Don’t panic — it’s just a market correction, and they’re more common than you think. Stay focused to protect your portfolio or even uncover new opportunities. Here’s how to navigate it with clarity and confidence.

Watching your portfolio take a nosedive isn’t exactly a feel-good moment. But before you hit the panic button or swear off investing forever, take a deep breath. Market corrections are a normal part of the ride.

Let’s unpack what they are, why they happen, and how to handle them like a seasoned investor — even if you’re just starting out.

What Is a Market Correction?

Let’s start with the basics. A market correction is when a major stock index — like the S&P 500 —drops 10% or more below its recent peak. It’s not a crash. It’s a course adjustment. Corrections are common. In fact, they happen about once a year on average. Some last days, others months.

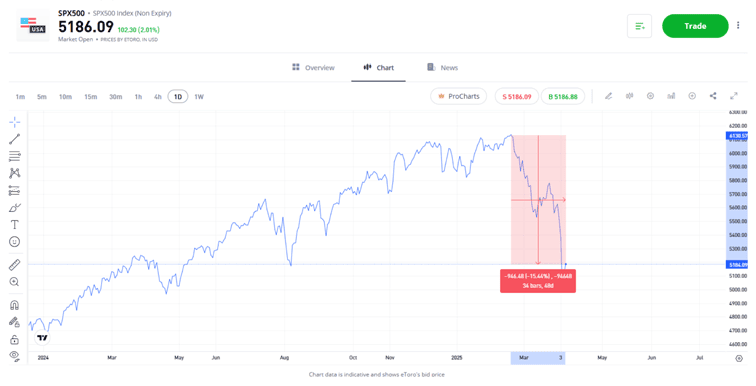

A recent example is April 2025, when the S&P 500 Index and the China 50 Index both stumbled as global tariffs returned to the headlines. Investors weren’t thrilled — markets dropped, headlines blared, but the world kept turning.

There are also other terms to know. A

Past performance is not an indication of future results.

Source: eToro

The red lines on the chart above tell a story we’ve come to know well — sharp drops, strong recoveries.

- Early 2020, the market crashed as fear took over and stocks sank fast, but the panic didn’t last. Just a few months later, things turned around, and the recovery was fast and strong.

- Then came 2022. Inflation rose, interest rates followed, and talk of a recession grew louder. This time, the market fell more slowly — and stayed down longer. It was a real bear market. But, by mid-2023, things started looking up again. Slowly but surely, stocks climbed back and hit new highs.

- In mid-2023, there was another dip. Not a crash — more like a breather. Some investors got nervous, but the market didn’t stay down long. It bounced back once again.

- The most recent drop came in late 2024. It was sharp and sudden. Traders were caught off guard. But even now, signs of a bounce are showing up.

Same pattern, different year: the market falls — but it always finds a way back. Every time.

How To Identify a Market Correction?

The maths is pretty straightforward: if a market index falls 10% from a recent high, you’re in correction territory. If it hits 20%, you’re facing a bear. But it’s not just about the numbers — it’s about the mood.

You’ll notice more red on your watchlist. News headlines will start using words like “plunge,” “turmoil,” or everyone’s favourite: “uncertainty.” Twitter/X will spiral into chaos. And your uncle who “doesn’t believe in stocks” will suddenly have a lot to say at dinner.

The chart below shows the April 2025 pullback in the SPX500 Index, where the market dropped 15.44% over 48 days. This places the move firmly in correction territory, just shy of the threshold for a bear market. Tariffs were the spark, but the selling was driven by fear — and once that fear fades, markets often bounce back.

Past performance is not an indication of future results.

Source: eToro

Why Do Market Corrections Happen?

There’s no single cause for a correction — it’s more like a cocktail of nerves, news, and numbers.

Sometimes, it’s economic data — like inflation coming in hot, GDP slowing down, or unemployment creeping up. Other times, it’s geopolitical drama — think trade wars, elections, or surprise wars nobody asked for.

Then there’s

And yes, sometimes markets just get overheated. Stocks climb too fast, valuations stretch thin, and a correction simply brings things back to reality. It brings everything back into balance.

“Here’s the silver lining. Corrections can offer chances to buy quality assets at a discount. If you believe in a stock or ETF for the long term, a lower price may be a gift — not a warning.”

How Should You Respond to a Market Correction?

When you’re in the middle of a market correction, your reaction is critical and should always be guided by your pre-defined investment goals and strategies.

Market corrections can feel intense, but they’re actually a normal part of the investment ride. The key is to stay disciplined and keep some perspective. Here’s how to approach it:

Stay calm and keep perspective

Seriously — don’t panic. Easier said than done, of course, but panic selling is how short-term dips turn into long-term regrets. Markets have a strong track record of bouncing back. Take a look at any long-term chart of a major index — it’s mostly up and to the right, with plenty of zigzags along the way.

If your goals are long term, a correction is just a detour — not a disaster.

Review, don’t react

Take this opportunity to check in on your

If your original reasons for investing still hold up, you likely don’t need to make any major changes. But a review never hurts.

Managing a Market Correction With eToro

eToro provides a practical toolkit to help you proactively manage your portfolio, identify risks, and spot potential opportunities so you can stay ahead, adapt quickly, and make smarter decisions. Start using the tools below on eToro today:

- Portfolio Insights shows you how your investments are spread across sectors, regions, and exchanges. It’s an easy way to see if you’re truly diversified or leaning too heavily in one direction.

- Risk Insights highlights which assets are cranking up your overall risk and suggests others that might help balance the load.

- With Expected Dividends, you can see how much income your portfolio is set to generate, with forecasts that extend through the rest of the year.

