course, it’s ventured into other businesses too, like online video streaming, audiobooks, music, pharmacy, and Whole Foods, among other things.

For years, Amazon was known as a great business, but too expensive of a stock. Has that changed? Let’s dig into the fundamentals and see what’s going on beneath the hood of this $2.3 trillion giant.

Forward Growth

Looking ahead, analysts expect roughly 9% to 10% annual revenue growth in 2025, 2026, and 2027. For investors who have followed Amazon over the years, that may seem low. But consider that if these estimates come to fruition, the company would generate more than $830 billion in sales in fiscal 2027.

On the earnings front, it’s more impressive. Estimates call for 20.5% growth this year, 17% growth in 2026, and 22.7% growth in 2027.

I must stress that using multi-year estimates is difficult, and should be taken with a grain of salt. No one knows what will happen in October…let alone in October 2027. However, if earnings growth can outpace revenue growth, it bodes well for Amazon’s margins.

Valuation and Risks

Source: Bloomberg, eToro

Amazon’s history is a case study in business and stock valuation. For years, this stock was expensive, but not many firms had the addressable market that Amazon did — and it allowed AMZN to grow into its rich valuation over the years.

In that time, we’ve seen Amazon’s valuation decline as its earnings have accelerated. In fact, Amazon has a lower forward P/E ratio than Walmart!

While the firm’s valuation has come down, many components aside from earnings have increased. For instance, operating margins and return on assets — the latter of which measures how effectively a company uses its assets to generate profit — have more than tripled over the last decade from roughly 3% in 2016 to more than 11% currently.

While Amazon’s cloud business is a bit more immune to macro-related volatility, Amazon’s main risk is the economy. If the US were to enter a recession and consumer spending took a major hit, Amazon’s revenue and business model would be disrupted. Further — and like most Magnificent 7 stocks — Amazon faces potential antitrust and headline risks, as well as ongoing trade-war risks.

Want to receive these insights straight to your inbox?

The Setup — Amazon

For what it’s worth, the consensus price target from analysts is currently near $240.

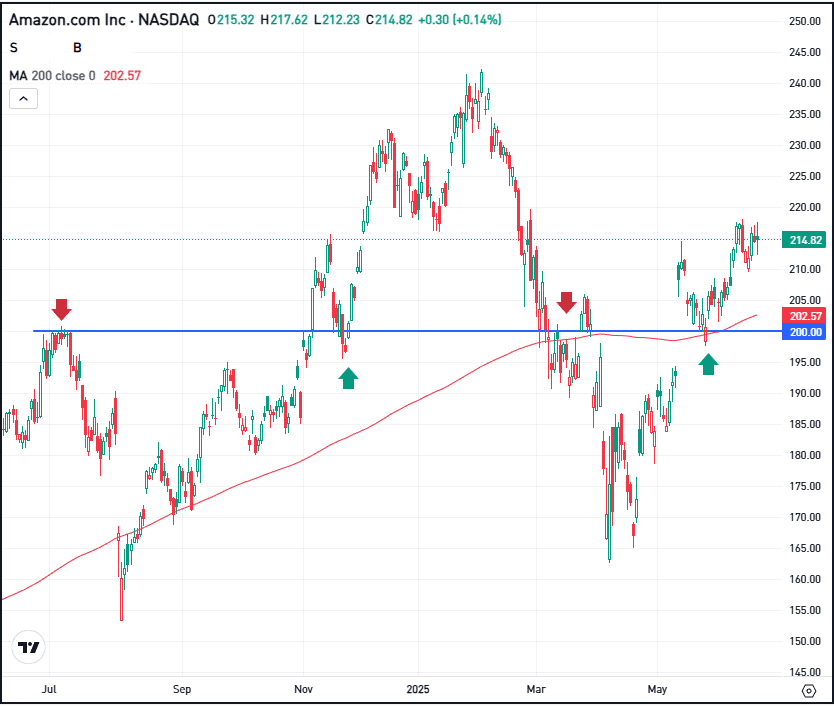

In July, Amazon struggled to break through the $200 level, then eventually did so in November. It’s been a bumpy ride since then, but now shares are holding above this level and the 200-day moving average.

If it can continue to do so, bulls may be able to maintain momentum.

On the one hand, shares are up just 6% from the early July highs. On the other hand, the stock is still down about 12.5% from its record highs in the $240s. Given its elevated growth rates and strong secular businesses, combined with a declining valuation, some investors may view Amazon stock as attractive under these conditions.

For other investors though, they may pass on the stock over certain macro- and company-specific concerns.

Options

Investors who believe shares will move higher over time may consider participating with calls or call spreads. If speculating on a long-term rise, investors might consider using adequate time until expiration.

For investors who would rather speculate on the stock decline or wish to hedge a long position, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.