The Daily Breakdown looks at Bitcoin and Nvidia, both of which are powering higher and recently notched record highs. Can they keep going?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Thursday’s TLDR

- BTC has led risk-on rally

- NVDA hits record highs

- MU, FDX report earnings

What’s Happening?

When Bitcoin traded higher on April 3rd and April 4th while the Nasdaq and S&P 500 fell more than 10% — yikes! — it was clear there was a shift developing in how investors viewed these risk-on assets.

Then Bitcoin surged back to a record high on May 22nd, more than a month before the Nasdaq was able to do so — which happened yesterday, by the way.

It begs the question: Can BTC not only continue to lead the way for risk-on assets, but can it give the entire crypto space a lift?

While Bitcoin has returned to record highs, many others in the space have not yet done so. That’s true for larger cryptocurrencies, like Ethereum, Ripple, and Solana, but it’s also true for the smaller but popular names like Dogecoin, Cardano, Polygon, and Shiba, among many others.

The good news? eToro US users can now trade all of these, with 50 cryptocurrencies now listed on the platform*.

Excluding Bitcoin, the total crypto market cap hit $1.6 trillion in December, its highest since the 2021 peak near $1.7 trillion. Now near $1.1 trillion, bulls would argue that there’s upside back toward those levels.

While there are potential catalysts in play, investors will likely need to see Bitcoin lead the way.

*Users in the following states cannot currently trade cryptoassets: Hawaii, New York, Nevada, Puerto Rico, U.S. Virgin Islands.

Want to receive these insights straight to your inbox?

The Setup — Nvidia

Shares of Nvidia notched a new record high on Wednesday, doing so for the first time since January 7th. Last time, shares opened higher, tagged an all-time high, then fell over 6% for the day.

This time, Nvidia powered to record highs and closed within pennies of that mark. It’s now higher in pre-market trading this morning — a much different (and better) vibe than last time.

Now investors are wondering if this rally could trigger a larger breakout.

Read our previous Deep Dive on Nvidia right here.

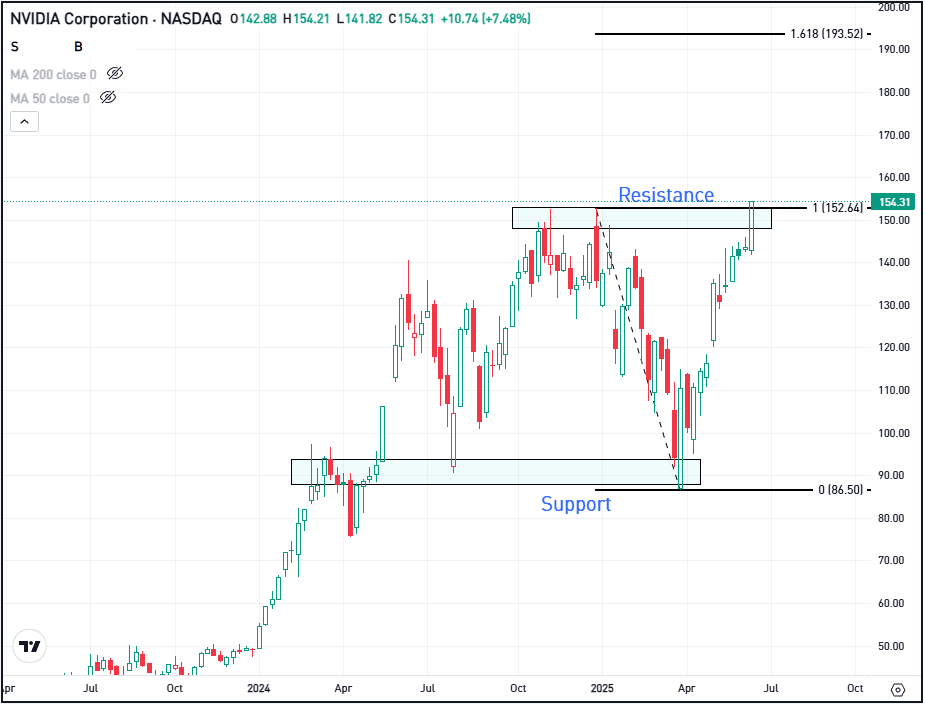

I’m zooming out with a weekly chart, which highlights key support and resistance areas for Nvidia over the past year. Notice how the stock has been consolidating since last summer, with the $145 to $150 zone previously serving as resistance.

If Nvidia can break out over this area, bulls will look for this prior resistance zone to turn into current support. If that happens, it could help set up the next leg higher, potentially making Nvidia a strong second-half contender.

While the stock has done well lately, note that it is basically flat over the last six months. If investors use Fibonacci extensions (I added them to the chart above to help illustrate) they might be looking for a longer-term target in the $190s.

However, if NVDA breaks back below the $145 to $150 zone, it could be vulnerable to more downside and continue consolidating for longer.

Options

Investors who believe shares will move higher over time may consider participating with calls or call spreads. If speculating on a long-term rise, investors might consider using adequate time until expiration.

For investors who would rather speculate on the stock decline or wish to hedge a long position, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

QQQ

The QQQ ETF powered higher on Wednesday, hitting its first record high since February. The rally comes after a significant pullback in March and early April, but marks a tremendous recovery for the Nasdaq. The SPY ETF (S&P 500) is within 1% of its record highs, but has not yet made fresh all-time highs. Check out the charts for the QQQ.

Shares of FedEx dipped over 3% on Wednesday after the firm reported earnings. While the company reported better-than-expected earnings and revenue, management’s outlook for next quarter was below analysts’ expectations.

Micron’s earnings report is helping give a boost to the semiconductor space this morning. Shares are higher by just 2% to 3% in pre-market trading after beating on expectations, but comes as the stock works on its fifth straight weekly gain, where it has climbed more than 36% in that span. Dig into Micron’s research page to find out more.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.