Short selling may allow traders to potentially profit when asset prices fall, rather than rise. It can also be used to hedge risk on long positions.This comprehensive guide explains how short selling works and why it might form part of a trading strategy.

Short selling offers something different to traditional investing. It can be used to take a directional view on over-heating markets or incorporated into more advanced market neutral strategies.

There are significant risks associated with short-selling, and a need to learn the mechanics of putting on and managing short positions. This article will outline what short selling is and how it works, using insightful case studies and step-by-step guides on how to sell short.

What Does Shorting a Stock Mean?

Put simply, short selling involves selling an asset that you believe will drop in value, with the intention of buying it back in the future at a lower price.

The gross profit or loss on a short sell trade will be the difference between the trade entry and exit prices. If you short a stock which then goes up in value you’ll make a loss, and vice versa if the price falls.

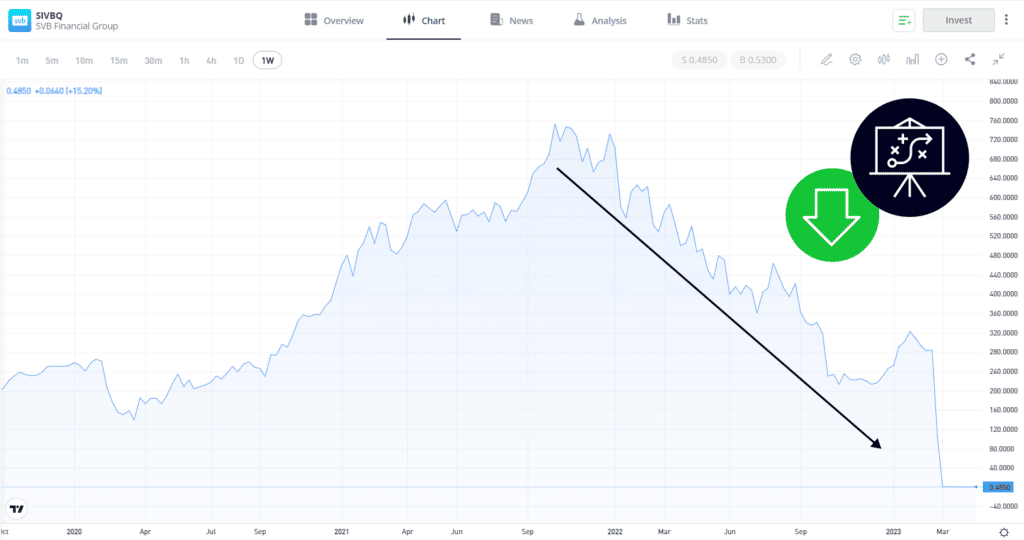

Case Study: Shorting Silicon Valley Bank

Using a real-world example involving the stock of Silicon Valley Bank can help outline the principles involved in short-selling.

- In January 2022, stock in Silicon Valley Bank was trading at around $447 per share.

- Economic fundamentals, including a predicted rise in interest rates, impacted the firm’s business model, causing the stock price to fall.

- By March 2023, the bank had failed, and its stock was worth considerably less than it was around a year prior.

If you had shorted SVB stock in January 2022, you would have made a profit from the subsequent price fall. If the price had risen, then the strategy would have made a loss. Short selling strategies involve trying to spot trading opportunities such as the one mentioned above.

How Does Selling Short Work?

In terms of trading mechanics, selling short on works by navigating to the asset you have identified and clicking on the “Short” or “Sell” button in the trading interface.

One popular way of short selling involves using

Most broker platforms handle all the technical aspects of borrowing and selling the asset in the market but it is important to factor in that open short positions held overnight can incur additional fees.

How To Place a Short Position

Follow these step-by-step instructions to open a short position:

- Find your asset – Search for the stock, currency, ETF, Index, or commodity you want to short

- Click “Trade” – Open the trading ticket for your chosen asset

- Select “Short” – Choose “Short” to open a short position

- Set position size – Enter the amount you want to invest (remember this will be a CFD position)

- Place your order – Click “Short” to execute your short position

Those steps outline the practical steps required to sell short but there are some other factors you may want to also consider.

Before placing a Short order, check:

- Asset availability for shorting (some assets may have temporary restrictions).

- Your account’s margin requirements.

- Any regional or jurisdictional limitations.

- Estimated

overnight fees . - If you want to set stop loss and take profit orders.

