The AI boom is full of winners, from Nvidia to AMD, Palantir to Microsoft, but Amphenol is probably a company you’ve never heard of. It’s not flashy, but shares have rallied more than 350% in the last five years and it has cemented its place as a key name in the AI revolution. It’s a giant in the world of electronic connectors and interconnect systems and simply, its cables are pivotal to the AI buildout that big tech is spending billions on. So, can it keep capitalising on the biggest technology revolution we’ve seen in decades? Let’s find out.

- Data centre demand is surging, but growth outside AI, like automotive and aerospace, is also accelerating, helping shares jump more than 100% this year.

- Strong free cash flow, expanding margins, and record profits this year signal a strong road ahead as Amphenol continues to execute.

- According to Bloomberg’s Analyst Recommendations, Amphenol has 13 buy ratings, 7 holds, and 0 sells. The average analyst price target is USD$144.74, signalling a 4% upside from current levels.

Explore Amphenol (APH)

The Basics

Amphenol is a behind-the-scenes powerhouse in electronics. It’s one of the world’s largest manufacturers of electrical, electronic and fibre-optic connectors and specialty cables. In other words, Amphenol makes the “nuts and bolts” that allow electronic devices and systems to connect and communicate.

Its reach spans nearly every sector you can think of: automotive, industrial, defence, aerospace, mobile devices, and cloud infrastructure. That diversification makes it less cyclical than most hardware peers. From the wiring harness in an EV, to the antenna in your smartphone, to the high-speed connectors in a hyperscale data centre, Amphenol is the silent enabler of multiple megatrends, including vehicle electrification, 5G, AI, and cloud computing, all at once.

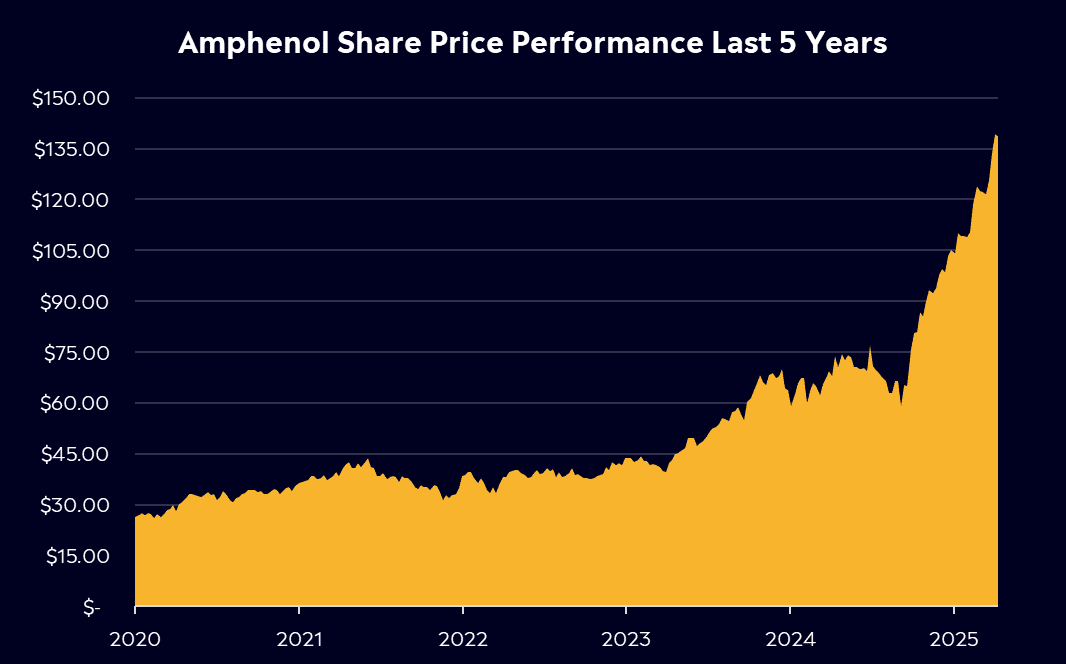

Amphenol may not be a standout name like Nvidia or Palantir, but it makes the connectors that make it all possible, quietly delivering huge returns for investors along the way. Shares are up 100% so far in 2025, recently hitting a record high of USD$142. It’s also a compounding beast having returned 26% average annualised returns in the last decade. The stock’s surge reflects not just the AI-driven data center buildout, but also a decade-plus of relentless execution.

Fun Fact: Amphenol was founded in 1932 in a Connecticut garage. Today it operates in 40+ countries, quietly becoming one of the world’s most important manufacturers in the age of connected everything.

Past performance is not an indication of future results.

