Shares of Coca-Cola have been a stalwart within the market for generations. The Daily Breakdown digs into its long run on Wall Street.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

The Coca-Cola Company has built one of the world’s strongest brands, manufacturing, marketing, and selling a wide range of nonalcoholic beverages. While it is best known for its flagship product — Coca-Cola — other notable brands include Sprite, Fanta, Schweppes, BodyArmor, Dasani, Powerade, Topo Chico, Simply Orange, Minute Maid, and Fairlife.

The company also supplies beverage concentrates and syrups — including fountain syrups — to customers such as restaurants and convenience stores. It operates through a network of independent bottling partners, distributors, wholesalers, and retailers, as well as its own bottling and distribution operations. Founded in 1886, Coca-Cola is headquartered in Atlanta, Georgia.

The Dividend

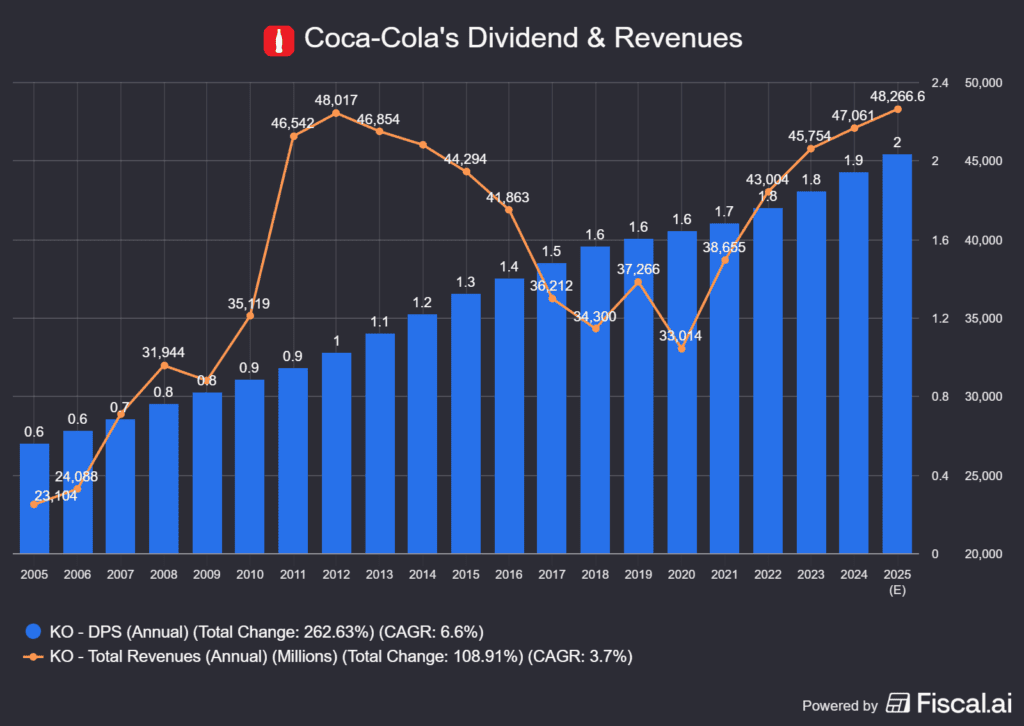

Coca-Cola is not typically viewed as an emerging growth stock, but rather as an established, blue-chip consumer staples name. It is also known for a steadily growing dividend: the company has raised its dividend for 63 consecutive years. The stock currently yields nearly 3%, and its payout has remained consistent over time despite fluctuations in revenue.

Future Growth Projections

The chart above shows some wild fluctuations in the firm’s revenue, but it’s been much steadier since 2020. Analysts expect that steadiness going forward. According to Bloomberg, analysts project the following:

- Earnings Growth: 7.8% in 2026, 6.6% in 2027, and 7.5% in 2028

- Revenue Growth: 5.3% in 2026, 3.9% in 2027, and 4.6% in 2028

Analysts currently have a consensus price target of ~$79.50 on KO stock, implying about 13% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper — Valuation

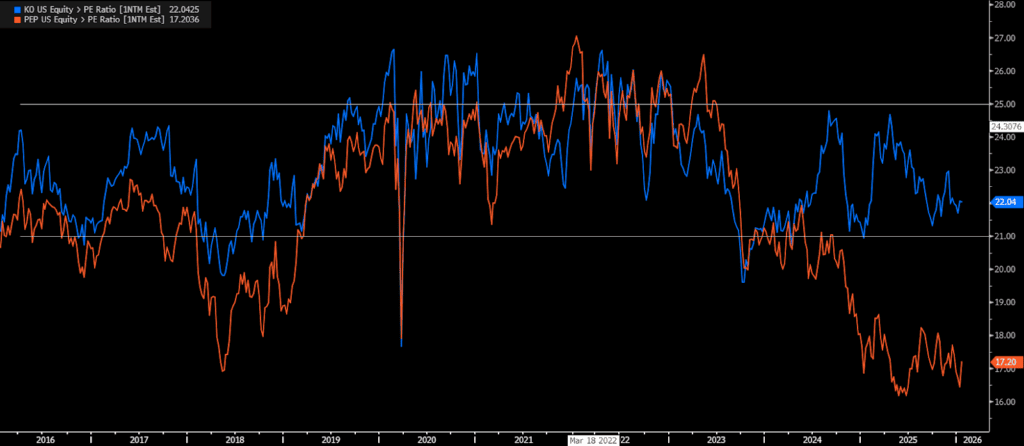

Below is a look at the forward P/E ratio for Coca-Cola (in blue) and PepsiCo (in orange). Notice that both valuations tracked fairly closely over the last decade, although PepsiCo’s has fallen considerably relative to Coca-Cola’s in recent years. That reflects PepsiCo’s efforts to steady its business after a period of inconsistency (see our Deep Dive from July). It’s also worth noting that, including dividends, KO has outperformed PEP — 68% vs. 21% over the last five years and 132% vs. 111% over the last decade.

Also notice that Coca-Cola’s forward P/E has mostly traded between ~21x on the low end and ~25x on the high end over the past decade. After the COVID-19 selloff and the ensuing 2022 bear market, KO shares traded at a premium as investors sought safety. However, the valuation has since returned to the lower end of its 10-year range.

Risks

Coca-Cola’s key risks include shifting consumer preferences away from sugary drinks and increased regulation. Profitability can be pressured by volatile input and packaging costs (sweeteners, aluminum, PET), foreign-exchange swings, and pricing/mix execution. Consumer spending is another variable if economic conditions deteriorate in the quarters or years ahead. Finally, intense competition across beverages — along with supply-chain disruptions and geopolitical instability — could weigh on volume and margins.

The Bottom Line

Buying Coca-Cola is not like buying Palantir, Amazon, Nvidia, or other high-growth tech names. This stock is better viewed as a value-oriented, blue-chip holding rather than a growth story. It is known for a mature business model and steady dividend payments, which may cause it to lag the broader market over time (KO is up 68% over the last five years versus a 98% gain for the S&P 500). Some investors will accept that trade-off for stability, while others will prefer companies with stronger upside potential.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.