Global markets remain on edge as trade tensions and tariff risks linger. Yet even in choppy conditions, certain companies are standing out with upbeat earnings and major upcoming catalysts. From tech giants unveiling new innovations to Australian firms posting robust results, investors have plenty to keep an eye on. Here are four stocks worth watching in June, each with significant developments on the horizon.

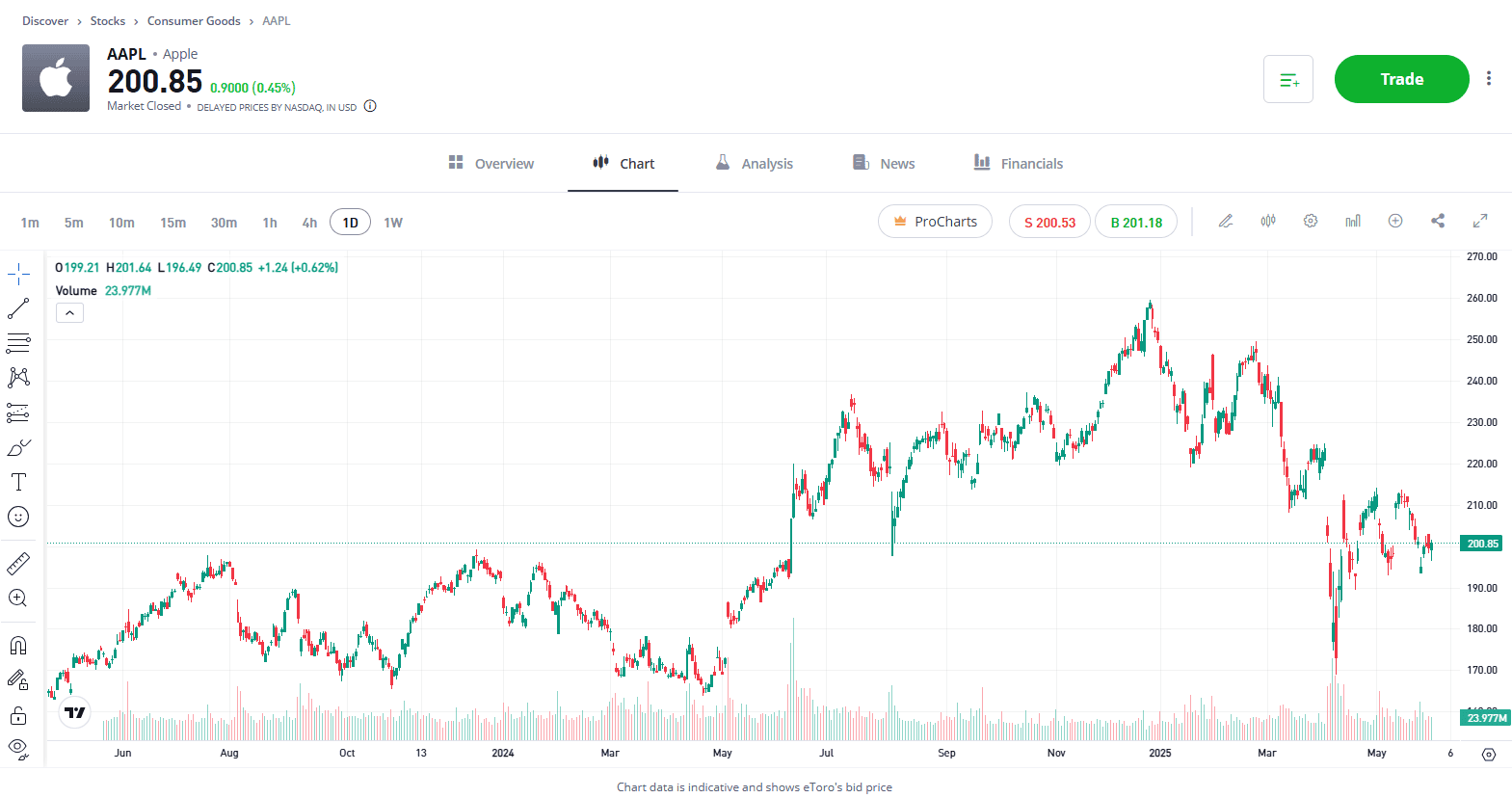

#1 Apple

Sector: Technology

Apple (AAPL) investors have been preoccupied with trade war headlines this year, as new U.S. tariffs weighed on its shares. Now, attention is shifting to Apple’s pivot toward artificial intelligence. At its Worldwide Developers Conference (WWDC) starting June 9, Apple is reportedly set to open up its in-house AI models to third-party developers, a move that could accelerate innovation across the Apple ecosystem. Last year, the company unveiled its “Apple Intelligence” AI platform, but critics noted the rollout was slow. By offering an AI toolkit for app creators, Apple could spur new AI-powered features for the iPhone and beyond. Its numbers remain resilient, though; Apple grew revenue 5% year-on-year to a record US$95.4 billion last quarter despite the tariff uncertainty. With robust consumer demand and a new AI strategy on the horizon, Apple’s trajectory will be closely watched this month as it balances short-term headwinds with long-term growth drivers.

Past performance is not an indication of future results.

