Meta Platforms (formerly Facebook) is a global tech powerhouse that connects nearly half the world’s population through its family of social apps. Best known for Facebook, Instagram, WhatsApp, and Messenger, Meta’s core business is selling targeted digital advertising across these platforms. In recent years, CEO Mark Zuckerberg has pivoted the company toward ambitious new frontiers like virtual reality, augmented reality, and artificial intelligence, even rebranding the company as “Meta” to reflect a long-term vision of a metaverse of immersive, interconnected digital experiences. They are spending billions of dollars to be a frontrunner in these sectors, so will it fuel long-term growth or weigh on shares? Let’s find out.

- Meta’s family of apps, Facebook, Instagram and WhatsApp reaches 3.5 billion people, providing an unparalleled audience that fuels a digital ad empire.

- After its worst drawdown in history through 2021-22, Meta’s “Year of Efficiency” cost cuts and AI-driven strategy have reignited growth. However, high spending and fierce competition from TikTok to Apple remain key investor watchpoints.

- According to Bloomberg’s Analyst Recommendations, Meta has 72 buy ratings, 8 holds, and 1 sell. The average analyst price target is USD$869.56, signalling a 15% upside from current levels.

Explore Meta

The basics

Meta Platforms is best known as the parent company of Facebook, Instagram, WhatsApp and Messenger. Together, these apps make up Meta’s “Family of Apps”, used by a staggering 3.5 billion people every day. That sheer scale makes Meta the biggest social media company in the world and an essential platform for advertisers.

Meta’s core business is advertising, accounting for almost all of its revenue. Years of data and advanced AI have made its ads highly effective, allowing businesses to target audiences with precision. Even after Apple’s iOS privacy changes disrupted tracking, Meta bounced back by leaning heavily on AI-powered tools. Most advertisers now rely on these features day to day, helping to keep revenue growth strong.

But Meta is also looking to the future. Through its Reality Labs division, it has pushed into wearables and virtual reality. Its Meta Quest VR headsets dominate the global market, while its Ray-Ban smart glasses combine style with AI features like cameras and voice assistants. They might not be mainstream yet, but selling over a million pairs in 2024 shows people are at least curious and Meta views them as a crucial stepping stone to a future of ‘metaverse’. At its recent Meta Connect developer event, Mark Zuckerberg unveiled a new lineup of AI-powered smart glasses, including the high-tech Ray-Ban Meta Display and sporty Oakley Meta Vanguard. Is Meta ahead of the game? Maybe. Smart AR glasses might one day be as present as smartphones, and Meta wants to be the leading hardware ecosystem when that happens.

At the same time, Meta has gone all-in on artificial intelligence. Its Llama AI models are open-sourced to spur innovation, and AI assistants are already built into WhatsApp and Instagram, attracting hundreds of millions of users. The company is investing tens of billions into AI infrastructure, from data centres to GPUs, while aggressively hiring top talent. It’s clear that Zuckerberg is bullish on AI and is prepared to spend eye-watering amounts to ensure Meta stays ahead.

Meta remains an advertising powerhouse and that’s its engine, set to deliver USD$190 billion in revenue this year vs USD$2 billion for Reality Labs. But, it’s betting big that AI and the metaverse will shape the next decade of technology.

Fun Fact: Instagram wasn’t built by Meta. It was acquired in 2012 for about USD$1 billion, a move often considered one of the best tech acquisitions ever. Instagram alone is likely worth hundreds of billions today. For more on Meta’s history, check out the movie The Social Network.

Competitor Diagnosis

Meta operates in highly competitive corners of the world, from social networking to advertising to cutting-edge tech like AI and VR. In social media, its biggest headache in recent years has been TikTok. The app’s short-form videos stole attention from younger users, forcing Meta to fight back with Instagram Reels. The move worked, with Reels now making up around half of the time people spend on Instagram, proof that Meta can still pivot fast when it needs to. But TikTok remains a serious challenger for both users and ad dollars, while others like Snapchat and YouTube remain real forces.

