Earnings season around the world is coming to a close, and results on both sides of the Pacific are shaping investor sentiment. In the US, S&P 500 companies have delivered their third straight quarter of double-digit earnings growth. Both in the US and Australia, stretched valuations mean good results are barely rewarded, and misses are being punished hard. Against that backdrop, Nvidia reminded investors it’s still the heartbeat of global markets, while closer to home Qantas impressed, Woolworths disappointed, and Domino’s delivered yet another stumble.

- Nvidia’s dominance endures, earnings stayed strong but guidance fell short of sky-high hopes.

- Qantas keeps flying high. Profits jumped, dividends soared, and growth plans remain on track.

- Headwinds persist for two giants. Woolworths struggles with shrinking margins, while Domino’s still can’t find the recipe for success.

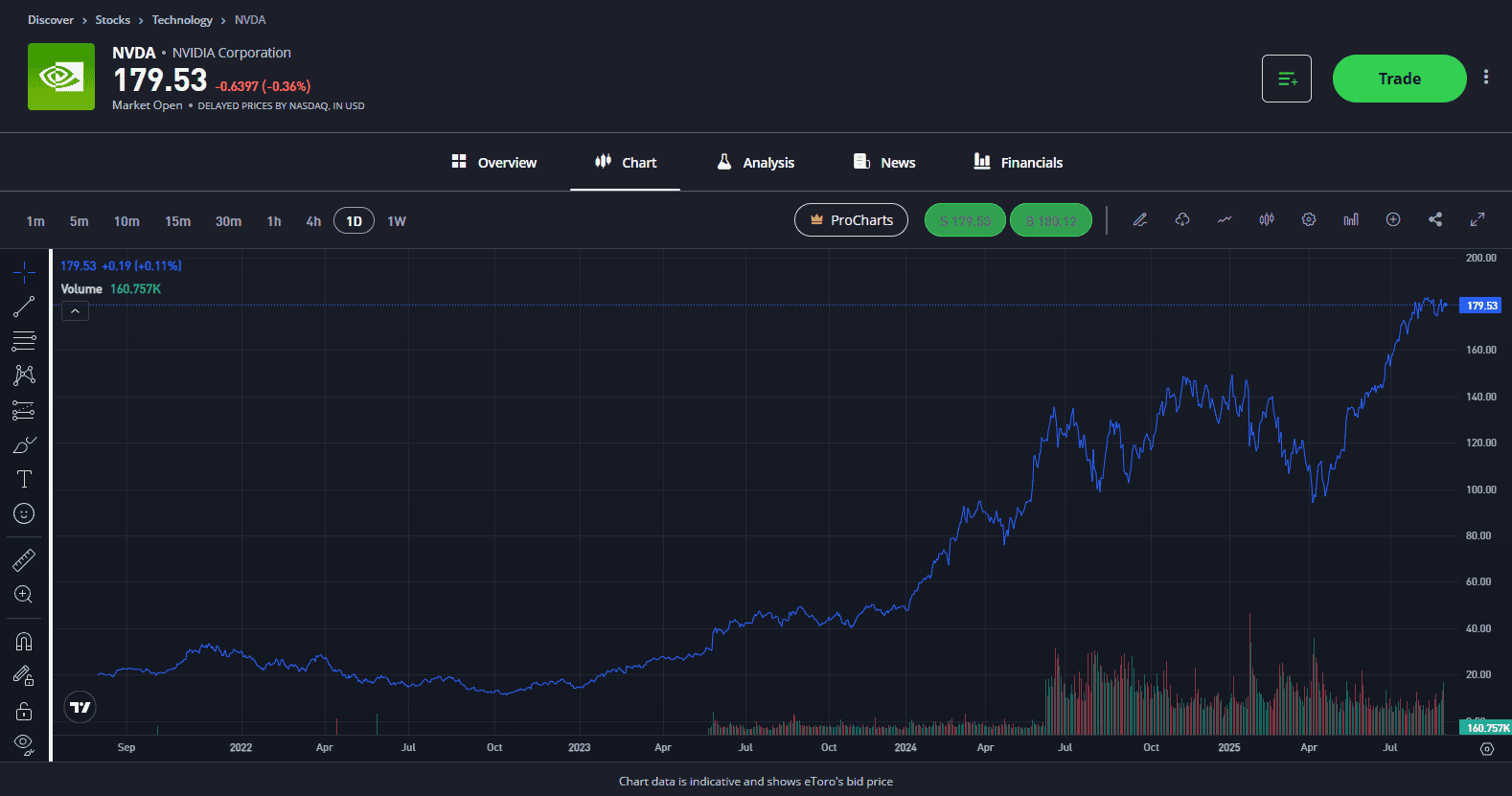

Nvidia keeps its AI crown despite guidance wobble

In the same way Apple symbolised the smartphone era, Nvidia now defines the AI era. The stock has become the heartbeat of the market, making up around 8% of the S&P500 weight, the single largest in history. Its market cap now eclipses the entire FTSE 100 and the ASX200 combined, and is even larger than the entire global crypto market, underscoring just how outsized its role has become in global markets. That scale underlines why its earnings dates are fast becoming just as vital to investors as economic and central bank data. Regardless of whether you own Nvidia shares or not, its results impact your portfolio in some way.

