The Daily Breakdown takes a closer look at how to use moving averages, what the difference between EMA and SMA is, and why trends matter. Don’t miss: Part I: Welcome to Technical Analysis.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Boot Camp: Moving Averages

Moving averages are one of the most widely used tools in technical analysis because they help cut through the market’s day-to-day noise and reveal the underlying trend. At their core, moving averages simply smooth out price action by averaging prices over a set period of time — such as 20, 50, or 200 days. Rather than reacting to every short-term swing, traders use moving averages to stay focused on the bigger picture.

Different Timeframes

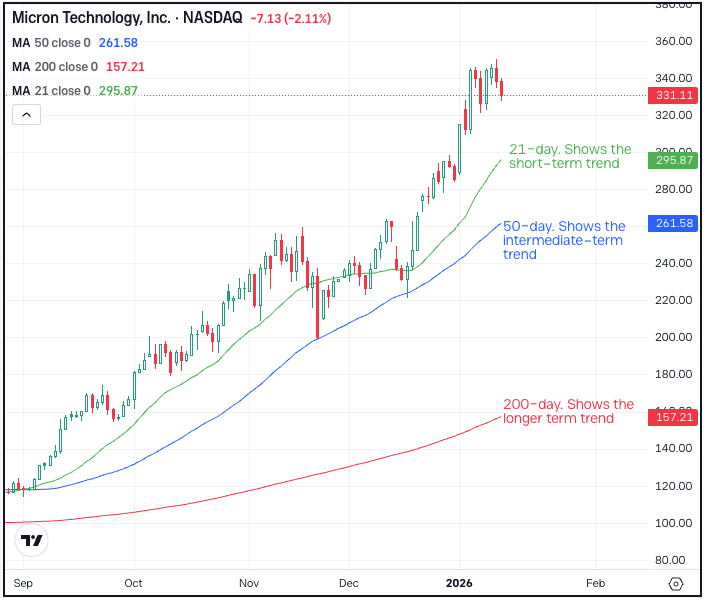

Using multiple moving averages adds another layer of insight. Shorter-term averages respond quickly to price changes and help identify near-term momentum, while longer-term averages move more slowly and reflect broader trend direction. When shorter-term moving averages cross above longer-term ones, it can signal improving momentum; when they cross below, it may suggest the opposite. Investors also watch how price behaves as it approaches key long-term averages, such as the 200-day, which often serves as a psychological line between bull and bear trends.

Investors usually use a blend of moving averages, often along the lines of something like this:

- Very short-term trend: 8 to 10 day moving averages

- Short-term trend: 20 or 21 day moving averages

- Intermediate-term trend: 50-day moving average

- Long-term trend: 200-day moving average

For what it’s worth, these moving averages can also be applied to different timeframes as well, such as intraday charts or weekly charts.

Trends Matter

How a moving average slopes matters too.

An up-sloping moving average suggests that buyers are in control, while a down-sloping moving average signals weakening momentum and increasing selling pressure. Prices that hold above a rising moving average are often viewed as being in a healthy trend, while repeated failures near a falling moving average can reinforce a bearish setup.

In this way, moving averages can act as dynamic areas of support and resistance, adjusting as prices evolve. In the example above, notice the different trend lengths — and notice how, at times, these measures can act as support.

Want to receive these insights straight to your inbox?

Getting Advanced

Traders often use moving averages as a risk-management framework, not just a trend signal.

One common approach is to use a key moving average as a line in the sand — staying in a trade while price remains above a rising average in an uptrend, and reducing or exiting exposure if it breaks below. This helps traders avoid riding positions too far once momentum starts to fade. Moving averages can also guide stop-loss placement, with stops set just beyond a widely watched average to limit downside while allowing normal price fluctuations.

SMA vs. EMA

The difference between an SMA (Simple Moving Average) and an EMA (Exponential Moving Average) lies in how they weight prices. An SMA gives equal weight to all prices in the look-back period, making it smoother and slower to react. An EMA places more weight on recent prices, allowing it to respond more quickly to changes in momentum.

Traders often prefer EMAs for short-term trading and faster signals, while SMAs are commonly used for longer-term trend analysis and widely followed reference levels — such as the 50-day or 200-day moving average.

The Bottom Line

Ultimately, moving averages matter because they help investors stay disciplined. They provide a framework for managing risk, identifying trends, and avoiding emotional decisions during volatile periods. While no indicator is perfect, moving averages remain a staple of technical analysis because they are simple, adaptable, and effective at keeping traders aligned with the market’s prevailing direction.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.