Messaging is another area of competition. WhatsApp and Messenger dominate globally, but in the US, iMessage holds sway, and in some regions, apps like Telegram and Signal are gaining ground. WhatsApp’s user base is massive, but Meta hasn’t cracked the code on monetisation just yet. Tools like WhatsApp Business and click-to-message ads are the current plays, but turning chat into a money-maker without annoying users remains a tough balance.

When it comes to ads, Meta’s biggest rival is Google. Together, they form a duopoly that hoovers up most online ad spend. Amazon is quickly muscling in, while Apple plays spoiler by limiting how much user data can be tracked, a move that once rattled Meta’s ad engine. Advertisers weigh their spend among these giants based on performance. Meta’s vast targeting data and social engagement give it an edge for certain campaigns, whereas Google dominates intent-based search advertising.

And then there’s the metaverse and AI. Meta leads in VR headsets with Quest, but Apple’s Vision Pro shows the competition is heating up. In AI, Meta is sparring with Google, Microsoft/OpenAI, and Apple in a talent and tech arms race. OpenAI’s ChatGPT became the poster child for generative AI in 2023, an area where Meta has since responded by open-sourcing its Llama models and integrating AI assistants into its own products. The talent war may also be crucial in this AI boom. Meta has been luring AI experts from companies like Apple, with rumours circulating that Meta hired Apple’s head of AI models, Ruoming Pang, with a reported USD$200 million package.

Financial Health Check

The last five years have been somewhat of a rollercoaster for Meta’s balance sheet, but its recent Q2 earnings were blockbuster, comfortably beating Wall Street expectations and reinforcing its position as a dominant force in both digital advertising and AI innovation.

Meta posted revenue of USD$47.5 billion, up 22% year-over-year, and earnings per share of USD$7.14, well ahead of the USD$5.88 consensus estimate. The core ad business continues to thrive with improved AI-driven targeting and growing user engagement across platforms like Reels and Threads. Ad impressions rose 19%, and the average price per ad climbed 6%, a clear sign of rising demand and pricing power.

