Crypto STAKING

Crypto Staking

What is staking?

Staking lets you earn monthly rewards just by holding certain cryptos on eToro.* When you stake with us, we handle the technical side – so you can focus on your portfolio while your eligible crypto grows automatically.

*T&Cs apply. Staking involves risk, only applies to certain cryptoassets, and is not available in certain US states. Learn more.

Staking on your terms

At eToro, staking is simple, transparent — and always your choice. You can opt in or out anytime with just a few clicks.

How to manage your staking

Here’s the deal

Your staked cryptoassets are always yours.

At eToro, we take the responsibility of handling the entire staking process for our users, ensuring top-notch security and efficiency.

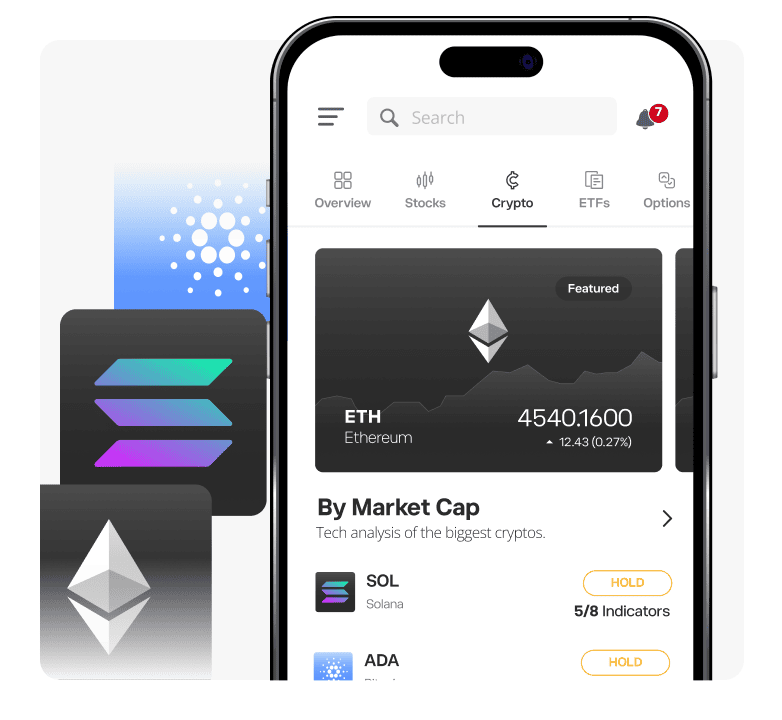

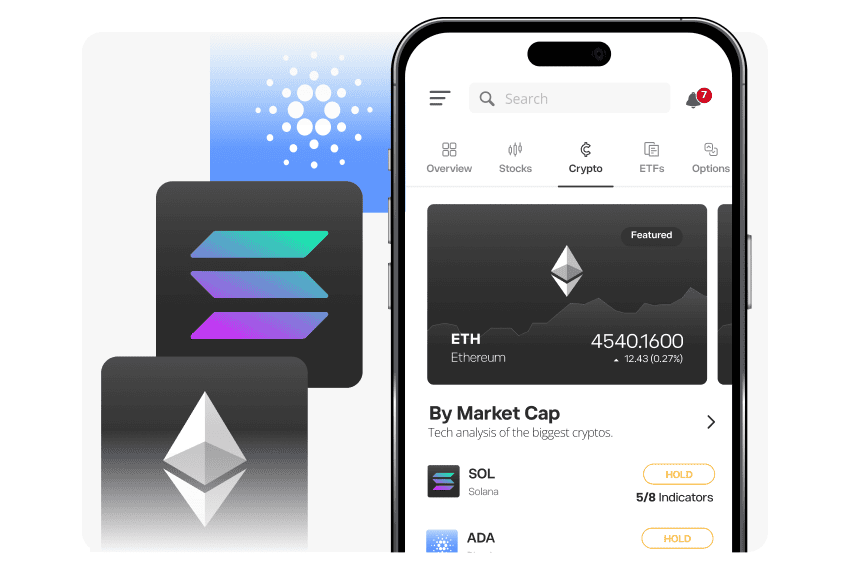

Supported cryptoassets

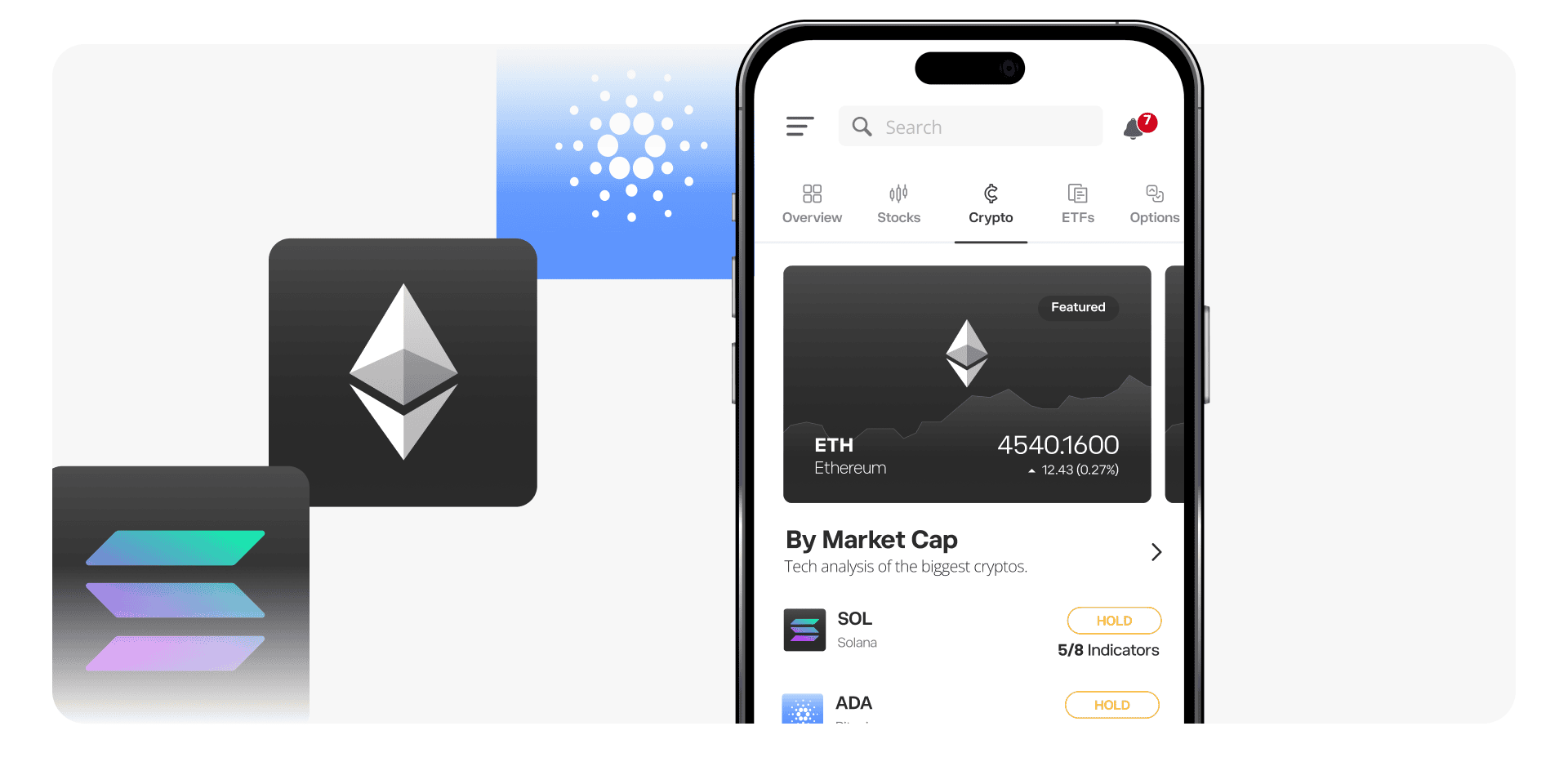

Ethereum (ETH)

The most widely used smart contract platform, powering everything from DeFi to NFTs.

Cardano (ADA)

A research-driven blockchain focused on sustainability, scalability, and peer-reviewed innovation.

Solana (SOL)

A high-speed blockchain known for ultra-fast transactions and low fees—built for scale.

eToro’s staking services only apply to certain cryptoassets and do not include cryptoassets held using CopyTrader, Smart Portfolios or assets in the eToro Money crypto wallet. Terms and conditions apply.

FAQ

- How does staking work?

-

Staking is a process that allows rewards to be earned by holders of a specific coin.

