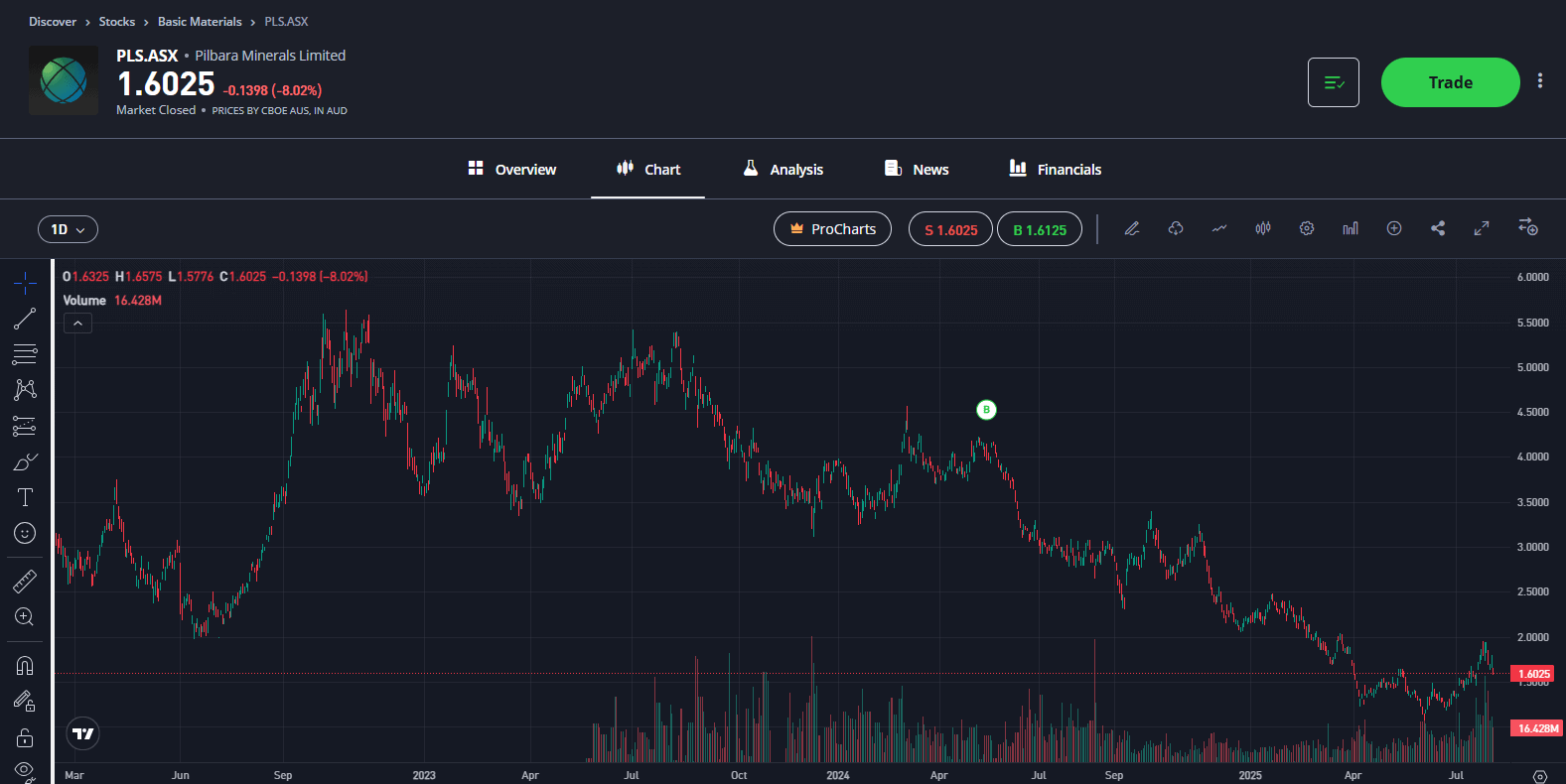

Stock #1: Pilbara Minerals (PLS.ASX)

Sector: Materials (Lithium)

Australia’s leading pure-play lithium miner is back on the radar after surging nearly 50% since June, as signs emerge that the global lithium glut is easing. Lithium prices had collapsed over the past 18 months, even forcing Pilbara into a first-half loss. But a recent supply squeeze , which included a Chinese producer halting output, has sparked a sharp rebound in lithium markets.