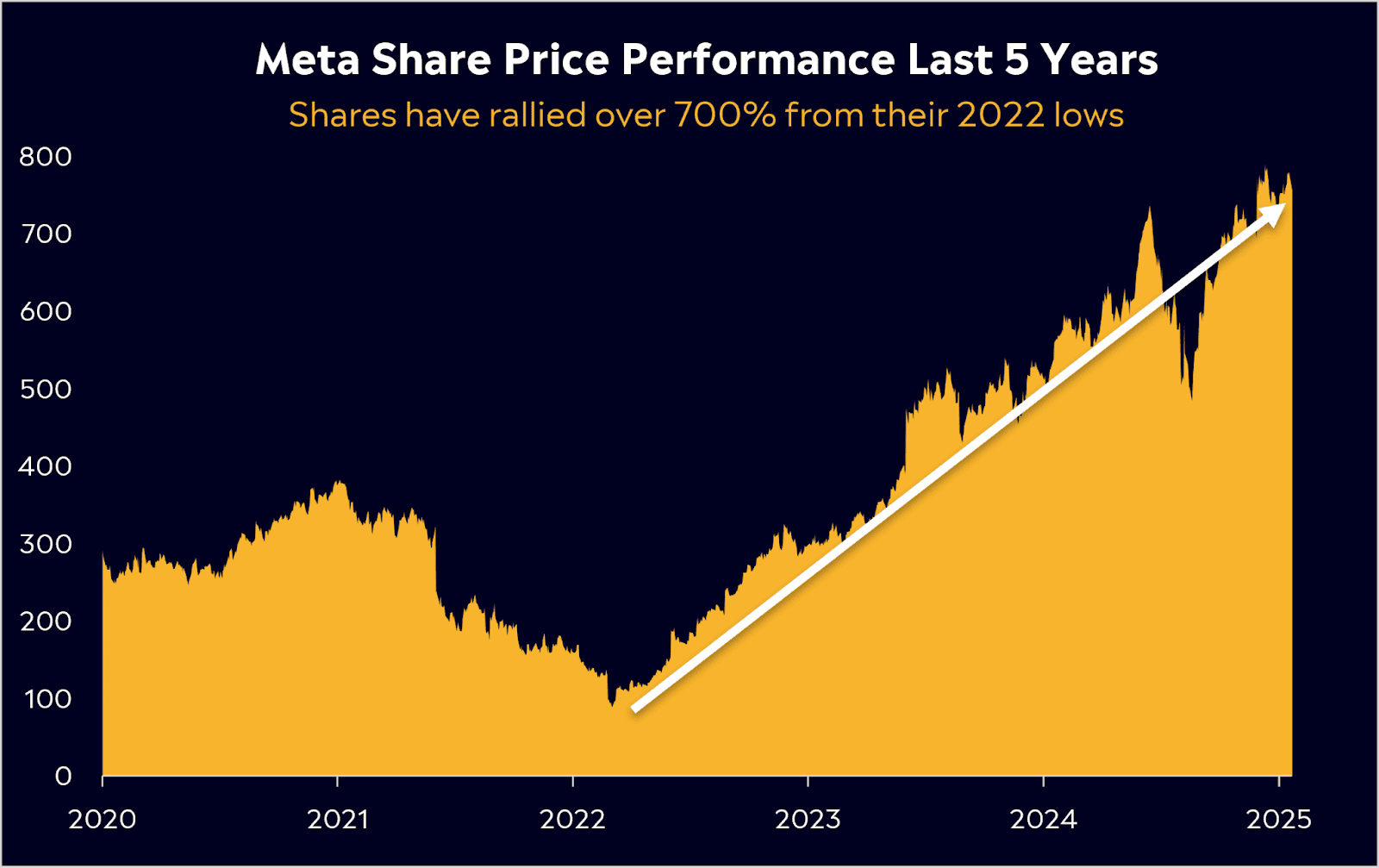

This follows a rough period in 2021 and 2022, where spending, particularly on the Metaverse, blew out and advertising revenue slowed dramatically. The result? Shares plummeted more than 76%, its largest drawdown ever. This brought Zuckerberg’s “Year of Efficiency”, which saw over 21,000 jobs cut and weaker projects axed, helping to boost margins. From its low in 2022, shares have rallied over 730%, a serious recovery.

But cost control is still a concern. Reality Labs, the home of Meta’s VR and AR ambitions, continues to burn cash. Losses topped USD$17.7 billion in 2024 alone, and those losses are only set to grow in the years ahead. By 2027, Meta is set to have lost over USD$100 billion on Reality Labs.

