Australia’s August reporting season is just around the corner, with the ASX hovering near record highs after gaining 12% (including dividends) over the past year. But with earnings expectations sky-high, can results live up to expectations? In the first of a two-part preview of reporting season, I’ll unpack what investors should watch for, and take a closer look at the state of the Australian economy as results begin to roll in.

- Earnings under pressure: ASX200 profits are expected to fall 1.7% in FY25, with resource sector earnings down nearly 20% and only a few bright spots like tech showing strong momentum.

- Valuations stretched: The ASX now trades at 19.5x forward earnings, well above its long-run average , raising the stakes for companies to deliver solid results and outlooks.

- What to watch: Margin pressures, AI impact, and cautious consumer trends will take centre stage as investors look for clarity in a high-expectation market.

Explore Australian Shares

ASX Near Records, But Can Results Deliver?

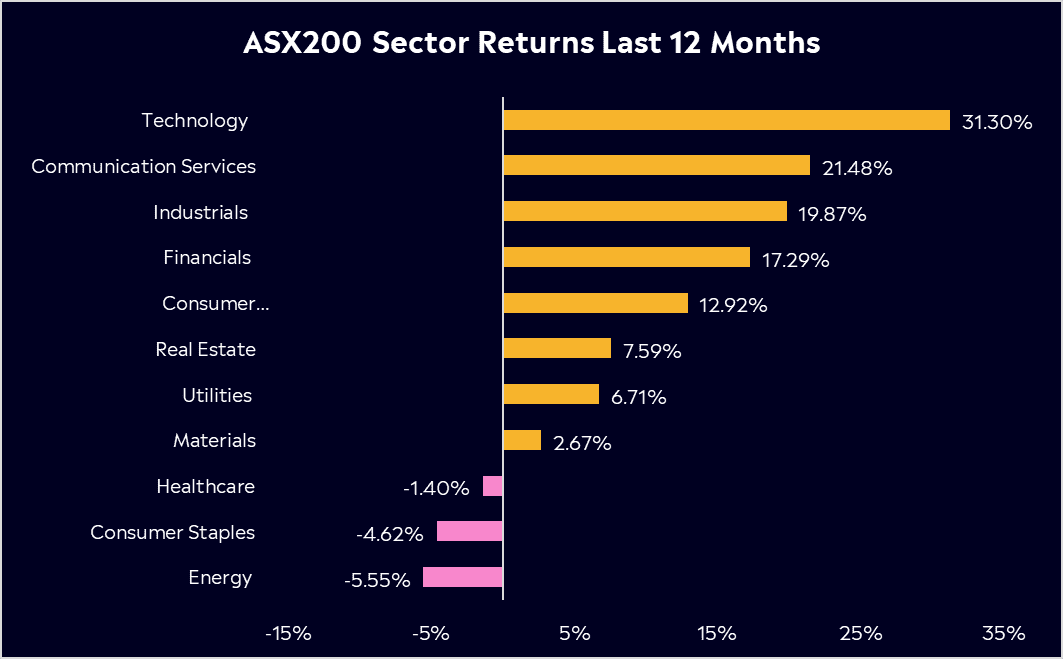

The ASX now trades at a price-to-earnings ratio above its 10-year average (around 19.5x 12 month earnings vs 17x historically). Against this backdrop, expectations for company earnings are high. However, the market expects ASX200 companies to post a decline for the second consecutive year, with profits set to fall 1.7%, with the key drag again coming from the resources sector, where mining and energy earnings are forecast to fall by almost 20%.

Outside of resource companies, the picture is only slightly better. Many industries face lacklustre growth, and only a few pockets look set to see earnings growth. Tech will likely be the standout, set to for 30% growth showing undeniably strong earnings momentum. In short, most companies are bracing investors for soft results, with falling commodity prices and higher costs biting into FY25 profits. The positive? Earnings growth looks set to return in FY26. However, that will need to be supported by solid outlooks this season.

In practical terms, that means this reporting season’s results and outlooks will be under close scrutiny: with the market near record highs, even solid results might disappoint if they fall short of lofty expectations. Fundamentals have to deliver.

Key themes to watch in the results include margin pressures and cost management. We will see which firms managed to protect their margins via price rises or efficiency gains and which struggled. Pricing power is a differentiator in this environment. Some consumer-facing companies may have had to absorb cost increases to avoid losing customers, squeezing profit margins.

We’ll also be listening out for AI delivery, a key focus among the tech sector but broadly across ASX200 companies. Are investments in AI improving profits or costs? Tariffs will also remain front of mind. Although there may not be the same impact as we’re seeing on US stocks, the outlook remains uncertain, and that could mean a cautious tone from management teams.

* Past performance is not an indicator of future results.

