The Daily Breakdown looks at the week ahead, as companies like American Express, JPMorgan, and Bank of America gear up to report earnings.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Stocks plunged on Friday as tensions between the US and China escalated, with President Trump threatening a significant increase in tariffs. After hitting record highs earlier in the session, markets reversed sharply. The S&P 500 dropped 2.7%, while the Nasdaq 100 fell 3.5%, with both indices closing near their session lows. Even Bitcoin wasn’t spared, falling more than 7%.

Markets are now rebounding, at least partly in response to one of Trump’s social media posts aimed at de-escalating the situation. Either way, Friday served as a reminder for investors to stay mindful of their positions — and their position sizing.

Weekly Outlook: Earnings Front and Center

This week’s big theme? Earnings.

Major banks kick things off Tuesday morning, with results from JPMorgan, Goldman Sachs, Citigroup, and Wells Fargo. Johnson & Johnson and Domino’s Pizza will report as well.

Later in the week, we’ll hear from a range of names including ASML, Bank of America, United Airlines, Taiwan Semiconductor, and American Express.

Economic Data in Limbo

This week was supposed to be packed with economic reports, including CPI and retail sales. However, unless the government shutdown ends, these will likely be delayed — joining other key releases, like the jobs report and weekly jobless claims. Once the shutdown ends, investors should get more clarity on the economy.

Want to receive these insights straight to your inbox?

The Setup — IBIT

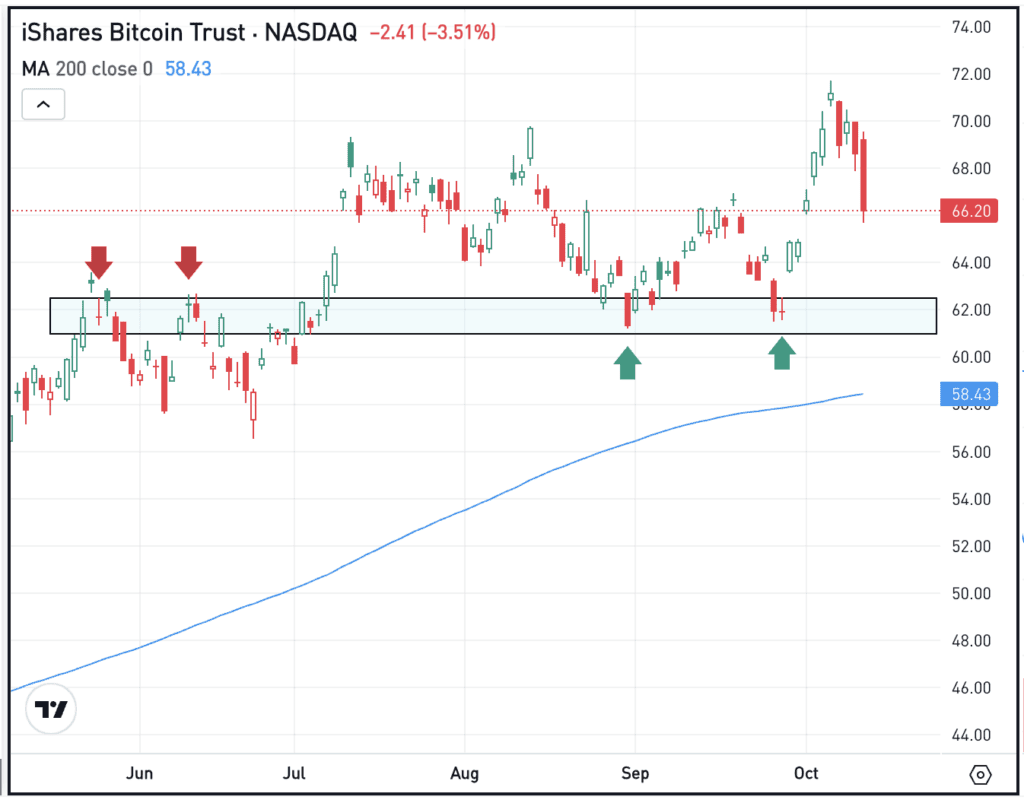

Despite the selling pressure last week, Bitcoin held a key support zone in the $107K to $111K range. Now, some bulls may be looking at the IBIT ETF, the Bitcoin ETF with the most assets under management, as it’s lower in Monday’s premarket trading session.

After acting as resistance in May and June, the $61 to $63 area has been support over the last couple of months. While currently trading in the mid-$60s, bulls are looking for potential support should IBIT continue to pull back.

Options

Remember, IBIT supports options trading. Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Bloom Energy are soaring this morning, up more than 25% after inking a deal with Brookfield to provide fuel cells for AI-related data centers. Under the deal, Brookfield will spend up to $5 billion to deploy Bloom’s technology. Shares of BE are set to open at record highs. Check out the chart for BE.

Gold prices were steady on Friday, rising about 1% amid the chaos in risk-on assets like stocks and crypto. Gold is higher again this morning, inching toward $4,100 an ounce, while silver continues its climb as well, now trading near $50 an ounce. That’s giving a notable lift to major metals ETFs, like the GLD and SLV.

PepsiCo reported earnings last week, climbing more than 4% on Thursday as a result. However, investors viewed PEP as a flight-to-safety trade on Friday, with shares rising another 3.7%. In all, shares rose more than 5% last week. Dig into the fundamentals for PEP.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.