The Daily Breakdown looks at the rebound in US stocks despite being downgraded by Moody’s, as well as the earnings reaction in Home Depot.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Tuesday’s TLDR

- Stocks muscle out gains

- Home Depot’s mixed quarter

- Can gold find its footing?

What’s Happening?

Monday’s session started off underwater thanks to the US credit downgrade, but in my opinion, eToro’s Lale Akoner nailed the takeaway — “Don’t overreact to the downgrade itself. History shows these calls often lag the fundamentals.” — helping pave the way to a solid rally in US stocks.

That’s as the S&P 500 and Nasdaq both finished higher yesterday despite a rough open.

The S&P 500 is now down less than 3% from its record high and is now up more than 23% from its lows last month. It’s been a remarkable comeback and shows just how important it was for the US to walk back those tough tariff talks.

Despite stocks eking out a gain, yesterday’s news did send the VIX higher too, while the 10-year Treasury yield continues to hover near 4.5% — its highest level since January when it was near 4.75%.

I know bonds can be boring to talk about. But if we see the 10-year inch toward those year-to-date highs, fear will grow that it will climb to (and potentially surpass) 5%.

All this is to say that the latest run has been outstanding for bulls and long-term investors, but there are still some headwinds and risks out there to be aware of.

Want to receive these insights straight to your inbox?

The Setup — Home Depot

Home Depot shares are inching higher in pre-market trading, up a little more than 2%. The rally comes amid a mixed quarterly report where the firm missed on earnings estimates, but beat on revenue expectations.

The mild move in pre-market trading is nothing new. In fact, in the prior seven quarters, the one-day change after Home Depot reported earnings has seen the stock move less than 3% (and five of those instances were less than 1.5%).

That doesn’t mean today’s move can’t be larger, just that muted reactions have become common for this stock. For what it’s worth, analysts see longer term upside, with an average 12-month price target north of $425. See more here.

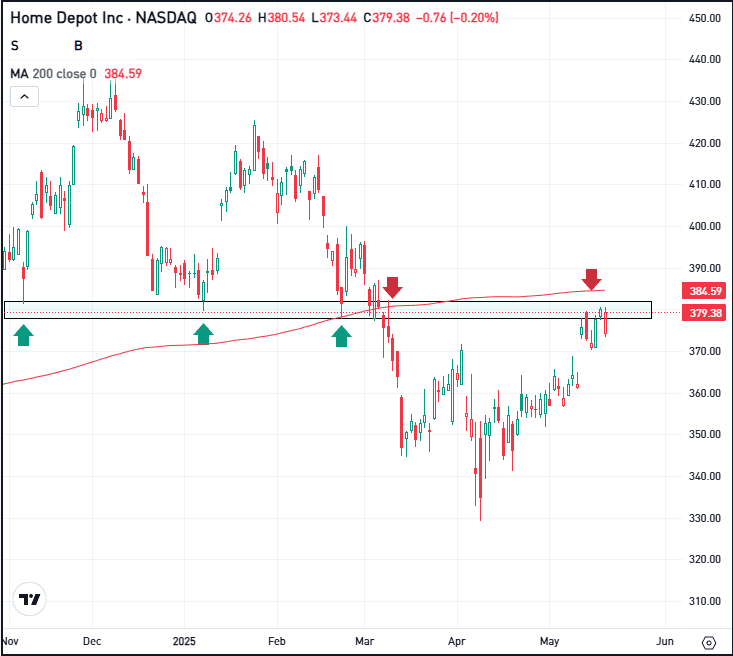

Bulls hope the stock will reclaim a notable technical level following today’s price action, irrespective of its magnitude.

That’s as the $377 to $382 range has become a notable support/resistance area over the past few quarters, and as the 200-day moving average hovers in the upper-$380s. Bulls will want to see HD reclaim these measures, potentially opening up more upside in the name. Bears will want to see this area hold as resistance, potentially putting more downside pressure in play.

Options

For some investors, options could be one alternative to speculate on HD. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and HD rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

GLD

Gold was all Wall Street seemed to talk about earlier this year, as it got off to a blistering start and as stocks were pounded. Gold is still up more than 20% this year and the GLD ETF has recently tested — and so far held — its 50-day moving average as support. Will buyers come back into gold or has it lost some of its luster? Check out the charts for gold.

PANW

Palo Alto Networks will report earnings after the close. The stock has rebounded more than 33% from the recent lows, but investors are looking for direction on the fundamentals. Analysts expect adjusted earnings of 77 cents a share on revenue of $2.27 billion, representing growth of roughly 17% and 15%, respectively.

LOW

Home Depot reported earnings this morning and Lowe’s is scheduled to report tomorrow morning. Investors will use these two companies to get a better idea about the housing market and how consumers are approaching large purchases right now, like home remodels. Investors are also looking for clues on how tariffs may be impacting these decisions as well.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.