The Daily Breakdown takes a closer look at this action-packed week: Five of the Magnificent 7 stocks report earnings and the Fed’s on tap.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening

Record Highs

Friday’s inflation report helped fuel stocks to new records, with the S&P 500, Nasdaq 100, and Dow all notching new highs. Those gains are set to continue today, with all three notably in the green in Monday’s pre-market trading session.

The CPI report came in below economists’ expectations — showing 3% year-over-year growth vs. expectations for 3.1% growth. Notably, CPI of 3% was either flat or higher for the fifth straight month. It also matched its highest figure of the past year (January 2025) and before that, was last at 3% in June 2024. In other words, inflation isn’t exactly tame right now.

Weekly Outlook

With a lack of other economic data, Friday’s lower-than-expected inflation print all but locked in a rate cut from the Fed this week. We’ll hear from Chair Powell & Co. on Wednesday afternoon, where investors expect a second 25 basis point rate cut. The critical focus will be on the December meeting: will Powell lean into — or away from — a third rate cut for 2025, which is what Wall Street currently expects.

Earnings

We’re in the thick of earnings season right now and there are some key companies due up this week with five of the Magnificent 7 holdings reporting, including: Microsoft, Meta, and Alphabet on Wednesday, and Apple and Amazon on Thursday.

Other key reports include: Visa, MasterCard, PayPal, SoFi, Boeing, Starbucks, Chipotle, Reddit, Eli Lilly, Exxon Mobil, and Chevron.

Want to receive these insights straight to your inbox?

The Setup — Ethereum

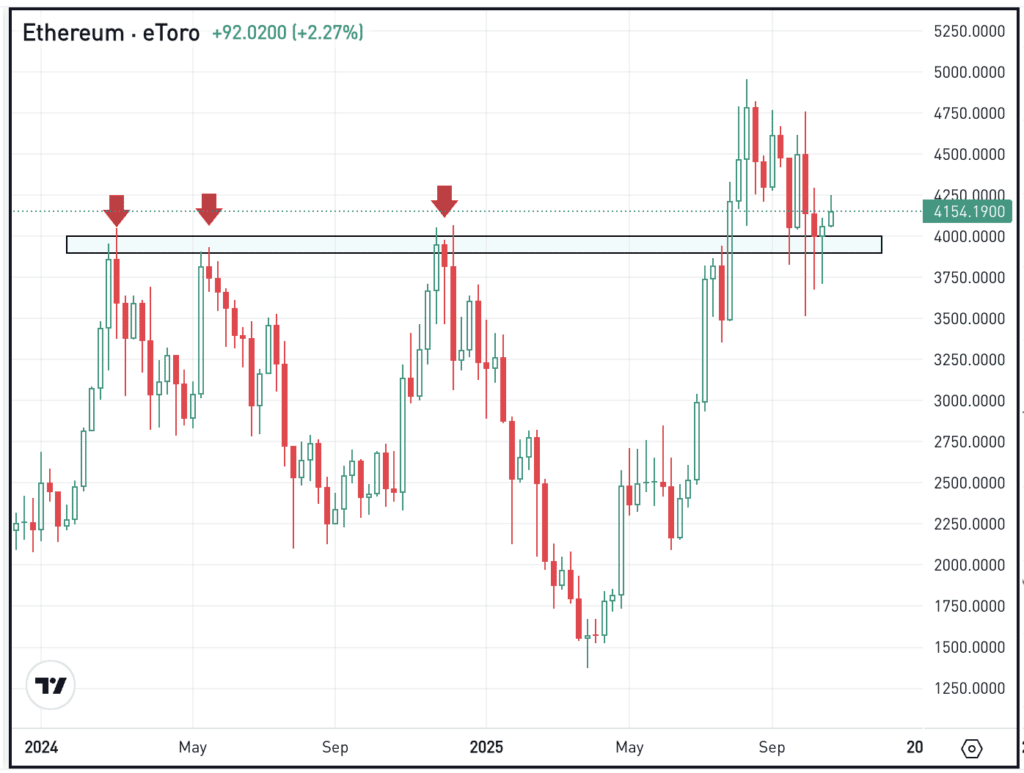

Friday October 10th was a tough day in the markets as Bitcoin fell more than 7%, while Ethereum dropped about 12%. Now though, ETH is finding its footing back above a key level that served as prior resistance.

It’s discouraging that ETH technically broke below the $3,900 to $4,000 area, which was significant resistance in 2024 and served as a major breakout point in August. We can see that by the thin little lines — called “wicks” — which are circled on the chart.

But it’s encouraging that ETH ultimately held this area as support, closing above it on a weekly basis despite the recent weakness and volatility. Now, bulls want to see Ethereum — and the rest of crypto — gain more momentum in the days and weeks ahead. If it can’t, keep an eye on this support level and the recent lows.

Options and ETFs

For investors who can’t trade or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the Ethereum front, ETHA remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

QQQ

The Nasdaq is in focus this morning and this week, as the QQQ ETF is higher by more than 1% in pre-market trading. That’s as the rally extends from Friday, but also amid optimism ahead of earnings, the Fed, and as the US negotiates a trade deal with China. Check out the charts for QQQ.

First it was General Motors, now it’s Ford. Shares of Ford soared more than 12% on Friday with the stock hitting its highest level in more than a year. The rally came on better-than-expected earnings results, where the automaker reported profits of 45 cents a share vs. estimates of 36 cents a share, while revenue of $47.2 billion beat expectations of $43.1 billion. Dig into Ford’s fundamentals.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.