Competitor Diagnosis

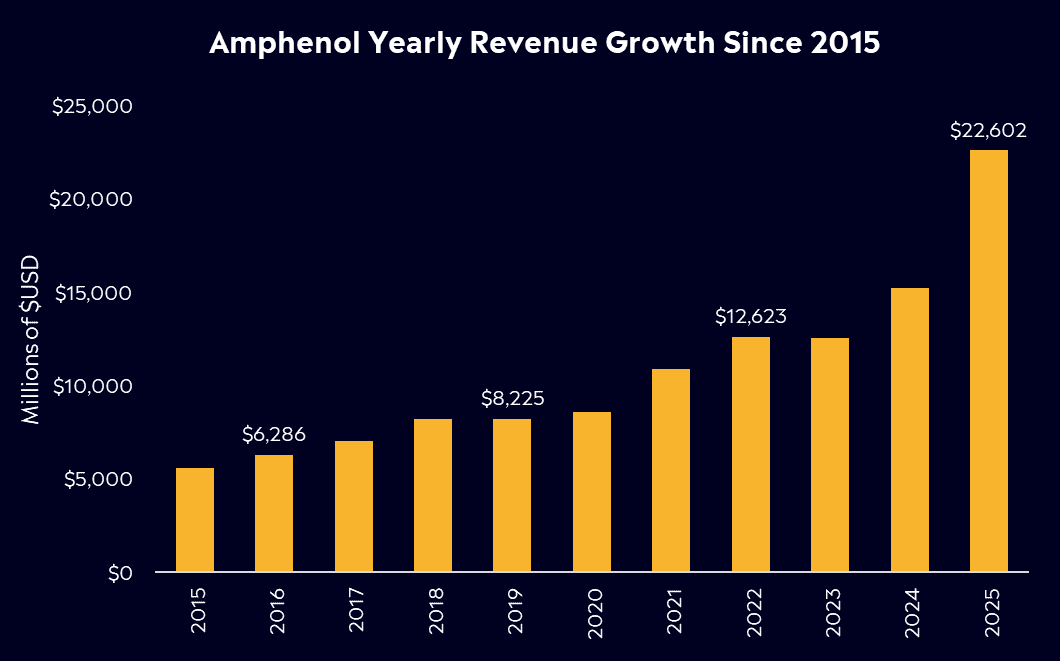

Amphenol operates in a market dominated by a few major players, with TE Connectivity (TEL) being the biggest rival. TE Connectivity is the world’s #1 connector supplier, with about USD$15.8 billion in sales in 2024, but Amphenol is hot on the tail of that number one spot, set to overtake TE with 48% revenue growth in 2025 as sales are expected to top over USD$22 billion.

Amphenol’s aggressive growth strategy has been closing the gap with TE. It’s a serial acquirer, with over 32 acquisitions in the last 6 years including a recent acquisition of CommScope’s connectivity business, enabling it to quickly broaden its product offerings and customer base with the deal set to close by the start of 2026. Beyond TE Connectivity, a few other competitors stand out. Molex is another big name, it’s considered the third-largest connector company and focuses heavily on consumer and automotive electronics. Aptiv is also in the top tier, specialising in automotive connectors and electrical systems. However, many rivals either concentrate on specific niches or lack Amphenol’s sheer breadth. Amphenol’s advantage is its diversification: it competes in almost every segment of the connector market.

The beauty is that this is a market that’s growing for everyone. The global electronic components market is set to double by 2032 and that creates a huge opportunity for Amphenol but also its competitors. But Amphenol’s focus on data centre connectors for use in AI servers has made it a cut above the rest, helping it to capture a greater market share.

Financial Health Check

Amphenol’s financial position is moving from strength to strength. As mentioned above, revenue growth for the full year is expected at 48%, but profits are set to jump by a huge 73% to USD$4 billion with margins continuing to expand, growing from 30% in 2020 to 36% in 2025. This trend of margin expansion reflects efficiencies and pricing power gained from scale. High demand and cost discipline have given Amphenol strong operating leverage, essentially, profits are growing even faster than revenues.

The company’s growth hasn’t come at the cost of an overstretched balance sheet. Amphenol also generates hefty free cash flow thanks to its high margins. Over the last year, free cash flow was USD$3.7 billion. This strong cash generation funds ongoing acquisitions and allows Amphenol to reward shareholders. The company has been actively returning cash to shareholders through dividends and buybacks. For example, in Q3 2025 alone Amphenol repurchased USD$153 million of its stock and paid USD$201 million in dividends.

While its AI-fuelled growth is getting most of the attention, its non-AI businesses are still delivering. In Q3, organic revenue growth outside of IT & Datacom came in around 15%, with broad-based strength across Industrial and Automotive. Amphenol’s financial health is excellent: growth is high, margins are expanding, and its balance sheet is strong enough to support ongoing expansion.

Past performance is not an indication of future results.

Buy, Hold or Sell?

Amphenol’s business fundamentals are unquestionably strong and AI’s insatiable demand for data transfer and storage capacity should keep Amphenol in the sweet spot. However, a lot of good news is already priced in. It’s currently trading at 36x forward earnings, which is well above the broader electronics industry of 24x and the S&P500 at 23x. Although that’s not crazy high for a company riding the wave of the AI boom, it does reflect expectations of ongoing rapid growth. According to Bloomberg’s Analyst Recommendations, Amphenol has 13 buy ratings, 7 holds, and 0 sells. The average analyst price target is USD$144.74, signalling a 4% upside from current levels.

The investor takeaway?

It’s the ultimate “picks and shovels” play, essential to AI infrastructure, EVs, aerospace, and defense, without having to focus on a single trend. And it keeps delivering. Recent acquisitions are also performing ahead of expectations, margins are expanding, and the company raised its full-year revenue forecast to $22.8B. A sizable dividend hike to $0.25 underscores management’s confidence. If both AI and non-AI momentum hold, there’s a real case for further upside, even from these elevated levels.

Explore Amphenol (APH)

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.