The Daily Breakdown takes a closer look at growth stock earnings, as well as Bitcoin’s approach toward $100K as the breakout continues.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Thursday’s TLDR

- Stocks jump on UK-US trade deal

- Chip stocks rally

- Bitcoin helps lead crypto rally

- Growth-stock earnings in focus

What’s Happening?

For growth investors, today is a big day of earnings. Shopify is down about 8%, and MercadoLibre is up about 8%, after both companies reported earnings this morning. After the close, Coinbase, Marathon Holdings, Cloudflare, SoundHound, and DraftKings will report.

Online advertising will be in focus too, as Trade Desk and PubMatic will hope to report good news after the close, while Magnite is up more than 10% in pre-market trading due to its earnings report.

The SPY ETF is up 1% this morning, and the QQQ ETF is up 1.4%. For the latter, active investors want to see the QQQ eventually clear the $491 level. Not only is that last week’s high, but it’s roughly where the 200-day moving average comes into play.

Stocks are rallying as there is reportedly a trade deal in place between the US and UK, signaling reduced tension in global trade. Stocks are also rallying as the Trump administration plans to repeal AI chip export restrictions that were put into place under the previous administration.

While further chip exports and/or tariffs are still on the table, investors are viewing this as good news for chip stocks like Nvidia and Advanced Micro Devices.

Lastly, while the Fed did not cut interest rates yesterday — which was in-line with expectations — Chairman Powell reiterated that the labor market remains solid and the economy is doing well, despite a number of uncertainties still looming overhead.

Want to receive these insights straight to your inbox?

The Setup — Bitcoin

Did you think we forgot about crypto this morning? Bitcoin is approaching $100K, while Bitcoin Cash and Ethereum are catching a bid.

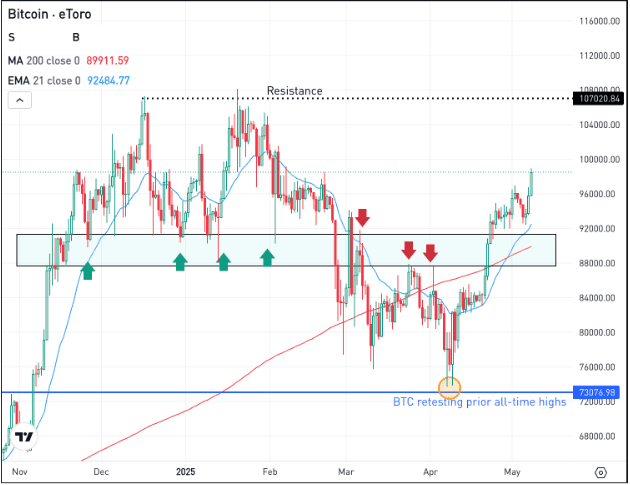

For BTC specifically, it successfully retested its prior record highs in early April and held that area as support. Then, it broke out over the 200-day moving average and a key support/resistance zone in the low-$90,000 area (the blue box on the chart below).

Now, it’s rallying toward $100K.

From here, bulls want to see BTC clear the key psychological level of $100K. If it can, it could set the stage for a rally toward the $107K to $110K range, which was resistance in Q4 and Q1.

On the downside, investors want to see support come into play in the $90K to $92K area, just as it has over the past few weeks. Additionally, they’ll want to see key moving averages — like the 21-day and 200-day, shown above — act as support as well.

At least for now, BTC is taking on a leadership role when it comes to risk-on assets, as it held up well in early April when stocks were getting decimated and is now hitting multi-month highs.

What Wall Street is Watching

GOOG

Shares of Alphabet tumbled yesterday, declining more than 7% on news that Apple is exploring the idea of adding an AI search engine to its Safari browser. The revelation came during Alphabet’s antitrust trial. Check out the chart for GOOG.

ARM

Arm Holdings fell 11% after issuing Q1 guidance that came in below expectations, despite beating Q4 earnings and revenue estimates. The cautious outlook weighed on investor sentiment, overshadowing an otherwise strong quarter as concerns around chip demand and pricing persisted.

ETH

Ethereum’s recent upgrade was technically successful, but the market reaction was initially muted. Now, ETH is up close to 8% on the day. Analysts note that while the upgrade improves Ethereum’s infrastructure, it doesn’t directly tackle growing competition from faster and cheaper alternatives, like Solana.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.