- And if you’re wondering how your performance stacks up, Portfolio Comparison lets you line it up against benchmarks like the S&P 500.

- Smart tools allow you to use advanced charts, set stop-losses, or take-profits.

- If you’re unsure about how to invest, lean into CopyTrader™ and follow seasoned traders with proven strategies.

Today’s Market Movers

From earnings surprises to geopolitical catalysts, these are the assets catching investors’ attention right now.

Tip: Correction or not, now’s the time to check your portfolio — these drops often expose hidden risks or imbalances.

Strategies for Investors During a Market Correction

Whether you’re looking to manage risk or identify new opportunities, there is a need to have a clear strategy when trading a market correction. Many of the principles of successful investing still apply, just even more so.

Strategy realignment

A market correction can be viewed as a time to reconsider how you want to allocate capital to different strategies. The relative price moves in assets could be an opportunity to rotate in and out of positions and move your portfolio to one which focuses on different strategies such as, value-based investing, dividend income, trend-following, or growth stocks.

The decision of whether or not to realign your portfolio will be influenced by the nature of the correction. You might consider it to be a short-term “blip” which is part of a continuing trend, or a sign that there is a more fundamental shift taking place. If the correction does represent a “paradigm shift” and an event which will impact price moves in the medium- and long-term, then, there are techniques you can use to help you to apply the strategies you think are the best ones for the current situation.

Rebalance without overreacting

Sometimes market drops skew your asset mix. Say your tech stocks fall 15%, and now they make up way less of your portfolio than they used to. That’s where rebalancing comes in — realigning your portfolio to reflect your long-term strategy.

On eToro, this process is easier than it sounds. Tools like weighting charts help you to visualise how your portfolio is distributed across sectors or asset types, while risk alerts highlight when certain positions may be adding more volatility than you’re comfortable with. With this kind of data at your fingertips, you can adjust strategically — without falling into the trap of emotional, overreactive trading.

Consider dollar-cost averaging

DCA means investing a set amount of money at regular intervals — say, once a week or once a month — no matter what the market’s doing.

Why does it work? Because you buy more when prices are low and less when they’re high, which lowers your average cost per share over time. It’s the financial equivalent of never timing the checkout line and just picking the shortest one — not perfect, but it gets the job done consistently.

Diversification is everything

On eToro, you can explore Smart Portfolios and sector filters to instantly add variety to your holdings. They make diversification as easy as a few clicks, letting you choose baskets of stocks based on sectors, themes, or strategies. You can also look at safe-haven assets such as gold or high-quality government bonds, which often hold value during uncertain times. No need to go all in — just be smart about spreading the risk.

Trade management during a correction

Be prepared to adjust the amount of time you need to manage your portfolio effectively. If you’re “time poor”, then limiting losses and locking in profits can be aided by using stop-loss and take-profit trade instructions. These will automatically close out positions at predetermined price levels even if you are not actively monitoring the markets.

Tip: Diversification is an ongoing process. Regularly review and adjust your portfolio to maintain a balanced risk profile.

Investment Opportunities and Risks During a Market Correction

Here’s the silver lining. Corrections can offer opportunities to buy quality assets at a discount. If you believe in a stock or ETF for the long term, a lower price may be a gift — not a warning.

Some investors use technical analysis indicators to find support levels, oversold conditions, or trends. Others simply keep it simple — adding to their positions over time using a strategy like the one below.

Tip: Some see corrections as trading opportunities — but always proceed with caution and informed judgement.

Risk management during a market correction

It’s relatively easy to take risks during “normal” market conditions, but a market correction presents a range of different risk management challenges. These are best met by sticking to your long-term investment goals.

One dilemma investors face is whether to cut positions and reduce overall exposure. Doing that will likely result in locking in losses, but trimming a portfolio to be more in line with your personal risk tolerance can help you to stay in other positions and keep more in line with your overall investment strategy.

There is also the temptation to sell positions with a view to entering back into the market at lower price levels. This is harder to do than it sounds. Trying to time entry and exit points can result in overtrading and also trigger a range of psychological biases which result in you deviating from your long-term plan and losing money.

Tip: Avoid over-trading — stick to purposeful moves that align with your goals and avoid racking up unnecessary fees.

Final thoughts

Market corrections can feel scary, especially if it’s your first time experiencing one. But, with a solid plan, a calm mindset, and the right tools, you can ride out the storm.

Stick to your goals, keep learning, and don’t let headlines shake your strategy. The market may dip, but your confidence doesn’t have to. And remember — on eToro, you’ve got the resources to stay in control, stay informed, and stay the course.

To learn more about eToro’s tools and how to invest during market corrections, visit the eToro Academy.

FAQs

- How long do market corrections usually last?

-

Market corrections can last anywhere from a few days to several months. On average, they tend to last around three to four months — but every correction is different. The important part? They’re temporary. As those who have considered the reasons to invest will point out, historically markets have always found their way back up.

- Should I sell everything during a correction?

-

Probably not. Panic selling often locks in losses and misses the eventual rebound. If your investments still make sense for your goals, riding it out may be the better move. Use this time to review your strategy, not rewrite your entire game plan.

- Is a correction a good time to start investing?

-

It can be! If you’ve been waiting for a “better entry point,” a correction might offer one. Prices drop, which could mean opportunities to scoop up quality assets at a discount. Just make sure you’re in it for the long haul — and not chasing bargains emotionally.

- What’s the difference between a pullback, a correction, and a bear market?

-

Great question. A pullback is a smaller drop — usually under 10%. A correction is a 10–20% dip from recent highs. And a bear market? That’s the big one — 20% or more down, often over a longer stretch. Corrections are part of the natural market rhythm — not necessarily a crisis.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.