Staking derives from the PoS (Proof-of-stake) mechanism, used by a distributed blockchain network, where blockchain miners can mine or validate block transactions according to how many coins they have. The more coins they hold, the more mining power they have. Staking rewards are shared with users who own the cryptoassets (like eToro and our clients) and who delegate their voting rights to staking pools. The more validations that are delegated to a staking pool, the higher chance of being elected to produce the next block, and the more rewards likely to be received. Not all cryptos can be staked; some blockchains use other mechanisms like Proof of Work (PoW) that do not support staking.

- Is staking profitable?

-

Staking can help you grow your crypto holdings over time by earning rewards—just for holding supported assets. Think of it like earning interest, but in the form of more crypto.

- Which coins can I stake with eToro?

-

eToro currently supports staking for Cardano (ADA), Solana (SOL), and Ethereum (ETH) and is working on plans to support more cryptoassets in the future.

- How can I start staking?

-

To begin staking, a user needs to purchase and own one or more of the supported cryptoassets.

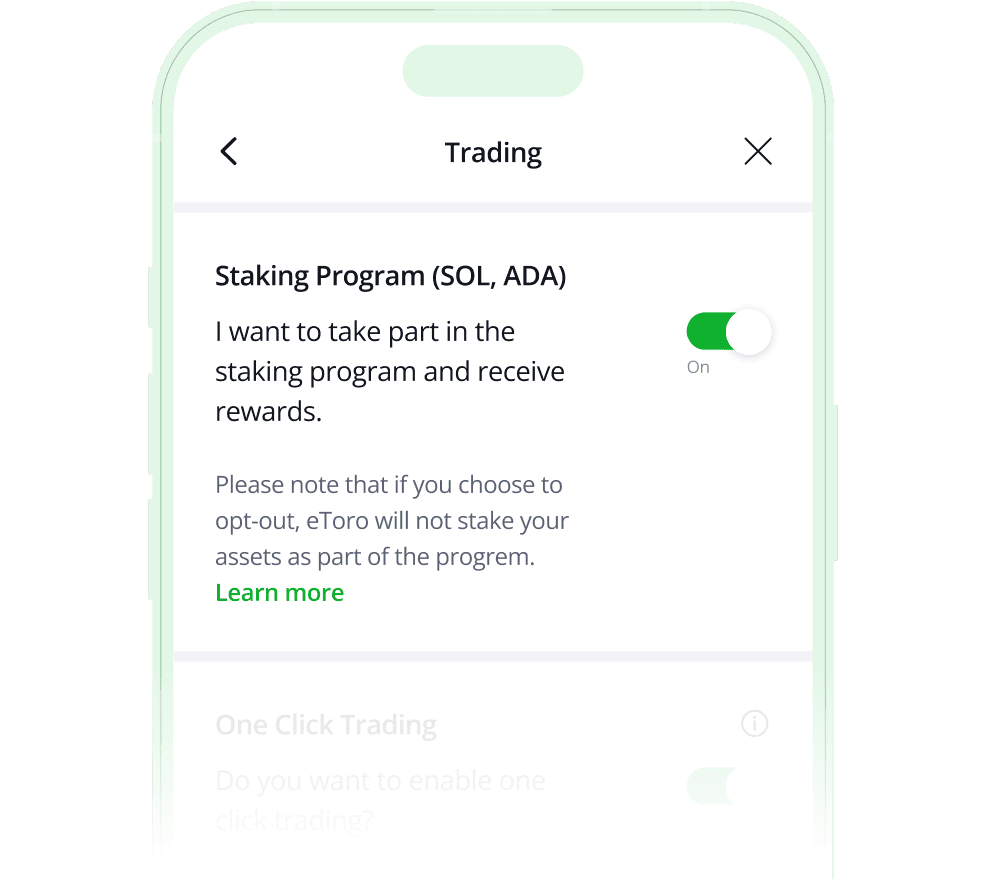

Staking is applied automatically to SOL and ADA. To stake ETH, users need to actively opt in to the staking program (go to Settings > Trading > Staking Program and toggle the switch to ON).

Users need to hold the open position of the staked cryptoasset for a certain period of time. The time period for each cryptoasset can differ; according to the blockchain of the specific cryptoasset, and how long it takes for it to be included in the staking pool.

- How long do I have to hold the coins to receive staking rewards?

-

A user is eligible for a staking reward if they have held an open position of the staked cryptoasset for a certain period of time. The time period for when a user becomes eligible differs per cryptoasset; according to the blockchain of the specific cryptoasset, and how long it takes for it to be included in the staking pool.