It’s latest Q2 earnings showed blockbuster numbers once again, but this quarter was a reminder that even the market’s heartbeat can skip. Revenue of USD$46.7 billion and EPS of USD$1.05 were both ahead of expectations, yet the outlook fell short of the sky-high hopes some investors had, sending shares lower after hours. Nvidia’s Q3 forecast of USD $54 billion represents about 84% year-on-year growth, but some analysts had anticipated guidance as high as USD $60 billion. Markets will obsess over the faults, but savvy investors will see short-term noise as a long-term opportunity.

China dominated much of the conversation, with the uncertainty of the region remaining a headache for Jensen Huang and his team. With no sales of H20 chips recorded in the quarter, Nvidia is navigating an increasingly complex geopolitical battleground that is limiting one of its biggest markets. Jensen Huang calls China a ‘$50 billion opportunity’ but admits the market is ‘effectively closed’ to U.S. firms a tension that marks the geopolitical reality of AI. It may be a closed door for now, but Nvidia isn’t walking away, it’s building a Blackwell variant for beefed-up future access to China. That weakness was more than offset by surging demand from US hyperscalers, but it shows how reliant Nvidia is on just a handful of customers.

Data centre sales of USD$41 billion highlight its dominance in AI infrastructure, and sovereign AI revenue is set to double this year, opening up new growth beyond the US tech giants. Add in a USD$60 billion buyback and margins holding in the mid-70s, and it’s clear Nvidia has the financial firepower to keep leading the AI race.

When close to perfection is brandished as weakness, that’s when you know you’ve got one of the best businesses we’ve ever seen on our hands. What’s remarkable is how Nvidia continues to scale at its current size. With annual sales now running at nearly USD$200 billion and still growing more than 50% year on year, this shows that Nvidia continues to define the AI era. Every quarter, Nvidia has to prove it’s still the king of AI, and although this wasn’t flawless, it’s kept its crown, and it isn’t giving it up anytime soon.

