August delivered another strong run for equities, with the ASX 200 even hitting a record high amid robust earnings and rising hopes of interest rate cuts. As we enter September, investors are eyeing a new set of catalysts, from major product launches to corporate turnarounds.

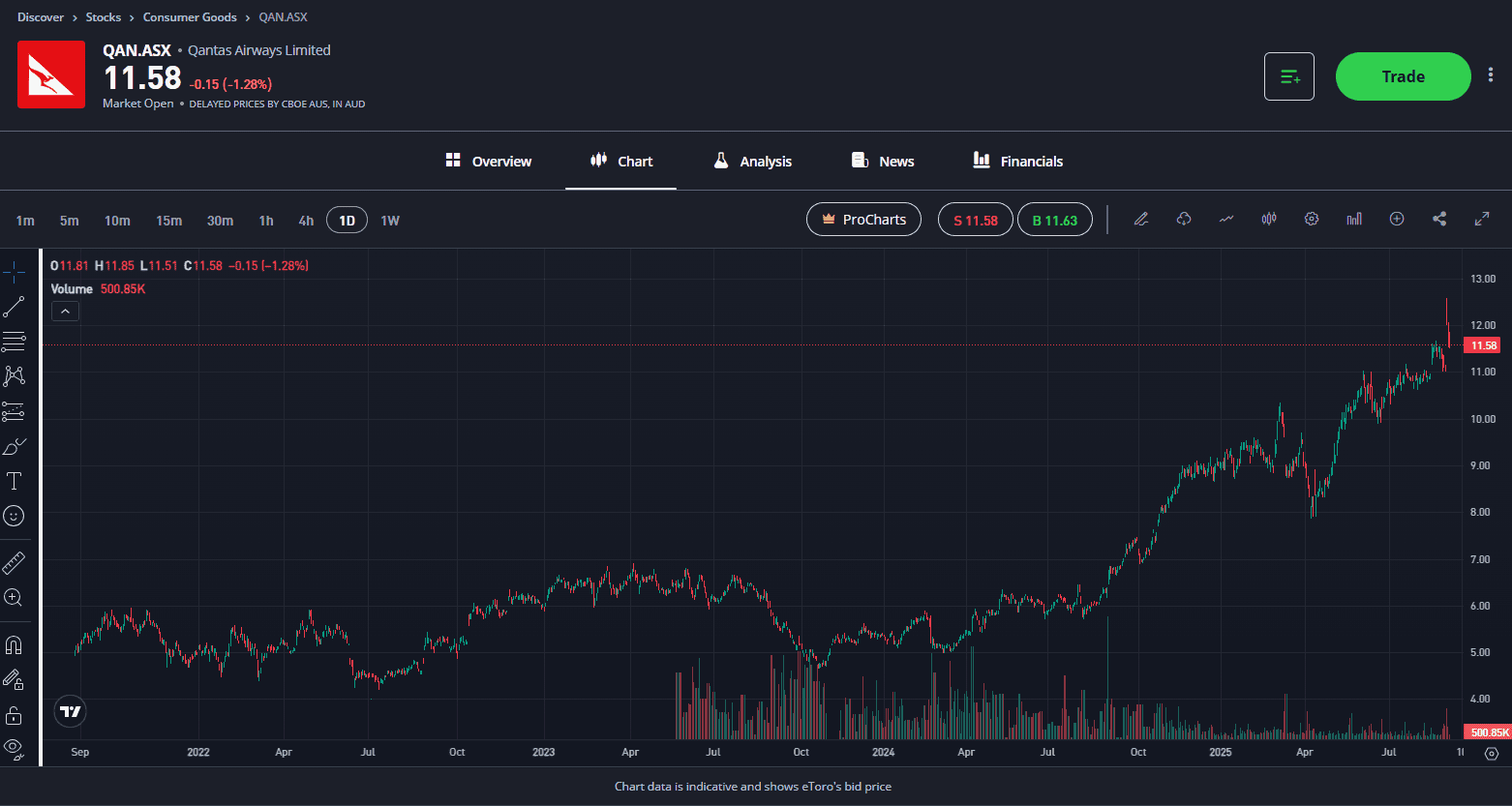

Stock #1: Qantas Airways (QAN.ASX)

