After a stellar rise in the decade between 2010 and 2020, Salesforce’s momentum has cooled in the last five years, with shares practically flat during that period. The cloud software pioneer, best known for its customer relationship management (CRM) platform, now faces a new chapter defined by cost discipline and bets on AI.

But does that mean its growth story is over? Well, CEO Marc Benioff has slashed costs, sharpened its focus on profitability, and doubled down on AI initiatives like Agentforce. With rivals from Microsoft to Oracle circling and investors expecting flawless execution, can Salesforce’s AI push and efficiency drive reignite its growth story? Let’s find out.

- Salesforce shares are down 30% this year amid slowing growth and AI disruption fears. But shares now trade at their lowest valuation ever alongside rising margins and record free cash flow.

- Salesforce’s fundamentals remain strong, but execution on AI is now the key. Investors want clearer evidence that AI can boost revenue.

- According to Bloomberg’s Analyst Recommendations, Salesforce has 50 buy ratings, 13 holds, and 1 sell. The average analyst price target is USD$326, signalling a 31% upside from current levels.

Explore Salesforce

The Basics

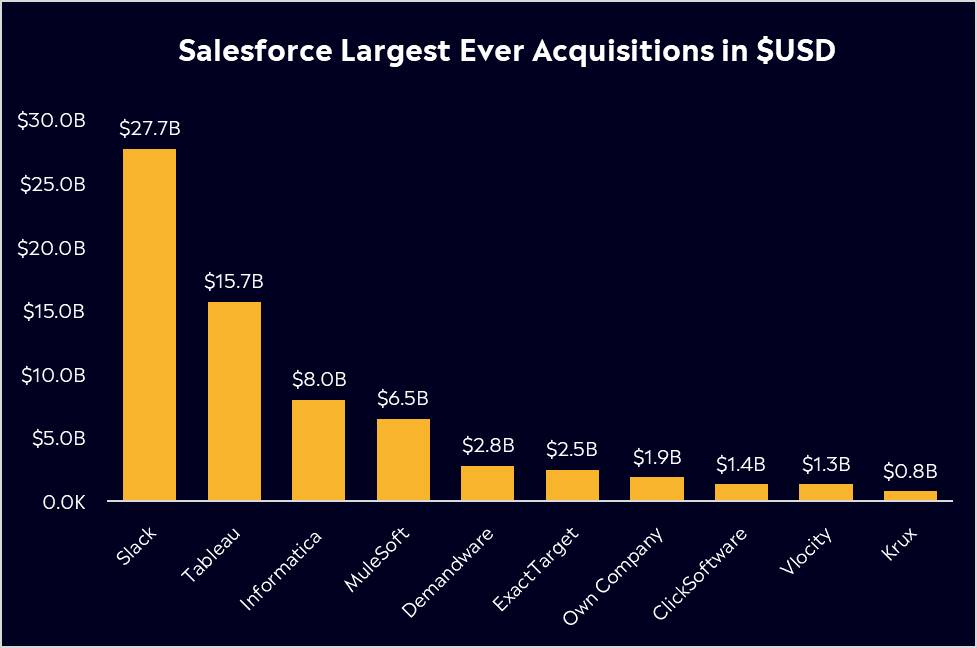

Salesforce (CRM) is a global leader in cloud business software, famed for pioneering the SaaS model. Founded in 1999 by Marc Benioff, Salesforce began as a sales force automation tool delivered entirely online. Growth has been fuelled not just by innovation but also by major acquisitions, including its USD$27.7 billion purchase of Slack in 2021. Salesforce now offers solutions for customer service, marketing, e-commerce, data analytics, and more.

After years of huge growth, Salesforce is the world’s number one CRM provider by market share. It accounts for about 20–21% of the global CRM market, far ahead of any rival and generates nearly USD$40 billion in annual revenue. Its software is deeply embedded in businesses of all sizes, creating high switching costs and a ‘sticky’ ecosystem. Now, Salesforce is aiming to make itself even more indispensable by infusing AI into its offerings, thereby helping clients work smarter and more efficiently.

But despite this strong foundation, the shares are down about 30% this year. Investors are wary that AI could disrupt or commoditise traditional SaaS platforms, and there’s been a broader valuation reset across the software sector. Concerns about Salesforce regaining double-digit growth, and a slower-than-hoped start for its AI tool, Agentforce, have added to the pressure. Even so, execution remains resilient and free cash flow continues to rise.

Fun Fact: One of the key reasons behind Salesforce’s success is its people. Not only is it regularly named one of the world’s best workplaces, but it also ranks among the highest-paying companies globally, helping the company attract top engineering talent and innovate at scale.

Past performance is not an indication of future results.

Competitor Diagnosis

Salesforce is the CRM king, but it faces strong competition across multiple fronts. Microsoft is one of its fiercest rivals by size and scale. Dynamics 365, Microsoft’s CRM suite, holds a smaller market share of around 10%, but Microsoft leverages its huge Office 365 and Azure customer base to cross-sell Dynamics. With AI features now woven into Microsoft’s ecosystem, clients tempted by an all-in-one Microsoft stack pose a constant threat to Salesforce. Other enterprise giants are also in the mix for a slice of Salesforce’s massive pie. Oracle also offers CRM as part of its broader cloud suite, appealing to firms seeking one-stop solutions. Meanwhile, smaller rivals cater to niches, such as simpler CRM tools for small businesses, like Zoho or HubSpot. In short, Salesforce must continually innovate to defend its market share.