Pilbara is ramping up production and expanding overseas, and its management believes “the stage is set” for a lithium price recovery that could boost earnings. With lithium a critical component in electric vehicle batteries, any revival in demand bodes well for Pilbara. Investors will be watching the company’s full-year results on 25th August 2025 for confirmation that this momentum is turning in its favour.

Explore Pilbara

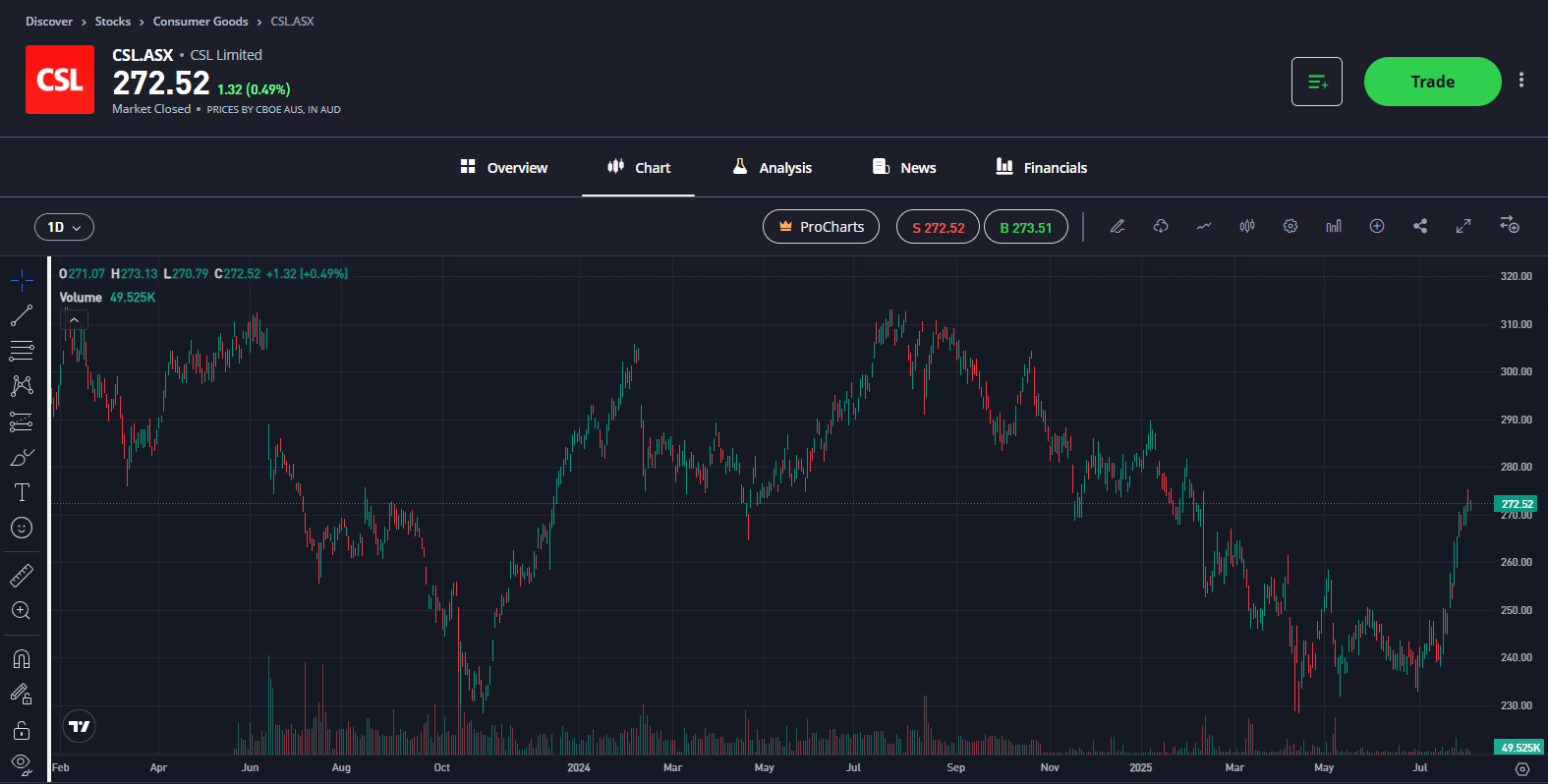

Stock #2: CSL Ltd (CSL.ASX)

