The Daily Breakdown digs into another round of Crypto Corner, going over Dogecoin, Solana, and USDC — with a closer look at SOL’s chart.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

We’re continuing our talk about the ins and outs of the crypto market, helping investors to get more familiar with the 100+ cryptoassets offered by eToro. Many of these names may be familiar to investors today, where we’ll discuss Dogecoin, Solana, and USDC.

DOGE: Currently trading near $0.245 with a market cap of roughly $37 billion.

Dogecoin launched in 2013 as a light-hearted, peer-to-peer payment system, originally forked from Bitcoin. It has no supply cap and is mined via Proof-of-Work. Though its founders stepped away years ago, Dogecoin remains popular for tipping online and community-driven causes — like the 2014 Jamaican Olympic bobsled team fundraiser. Dogecoin is decentralized and has an open-source protocol that utilizes consensus for transaction validation.

Solana: Currently trading near $225 with a market cap of roughly $122 billion.

Launched in 2020, Solana was designed to support scalable, user-friendly decentralized applications. It’s a high-performance, permissionless Layer 1 blockchain that uses Proof-of-History and Proof-of-Stake to achieve speeds of over 65,000 transactions per second. The SOL token is used for transaction fees, staking, and interacting with on-chain programs.

Solana supports a wide range of applications — including DeFi, NFTs, gaming, and Web3 platforms — and has seen rapid ecosystem growth from both retail and institutional adoption.

USDC: Currently trading near $1 with a market cap of roughly $72.3 billion.

USDC is a fiat-backed stablecoin created by Circle and Coinbase through the Centre Consortium. USDC is designed to maintain a stable value, with 1 USDC being backed with 1 US dollar on the bank of the issuer. Its primary strength lies in its transparency and regulatory compliance.

USDC’s technology enables it to function as a “digital dollar,” leveraging the speed and security of blockchain for global transactions. It is available on multiple blockchains and this multi-chain presence allows users to move funds quickly and at low cost — bypassing traditional banking hours and international transfer fees.

Check out these three crypto offerings — and many more — on eToro’s Discover page and consider adding them to your watchlist.

Want to receive these insights straight to your inbox?

The Setup — Solana

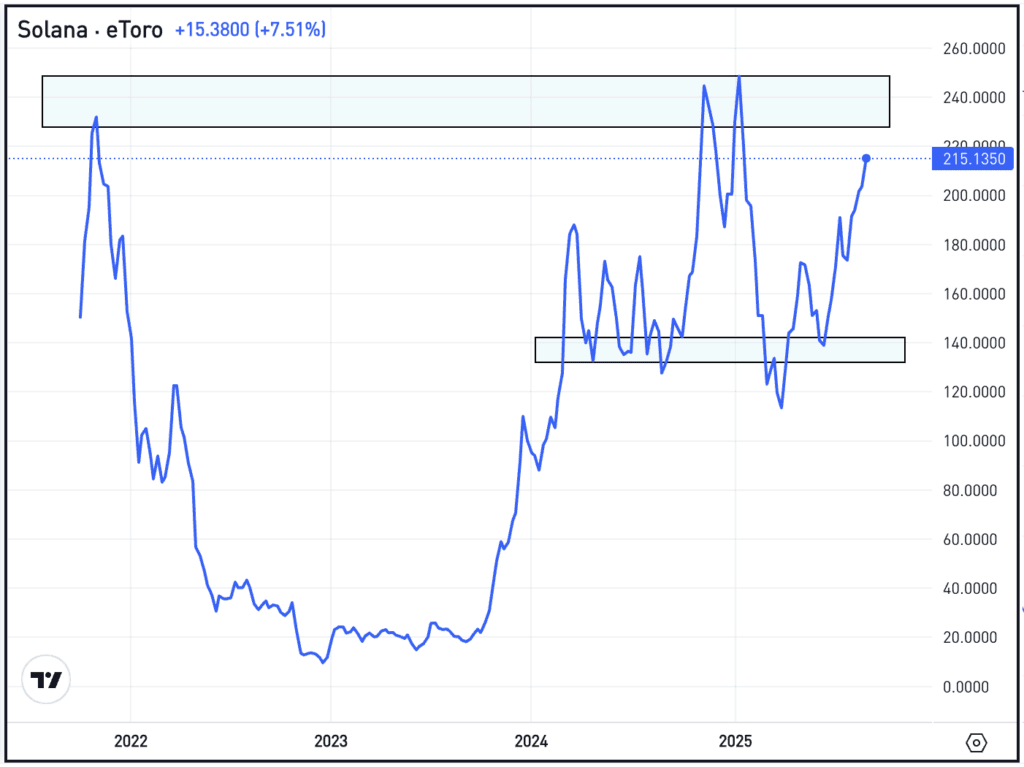

We looked at the technical setup for Doge earlier this week, so let’s take a closer look at the charts for Solana.

Solana rallied up toward the $250 area in late 2021 before a precipitous decline sent it tumbling lower. After another strong rally, support formed in the $120 to $140 region throughout 2024 and 2025, and now SOL is pushing higher once again. While the $250 area remains resistance, bulls are hoping that narrative changes — if Solana can get back to this zone.

What Wall Street’s Watching

On the back of Oracle’s massive post-earnings rally, Broadcom also jumped higher on the day, climbing almost 10% in Wednesday’s session and sending shares to record highs. If that sounds familiar, it’s because shares rallied 9.4% to new highs on Friday on its earnings reaction. Now trading with a market cap near $1.75 trillion, dig into the company’s fundamentals.

Shares of Opendoor Technologies soared in after-hours trading after the company announced Kaz Nejatian — who recently served as the COO for Shopify — as its new CEO, and said co-founder Keith Rabois will return to the board. OPEN stock has been an active lately, with the 20-day average trading volume soaring to 382 million shares as of Wednesday’s close.

Chewy stock tumbled on Wednesday, falling more than 16% on the day. That’s despite the firm delivering a top- and bottom-line beat and raising its full-year revenue outlook above analysts’ expectations. Check out the chart for CHWY.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.