Tech has been under tremendous pressure so far this year, so The Daily Breakdown took a look at the valuations for Magnificent 7 holdings.

Tuesday’s TLDR

- Digging through the Mag 7

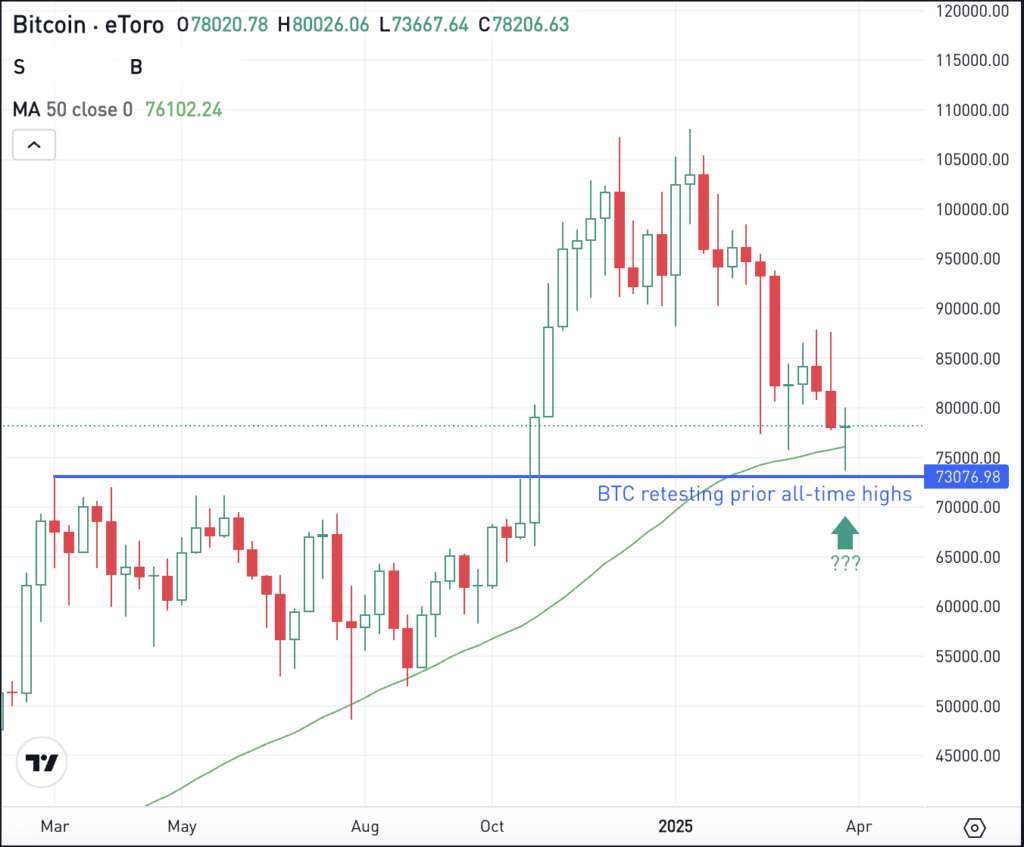

- Bitcoin retests key level

- Apple stumbles on tariffs

What’s happening?

Markets opened with a nasty drop yesterday, but fought back to positive territory. By the end of the day, the S&P 500 was only down slightly — rather than down 4.7% at its lows — while the Nasdaq 100 finished higher on the day, up 0.2%.

I wanted to go in a different direction today, and look at the Magnificent 7 group.

While these stocks were the leaders in the 2023 bull market, they have been hammered so far this year and many of them have struggled since summer.

Despite this — and many other loud rhetorics at the moment — many of these stocks are still expected to post solid growth this year and are trading at valuations that are on the lower end of their averages of the past few years.

For instance, analysts still expect Nvidia to grow earnings more than 50% so far this year, while Alphabet and Microsoft are forecast to grow earnings ~13.5% and ~11.5% this year, respectively.

When we look at the forward price-to-earnings ratio — which divides the stock price by the expected earnings per share for the next year — the cheapest Mag 7 stock is Alphabet, at about 16 times earnings. That’s followed by Meta at 19.8x and Nvidia at 21x.

Investors who don’t want exposure to just one stock can always consider a fund that has exposure to this group. The QQQ ETF and XLK ETF have plenty of Mag 7 exposure.

Want to receive these insights straight to your inbox?

The setup — Bitcoin

Bitcoin prices were holding up really well despite the carnage in the market last week. However, Bitcoin, Ethereum, and other cryptocurrencies took a tumble over the weekend.

On the plus side, BTC recently found its footing — at least temporarily — and bounced from yesterday’s low. That low came into play around the 50-week moving average, which has been support in the past. It also comes into play near Bitcoin’s prior record high from a year ago.

The risk here is that BTC will still need to fully retest that prior record high, and if the macroeconomic worries worsen, an even larger decline may be in the cards.

However, if the recent lows hold, then Bitcoin could enjoy a further rebound to the upside. While technical traders are also watching the recent lows, they are hoping for renewed strength. For it to happen though, they will want to see the recent lows in the low- to mid-$70,000s hold as support.

What Wall Street is watching

AAPL – As trade-war tension between the US and China escalate, Apple has found itself in the crosshairs. It was the worst-performing Magnificent 7 stock yesterday and has now fallen 19% in the past three trading sessions. Check the charts for Apple.

BABA – Alibaba was also under pressure on Monday on trade-war worries between the US and China. In fact, Chinese stocks have been under immense pressure lately, with the FXI ETF falling more than 16% in the past five days. After being a powerful performer, the ETF is now down more than 20% from its recent highs.

UNH – UnitedHealth Group shares are trading higher this morning, up about 5% in pre-market trading. The rally comes as there will be a substantial increase in Medicare payment rates, giving health insurers a lift.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.