Nvidia is rallying to new record highs on the back of positive updates for its business in China. The Daily Breakdown dives in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Tuesday’s TLDR

- NVDA gets China nod from DC

- GOOGL tries to gain momentum

- CPI in focus this morning

What’s Happening?

This morning’s buzz isn’t so much about crypto, but about another high-flying name in tech: Nvidia.

Just last week, Nvidia became the first company ever to notch a market cap of $4 trillion. Now higher by almost 5% in pre-market trading, shares look set for another record high. Today’s momentum comes as Nvidia said it will start selling its H20 AI chip to China again.

The US has had a contentious relationship with China when it comes to chip exports, as it tries to stifle China’s advances with AI. That meant curbing exports of certain products from companies like Nvidia and Advanced Micro Devices to the country, something that hurt these firms earlier in the year.

As Bloomberg noted, “Nvidia designed the less-advanced H20 chip to comply with earlier China trade curbs from Washington, which Trump’s team tightened in April to block H20 sales to the Asian country without a US permit.”

Now according to Nvidia, “The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon.”

The news is boosting both Nvidia and AMD, as well as the overall chip space as Broadcom, ASML, Taiwan Semi and others advance.

Want to receive these insights straight to your inbox?

The Setup — GOOGL

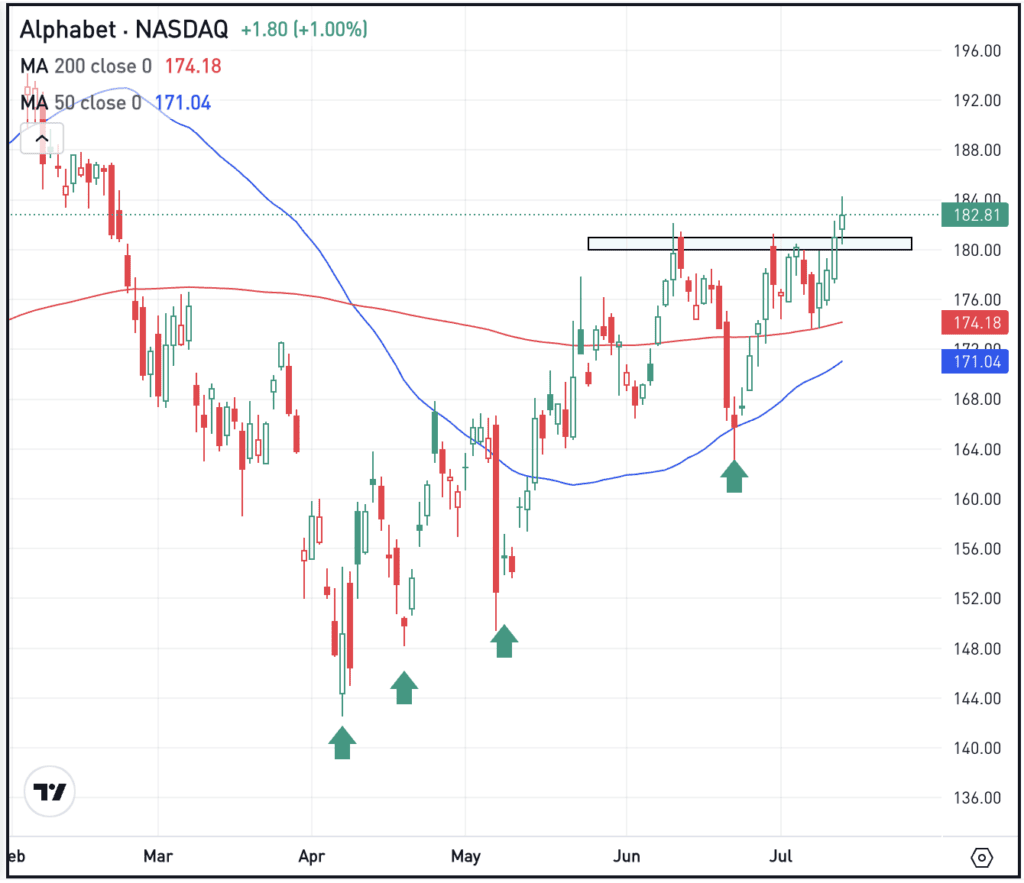

While Nvidia is in focus, traders are keeping an eye on Alphabet as the stock just hit its highest level since February.

Alphabet has continued to put in a series of higher lows, an encouraging technical development noted on the chart via green areas. More notably, shares cleared the $180 area in Monday’s session, which had been a key resistance area over the past month. Now bulls will look for shares to stay above this level and potentially push higher in the days and weeks ahead.

Keep in mind, GOOGL currently sports a 52-week high near $207. The firm reports earnings next week on July 23rd. While bulls will look for a further rally over resistance, bears are hoping for a break below the $180 area, potentially putting the stock’s 50-day and 200-day moving averages back in play.

For more on our Q3 outlook regarding tech, visit this link or click on the banner below.

Options

As of the close on July 14th, the GOOGL options with the highest open interest are in the long-dated options. Specifically, the December 2026 $300 calls have the highest tally, followed by the $260 and the $250 calls in the January 2026 expiration.

For some investors, options could be one alternative to speculate on GOOGL. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and GOOGL rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

SPY

While the QQQ and SMH ETFs are getting a nice lift this morning on the back of Nvidia’s encouraging news, investors will be keeping a close eye on the SPY and VOO ETFs to see how markets react to today’s big inflation number. Economists expect CPI to have risen 2.6% year over year.

Bitcoin notched new record highs yesterday, briefly clearing the $123K area. Now it’s pulling back on Tuesday, currently trading near $117K. Despite the dip, bulls are optimistic that Bitcoin’s recent breakout can further fuel gains through the summer. Check out the chart for BTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.