Are you a smart investor?

Embrace a smart and innovative approach to personal investing with eToro’s ready-made diversified portfolios

What are Smart Portfolios?

Smart Portfolios are innovative, long-term investment portfolios, curated by eToro analysts. Each with its own unique investment strategy, Smart Portfolios are a convenient and diversified way to access major market trends shaping our world today, without paying portfolio management fees.

Smart Future

Choose a portfolio according to your time horizon with targeted strategies that automatically adjust for your goals. Target Model Smart Portfolios, created in partnership with Franklin Templeton, focus on higher potential returns early on and become more conservative as the target year nears.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. *If capital is withdrawn prior to the minimum holding period (June 30, 2030), your capital will be at risk. Please see Terms & Conditions for further details on the associated risks. Other fees apply.

New: Alpha Portfolios

Discover the Alpha Smart Portfolios, designed to adapt to any market conditions. We use advanced AI and data from millions of eToro investors to create portfolios that adjust as markets change, without the high costs of traditional hedge funds.

Diversify Your Portfolio With Commodities

Gain exposure to a range of commodities in a single, expertly managed portfolio. Explore the WisdomTree-Comm Smart Portfolio and invest with confidence.

Invest for tomorrow, today

Take a page from visionary tech investor Cathie Wood’s strategy book with our newest Smart Portfolio, ARK Future First

