Amazon and Alphabet headline a busy week of earnings, while The Daily Breakdown digs into gold, bitcoin, and other big movers from January.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

January Recap

We’re coming off a wild week to cap a rather up-and-down month. The S&P 500 hit new all-time highs last week and finished January up 1.4%. However, cryptocurrencies like Bitcoin and Ethereum ended the month on sour notes, dipping 10.1% and 17.4%, respectively. Gold and silver finished the month higher despite plunging last week — gold fell 9% on Friday but rose 13.4% in January, while silver dropped 26.3% on Friday but still gained nearly 20% for the month.

Weekly Outlook

It’s the first week of the month, which will bring investors a heavy slate of labor data. On Tuesday, we’ll receive the JOLTS report, which covers job openings, quits, and layoffs. We’ll also get the ADP report (private payrolls) on Wednesday, Thursday’s initial jobless claims, and Friday’s all-important monthly jobs report, which includes the updated unemployment rate.

Earnings

Earnings season continues and will feature several big names, including Disney and Palantir on Monday, and PayPal, Advanced Micro Devices, and Chipotle on Tuesday. Uber, Alphabet, and Eli Lilly report on Wednesday, while Amazon, Strategy, and Reddit report on Thursday.

Want to receive these insights straight to your inbox?

The Setup — SOFI

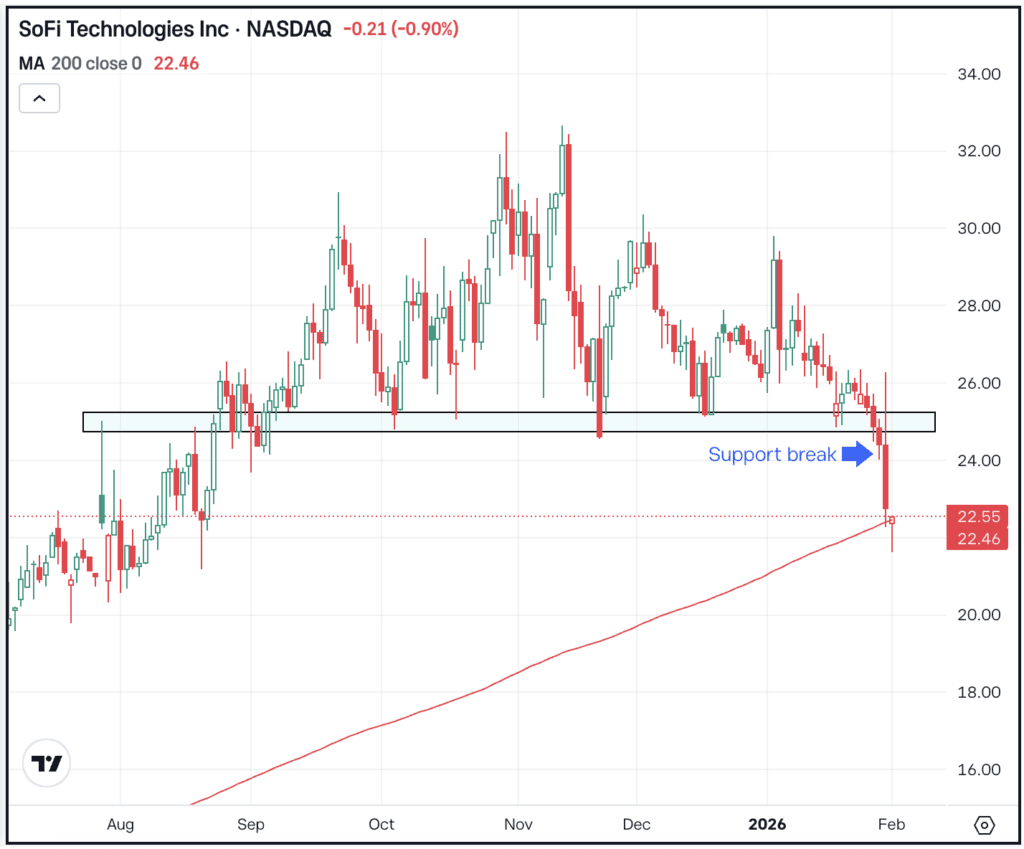

Shares of SoFi Technologies stumbled on Friday, falling more than 6% after reporting earnings. The stock lost more than 11% last week and is now down about 30% from its record highs. Investors are now wondering if more downside is in store or if SoFi may soon find support.

Shares had been mostly rangebound between $25 support and $30 resistance, but last week, support gave way as SOFI flushed down toward $22. Amid the decline, buyers stepped in around the 200-day moving average. The question now is, will this moving average continue to act as support or are lower prices on the way?

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

ORCL

Oracle announced plans to raise $45 billion to $50 billion in gross proceeds during calendar 2026 through a mix of debt and equity financing to aggressively expand its AI cloud infrastructure. The company aims to add capacity to meet contracted demand for AI workloads from cloud customers including Nvidia, Meta, OpenAI, AMD, TikTok, and xAI. Check out the chart for ORCL.

SPY

Investors are still digesting last week’s Fed announcement (no interest-rate change) and the news that Kevin Warsh will be named the new Fed chair later this year. Like many candidates, Warsh favors lower interest rates. However, many investors remember his Fed stint as a more hawkish one. This impacted more than just stocks last week, as bonds, currencies, metals, and crypto were all on the move.

MSFT

Microsoft stock tumbled 7.7% last week as investors reacted to the firm’s earnings. Despite headline results that beat analysts’ expectations, investors were more concerned about Microsoft’s cloud growth, as it prioritizes some of its own initiatives over short-term growth. Alongside higher spending expectations, shares fell to their lowest levels since mid-April. Dig into the fundamentals for MSFT.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.