Sector: Consumer (Airlines)

Australia’s flag carrier is navigating through turbulence into clearer skies. Qantas just reported a 28% jump in full-year net profit to $1.6 billion, buoyed by booming international and domestic travel demand. Its budget arm Jetstar, had a standout year, carrying a record 16 million domestic passengers with earnings up 55%, underscoring how crucial the low-cost carrier has become as households continue to battle cost-of-living pressures

CEO Vanessa Hudson, is focused on rebuilding trust after a string of scandals. The airline has implemented dozens of governance reforms and set aside provisions for legal penalties. The new management is “changing Qantas for the better,” Hudson insists. Investors seem encouraged, Qantas shares surged 8% to a record high after results and remain up around 30% this year. Looking ahead, the carrier’s focus is on maintaining momentum, helped by steady fuel prices, and preparing for growth initiatives like ultra-long-haul “Project Sunrise” flights due in 2027. Qantas’s journey won’t be entirely smooth, but with travel demand still robust and reputation repair underway, many analysts are staying bullish on the flying kangaroo’s recovery story.

Explore Qantas

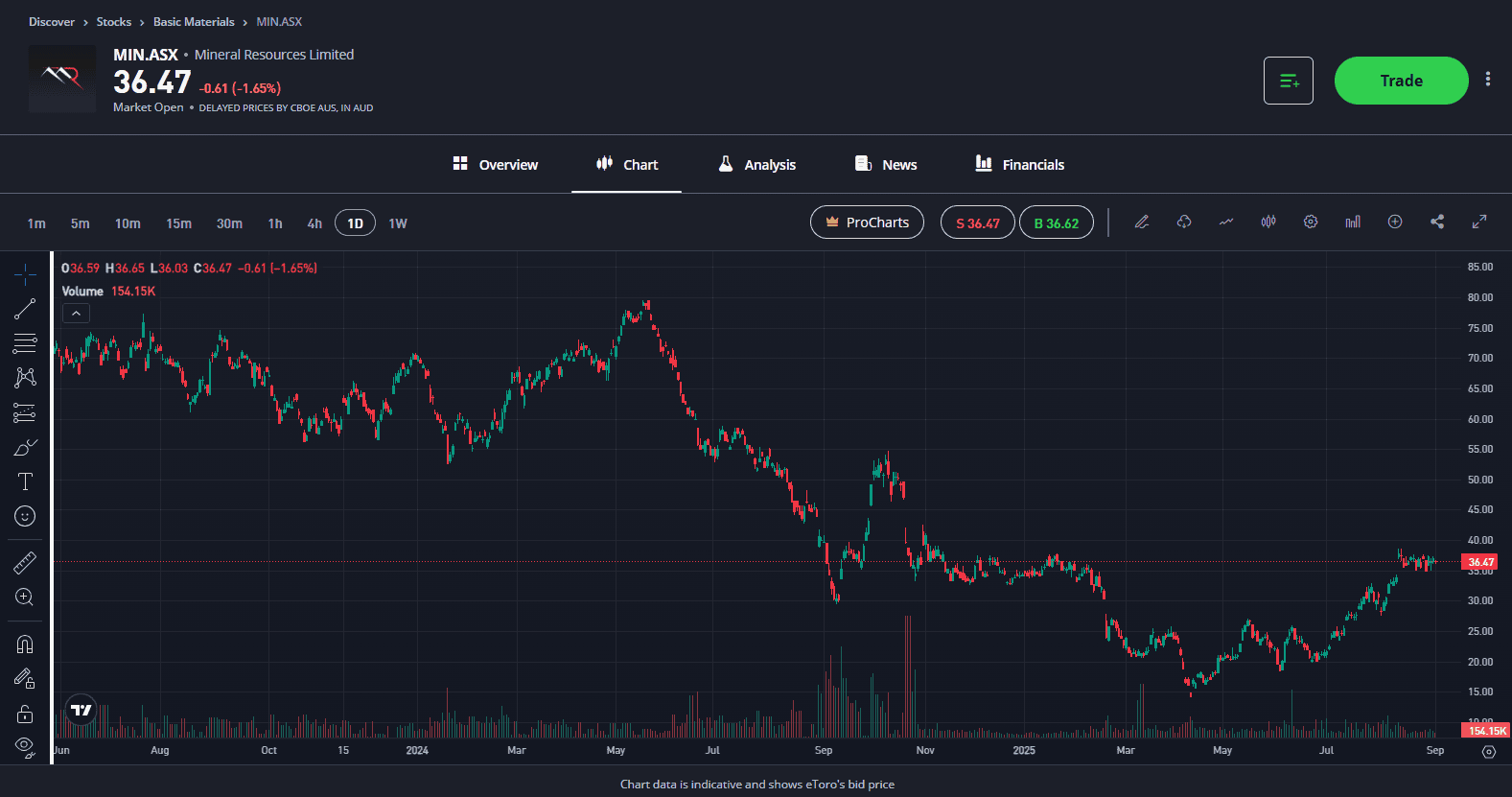

Stock #2: Mineral Resources (MIN.ASX)

Sector: Materials (Mining)

After a tough start to the year, this diversified miner has come charging back onto watchlists. Mineral Resources was among the ASX’s worst performers in FY2025, hit by the lithium price crash and cost challenges.

The company just finished resurfacing a critical 150km haul road to the new Onslow Iron project in WA, which is on schedule for completion in September 2025. This logistical upgrade will be transformational: it enables MinRes to ramp iron ore exports toward a 35 Mt annual capacity and significantly lower unit costs, which should boost cash flow and help pay down debt. MinRes’s lithium division, once its profit engine, struggled over the past 18 months as lithium prices plunged. The downturn drove Pilbara Minerals (a peer) to an 89% profit collapse, and MinRes likewise saw earnings slump in FY25. The good news: there are early signs the global lithium glut is easing (Chinese producers have cut output, sparking a price rebound)

Management remains confident in the long-term EV battery demand story and has continued expanding production capacity rather than retrenching. The company shored up its balance sheet by selling non-core oil & gas assets for $1.1 billion last year. With fresh iron ore revenue coming online and any uptick in lithium prices a bonus, MinRes is poised for a brighter year ahead.

