We’re finally getting an update on the economy with the monthly CPI inflation report. The Daily Breakdown digs into the details.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

With the government shutdown now extending into a third week, investors and the Fed continue to fly blind when it comes to economic data releases.

That changes tomorrow morning, when the Bureau of Labor Statistics releases the CPI report at 8:30 a.m. ET. The report should help shed light on the inflation picture — and it comes at a crucial time, with the Fed set to announce its next interest rate decision on Wednesday, Oct. 29.

An in-line or lower-than-expected reading would help boost investor confidence in the outlook for two more rate cuts this year — which remains the current expectation, according to the bond market. However, a hotter-than-expected print could cause that confidence to waver, particularly ahead of the December Fed meeting.

Earnings — Tesla, Intel, Ford

Tesla shares are down about 4% in pre-market trading after the company reported mixed Q3 results. Revenue topped expectations, but earnings came in light as higher tariff costs and the expiration of the tax credits weighed on profits. Even with this morning’s dip though, shares remain up more than 35% over the past three months.

Up next: Intel and Ford report tonight. Investors will look for signs of progress in Intel’s turnaround efforts, while Ford shareholders will be hoping for a strong showing after General Motors hit record highs this week following a solid quarter.

Want to receive these insights straight to your inbox?

The Setup — Netflix

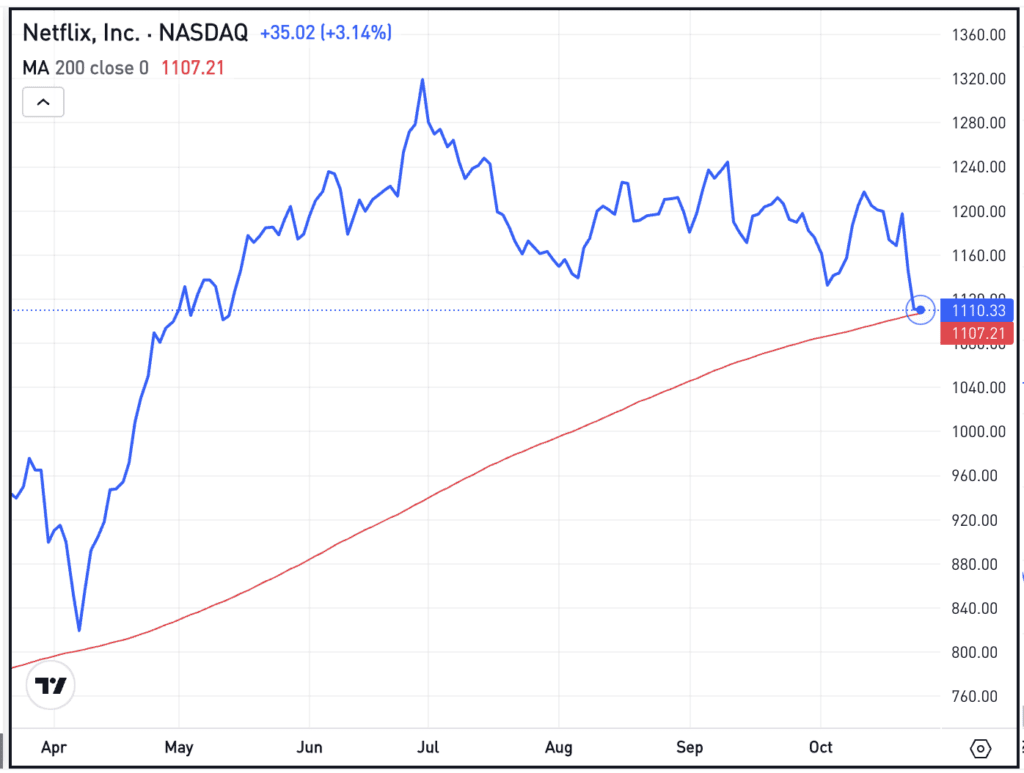

Netflix shares sank more than 10% yesterday after reporting its quarterly results. The company missed on earnings expectations — due to a one-time tax issue in Brazil — while revenue grew 17% year over year and was roughly in-line with analysts’ expectations. Now, bulls are wondering if the 200-day moving average will act as support.

Bulls want to see support come into play near this area — around $1,100. If it does, a bounce could take hold, helping to steady the stock after earnings. However, if support does not come into play, lower prices may be in store for NFLX.

Options

One downside to NFLX is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads. Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of IBM stock are moving lower this morning, down about 7% after the firm reported its quarterly results. That’s despite IBM beating on earnings and revenue expectations and lifting its full-year outlook for revenue growth and free cash flow. Dig into the fundamentals for IBM.

Quantum stocks like Rigetti, IONQ, and D-Wave Quantum were hit by a wave of volatility yesterday and extended their recent losing streak. For RGTI, shares have now fallen 36% amid a five-day losing streak. However, quantum stocks are on the mend this morning, as investors hope this bounce can hold. Check out the charts for RGTI.

Despite increasing volatility in equities and in precious metals, Bitcoin remains in a relatively tight pattern as it holds around the 200-day moving average. Bulls are hoping that this area can act as support and eventually provide a lift to BTC, IBIT, and other related names.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.