Despite a volatile and admittedly underwhelming 2025, the ASX200 still looks set to post another year of gains. The index has returned 9% year to date, including dividends, and has climbed more than 25% from its April low following Donald Trump’s ‘Liberation Day’. That’s a respectable outcome considering the backdrop of global tariffs, stubborn inflation and slower-than-hoped rate cuts.

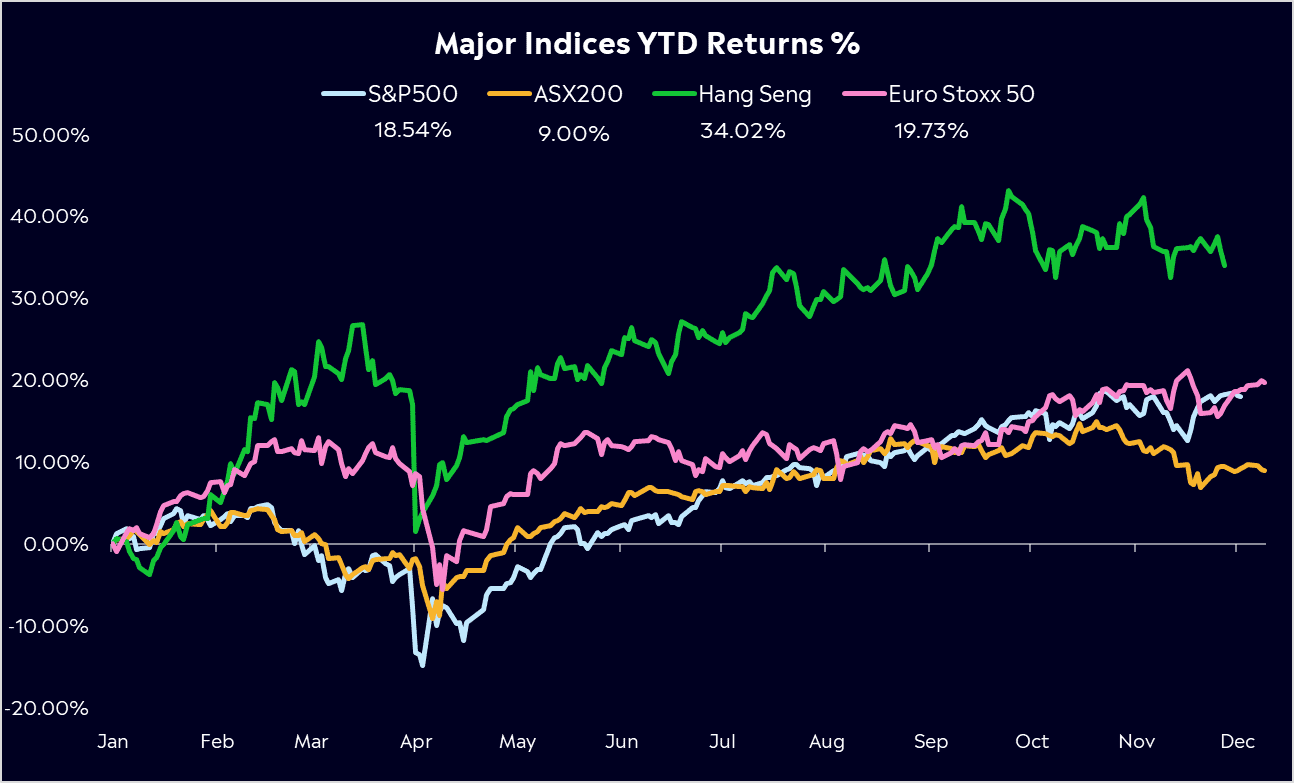

But there’s no sugar-coating it. Among major global indices, the ASX200 has been one of the weakest performers. The S&P 500 has returned over 18%, the Euro Stoxx 19% and the Hang Seng 34% (all including dividends). Local earnings were a disappointment, marking a third straight year of negative earnings growth in FY25, a trend compounded by Australia’s persistently weak productivity, which has hovered below 1% annually, leaving the economy struggling to keep pace with efficiency gains overseas.

