The Daily Breakdown takes a closer look at Magnificent 7 earnings with Alphabet and Tesla on deck, while gold bulls eye a breakout.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Wednesday’s TLDR

- GOOG and TSLA set to report

- Gold bulls eye breakout

- Kohl’s gets meme treatment

What’s Happening?

There are a few things standing out in markets today, so let’s have a morning rundown.

US stocks teetered yesterday, and despite barely closing higher on the day, the S&P 500 notched another record close. Same for the VOO, IVV, and SPY ETFs. However, small caps were the real leader on the day, with the IWM ETF climbing 0.8% — the best among the major US indices.

Zooming into the sector-by-sector layer, healthcare was yesterday’s leader, gaining 1.9% on the day. The sector has struggled this year, failing to attract investors as it’s down about 3% year to date — the worst of any sector. Notably, tech was the only sector that finished lower in Tuesday’s session, dragged down by Nvidia, Broadcom, and other chip stocks.

Magnificent 7 earnings are set to get underway tonight, when Tesla and Alphabet report earnings. Tesla has been the worst-performing Mag 7 stock so far this year, and while Alphabet hasn’t wowed investors — it’s up 1% in 2025 — the stock is riding a 10-day win streak.

Want to receive these insights straight to your inbox?

The Setup — Gold

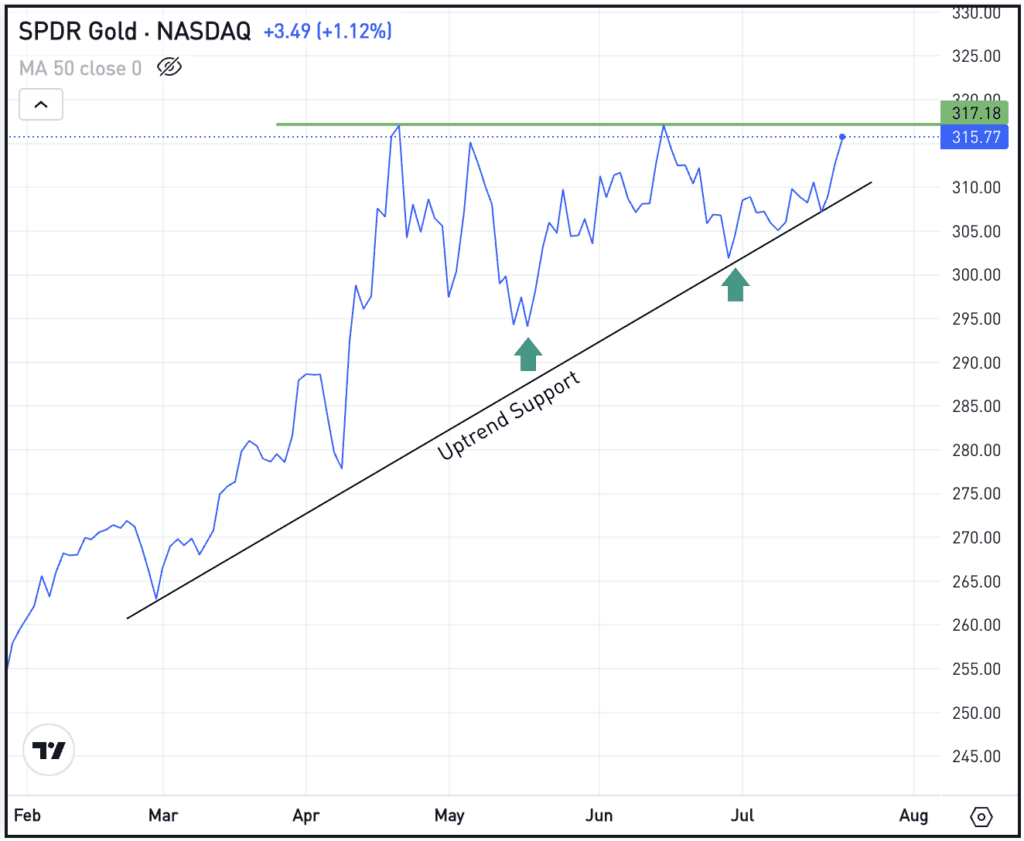

Gold has been a strong performer, with the GLD ETF rallying almost 30% so far this year and more than 40% over the past 12 months. It broke out earlier this year amid increased volatility, but since markets have calmed down, gold prices have been consolidating. Notice how the dips in GLD have gotten more shallow while it keeps retesting the $315 resistance area.

The trend has been strong, and bulls are looking for a breakout over this $315 to $317 area, potentially propelling gold higher in Q3 and Q4. Bears are hoping that this area remains resistance, potentially allowing the GLD to run out of momentum and roll over.

Options

As of yesterday’s close, the August $315 and $325 calls have the highest open interest — meaning the largest open positions in the options market.

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, investors might consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

Target shares hit their highest level since early April, rising almost 5% on Tuesday. But bulls have been discouraged with Target, as shares are down more than 20% so far this year. However, with a long history of raising its dividend, which now yields 4.3%, investors are hoping the firm can find a way to reverse its fortunes. Check out the fundamentals for Target.

As “meme madness” returns, shares of Kohl’s momentarily doubled yesterday, before ending the day higher by 37%. The action follows what we saw in Opendoor Technologies as the price action drums up old memories of prior meme-stock trades.

Shares of Texas Instruments are tumbling this morning, falling almost 10% in pre-market trading after the company released its quarterly results. The company beat on earnings and revenue expectations, and when looking to next quarter, delivered solid revenue guidance but an earnings outlook that was slightly below analysts’ estimates. Check out the charts for TXN.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.