Explore Apple

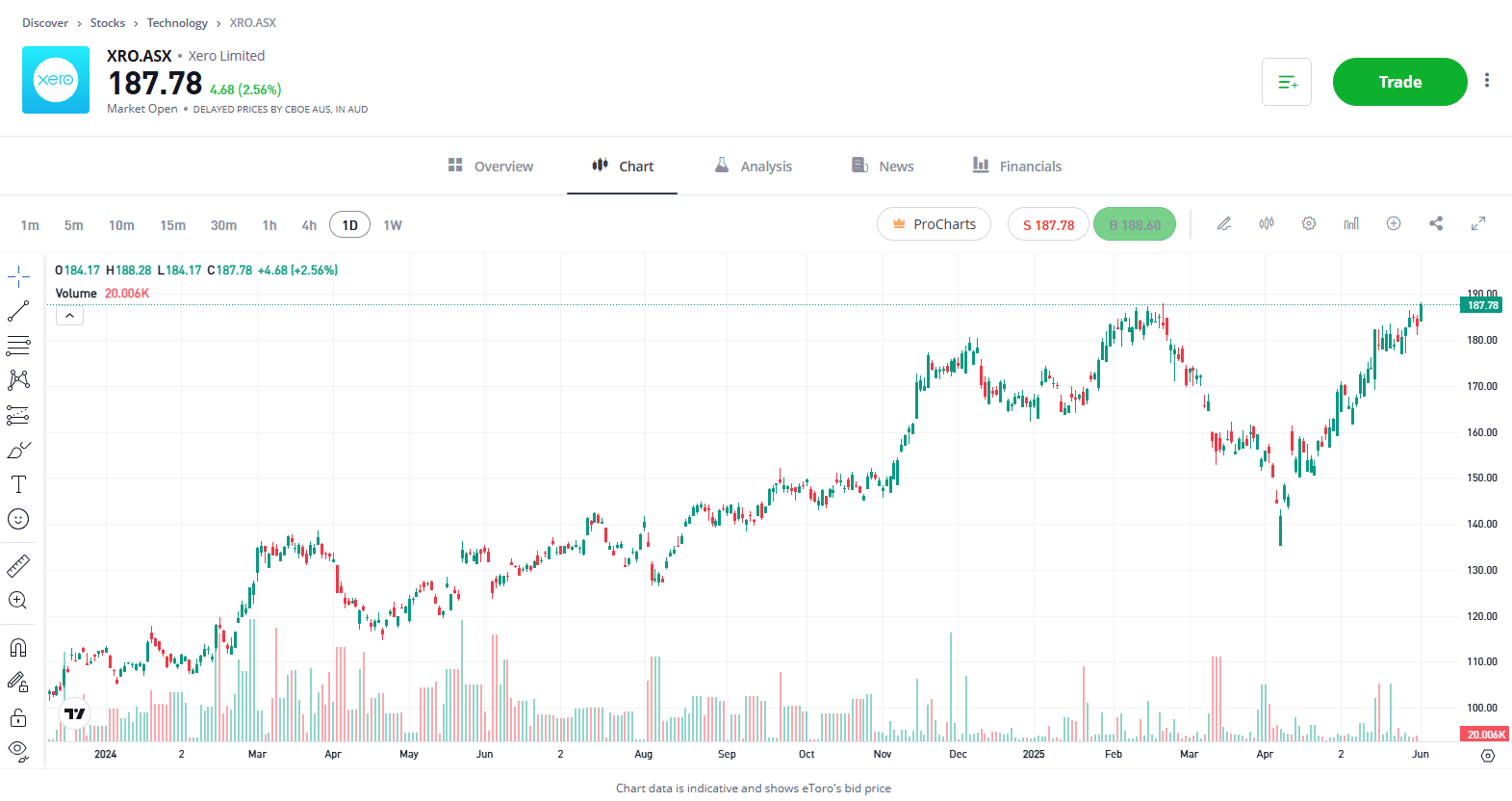

#2 Xero

Sector: Technology

Cloud accounting software provider Xero continues to show why investors have flocked to the stock over the years after delivering solid full-year results last month. For the financial year ended March 2025, Xero’s operating revenue jumped 23% (to NZ$2.1 billion) and adjusted EBITDA rose 22% – a rare combination of high growth and rising profitability. Management highlighted the results as evidence of “macro‑resilient” growth and effective execution of strategy. The company has been investing in product development to bring more features to small-business customers, which is expanding its global appeal. With small enterprises worldwide still digitising their operations, Xero sees a large untapped market for its platform. Shares reacted positively to the earnings beat, and analysts remain upbeat on Xero’s international expansion. As the new financial year begins, Xero’s solid momentum and improving margins make it one Aussie tech stock to watch.

Past performance is not an indication of future results.

Explore XERO

#3 BYD

Sector: Automotive (Electric Vehicles)

Chinese electric vehicle leader BYD (1211.HK) continues its growth on the world stage. The company has leveraged affordable, high-tech EVs and hybrids to dominate its home market, even unseating Volkswagen as China’s top-selling automaker last year. In 2025, BYD’s growth has only accelerated. In May alone, it sold a huge 382,000 new energy vehicles, including about 89,000 units overseas, marking one of its best months on record. BYD’s volume in China now far outstrips Tesla’s (at one point logging 68,000 EV sales in a single week versus 3,000 for Tesla, and it even overtook Tesla in Europe’s EV sales for the first time in April. Buoyed by this momentum, BYD is on track to surpass Tesla as the world’s top EV seller in 2025. The company is rapidly expanding into new markets from Asia to Europe, with a strategy of introducing both pure electrics and plug-in hybrids to navigate regional tariff barriers. While trade policies pose challenges, BYD’s growth and global ambitions have positioned it as a true EV powerhouse. With record sales and new models rolling out, investors will be watching how BYD’s international push progresses in June.

Past performance is not an indication of future results.

