The Daily Breakdown looks at the week ahead, which includes earnings from AMD, Uber, and Palantir, among other key stocks.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Monday’s TLDR

- S&P 500 goes 0/5 last week

- Can stocks find their footing?

- Reddit jumps on earnings

Weekly Outlook

Last week was…insane! We had the GDP, jobs and PCE inflation reports, a Fed meeting, and a ton of earnings reports — including Meta, Microsoft, Apple, and Amazon, which combine for a market cap of more than $11 trillion.

The market handled those events pretty well through Wednesday evening. But a higher-than-expected inflation report and a disappointing jobs report weighed on US equities as we entered the weekend.

The S&P 500 and Nasdaq 100 fell 1.6% and 1.9% on Friday, respectively, while those indices are now down about 3% to 3.5% from the record highs they opened at on Thursday morning.

So when it comes to this week, investors really want to know whether risk-on assets like stocks and crypto can find their footing.

In terms of key events, next week is fairly quiet on the economic front. However, notable earnings include: Palantir, Hims & Hers, Rivian, Pfizer, Advanced Micro Devices, Uber, Disney, and McDonald’s.

If you want to upgrade your investing knowledge this summer, make sure to join our eToro Academy Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $20 in rewards. Terms and conditions apply.

Want to receive these insights straight to your inbox?

The Setup — S&P 500

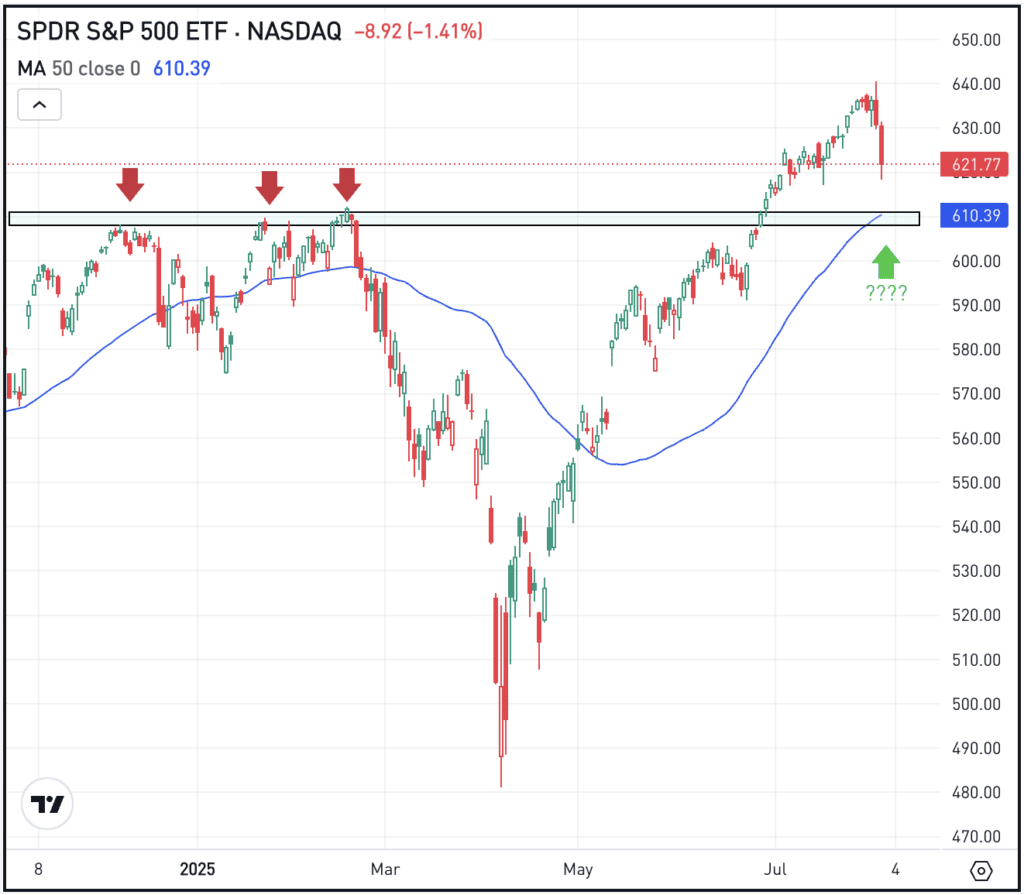

For the S&P 500, we’ll look at the SPY ETF, which has had a blistering run. From the April low to last week’s high, it had climbed almost 33% and was up over 9% on the year. After such a powerful rally — one that sent stocks to new record highs — a pullback and some consolidation would be a good thing.

Narratives change and headlines hit, but as long as earnings growth continues higher — forward 12-month earnings per share expectations for the S&P 500 are at record highs — then it’s possible that stocks can continue to hold up.

Keep an eye on the $608 to $611 area. While the SPY may not decline to this zone, it would mark a decline of about 5% and allow the S&P 500 to retest the key breakout area over its prior all-time highs. Note that this area was resistance in Q4 and Q1, and it will be bulls’ hope that it acts as support if it’s tested. If it fails as support, a further decline could take place.

Fun fact: The SPY closed lower in each session last week after gaining in all five sessions the week before. What will this week bring?

What Wall Street Is Watching

Bitcoin continues to hover above the key $110K to $112K breakout area from July as it consolidates its latest run to new highs. It hit a multi-week low this weekend, but the breakout area held as support. Can it regain its form this week? Check out the chart for BTC.

XLV

On Friday, the healthcare sector ETF — XLV — hit its lowest level since May. That’s despite stocks like AbbVie, Eli Lilly and Bristol-Myers leading the S&P 100 last session. Investors are wondering whether this sector can fetch a bid in the second half of the year.

What selloff? Reddit shares soared higher on Friday, climbing over 17%. The rally comes after better-than-expected Q2 results, where revenue climbed 78% year over year to $500 million and earnings per share of 45 cents was more than double Wall Street’s expectation. Lastly, Q3 revenue guidance of $535 million to $545 million was well ahead of consensus estimates of $473 million. Dig into the financials for Reddit.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.