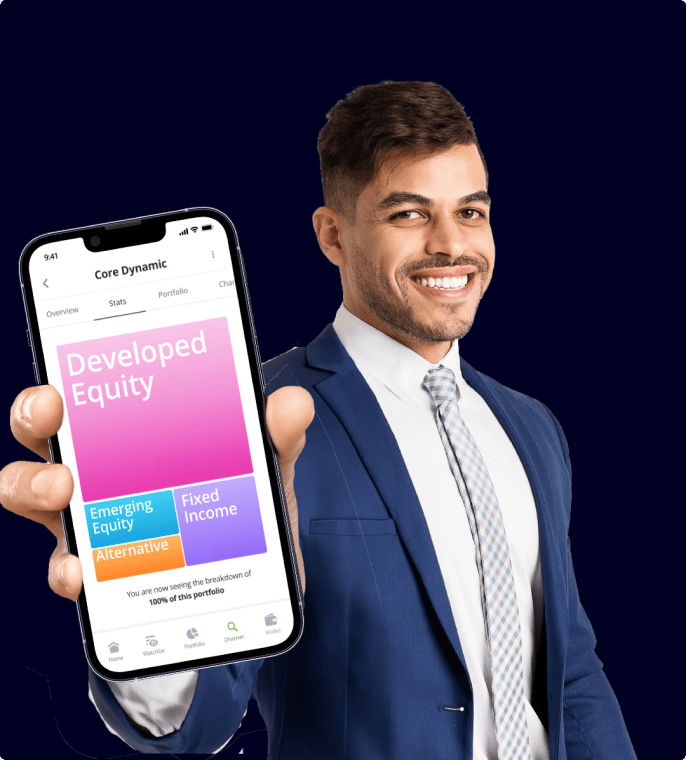

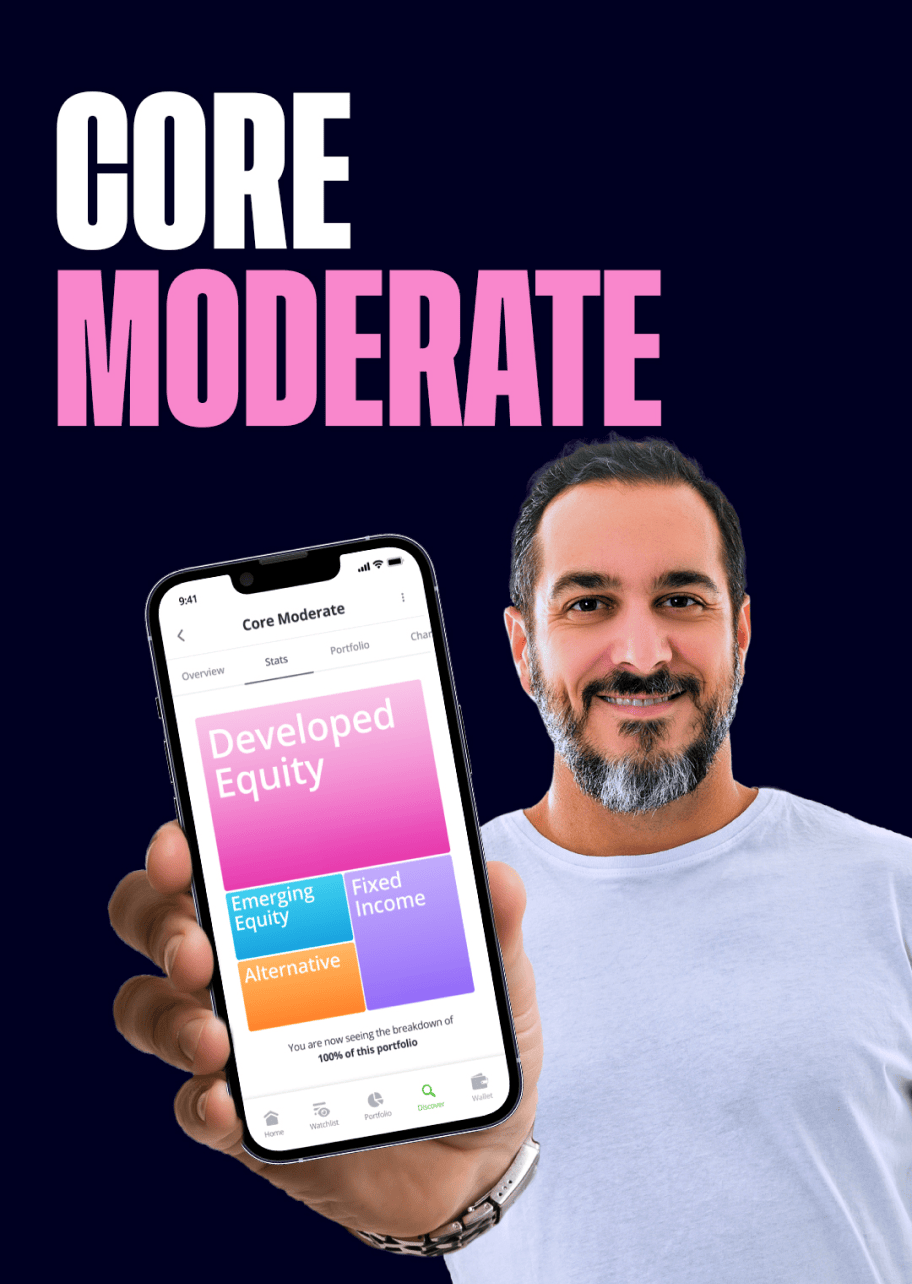

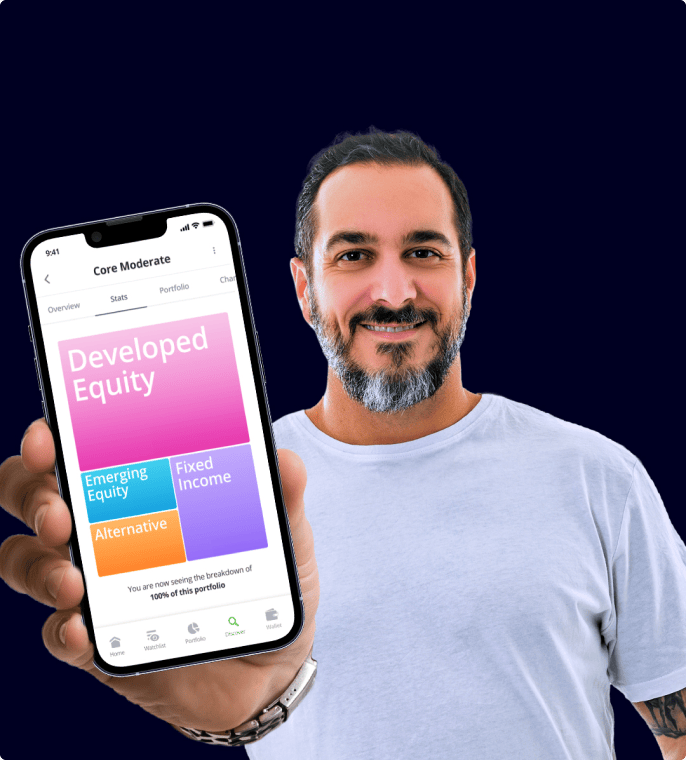