Explore Nvidia

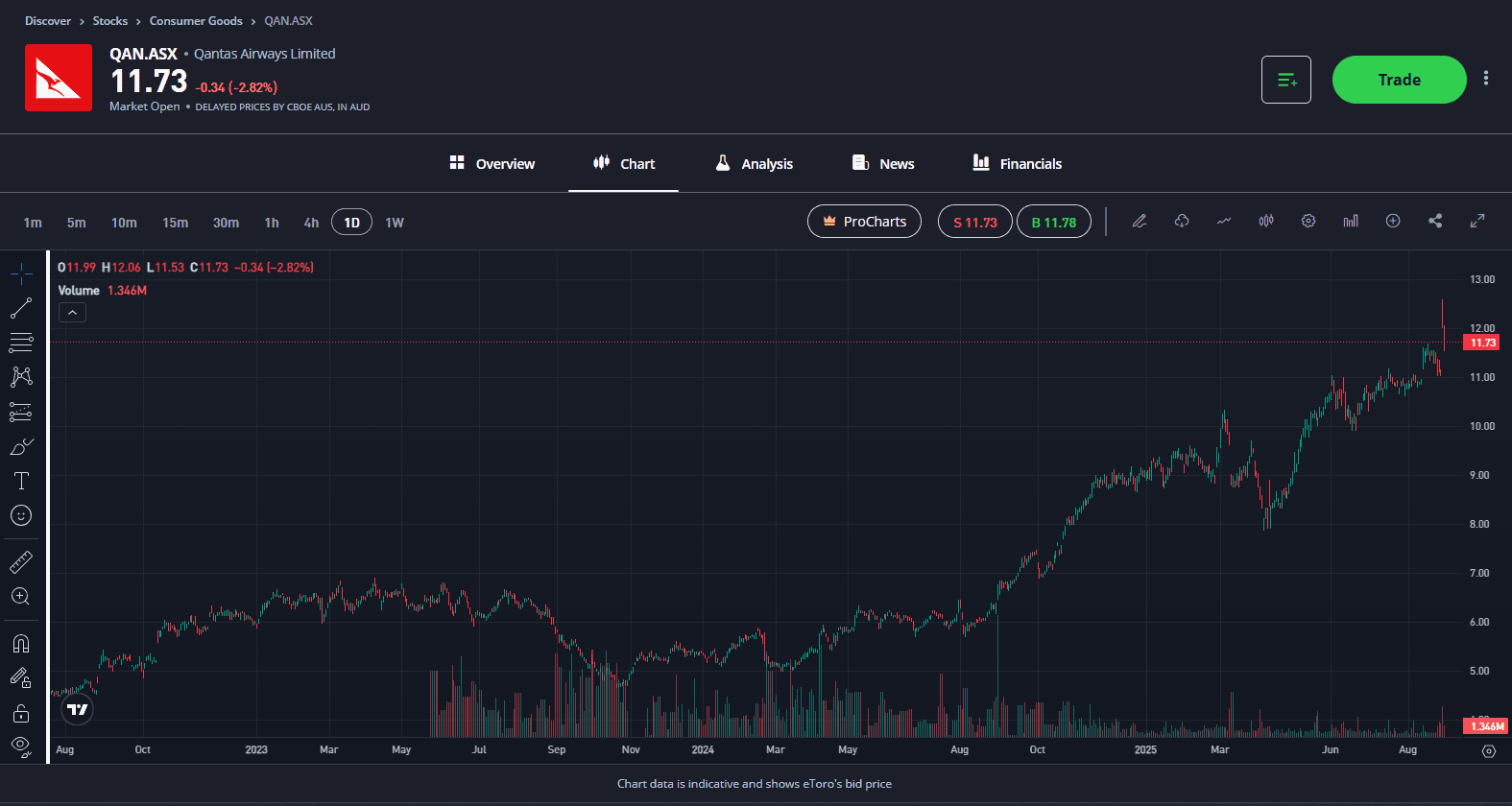

Qantas takes flight with soaring profits

Qantas delivered a strong set of full-year results today, comfortably beating analyst expectations and highlighting just how far the airline has come under CEO Vanessa Hudson. Underlying pre-tax profit rose 15% to AUD$2.39 billion, while net income jumped 28% to AUD$1.61 billion. Importantly for investors, Qantas announced a final dividend of 16.5 cents per share alongside a special dividend, marking another significant return of capital.

Jetstar was the star performer once again, posting a 55% surge in underlying earnings to AUD$769 million, underscoring how crucial the low-cost carrier has become as households continue to battle cost-of-living pressures. International demand also remained firm, with Qantas International earnings rising 7% year-on-year, with strong demand for premium cabins. Not only is Qantas shining at the budget end, it’s also glowing at the front of the plane as well.