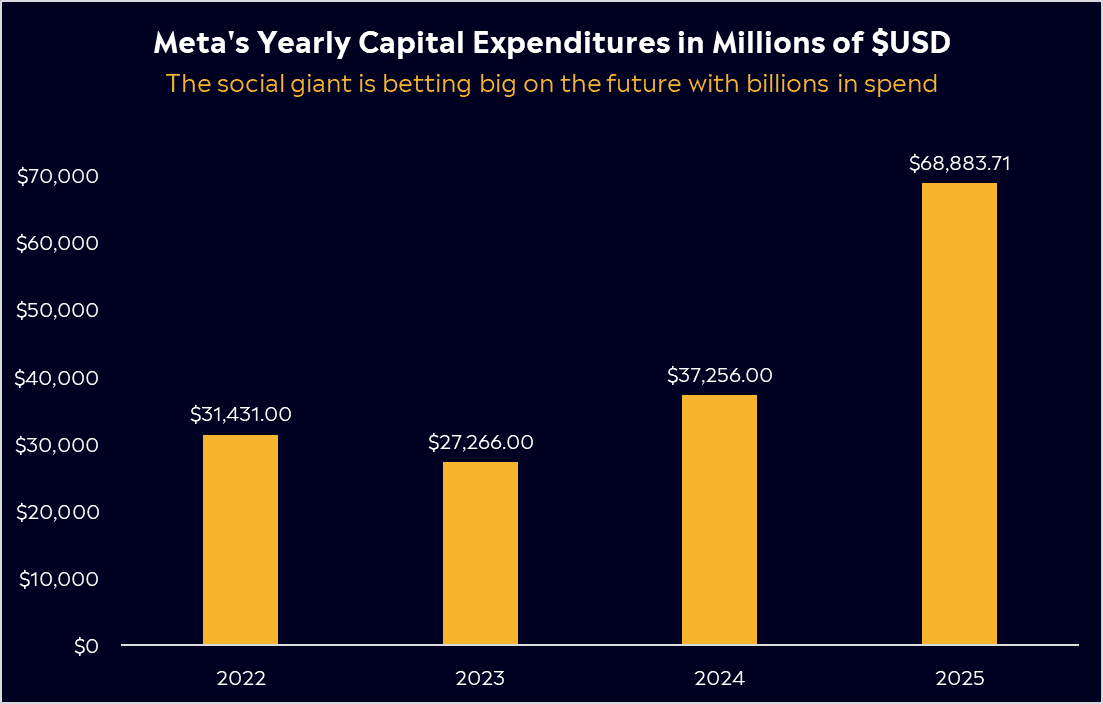

The good news is Meta can afford to dream. It’s sitting on a fortress balance sheet, with hefty cash reserves, strong free cash flow, and relatively little debt. In 2025, Meta plans to spend a staggering $69 billion in capital expenditure, with roughly 70% of that devoted to AI infrastructure, think data centres, servers and GPUs. It’s one of the biggest tech investments on the planet and shows just how determined Zuckerberg is to make AI central to Meta’s future. Despite the spending spree, net income is still set to top more than USD$70 billion this year, Meta’s most profitable year ever.

For shareholders, Meta has even started share buybacks and modest dividends, a sign of confidence in its cash machine.

Buy, Hold or Sell?

For investors, Meta is not holding back on its ambitions, but it’s got a steady business at its core. Its primary apps, Facebook and Instagram, remain an unmatched ecosystem that continues to print cash. The company has proven it can adapt, whether by embracing short-form video or weaving AI into its platforms, keeping users engaged and advertisers spending.

At the same time, Meta’s future bets carry real risks. Reality Labs is burning through cash, with no clear path to profit. If VR and AR adoption takes longer than hoped or rivals like Apple take the lead, those billions might never pay off. Even in AI, where Meta has strong momentum, competition from Google, Microsoft/OpenAI and Apple is intense, and the cost of staying ahead is enormous.

Meta trades around 26x forward earnings, the second-cheapest Magnificent Seven stock behind Alphabet. I’d say that’s a pretty reasonable valuation with Meta’s strong position in AI, and that won’t look expensive if it can execute. Recent results show that growth is back, margins are improving, and cost discipline is paying off, but the balance between investing for tomorrow and delivering profits today will remain a key tension for Meta.

According to Bloomberg’s Analyst Recommendations, Meta has 72 buy ratings, 8 holds, and 1 sell. The average analyst price target is USD$869.56, signalling a 15% upside from current levels.

The investor takeaway?

Meta has re-energised its core business and is one of the few companies with the talent, user base, and cash to fully capitalise on the AI boom. Meta’s willingness to invest for the future is admirable, but at some point, the scale of investment must be justified by tangible returns. Let’s be clear, Meta is far from a stagnant giant; it’s innovating and remains a dominant force in consumer tech, which bodes well for long-term investors.

Explore Meta

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.