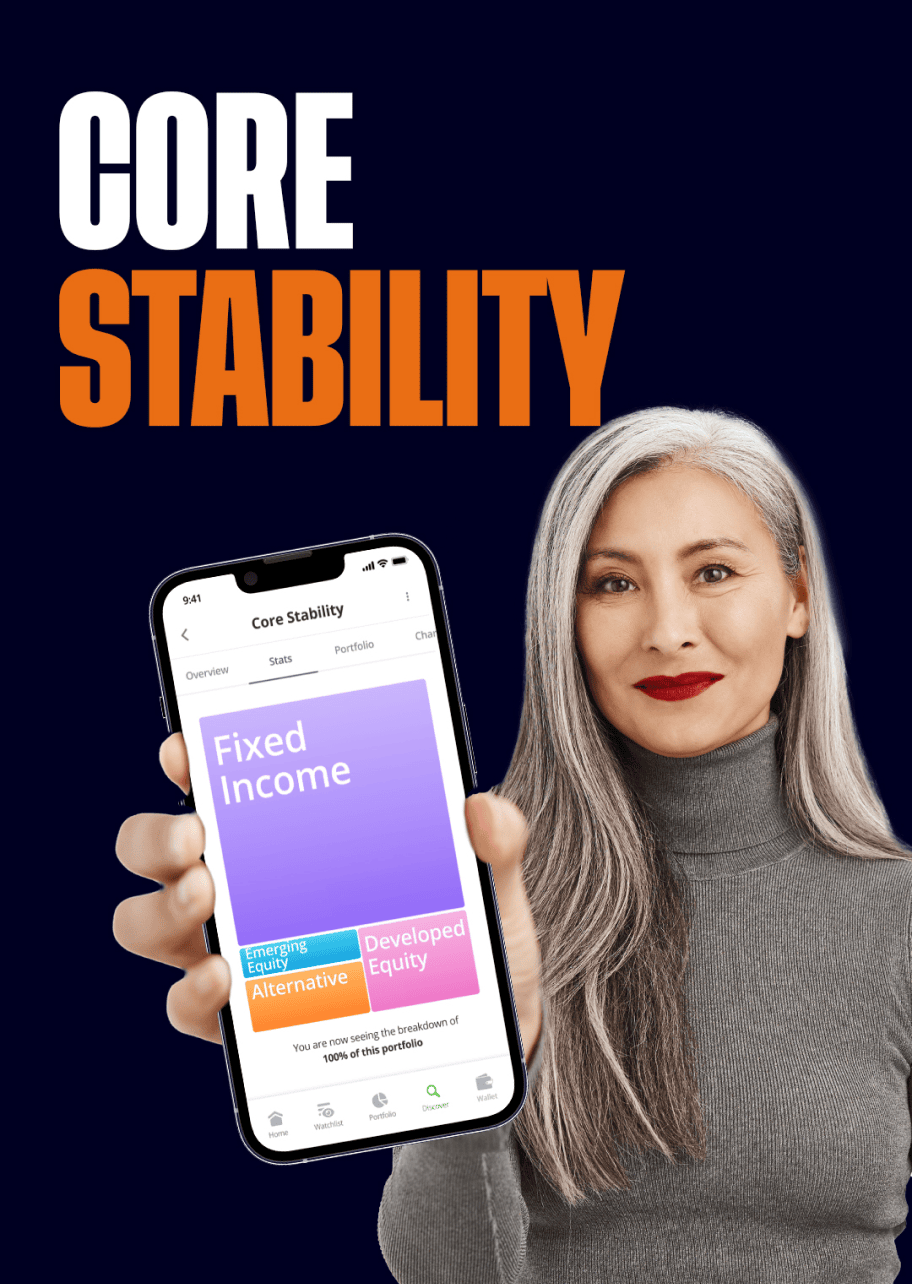

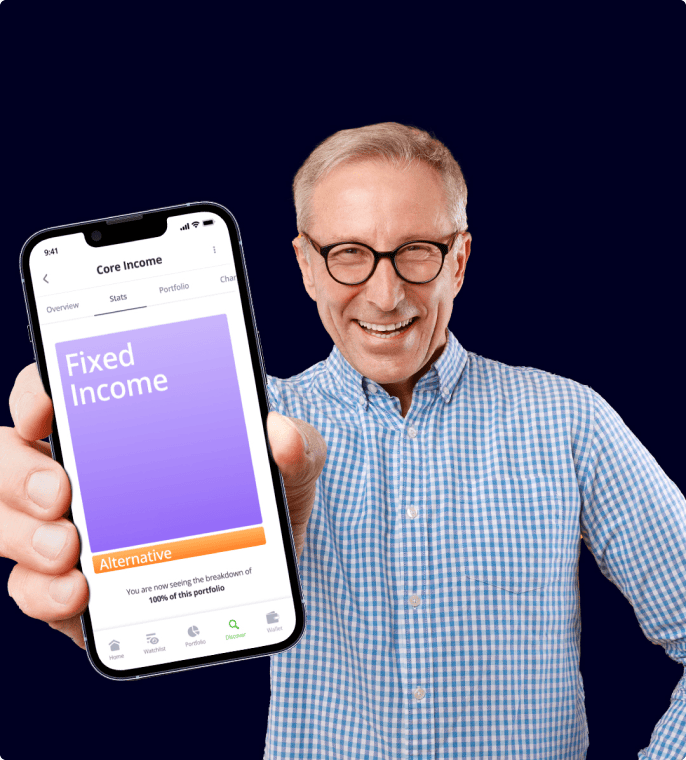

Choose your core

Invest in a Core portfolio best suited to your long-term financial goals, with asset allocation guidance provided by BlackRock