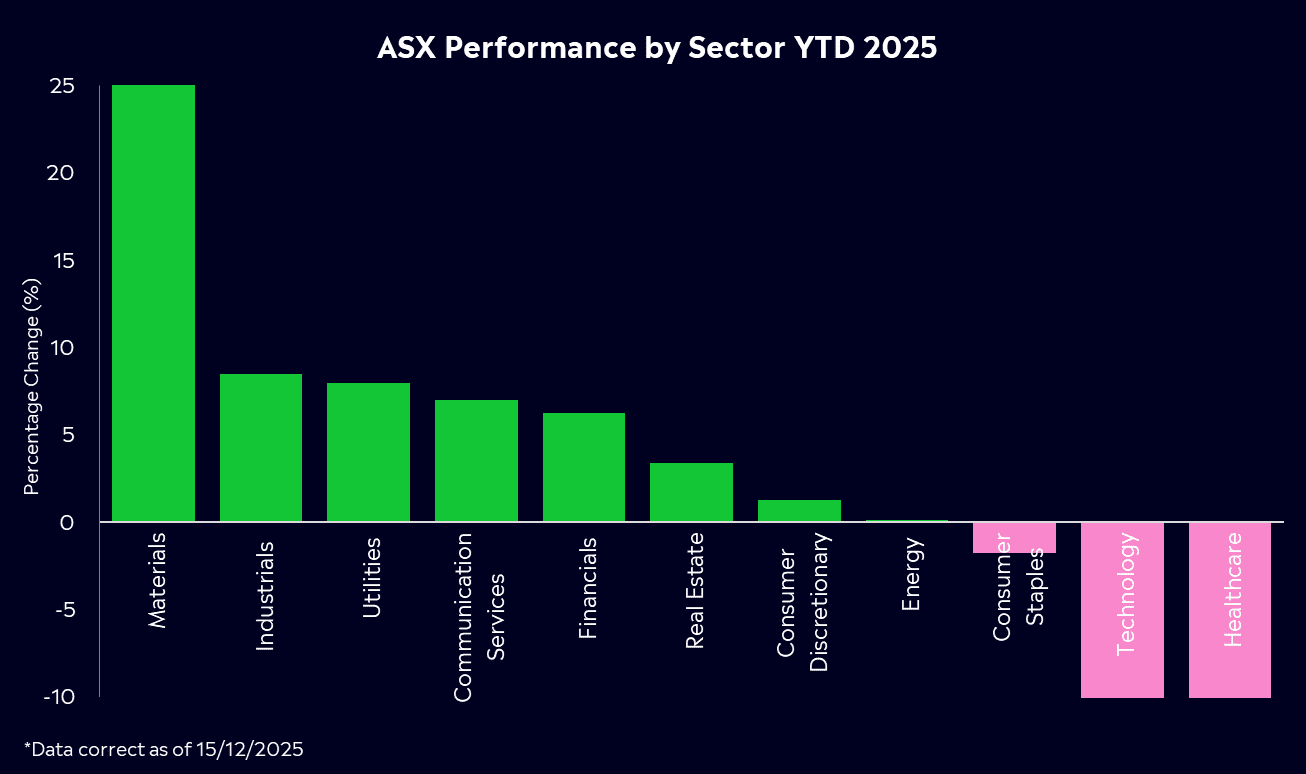

In the local markets defence, the US was supercharged by the ongoing AI boom, while in Europe, defence stocks have driven markets higher. Those gains simply haven’t translated to the ASX, which has far less exposure to both these themes. In fact, the local tech sector has fallen 20% this year, dragged lower by Wisetech and Xero’s underwhelming performance.

At the same time, some of the ASX’s heavyweight sectors struggled to fire. Banks, which make up almost a quarter of the index, delivered stable dividends but limited share price growth as higher funding costs, slower credit demand and cautious consumers kept a lid on margins. Healthcare has been the worst-performing sector, down 22%, with market darling CSL slipping 35% this year. The Materials sector is the best performing, up 28%, helping to drive the market despite what has been an uneven year for the mining stocks.

So what’s in store for 2026? Let’s find out.

*Past performance is not an indicator of future results. Returns as of 10/12/2025.

The macro backdrop

Australia heads into 2026 with growth expected to be around 2%. A combination of immigration, government investment and a stabilising labour market is helping to keep demand intact, even as consumer spending remains patchy. Inflation, which re-accelerated late this year, is expected to ease gradually, and that path won’t be smooth. The RBA may not see inflation settle comfortably in the target band until late 2026. That has raised the prospect of a rate hike in the first half of the year, and shifted the conversation to how long policy settings remain restrictive, which limits how quickly momentum can pick up.

One key constraint heading into 2026 is weak productivity. It has held back income growth and overall demand, meaning the economy can remain stable but is unlikely to gain meaningful momentum without structural improvements. It won’t be a booming environment, but the economy continues to show surprising resilience, even as households remain under pressure.

