The Daily Breakdown takes a closer look at Nvidia ahead of its earnings report, as well as the new crypto offerings that eToro is supporting.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Wednesday’s TLDR

- New cryptos are added

- NVDA set to report earnings

- GME buys BTC

What’s Happening?

We’re really excited to announce that investors can now trade more crypto securities in their eToro account. Bitcoin, Ethereum, and Bitcoin Cash were staples within the platform’s crypto offerings.

Now though, it will also include: Aave, Cardano, Chainlink, Compound, Dogecoin, Ethereum Classic, Litecoin, Ripple, Stellar, Shiba Inu, Uniswap, and Yearn Finance.

With Bitcoin holding up near the highs, and ETH and BCH posting big rallies off the lows, expanding our crypto offerings opens the door to more possibilities. Read more about it, here.

Elsewhere, yesterday’s consumer confidence came in well ahead of economists’ expectations. The reading of 98 beat consensus estimates of 87.1 and topped even the highest forecasts on Wall Street, according to Bloomberg. That’s as consumers breathe a sigh of relief amid easing trade tensions.

The report snapped a streak of five consecutive declines, which took the consumer confidence number to its lowest level in several years. Now, all eyes can shift to Nvidia.

Want to receive these insights straight to your inbox?

The Setup — Nvidia

Nvidia is scheduled to report earnings after the close today. It’s worth mentioning that other stocks will too, like Salesforce and C3.ai, but NVDA will be the main event.

Despite a year of strong sales and earnings growth, Nvidia stock has struggled for traction. That’s as shares are near the same level they were in June of last year.

While the stock has done better lately, will earnings be enough to keep it going or will they put on the brakes?

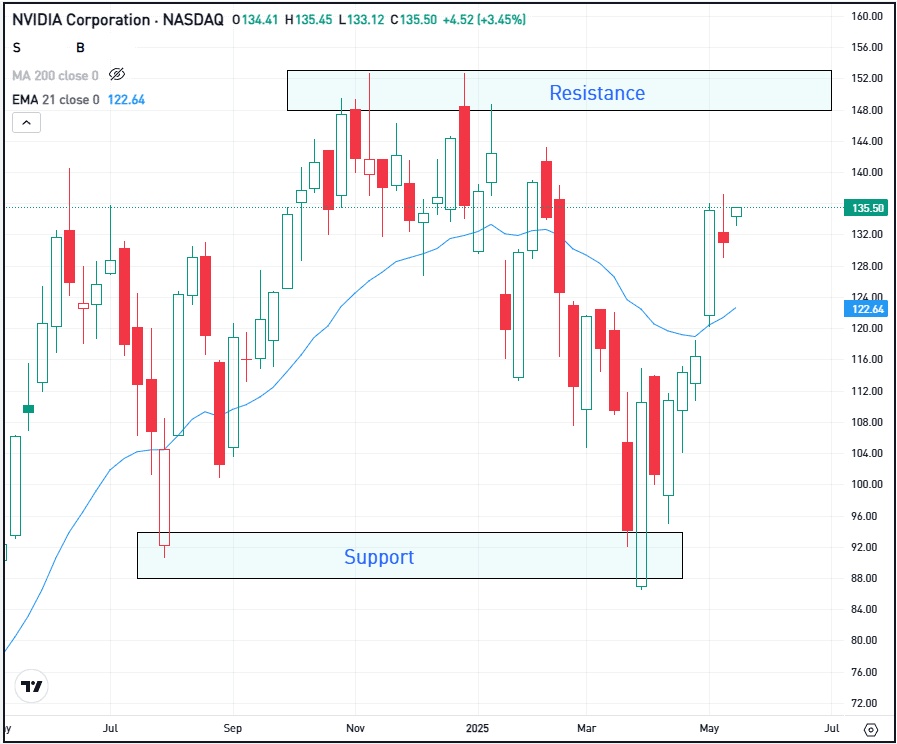

Over the past year, Nvidia has found support near $190 and resistance near $150. Closing near $135 yesterday, it would take a rally of about 10% for it to retest resistance. And from the recent lows, shares are already up more than 50%.

Eventually — whether it’s this week or not — bulls want to see NVDA shares gain altitude and retest that key resistance area, which could set up for a potential breakout to new heights. If shares pull back, they want to see support come into play. Potentially, in the low- to mid-$120s.

As for expectations, analysts expect earnings of 93 cents a share on revenue of $43.3 billion, representing year-over-year growth of 52.7% and 66.3%, respectively.

Options

For options traders, calls or call spreads are one way for investors to speculate on more upside, while puts or put spreads allow them to speculate on further downside or allow bulls to hedge their long positions.

Using options around big events — like earnings — tend to be more expensive. However, one advantage is that the total risk of the trade is tied to the premium paid when buying options or option spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

Rallying nearly 7% yesterday, Tesla was the best-performing Magnificent 7 holding on Tuesday. The rally sent Tesla shares to multi-month highs, as it hit its highest level since mid-February. Check out the chart for TSLA.

GameStop has been gaining traction lately, rising over 6% yesterday after gaining almost 18% in the prior two trading sessions. The recent rally comes amid excitement that the company has been buying Bitcoin, recently acquiring 4,710 BTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.