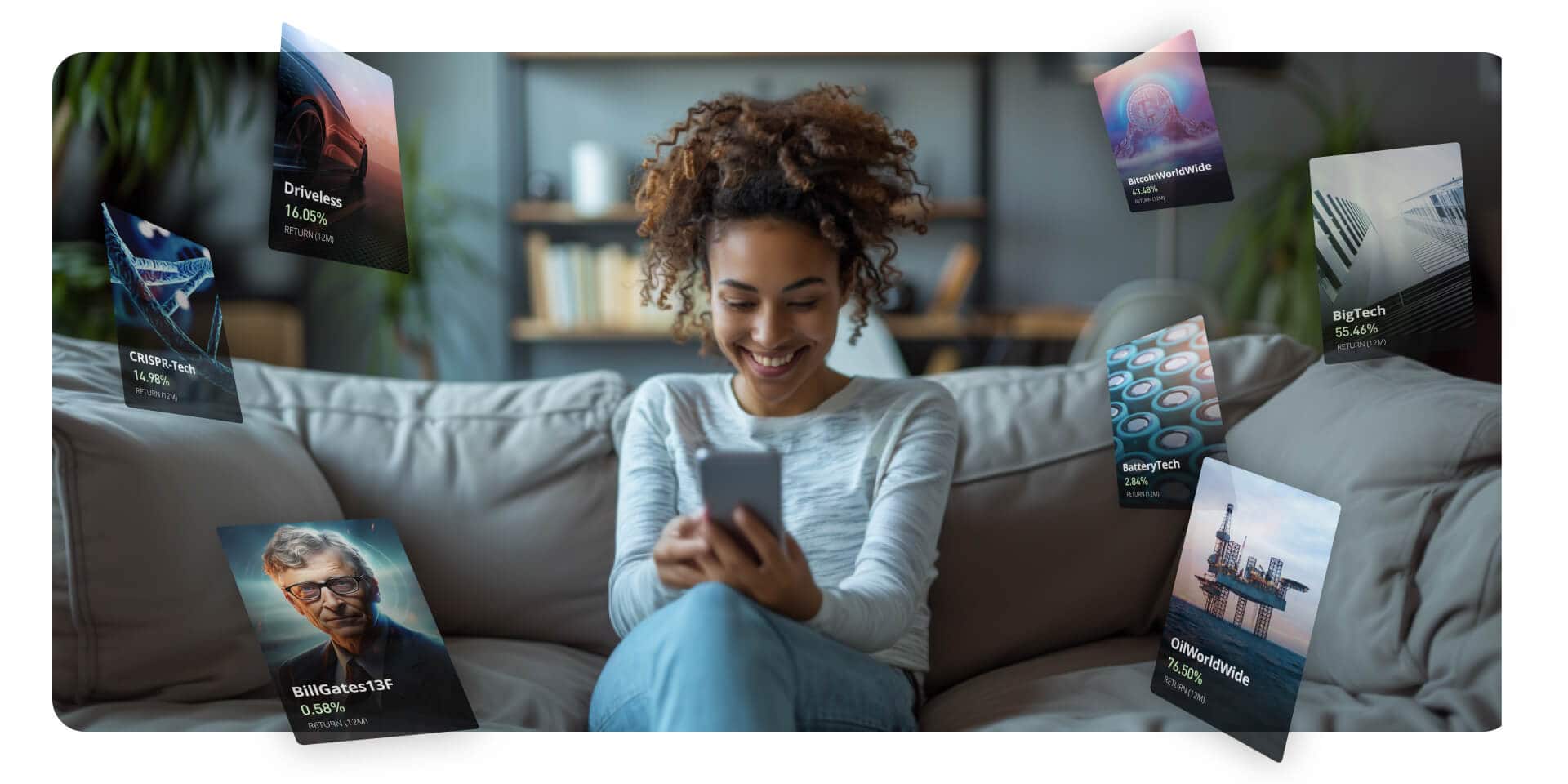

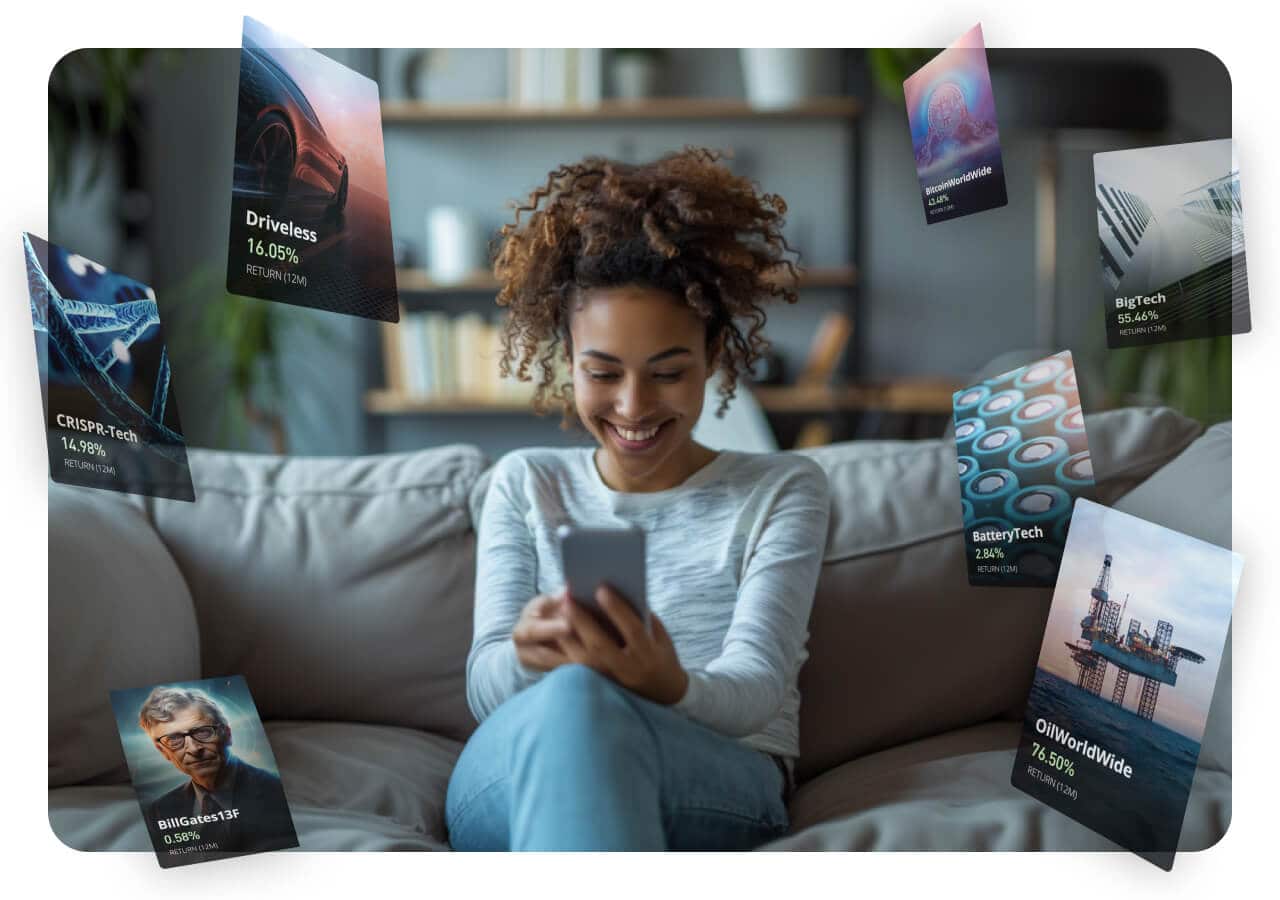

One-of-a-kind portfolios, only on eToro

Our investment experts have done the research, analysis, and allocation to create a ready-made, balanced and diversified portfolio for our clients, specifically designed for optimal long-term performance. All you need to do is to take your pick from a variety of over 65 Smart Portfolios, spanning a range of top market themes, trends, and industries.

Disruption focused thematic investment portfolios. Gain exposure to the biggest disruptions since the Industrial Revolution.

AI-Revolution | Fin-Tech | Space-Tech

Using cutting-edge algorithms, eToro leverages billions of metrics generated by millions of users to create next-level, data-driven investment strategies.

eToro is partnered with some of the most innovative investment start-ups in the world and has enabled them to create their own portfolios.

NDI-FutureTech | The-Chameleon | Cutting-Edge | Franklin Templeton |

Alpha

The Smart Way to Invest

A well-diversified portfolio is one of the best risk management strategies out there. Although assets have a common theme, they can span varied sub-sectors, regions, and even asset classes.

Using in-depth research and analysis, we choose companies and assets from around the world that are proven leaders and have the best potential for a buy-and-hold approach based on current data.

eToro’s Smart Portfolios are created using the most cutting-edge technology and advanced data, and are designed to adapt as market conditions change.

We want these innovative products to be accessible to any level of investor, as well as effective as a diverse bundle of assets. That’s why we’ve priced them starting at only $500 for the initial investment.

Pick Smart

Choose your Tech Smart Portfolio and start investing

Past performance is not an indication of future results.

Dividend Reinvestment

When assets that are eligible for dividend payments are held via a Smart Portfolio, these dividends are added to the portfolio’s cash balance. When the portfolio is rebalanced, these sums are reinvested in the portfolio’s holdings.

Start Investing Smart

How can you start investing for the long term with eToro’s Smart Portfolios?

Pick a theme you believe in.

