Semiconductor stocks have regained their groove, while one name in particular is making new record highs. The Daily Breakdown digs in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Wednesday’s TLDR

- AVGO leads semiconductor gains

- MSFT nears record highs

- CRWD dips on earnings

What’s Happening?

Welcome to Wednesday, where we’re diving into semiconductor stocks — and a new potential leader emerging in the group. No, I’m not talking about Nvidia or Taiwan Semiconductor.

These two have long been the one-two punch, the juggernauts of the space — even if Nvidia tends to get far more fanfare than TSM, especially here in the States.

That said, there’s been surprisingly little buzz around Broadcom. Yet the stock has quietly rallied in 14 of the last 16 sessions, hitting new all-time highs along the way and pushing its market cap to $1.2 trillion. This company is a juggernaut in its own right.

What stands out to me, though, is that AVGO has climbed to record highs while Nvidia and TSM have not. To be fair, both are trading well, and Nvidia seems to be finding its groove again after delivering yet another strong quarter last week.

Together, these three stocks make up over 40% of the SMH ETF. But of the top 10 holdings in the ETF — which account for nearly 75% of the fund’s total weighting — Broadcom is the only one to recently notch new record highs.

So here are my questions:

Can Broadcom maintain its momentum with earnings due up after the close on Thursday?

And can AVGO hold onto its new leadership role in the semiconductor space — potentially reigniting the AI trade and sparking fresh bullish momentum?

Want to receive these insights straight to your inbox?

The Setup — Microsoft

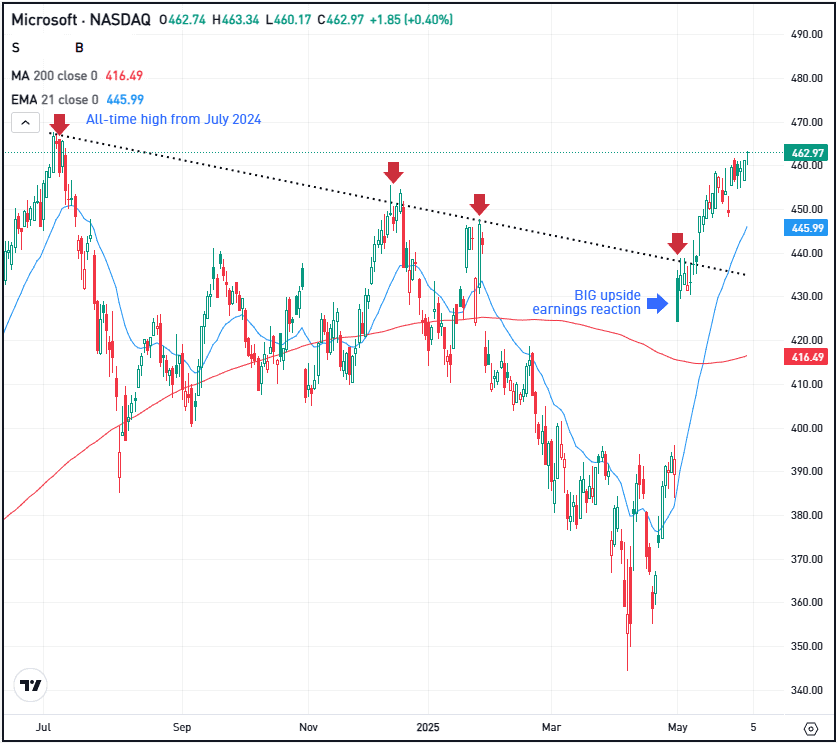

There’s probably a few investors saying to themselves, “finally!” as Microsoft nears its record high from July 2024.

The stock had been mired in sideways trading after its run to record highs, but then macro-induced volatility weighed on MSFT throughout Q1, as it dipped below $350.

Earlier this month, shares jumped higher after strong earnings and we’ve seen the stock continue to climb since that report. Generally, that’s a sign of institutional accumulation — a fancy phrase that translates to “the big firms are buying the stock.”

When we see these types of earnings reactions — and it helps that MSFT broke out over a long-term downtrend resistance line — it helps set up a stronger bullish trend. Those are the trends where investors tend to feel safer buying the dips when they materialize.

I’m keeping an eye on Microsoft to see if shares can make a new high, but either way, the charts are much, much healthier after that strong earnings report and even stronger stock response.

Options

On a dip, buying calls or call spreads may be one way to take advantage of an eventual pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

CRWD

Shares of Crowdstrike are under pressure this morning, falling about 7% in pre-market trading after the firm reported earnings. While the company beat earnings, management’s revenue outlook for next quarter — calling for a range of $1.14 billion to $1.15 billion — was just shy of analysts’ estimates for $1.16 billion. Check out the charts for CRWD.

DG

Dollar General stock jumped more than 15% yesterday after reporting better-than-expected earnings. The company earned $1.78 a share, well ahead of expectations for $1.46 a share, while revenue of $10.4 billion beat estimates of $10.3 billion. Management also raised its outlook for the year.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.