Course Stock Investing Strategies

Course Building Your Portfolio

Tech Stocks: Your Guide to Investing

Good Stocks vs Bad Stocks

How To Buy Stocks In The UAE

Getting To Know Cyclical Stocks

The Nasdaq vs the Dow

IPO vs Direct Listing: What’s the Difference?

The Most Popular Stock Exchanges and How They Work

Getting to know preferred stocks

Investing In Healthcare Stocks

AI Stocks Poised for Growth in 2025

Stocks Poised for Growth in 2025

Top Dividend Stocks for 2025

Top Growth Stocks for 2025

What are Small-, Mid- and Large-Caps?

Everything You Need To Know About Telecom Stocks

Managing Financial Losses on eToro

What Is a Dual-Class Share?

Earnings Season: What You Need To Know

What are Blue-Chip Stocks?

Stock Split Guide: What they are and how they work on eToro

What is Stock Market Volatility?

How to Invest in the Stock Market

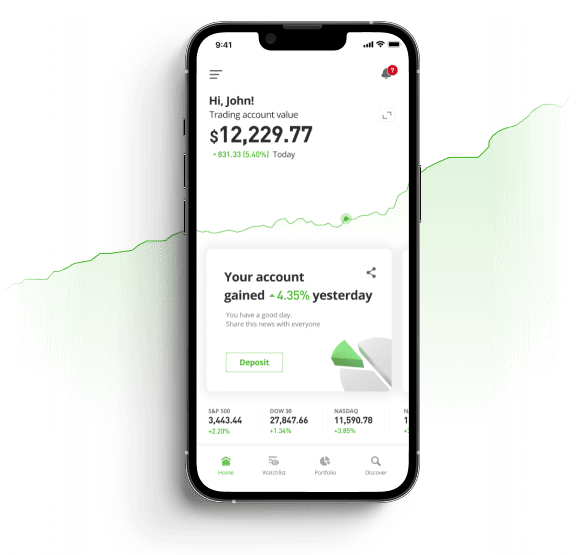

Ready to get started?

Open your investment account today and start building your ultimate stock portfolio. Registration is free!