Find the Smart Portfolio that suits your vision.

Start investing for the long term from just $500.

FAQ

- What are portfolios?

-

eToro Portfolios (Smart Portfolios) are investment vehicles that bundle together a collection of financial assets, based on a theme and each with its own unique strategy. The assets to be included are selected and updated according to the portfolio’s strategy, which can be viewed on the stats tab of each portfolio’s asset page.

- Who structures the portfolios?

-

Most Portfolios are created and managed by the eToro Investment Team. Each portfolio is built with a lot of thought and consideration, taking into account factors such as balance, exposure, potential yield, risk and more. In addition, Partner Portfolios are created and managed by eToro’s partners, which include some of the most sophisticated financial companies and innovative startups in Fintech.

- Are the portfolios considered active or passive?

-

eToro’s Smart Portfolios employ a dynamic approach to investing, which is a combination of both. On the one hand, Smart Portfolios are not updated on a daily basis — in this sense, this is closer to the passive approach. Yet, more like the active approach, they are regularly rebalanced and fine-tuned by the eToro investment team.

- When are portfolios rebalanced?

-

To maintain the asset allocation ratio according to the Smart Portfolio’s strategy, portfolios are rebalanced periodically. Rebalancing is a means of ensuring that each Portfolio is consistently aligned to its methodology to match the original asset allocation plan and optimised for maximum results. Assets that perform well this year aren’t guaranteed to perform well next year – therefore, this re-alignment is necessary to maintain the portfolio’s overall growth.

However, rebalancing periods differ from portfolio to portfolio. Therefore, we suggest reading the information on each portfolio’s page to understand when, and using which criteria, it is rebalanced.

- Why is the minimum investment $500?

-

eToro’s Portfolios contain various financial assets, each of which is allocated a specific proportion of the overall investment. An investment of at least $500 ensures that there are enough funds to open all of the positions needed for the investment.