Hudson inherited a mammoth challenge in balancing shareholder returns, rebuilding trust with consumers, and satisfying regulators. Just under two years in the job, and the results speak for themselves. The airline has stabilised, costs are being managed effectively, and customer sentiment is slowly being rebuilt. The return of dividends is also a great way to keep investors pleased, alongside the huge gains in the last year.

It’s not always a one-way flight, though. Net debt climbed 22% to AUD$5.03 billion as Qantas invests heavily in fleet renewal, new aircraft orders and customer initiatives, though these are necessities, not luxuries. Its recent AUD$90 million fine isn’t ideal, however, and competition from Virgin Australia is also intensifying. But with operating margins expanding to 11.1%, demand for air travel strong and growth drivers like Qantas Loyalty and Project Sunrise on the horizon, the airline looks well-positioned for the next leg of growth.

This was another solid result and one that was needed to reaffirm the run we’ve seen in shares. Qantas is making the right moves at the right time to keep passengers flying and shareholders invested.

Explore Qantas

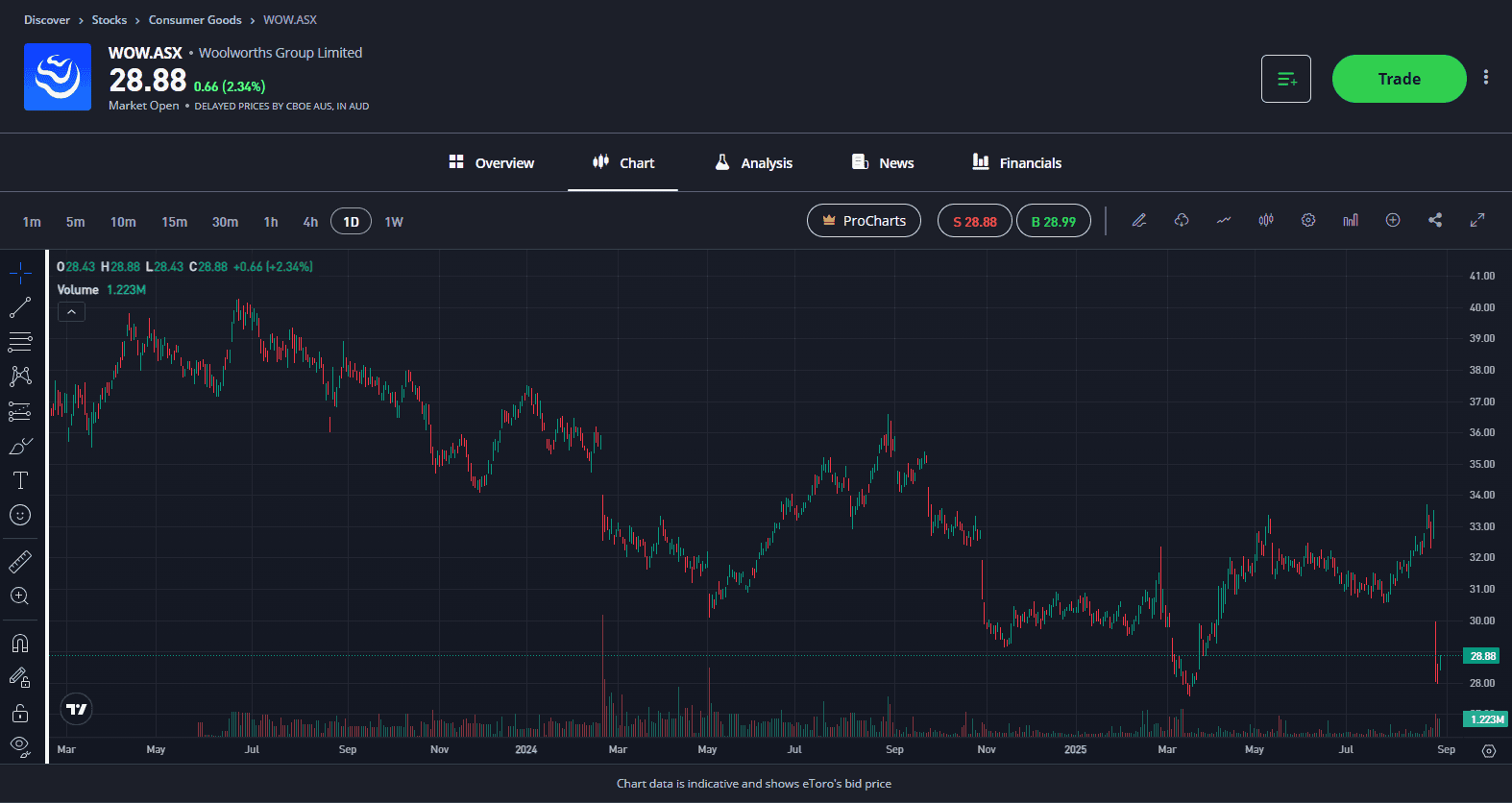

Woolworths results fail to inspire