The State of the Australian Economy

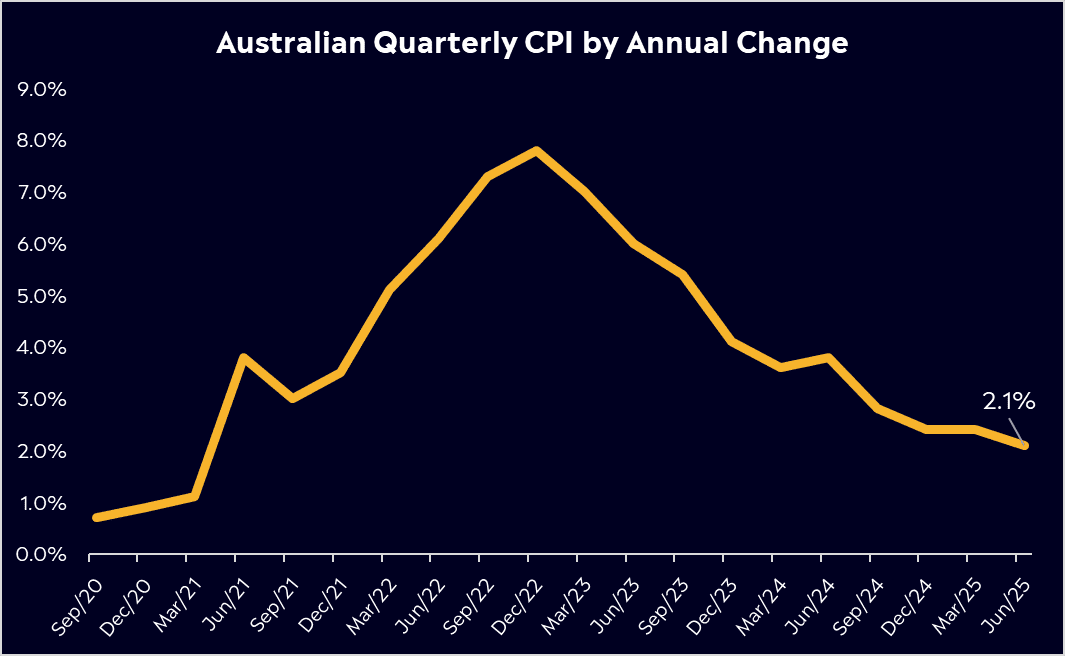

Australia’s economy is clearly slowing, and growth has been on a downward trend as the post-pandemic rebound fades. High interest rates have cooled consumer spending and housing activity for much of the year. Importantly, though, inflation has fallen into the RBA’s target range. So far this year, the RBA has delivered two rate cuts, bringing the cash rate down to 3.85%. They surprisingly left rates on hold at the start of July, citing that it could wait for a little more information to confirm that inflation remains on track to reach 2.5% on a sustainable basis.

The base case for the rest of the year is at least a couple of rate cuts as inflation moderates.

The central bank itself has sounded more dovish, expressing greater concern about downside risks such as the impact of overseas tariffs and indicating it is prepared to continue easing as needed, which should eventually support growth. But, don’t expect reckless easing. Policymakers want to avoid re-stoking price pressures, so they’ll move cautiously.

The most recent quarterly CPI print is the confirmation the RBA has been waiting for though. Headline inflation has dropped to 2.1% year-on-year, right at the bottom of the RBA’s target band, and underlying inflation fell from 2.9% in the first quarter, reinforcing the disinflation narrative that’s been building for months. Markets are now pricing a 100% chance of a cut in August, and it’s easy to see why. Cost-of-living pressures are easing, and the risk is now skewed towards holding rates too high for too long. The RBA’s inflation fight looks all but won, and the board has a narrow window to move before downside risks mount further.

For companies, this means borrowing costs should stop rising and may even tick down by the second half of FY2025, providing some relief to highly leveraged sectors. But no one is expecting a return to ultra-loose monetary policy overnight.

Consumer Confidence, and Local Market Sentiment

The Australian consumer remains a focal point of the Australian economy. Employment has stayed robust, and wages are finally growing in real terms (outpacing inflation modestly), which is a positive development for households. Additionally, the Stage-3 tax cuts have now come into effect, delivering a substantial boost to take-home pay for middle and high-income earners.

In theory, these factors should support consumer spending. Yet, consumer confidence surveys and on-the-ground data paint a cautious picture. Many households are feeling the squeeze from higher mortgage repayments and rents, and are responding by trimming discretionary expenses. This is essentially creating a tug of war between positive income tailwinds and the desire (or need) to save. This will determine how healthy retail and service sector activity remains.

Australia has also been somewhat insulated from the direct effects of trade wars and tariffs, with only an estimated 1% of GDP directly exposed to tariff measures. This means the U.S.-China trade tensions haven’t hurt Australia’s economy in a first-order way. This is why retail investors have grown more confident in the local market, because it’s seen as relatively safe amidst global geopolitical and economic uncertainty. eToro’s latest Retail Investor Beat survey revealed a growing shift toward homegrown investments. In a survey of 10,000 retail investors across 12 countries – including 1,000 from Australia – 42 per cent of Aussies believe the ASX will deliver the strongest returns in the long term out of all regional stock markets, up from 30 per cent in Q4 2024.

Looking ahead, a major swing factor will be China’s economic trajectory. A faster rebound in China or significant stimulus there could boost demand and prices for Australian resources and agricultural goods. Conversely, if China remains sluggish or further property sector woes emerge, it could dampen Australia’s export earnings and business sentiment.

* Past performance is not an indicator of future results.

Investor Takeaway

Any surprise disappointments in earnings or cautious outlooks could test that optimism. On the flip side, genuinely strong results or upbeat guidance from companies could validate the market’s confidence and propel further gains. In short, expectations are high but also fragile, making this one of the more intriguing reporting seasons in recent years.

Stay tuned for part two of my reporting season preview next week, where I’ll give you top tips to navigate reporting season and the sectors to watch closely.

Explore Australian Shares

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.