- SOL, ETH: 7 staking intro days (rewards begin on day 8 of holding)

- ADA: 9 staking intro days (rewards begin on day 10 of holding)

Important: The number of intro days for ETH may vary depending on the ETH network.

- When will I receive staking rewards?

-

Staking rewards will be distributed for a specific month within 14 days of the following month. No action is required on the part of the user.

- Does staking carry risk?

-

While staking crypto can help you grow your crypto holdings, it does carry some risk, including limited liquidity for assets being staked, potentially reduced (slashed) rewards in the event of malicious activity, and regulatory changes preventing the distribution of rewards. You can read more about these risks below to understand if staking fits your goals.

- Liquidity Risk: Staked assets might be locked and not immediately available for trading, limiting your ability to react to market changes. eToro addresses the liquidity risk by maintaining an operational buffer of each staked asset, ensuring that a number of the assets remain available for trading even during high volatility or extended lock-up periods.

- Slashing Risk: Some blockchain networks penalize validators for protocol violations, potentially leading to a loss of assets. While your staked assets remain yours, slashing could potentially reduce your staking rewards – although the chances of slashing are extremely minimal and would be the result of an intentional malicious act. eToro ensures that it collaborates only with reputable staking providers and implements top-tier security protocols to minimize these risks. Note: Slashing can affect only some of the stakable assets on eToro.

- Regulatory Risk: Regulatory changes can potentially affect the availability of staking services in certain states. eToro regularly monitors changes in regulation, and adjusts its practices accordingly.

- Protocol and Network Risk: Staking rewards depend on the specific Proof-of-Stake (PoS) protocol and are not guaranteed. Additionally, changes in blockchain networks or protocol violations can potentially affect staking rewards.

- Can I opt out of staking my assets?

-

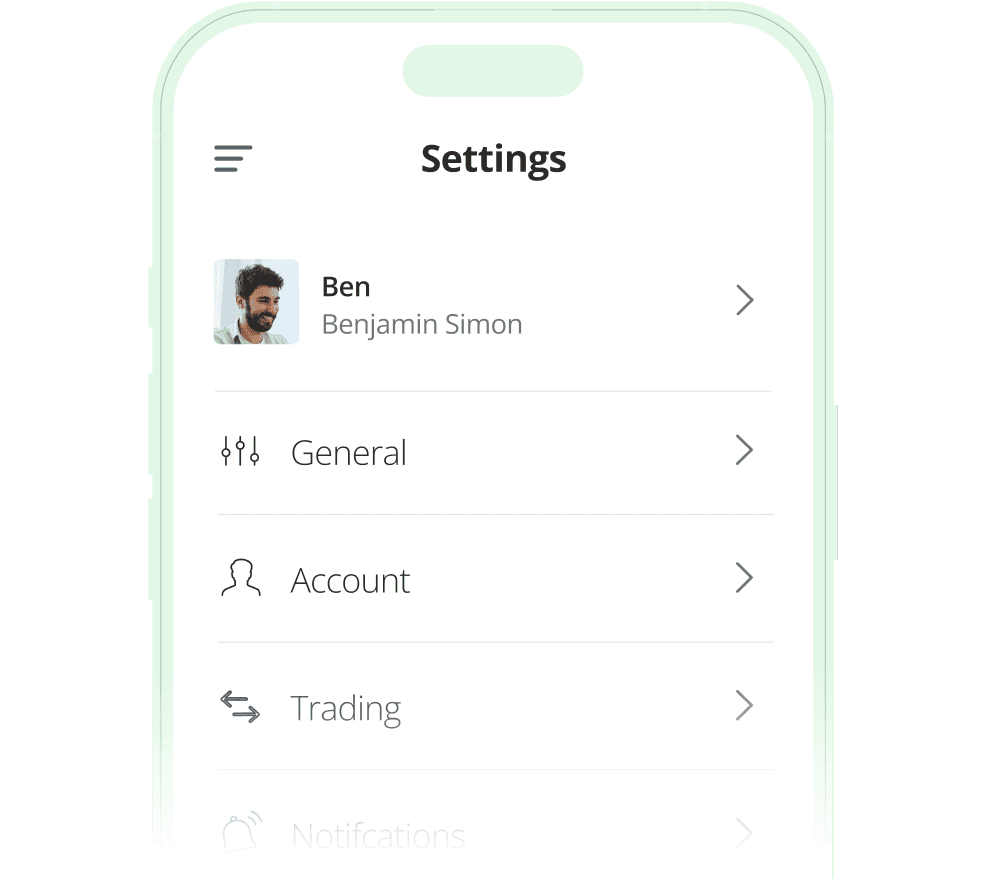

Yes, eToro offers users the ability to opt out of staking their non-Ethereum cryptoassets as they choose. To opt out of staking your crypto, follow these steps:

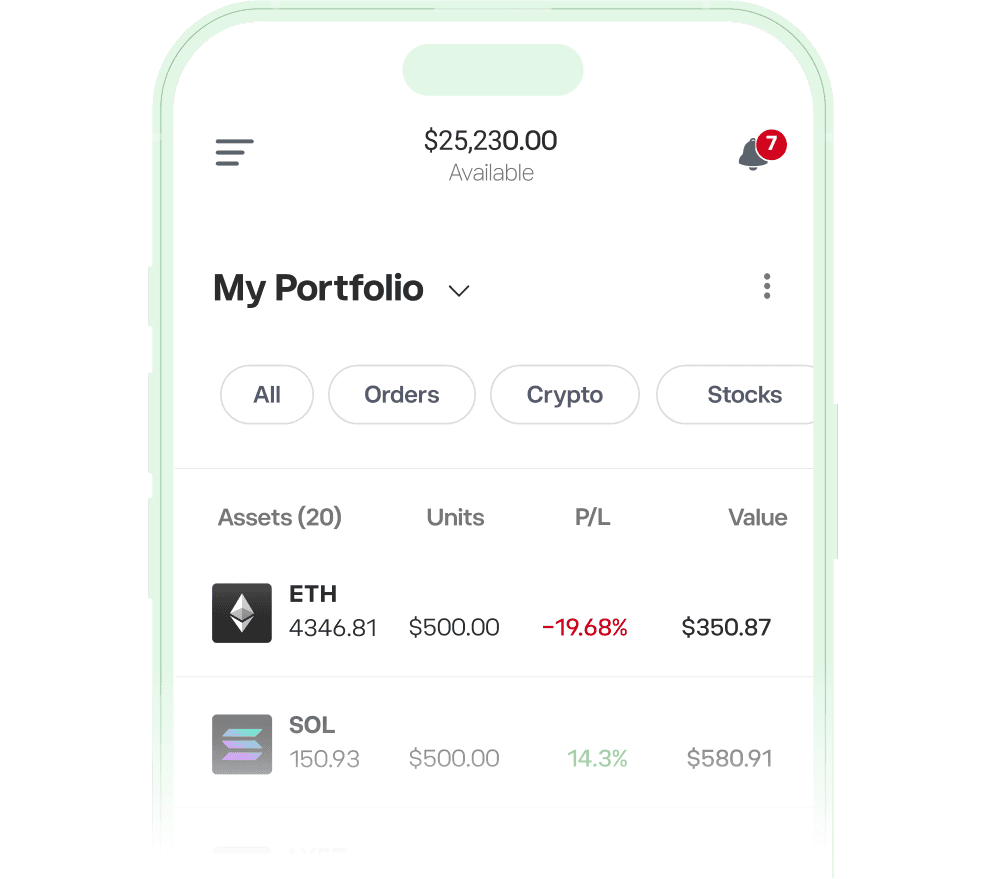

- Go to your eToro investment portfolio.

- Go to Settings > Trading > Crypto Staking Program.

- Move the button to the OFF position.

Note: Users are automatically opted out of staking ETH and will need to opt in to staking for this asset manually. You can follow the steps above to locate and activate or deactivate the ETH staking toggle.

- Will staking rewards also be used as part of the input amount for the next staking reward calculation?

-

Yes. The staking reward calculations for one month (e.g. October) will include staking reward percentages earned in the previous month (e.g. September). The rewards will be calculated according to the number of intro days of the specific cryptoasset. For example, Cardano has nine intro days, with calculations beginning on the tenth day of holding the asset.

- Does staking reward eligibility vary?

-

Your monthly staking reward calculations are based in part on your eToro Club tier—the higher your tier, the greater your reward.

- Which US states are eligible for staking?

-

Staking availability varies by state due to regulatory requirements. As of September 2025, staking is not available in the following states: California, Hawaii, Maryland, New Jersey, New York, Nevada, Puerto Rico, Wisconsin, Washington and US Virgin Islands. Availability is subject to change based on state regulations.