Costs of Short Selling at a Glance

Understanding the costs associated with short selling is crucial for calculating your potential returns. Here’s an approximated breakdown of the fees typically associated with different types of financial instruments.

| Instrument | Fee Components | When Applied | Where to See in Ticket |

|---|---|---|---|

| Stocks (CFD) | Spread. No overnight fees on Easy to Borrow stocks Spread + Overnight fees if stock is Hard to Borrow (borrow fee > 10%) | Spread at entry/exit. Overnight fee (if applicable): Daily at 21:00 GMT Most HTB stocks have x3 overnight “weekend fees” charged on Friday. | “Estimated Opening Cost” on the trade screen details the cost associated with the spread. |

| ETFs (CFD) | Spread + Overnight fees | Spread at entry/exit. Overnight fee (if applicable): Daily at 21:00 GMT Most ETFs have x3 overnight “weekend fees” charged on Friday. | “Estimated Opening Cost” on the trade screen details the cost associated with the spread, but not ongoing overnight fees. |

| Indices (CFD) | Spread + Overnight fees | Spread at entry/exit. Overnight fee (if applicable): Daily at 21:00 GMT Most Indices have x3 overnight “weekend fees” charged on Friday. | “Estimated Opening Cost” on the trade screen details the cost associated with the spread. The display also details overnight fees. |

| Commodities (CFD) | Spread + Overnight fees | Spread at entry/exit. Overnight fee (if applicable): Daily at 21:00 GMT Most commodities have x3 overnight “weekend fees” charged on Wednesday. Oil and Nat Gas weekend fees are charged on Friday. | “Estimated Opening Cost” on the trade screen details the cost associated with the spread. The trading display also details overnight fees for some, but not all, commodities. |

| Currencies (CFD) | Spread + Overnight fees | Spread at entry/exit. Overnight fee (if applicable): Daily at 21:00 GMT Most currencies have x3 overnight “weekend fees” charged on Wednesday at 21:00 GMT. | “Estimated Opening Cost” on the trade screen details the cost associated with the spread The display also details overnight fees. |

These examples are simplified and for illustrative purposes only. Overnight fees change from time to time based on global market conditions. Fees may change without advance notice and always apply to open positions.

Why Are Some Stocks Hard to Borrow?

The stock loan market where brokers arrange to borrow stocks for their clients is subject to the laws of supply and demand as much as any other market. If shorting activity increases, it may become harder to borrow a stock and lenders may charge a higher fee.

This explains why short CFD positions in ‘hard to borrow’ stocks incur a higher fee, and traders should be aware that the list of stocks given a hard to borrow classification can change over time depending on market conditions.

Tip: Practising using a demo account is one way to develop your understanding before using real cash.

Availability and Restrictions

Not all assets can be shorted at all times. Several factors can affect your ability to open a position:

- Unborrowable assets – The stock may temporarily have no shares available to borrow

- Platform safety mechanisms – platforms may restrict shorting during extreme volatility

- Regulatory restrictions – Sometimes, ad hoc restrictions can be implemented on short selling in an effort to restore stability to the financial system.

- Regional limitations – Product availability varies by jurisdiction and account type

Differences Between Long and Short Positions

The key difference between long and short positions is that investors will profit if the price of an asset rises on a long position, whereas the opposite is true for a short position.

However, there are critical differences:

Long positions:

- Profit when prices rise

- Maximum loss limited to invested capital

- No time restrictions

- No borrowing costs

Short positions:

- Profit when prices fall

- Unlimited loss potential as prices can rise indefinitely

- Subject to overnight fees

- May face forced closure due to short squeezes or borrow recalls

These and other differences between the characteristics of long and short positions are displayed in the table below.

| Aspect | Long Position | Short Position |

|---|---|---|

| Market View | Bullish (expecting price rise) | Bearish (expecting price fall) |

| Profit Potential | Unlimited | Limited to initial price |

| Loss Potential | Limited to investment | Unlimited |

| Dividends | Receive dividends | Must pay dividends |

| Complexity | Simple to execute | Requires margin account |

| Borrowing costs | None | Overnight fees |

| Security of position | Full control | Possible forced closure |

Risks of Short Positions

If you’re considering shorting stocks it is important to factor in that there are some risks which are unique to the approach and which can result in significant losses.

- Unlimited loss potential: Losses on short positions are potentially infinite, as there is no limit to how high the price of an asset can go.

- Short squeezes: If the price increases and holders of short positions begin to close out their trades, that will create additional buying pressure – which can create a cycle of buying pressure which drives the price even higher.

- Dividend adjustments: Short sellers must pay any dividends to the stock lender

- Regulatory bans: Authorities may ban short selling during market stress

- Liquidity risk: Difficulty closing positions in thinly traded stocks

- Borrow recall: Lenders can demand their shares back at any time

Tip: Short-squeeze risk is increased if a market has been heavily shorted by many traders or stock-borrow positions are recalled.

How to Develop a Short Selling Strategy

Short selling can be used to take an outright directional position on a market – that it will go down, but shorts can also be incorporated into various trading strategies or used to manage overall risk exposure.

Market Neutral Long-Short Strategy

Short selling can be used to balance out a portfolio’s performance, and reduce overall

For example, you might favour Apple stock over Microsoft stock. In this case:

- Long position: Buy AAPL stock

- Short position: Sell MSFT stock short

Net returns would be the sum of the returns on both trades. If both stocks were to rise in value, but Apple stock outperformed Microsoft stock, the net return on the trade would be positive with the gains on the AAPL trade counteracting the losses on the MSFT

Tip: CFDs are derivatives which means traders can use leverage but that involves additional risks you may want to avoid.

