Investors are getting excited with markets nearing record highs. The Daily Breakdown looks into what’s driving the gains.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Wednesday’s TLDR

- Nasdaq nears new records

- Lyft breaks out

- AMD jumps as semi stocks gain

What’s Happening?

It took just 33 sessions for the Nasdaq 100 (and the QQQ ETF) to fall from its record high in mid-February to its low in early April — a decline of more than 25.5%. A bulk of those losses were erased 45 days later, as the Nasdaq rallied more than 31%.

Yesterday it came within 2 points of its record high of 22,222.61. For the QQQ, it came within 11 cents of $540.81.

Now higher in pre-market trading, bulls are hopeful that the Nasdaq will be able to make fresh record highs in Wednesday’s session — particularly without anything daunting on the calendar.

There are no major economic events, while earnings are contained to firms like General Mills, Winnebago, Jefferies, and Micron — the last of which will likely be traders’ major focus of the bunch.

As for the S&P 500 and SPY ETF, it’s close to a record high too. A 0.75% gain from yesterday’s high would notch a new record for the index, just months after it looked like the bottom was going to fall out.

Want to receive these insights straight to your inbox?

The Setup — Lyft

Shares of Lyft caught a major boost yesterday, rising more than 6% on the momentum from Uber, which rose 7.5% on news that it and Alphabet’s driverless taxi service, Waymo, are partnering in Atlanta.

For what it’s worth, Uber is generally considered the more “high quality” name of the two, and the stock also broke out over resistance, putting it near record highs. Maybe we’ll look at that name tomorrow.

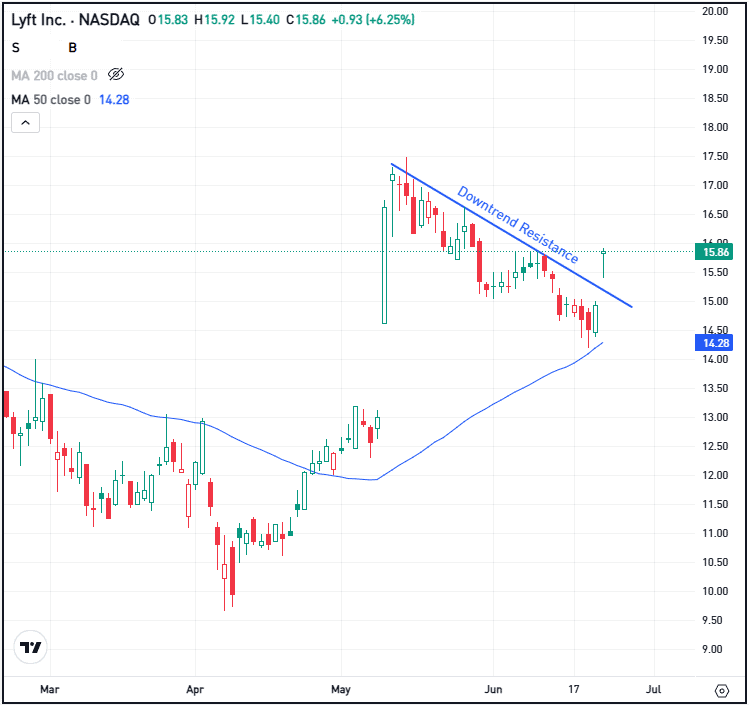

For now though, we’re taking a closer look at Lyft as shares pulled back to the 50-day moving average, held this measure as support, then broke out over downtrend resistance (blue line):

Lyft shares may need some time after this breakout to continue higher, but Tuesday’s breakout was a strong first step to potentially higher prices.

From here, bulls want to see the stock stay above the $14.50 area. Not only has that area attracted buyers since May, but it’s also where the 50-day comes back into play. If shares continue higher, bulls might look for another charge back toward the recent highs.

However, below $14.50 and momentum will have likely soured.

Options

Investors who believe shares will move higher over time may consider participating with calls or call spreads. If speculating on a long-term rise, investors might consider using adequate time until expiration.

For investors who would rather speculate on the stock decline or wish to hedge a long position, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

Semiconductor stocks have quietly been making their way higher. Juggernauts like Nvidia and Taiwan Semi are within a stone’s throw of record highs, while Broadcom has notched new all-time highs in recent trading. Even beaten-down semiconductor names like Advanced Micro Devices and ASML have been on the mend, with AMD rallying over 10% last week and already up 8% this week.

Bitcoin is going for a third straight daily rally as it pushes toward $107K. BTC has done a great job of finding support near the key $100K level as it continues to consolidate from its massive rally off the April lows. Now investors are wondering if and when it can make its way to new highs. Check out the chart for BTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.