The battleground is now extending into AI. Enterprise software leaders are racing to add generative AI and automation features. Salesforce has also been rolling out a wave of new AI features. Agentforce 360, announced ahead of Dreamforce, was pitched as a major upgrade. This ‘AI arms race’ means Salesforce cannot rest on its laurels. It needs to demonstrate that its AI-enhanced platform delivers superior value. The challenge for Salesforce is balancing efficiency with innovation. It needs to invest enough in AI to stay competitive while maintaining its margin progress.

Financial Health Check

One of the reasons Salesforce shares have been under pressure in 2025 is that revenue growth has slowed to single digits in the last six quarters, including its most recent earnings. Revenue came in below expectations, just shy of USD$10.26 billion, representing 9% year-over-year growth. However, earnings beat estimates at USD$3.25, comfortably above the USD$2.86 consensus, thanks to disciplined cost management.

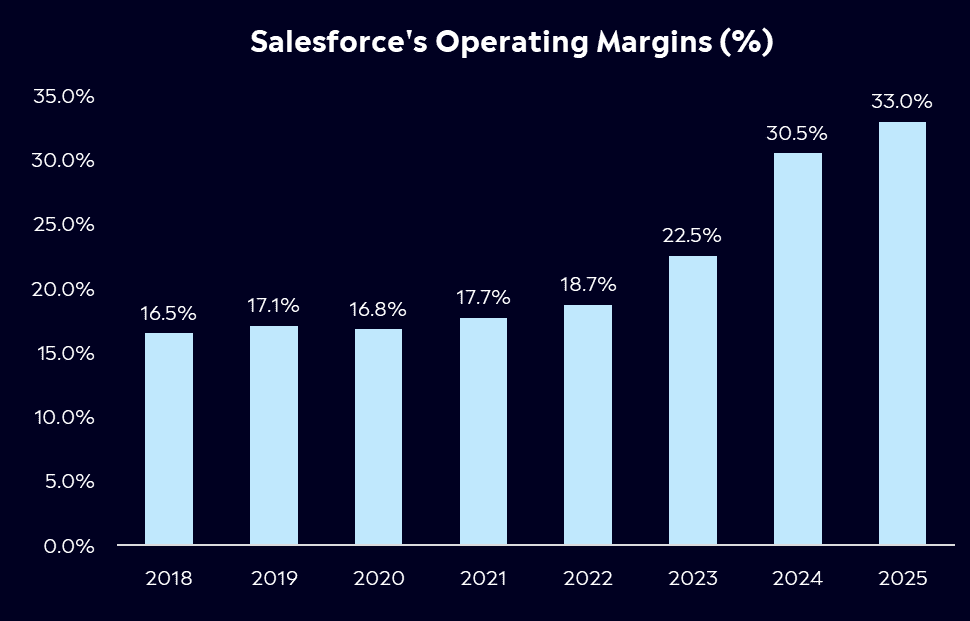

The key takeaway is that while single-digit growth is a slowdown from the double-digit pace of years past, those sales are now far more profitable, with operating margins jumping to 35% in the quarter. Robust cash generation is a reflection of that, with cash flow jumping 22% in the quarter, showing Salesforce’s improved efficiency. Part of that efficiency was cutting roughly 10% of its workforce in early 2023 and reining in its acquisition spree.

The real narrative, though, is around AI. Salesforce’s Agentforce platform has hit over US$500 million in ARR, up 330% year-on-year, which shows its AI bet is paying off in a tangible way. With enterprises scrambling to embed AI into their workflows, Salesforce is positioning itself as the platform to do that at scale. Salesforce also raised its guidance for the next quarter and continued to repurchase a substantial amount of stock, with its buyback program now totalling USD$50 billion, capitalising on its record free cash flow generation.

Past performance is not an indication of future results.

Buy, Hold or Sell?

Salesforce is growing its operating margins, generating record levels of free cash flow, and buying back large amounts of stock at what are now discounted valuations, showing that despite weakness this year, it’s still delivering. Shares are trading at around 18.6 times forward earnings, close to the lowest valuation in the company’s history. That creates an opportunity at current levels, but a higher multiple will be hard to justify unless AI starts to drive meaningful incremental growth.

Management continues to guide for a return to double-digit revenue growth, which could come as soon as next quarter, backed by greater AI adoption and the recently completed Informatica acquisition. Agentforce is gaining real traction, with thousands of new deals being signed as more companies look to integrate AI into their workflows. Investors still want to see that this momentum can translate into sustained top-line acceleration, but early signs suggest Salesforce’s AI strategy is beginning to take hold.

On the other side, Microsoft and others are bundling AI across their software suites in ways that could pressure Salesforce in key segments. Integrating AI across Salesforce’s vast product range and convincing customers to pay extra for these new capabilities remains a significant execution challenge.

According to Bloomberg’s Analyst Recommendations, Salesforce has 50 buy ratings, 13 holds, and 1 sell. The average analyst price target is USD$326, signalling a 31% upside from current levels. So, can Salesforce’s AI push and efficiency drive reignite its growth story? It can, but patience is required. Salesforce has consistently demonstrated its ability to adapt, from inventing cloud CRM to transforming itself into a more efficient and cash-generative business. The next test is proving that AI can lift demand and spark a new phase of growth. At today’s valuation, Salesforce looks appealing for long-term investors who believe it can execute its AI vision.

Explore Salesforce

eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results.