Using Shorts to Manage Risk

Short positions can also be used to manage overall risk exposure in a portfolio.

Take the example of an investor following a buy-and-hold strategy who holds a portfolio of stocks. If market conditions become increasingly uncertain, opening a short position in a stock Index could represent a hedge of market risk and a wider market slump reducing the value of the investor’s portfolio.

There are operational factors to consider which might make using a short position a preferable way to hedge the overall risk, particularly if the investor might want to buy back the stocks once market conditions improve:

- While there will be costs associated with the short position, the costs of selling and potentially rebuying the stocks may be greater, particularly if there are taxes such as SDRT on stock purchases.

- If assets held in a tax-efficient account are sold, there may be annual allowance restrictions which prevent the investor from using that account again, should they decide to buy the stocks back.

These examples are simplified and for illustrative purposes only; actual liability depends on personal circumstances and local laws.

How to Hedge a Short Position

When shorting a position, there’s always a risk that the price will rise. There are however steps which can be taken to mitigate that risk as it is possible to hedge short positions as well as long positions.

Hedging strategies:

- Index hedge: If you short a particular stock based on fundamental valuation analysis you could hedge the risk of the wider market rising in value by taking a long position in a relevant index, such as the S&P 500 Index.

- Sector rotation: A more nuanced approach might involve hedging short positions in one sector with longs in another, rather than an index.

- Options strategies: Call options give their owner the right (but not the obligation) to buy an underlying asset at a predetermined price by a particular date.

Case Study: Hedging a Short AMZN Position

If your analysis suggests that Amazon is overvalued and you open a short position in the stock, then there are several options open to you in terms of hedging.

- You could hedge a short in AMZN by going long on the NASDAQ 100 Index, with that index including comparable US tech stocks.

- Alternatively you could open long positions in another sector such as healthcare.

- Or you could buy out-of-the-money call options in Amazon which could be exercised should the price of the underlying stock rise sufficiently to make those options profitable.

Worked example: Short selling with costs

Let’s calculate a short position’s profit/loss including all fees.

Scenario: Short 100 shares of Alibaba and hold the position for 5 days

- Entry price (Short): $50.00

- Exit price (Buy): $45.00

- Position size: $5,000

- Holding period: 5 days

- Stock type: Easy-to-borrow

- Spread: 0.1% each way

Calculation:

- Gross profit: ($50 – $45) × 100 = $500

- Entry spread cost: $5,000 × 0.1% = $5

- Exit spread cost: $4,500 × 0.1% = $4.50

- Overnight fees: $0 (easy-to-borrow)

- Net profit: $500 – $5.00 – $4.50 = $490.50

If ULVR had been a hard-to-borrow stock with 15% annual borrow cost:

- Additional overnight fees = ($5,000 × 15% ÷ 365) × 5 days = $10.27

- Net profit: $490.50 – $10.27 = $480.23

These examples are simplified and for illustrative purposes only; actual liability depends on personal circumstances and local laws.

Final thoughts

Short selling offers traders a way to profit from falling markets and hedge existing positions. However, it requires careful consideration of the unique risks involved, particularly the potential for unlimited losses and the impact of short squeezes.

Success in short selling depends on thorough market analysis, disciplined risk management, and a clear understanding of all associated costs. The ability to short sell can enhance portfolio flexibility, but should be approached with caution and proper education.

Find out more about short-selling strategies by heading to the eToro Academy.

FAQs

- What costs apply when shorting on eToro?

-

Short-selling orders and leveraged positions on stocks are executed as CFDs and incur CFD spreads and potentially overnight fees. Easy-to-borrow stocks incur only spread costs, while hard-to-borrow stocks (above 10% annual borrow cost) also include borrow fees reflected in the overnight charge.

- Why is the “Short” button greyed out?

-

The Short button may be unavailable due to: temporary unavailability of shares to borrow, platform safety limits during extreme volatility, or regional and regulatory restrictions. Check eToro’s Help Center for specific asset availability and be aware that liquidity in stock-lending markets can vary according to market conditions.

- Where can I see borrow costs?

-

Hard-to-borrow stocks will incur a borrow cost reflected as an overnight fee (borrow cost divided by 365) on your position. You can view estimated costs in the “estimated cost” section of the trade ticket before placing your order.

- What is a short squeeze?

-

The term “short squeeze” explains a situation where a market which has a lot of short interest begins to rise in value creating a self-staining cycle of buying pressure which takes the price even higher. When traders with short positions close their positions that is reflected as an increased number of “Buy” trades. If price continues to rise, this creates a feedback loop of rising prices which can be costly for those traders who do not exit short positions early enough.

- Is shorting available on all asset classes?

-

No. While some markets such as stocks, forex, and indices have well-established short selling practices, not all asset classes can be shorted. And if market conditions change, you may find some instruments which were possible to be shorted no longer are. Short selling availability varies by instrument, jurisdiction, regulatory provisions, and market conditions, and it is important to check the terms and conditions provided by your broker.