China responds to the trade escalation from Washington. The Daily Breakdown digs into the latest of what’s moving markets.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening

China’s Answer

Markets had been missing one thing over the past few months: volatility. Now, there’s plenty of it.

Crypto rebounded over the weekend, and stocks surged on Monday. The S&P 500 climbed 1.6%, the Nasdaq 100 jumped more than 2%, and the Russell 2000 rallied nearly 3%. However, those gains are unwinding on Tuesday, as China responds to the White House’s initial trade-war escalation from Friday.

According to Bloomberg: “China sanctioned the US units of a South Korean shipping giant and threatened further retaliatory measures on the industry, the latest in a series of tit-for-tat moves as Beijing and Washington jockey for leverage before expected trade talks.”

If that’s where the escalation ends — if Washington doesn’t respond — markets may very well move on. But if there is another response, investors risk seeing a renewed “risk-off” reaction like we saw on Friday.

Bank Earnings

JPMorgan, Wells Fargo, Citigroup, BlackRock, and Goldman Sachs reported earnings this morning, triggering a mixed reaction in the financial sector ETF — the XLF.

Across the board, these firms beat expectations on both earnings and revenue. However, the reaction has been underwhelming. Financials are the second-largest sector in the S&P 500, so the strong start to earnings season is still a positive sign. Now the focus shifts to how these stocks perform in the days and weeks ahead.

Want to receive these insights straight to your inbox?

The Setup — GRAB

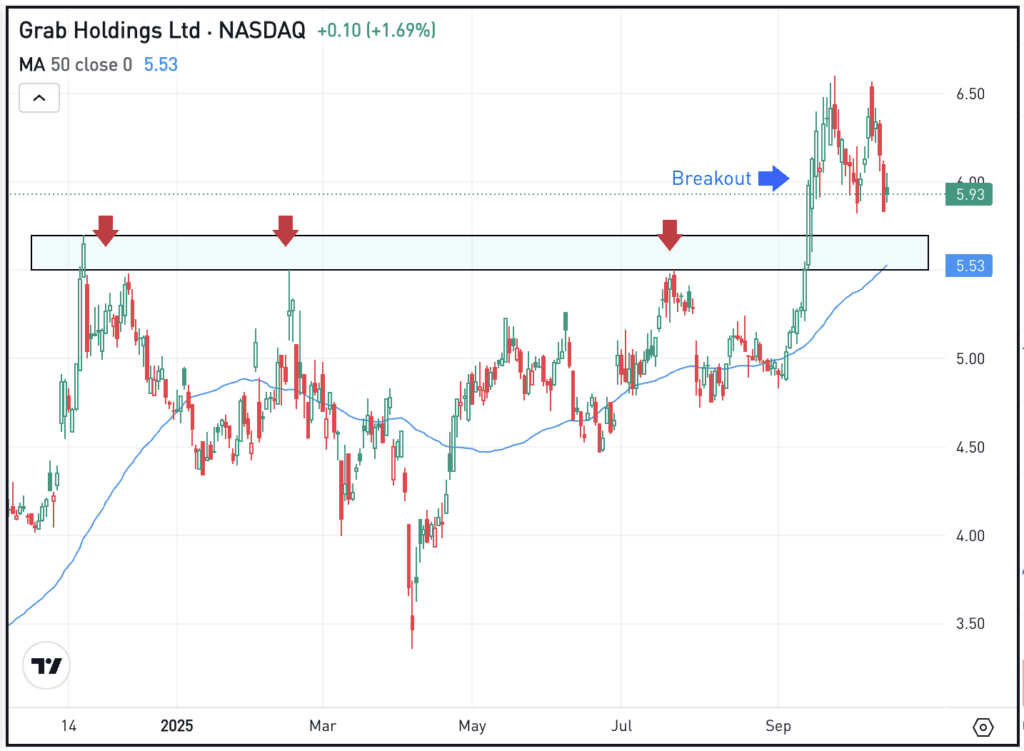

Shares of Grab have been in focus lately, as shares rallied more than 20% in September. Now pulling back, bulls are keeping an eye on the chart.

That’s as the stock dips down to a prior area of resistance, in the range of $5.50 to $5.70. The 50-day moving average is near this zone as well and bulls are hoping that this range acts as support on this dip. One risk is that overall market volatility continues to increase and support does not hold for GRAB stock.

Options

As of October 13th, the options with the highest open interest for GRAB stock — meaning the contracts with the largest open positions in the options market — were the January 2027 $10 calls, followed by the January 2027 $7.50 calls and the January 2026 $7.50 calls.

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Johnson & Johnson are slightly lower in pre-market trading after the firm reported its Q3 results. Earnings of $2.80 per share beat expectations of $2.76 per share, while revenue of $24 billion beat estimates of $23.75 billion. Shares of JNJ recently hit new record highs and are up 32% so far this year. Dig into the fundamentals for JNJ.

Bitcoin is back under pressure this morning for the same reasons that stocks are too. Now bulls will look to see if current support in the $107K to $111K region remains in play, while the 200-day moving average lingers near the bottom of this range. Check out the chart for BTC.

QQQ

The QQQ ETF hit new all-time highs on Friday, then tumbled lower on the day, falling 3.5% to a low of $589.05. While it did rally more than 2% yesterday, it’s back under pressure this morning, down about 1% in pre-market trading. Will the QQQ avoid retesting Friday’s low in the days ahead?

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.