Sector: Healthcare

CSL is a global leader in blood plasma therapies and vaccines, and has long been considered a high-quality growth stock in the ASX healthcare sector. However, CSL’s share price has been under pressure this year down about 3.5% amid investor concerns. More recently though, it’s been a more optimistic story, shares have rallied 8% in the last month on a number of broker upgrades that now give CSL 17 buy ratings, 2 holds and 0 sells.

Its flu-vaccine unit (Seqirus) has seen softer sales, and its recently acquired kidney therapeutics division (Vifor) has had a slow start. Crucially, though, CSL’s core plasma division (Behring) is performing well, supported by strong demand for immunoglobulin (Ig) therapies. In fact, the company has guided for 10–13% net profit growth in FY2025, and first-half results showed Ig revenue up 15% with improving profit margins. CSL has an entrenched advantage in plasma collection and a rich R&D pipeline, giving it pricing power.

With CSL set to report full-year earnings in August, investors will be watching for updates on its plasma business momentum, any recovery in Seqirus/Vifor, and whether management’s outlook reaffirms that double-digit growth trajectory. If CSL can deliver solid results and reassure on its challenges, those broker upgrades will be justified.

Explore CSL.ASX

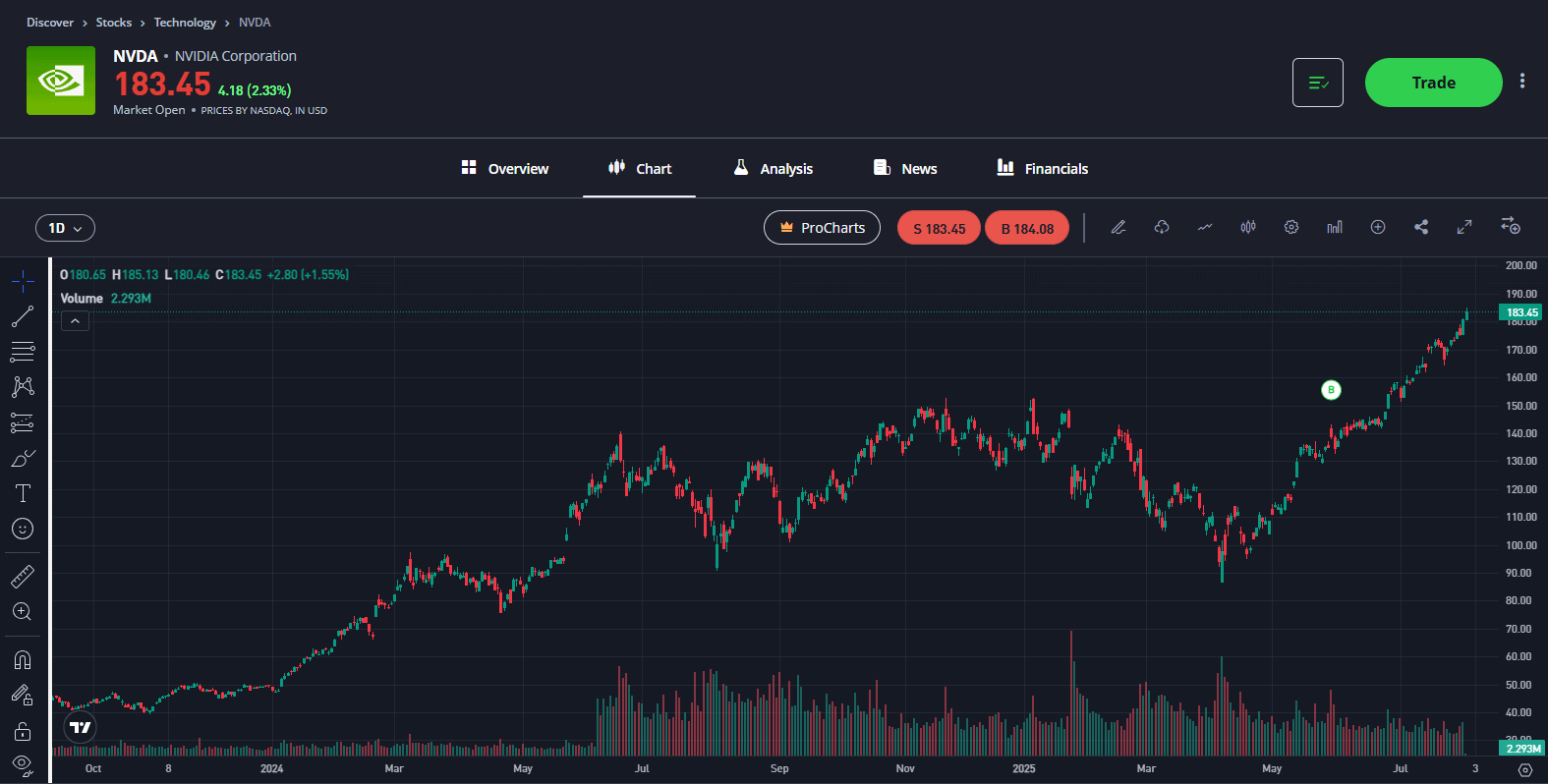

Stock #3: Nvidia (NVDA)

Sector: Technology

The largest stock on the planet will be a name we watch closely in August. Nvidia has emerged as the poster child of the AI boom, and for good reason. The company’s earnings last quarter were nothing short of magnificent, quarterly revenue hit USD$30 billion, up 122% year-on-year, with its data centre segment (which includes AI chips) surging by over 150%.

Demand for Nvidia’s GPU processors , the critical hardware that powers generative AI and machine learning in data centres, is far outstripping supply, leading to record sales and profitability. Nvidia’s meteoric growth has propelled its stock to all-time highs. As of July, the company’s market capitalisation soared past USD$4 trillion. This valuation reflects huge optimism that Nvidia will continue to be the focal point for the AI revolution.

Looking ahead to this month, Nvidia is due to report another set of results (for its fiscal second quarter), and expectations are sky-high. Investors will be watching for any signs of supply chain bottlenecks or competition that could temper Nvidia’s growth.

Nvidia has continued to beat forecasts and even announced a massive USD$50 billion share buyback authorisation, signaling confidence in its future. If CEO Jensen Huang delivers another strong outlook – showing that demand from cloud providers, enterprises, and even governments (for “sovereign AI”) remains robust, Nvidia’s shares could extend its incredible 2025 run.

