The Daily Breakdown digs into the upcoming jobs report, as well as precious metals as silver sets up for a major breakout to multi-year highs.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Thursday’s TLDR

- Silver hits 13-year high

- Jobs report in focus

- TSLA hits a speed bump

What’s Happening?

If the S&P 500 rallied 3%, it would hit new record highs. That’s a pretty stunning reality given the volatility investors endured in March and April. And at least in the short term, the jobs market could be a key catalyst to whether we get to those highs — or not.

Tuesday’s JOLTS (job openings) report was stronger than expected, a welcome development for nervous investors. However, the ADP report was notably weaker than expected. This report is nowhere near as significant as the one we’ll get tomorrow, which is the monthly non-farm payrolls report.

Known more casually as the “monthly jobs report,” it will shed light on the unemployment rate (currently 4.2%) and tell us how many jobs were added or lost in May. Currently, economists expect about 125K jobs were added last month. It will also update the prior report (for April) for a more accurate picture of the labor market.

But before we get those figures, we’ll receive the weekly jobless claims report, which measures the number of individuals who filed for unemployment benefits for the first time during the previous week, serving as a timely indicator of labor market health.

This figure showed an uptick last week to 240K, but thankfully, spikes to this area have generally been short-lived outlier weeks over the past year (as shown above). In that sense, it would be nice to see it lose some momentum this week.

By the way, five more cryptocurrencies just became available for trading on eToro. Explore them here or click the banner below.

Want to receive these insights straight to your inbox?

The Setup — Silver

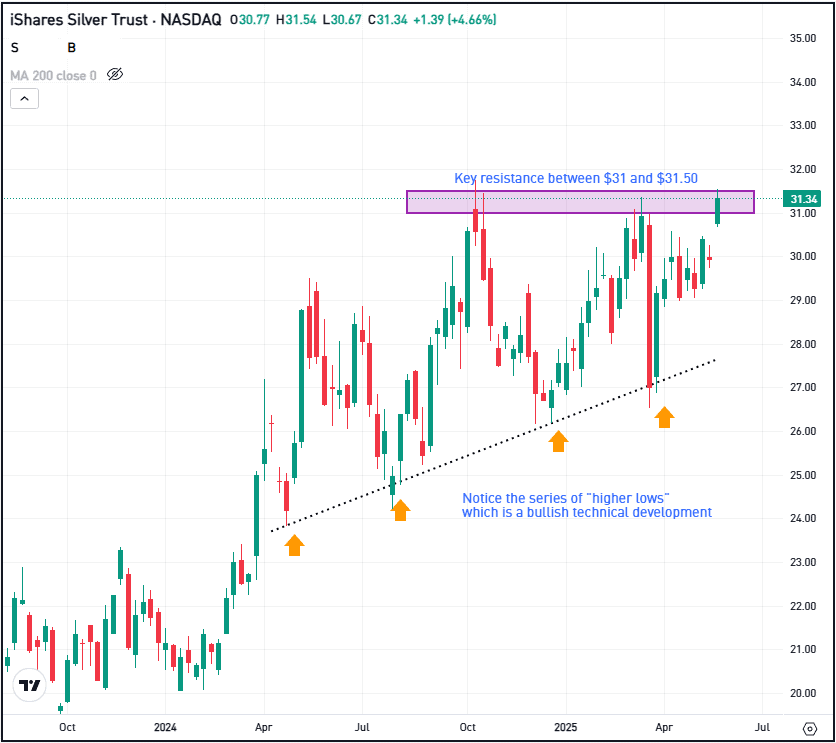

We’ve talked about gold a lot lately, and I even posted about it on the eToro feed this morning. But silver is the one making a big move in pre-market trading.

While the GLD ETF is up modestly this morning, the SLV ETF, the largest silver-based ETF, is up almost 4%. If it opens near current levels, it will be well above its current 52-week high of $31.80 and will mark the fund’s highest price in more than a decade.

As of 8:00 a.m. ET, the SLV ETF is trading near $32.50 in pre-market trading. If those gains hold into the open, it will be well above the key resistance area of $31 to $31.50. If today’s rally holds up, bulls will want to see this former resistance level become support.

If that happens, it could act as a major technical catalyst, helping setting up for the next potential leg higher in silver. However, if SLV breaks back down below $31, it could lose quite a bit of its current momentum and could trade lower in the short to intermediate term.

Options

For some investors, options could be one alternative to speculate on SLV. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and SLV rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

TSLA

Shares of Tesla fell 3.6% yesterday and are down again in pre-market trading. European sales remain pressured for Tesla, even as overall EV sales continue to jump. Further, there’s a worry that Musk’s public criticism of the current Republican-led tax bill could create political rifts. Follow the news on Tesla right here.

CRWV

Shares of CoreWeave — a company that Nvidia owns a 7% stake in — have been on fire. While the stock jumped more than 8% yesterday, CRWV is up more than 40% so far for the week. And from its April 21st low, the stock is up almost 400%. Feel free to track the chart for CRWV.

MDB

MongoDB stock is flying higher this morning, up more than 15% in pre-market trading after the firm reported earnings. Earnings of $1 per share came in well ahead of analysts’ expectations of 67 cents a share, while revenue of $549 million topped estimates for $528 million. It’s worth pointing out that MDB shares tumbled more than 25% in March following a disappointing report.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.