Sectors to watch in 2026

The positive news for investors is that after years of negative earnings growth, 2026 is set to see earnings growth return, providing a tailwind to equities. However, markets are forward-looking, so some of the good news will already be priced in, and the ASX is trading at a premium valuation, at 18.6 times forward earnings, which is much higher than its 10-year average of around 15 times.

Materials Sector in the driver’s seat

After a mixed 2025, the materials sector ended the year strong, with gold miners driving much of the sector’s performance. Gold has been one of the best-performing assets on the planet, up almost 60% YTD and delivering its strongest year in more than four decades. Prices hovered near record levels for much of the year, supported by safe-haven demand, persistent geopolitical tensions, relentless central bank buying and record ETF inflows. Major miners BHP and Rio Tinto weathered weakness in China, despite earnings coming under pressure.

Looking to 2026, stable commodity prices, a weaker US dollar and continued investment in infrastructure and the energy transition provide a supportive backdrop. A rotation out of financials and into materials has been building for months, and earnings momentum now appears strongest in mining and related sectors. The key will be ongoing fiscal support and targeted stimulus from China, while broader exposure to copper, lithium and energy-transition metals gives the sector more diversified drivers of growth.

Financial Sector to finally lag after an extended run

Banks started 2025 in solid shape, helped by defensive positioning and expectations of earlier rate cuts, but valuations now look stretched. CBA shares have fallen 14% since early November, highlighting how stretched valuations had become and that weaker performance is likely to carry into next year. Slower credit growth, a softer consumer and a more constrained income outlook point to a tougher 2026. Banks should remain reliable dividend payers, but total returns may lag the broader index.

Global earners and AI-adjacent companies still have momentum

Companies with offshore revenue exposure or links to the AI investment cycle should continue to benefit from stronger global capex. We saw that late in 2025 with OpenAI and NextDC’s infrastructure partnership, highlighting how AI-related investment continues to expand beyond the US. These names offer diversification away from domestic headwinds while still providing earnings growth. While the local tech sector was dragged lower by a handful of large underperformers this year, 2026 is shaping up as a more constructive environment.

*Past performance is not an indicator of future results. Returns as of 10/12/2025.

The risks investors need to watch

It’s always good to look at some of the key risks for investors, but it’s always important to remember that there has and always will be something to worry about in markets.

- Sticky inflation. This will be huge in the first half of the year, and recent data has increased expectations of a hike, confirming that the easing cycle is done for now. That will keep pressure on consumers and rate-sensitive sectors.

- Valuations. Not just locally, but globally. They remain higher than average, and that means local stocks will need to deliver earnings growth in 2026 to justify their valuations.

- Slower growth among key trading partners, particularly in China, which could weigh on commodity demand. The property slump continues, and deflation is persistent.

- Consumer fragility, as households remain the biggest wildcard for domestic earnings.

Reasons for optimism in 2026

Despite risks, we head into 2026 with optimism, and the bigger picture remains constructive.

-

- The economy is still expanding, even under restrictive rates, and the ASX200 will see positive earnings growth for the first time in years.

- Although inflation has picked up, we expect underlying inflation to ease gradually, helping the RBA to avoid hiking, even if rates remain on hold.

- Materials and energy-transition themes provide a clear pathway for earnings growth.

- Australian equities continue to offer attractive yield, strong balance sheets and sector diversity.

- The tech sector’s profits remain strong, and AI investment is unlikely to slow down, given that it’s the biggest technology revolution we’ve seen in decades. Demand remains robust, and monetisation is front and centre.

- The economy is still expanding, even under restrictive rates, and the ASX200 will see positive earnings growth for the first time in years.

The road ahead

History continues to show that time in the market beats timing the market. With moderate growth and improving corporate earnings, 2026 may not have the same level of excitement as previous years, but it should lay the groundwork for another positive year for the ASX. Returns are unlikely to be as easy as the early AI-driven rally, but history suggests that staying invested through these mid-cycle phases is what compounds wealth.

Dollar-cost averaging, staying diversified and leaning into value when pullbacks occur will likely serve investors far better than chasing short-term themes. As Australia works through its structural challenges and inflation normalises, investors can focus less on short-term noise and more on building long-term positions in high-quality assets.

Although every year is unique, investors should keep a clear focus on their goals by thinking long term and not just the next quarter or year. 2026 may well be remembered as the year Australia’s resilience mattered more than the headlines.

Explore Markets

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results.