Woolworths’ full-year results highlighted once again a business in transition, but one that is quickly losing investor patience. Profits sank 19%, weighed down by rising costs and weaker margins in its core Australian food business. The supermarket giant’s challenges remain clear and its struggles persistent. Margins continue to be squeezed as Woolworths balances competitive pricing and cost inflation, with Australian food EBIT falling 11%. Its discount retailer, Big W, remains a drag on the business, with losses widening to A$63 million.

Since taking the helm, CEO Amanda Bardwell has been more firefighter than visionary, putting out flames to steady the ship. That fight is still ongoing, and the hard work of rebuilding lies ahead. While its cost-saving program of AUD $400 million lays the groundwork for the next leg of Woolworths’ story, execution will be critical to restoring investor confidence.

The focus now is on rebuilding momentum in Australian supermarkets. A 4% jump in AU food sales in the first eight weeks of FY26, led by eCommerce growth, is a step in the right direction, but it won’t exactly excite the market. eCommerce could be the lever that helps Woolworths rebuild margins, but it’s no magic fix for a business under pressure.

The 21% cut to its final dividend will be a kick in the teeth for loyal shareholders who’ve endured zero growth from shares in the last five years, and that won’t do much for confidence. Investors were waiting for a reason to believe in a turnaround, but once again, they’ve been delivered another blow and left waiting.