Explore Nvidia

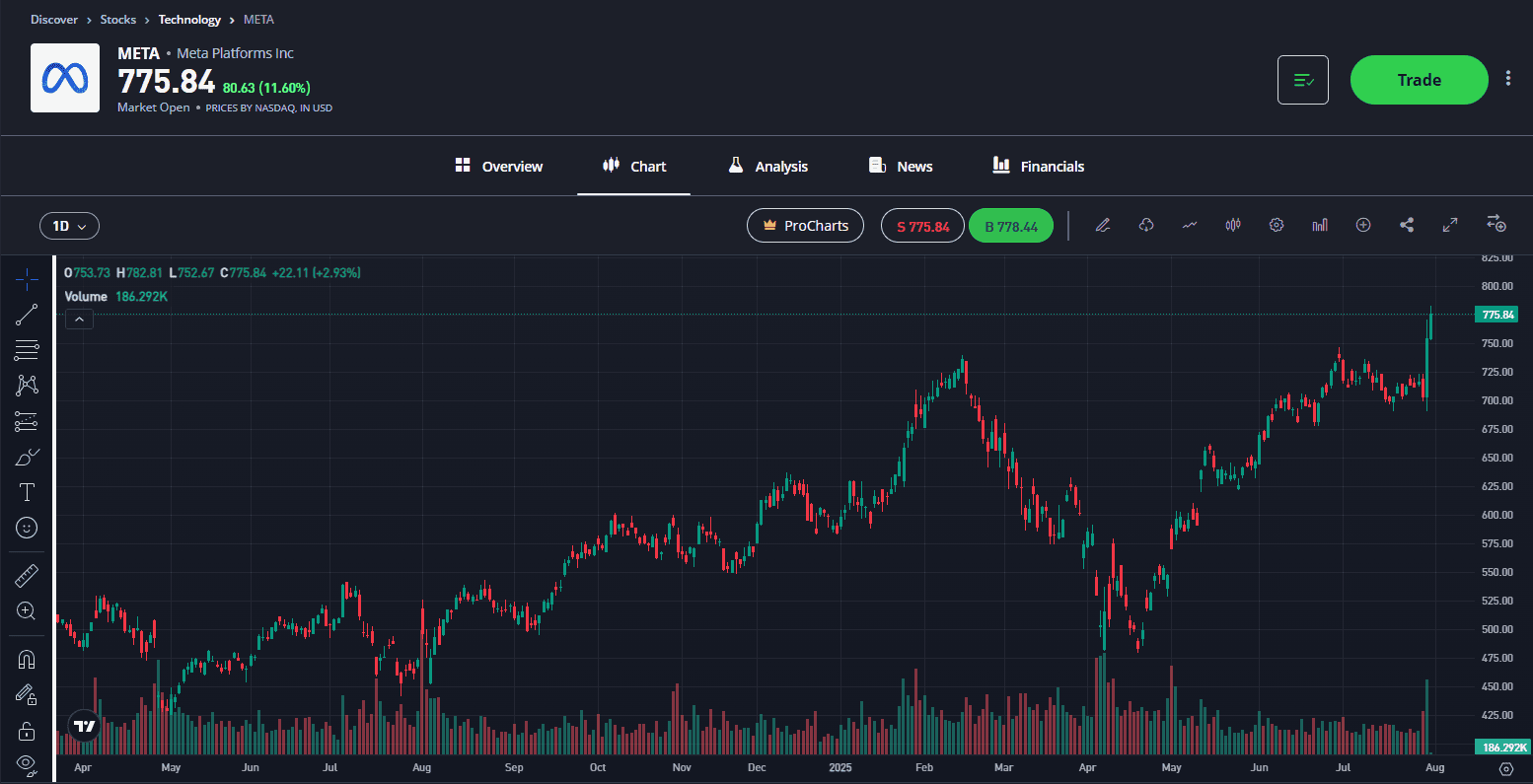

Stock #4: Meta Platforms (META)

Sector: Communication Services

Meta Platforms, the parent of Facebook, Instagram and WhatsApp, delivered a huge Q2, posting revenue of USD$47.5 billion, up 22% year-on-year, and earnings per share of USD$7.14, well ahead of the USD$5.88 consensus. Ad impressions rose 19% and the average price per ad increased 6%, underlining Meta’s improving pricing power and AI-driven ad efficiency. Investor response was swift, Meta shares jumped over 10% in after-hours trading on the earnings beat and bullish Q3 revenue guidance of up to USD$49 billion.

The company’s massive AI push is starting to show results. Its Llama model and Meta AI assistant are nearing 1 billion monthly users, while AI-powered features continue boosting engagement across platforms like Reels and Threads. Meanwhile, Meta has reaffirmed its commitment to the AI race with updated 2025 CapEx guidance of USD$66–72 billion, and significant financial offers to top-tier AI talent as it competes with OpenAI and Anthropic for dominance in ‘superintelligence’.

CEO Mark Zuckerberg has made no secret of his “year of efficiency” turning into a multi-year effort to build “superintelligence”, Meta is pouring billions into new data centres and even acquiring stakes in AI startups to recruit top talent. While those bold bets are crimping margins in the short term, Meta’s leadership believes they will reinforce the company’s long-term dominance.

Despite continued heavy losses in its Reality Labs division, Meta’s core business remains strong. While its aggressive spending pace will keep operational efficiency in focus, Meta is proving it can grow both top and bottom lines while positioning itself at the forefront of the next tech wave. With the stock up more than 700% from its 2022 lows, Meta Platforms is definitely a stock to keep an eye on this August.

Explore Meta

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.