Explore BYD

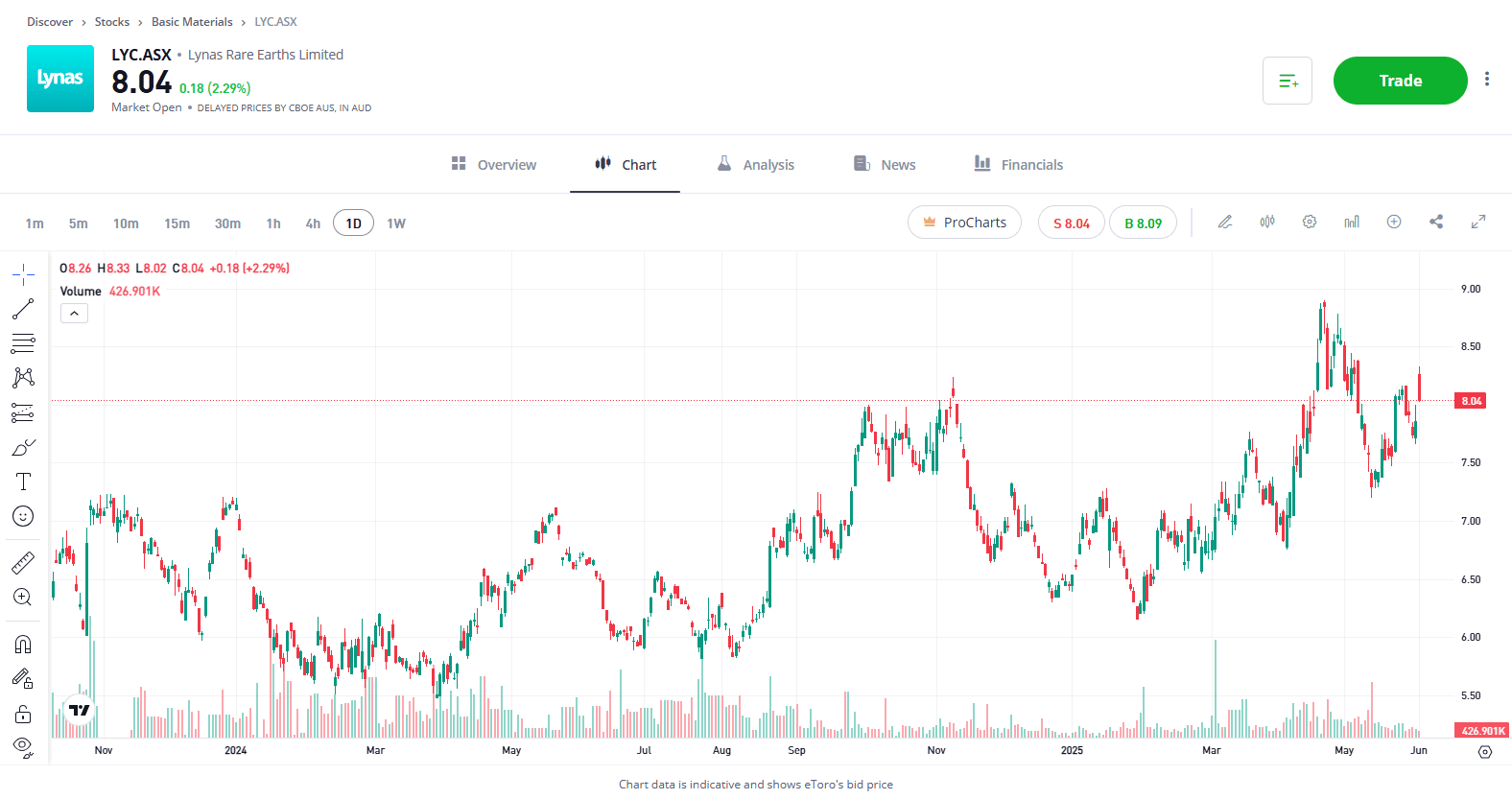

#4 Lynas Rare Earths

Sector: Materials

Lynas Rare Earths is attracting attention as a critical player in the global supply chain for high-tech metals. The Aussie company operates the world’s largest rare earths mine outside China and has just achieved a major milestone: it began producing heavy rare earth elements at scale, something no other supplier outside China has done before. Lynas recently commissioned a new processing facility in Western Australia and upgraded its Malaysian plant, enabling it to separate valuable heavy rare earths like dysprosium and terbium. In fact, the company’s latest quarterly report forecast first terbium output by June 2025, adding to Lynas’s product suite at a time of robust demand for these metals in electric vehicles, wind turbines and electronics. This progress bolsters Lynas’s status as the only significant non-Chinese source of rare earth materials for global industries. The stock had faced headwinds previously due to regulatory hurdles and China’s dominance in this sector, but Lynas’s new production capabilities are a potential game-changer. As governments and manufacturers seek to secure supply chains, Lynas stands to benefit, making it an Aussie stock to watch closely in June.

Past performance is not an indication of future results.

Explore Lynas rare earths

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.