Explore Woolworths

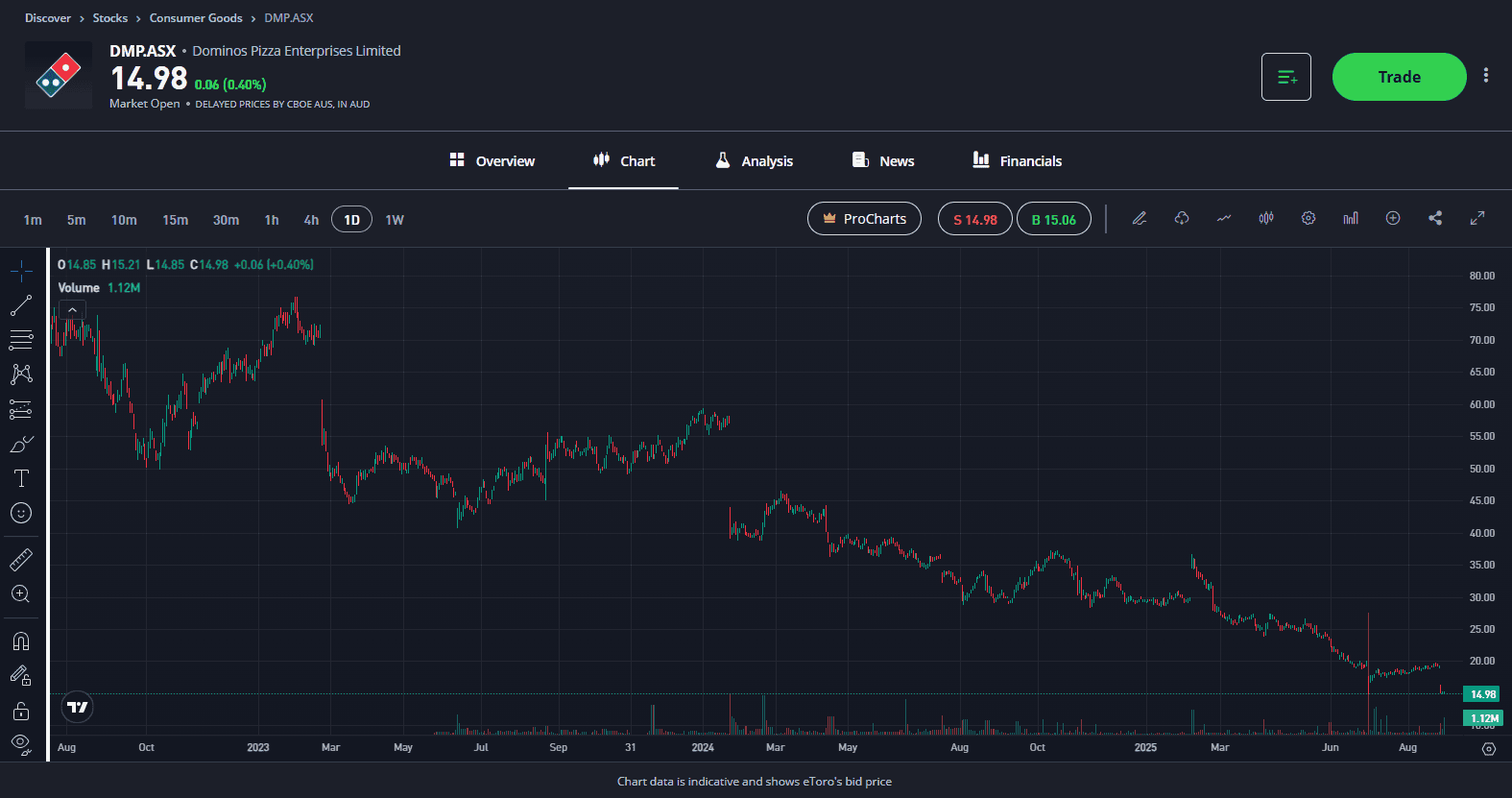

Domino’s delivers more disappointment

Domino’s latest results have delivered yet more disappointment. They posted a net loss of AUD$3.7 million, swinging from a AUD$96 million profit last year, with revenue falling 3% and same-store sales declining. Performance was patchy across regions. Australia delivered solid results, but France and Japan remained a drag, while Asia revenue fell almost 7%. Store closures weighed on network sales, which fell 0.9% to AUD$4.15 billion.

Leadership instability continues to cloud the investment case and only deepens the problem. In the space of a year, long-serving CEO Don Meij retired, his successor Mark van Dyck stepped down after only months, and investors are still waiting for a clear strategy. A revolving door in the boardroom makes it harder for investors to buy into a long-term growth story.

There are signs of progress, with a renewed focus on cost savings and tighter capital discipline. The decision to only open new stores when profitability is sustainable is sensible, but it also highlights the difficult operating environment. Same-store sales in the first seven weeks of FY26 are already down 0.9%, showing that demand for pizza remains soft.

This isn’t going to be an overnight turnaround, with rising costs, delivery platform competition and pressure on franchisees, confidence won’t be easily restored. Quick fixes like store closures and simplified menus may ease the pain, but winning back customers and rebuilding profitability will take time. Investors will want to see concrete evidence from leadership that it’s got a clear, drawn-out plan in place and show signs of executing on that before confidence is restored.

Explore Dominos

The investor takeaway?

This earnings season has underscored the divide between winners and laggards, both globally and locally. In the U.S., the AI-fuelled giants continue to dominate while the broader market battles to justify stretched valuations. In Australia, Qantas’ strength shows that well-positioned businesses can thrive even in a tougher environment, while Woolworths and Domino’s highlight the challenges facing food and retail more broadly. For investors, the takeaway is that markets are rewarding companies with strong balance sheets, pricing power, and clear growth strategies, while punishing those still searching for direction. The task now is not just to follow the headlines but to identify where short-term setbacks could mask long-term opportunity and where apparent strength might already be priced in.

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.