Explore Mineral Resources

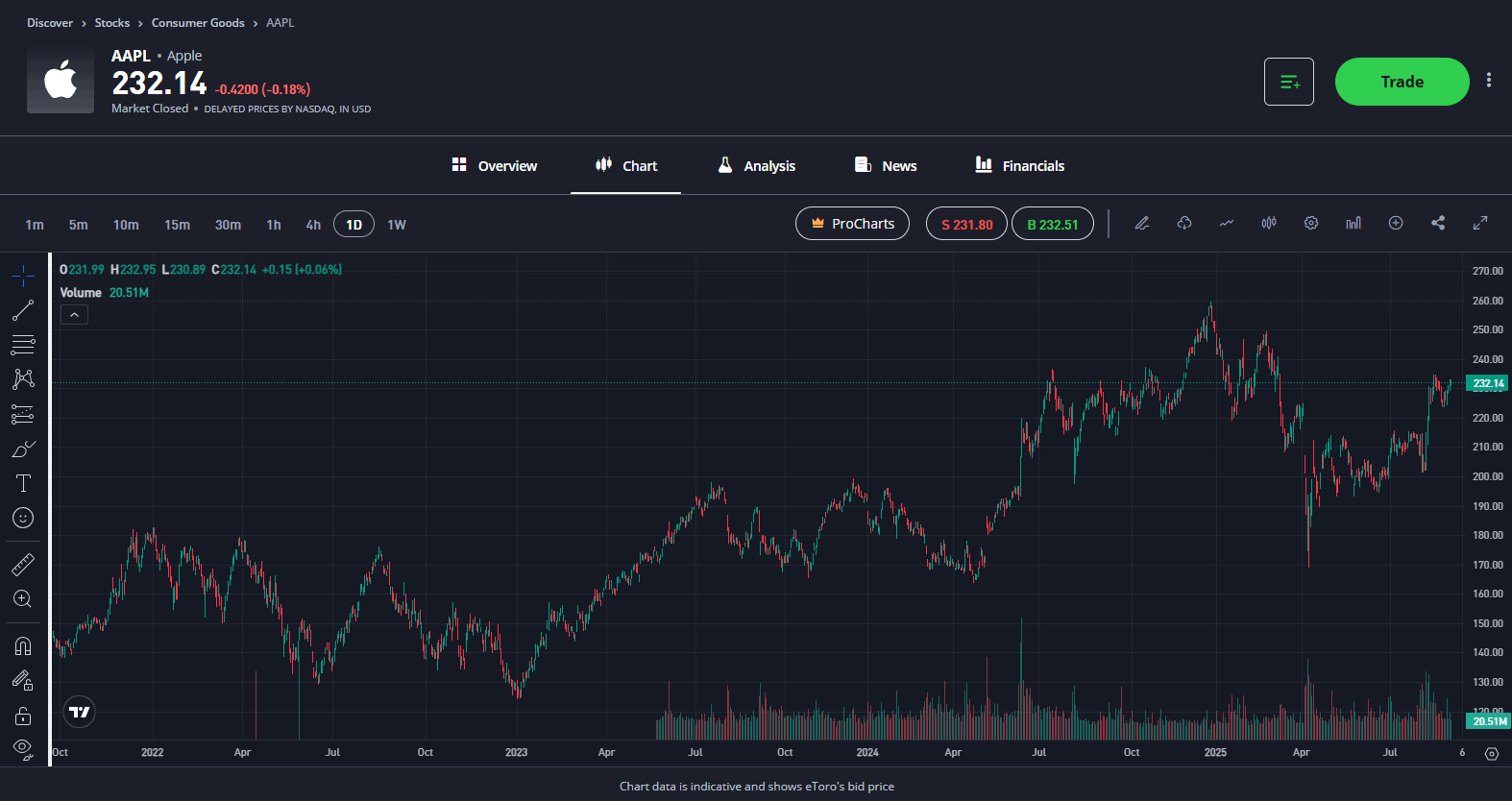

Stock #3: Apple Inc. (AAPL)

Sector: Technology

Apple heads into September with all eyes on its “Awe Dropping” product event, where it will unveil the new iPhone 17 lineup. Expectations are high: leaks point to an ultra-slim “iPhone 17 Air” model (Apple’s thinnest ever) alongside the usual base and Pro versions. Upgraded cameras, new colour options, and possibly more on-device AI features are expected, as Apple looks to catch up on AI integration in smartphones. The company is also likely to announce Apple Watch Series 11 and new AirPods Pro earbuds at the event. Perhaps most exciting, Apple is laying the groundwork for a foldable iPhone in 2026, making this year’s launch the start of a “once-in-a-generation iPhone overhaul” roadmap.

For Apple’s share price, the question is whether this event will reignite momentum. Shares have been surprisingly subdued in 2025, down about 8% year-to-date even as the broader S&P 500 climbed. Historically, Apple’s launch events can be “sell-the-news” moments, with the stock often rallying beforehand and then dipping once products are revealed. However, the backdrop now includes a friendlier Fed with a rate cut expected this month and a strong upgrade cycle potential if the iPhone 17 impresses.

AAPL still boasts unparalleled customer loyalty and a growing services ecosystem, which helped its revenue inch up despite slower device sales last quarter. Investors will watch the iPhone 17 reception and any hints of demand strength, especially in China and India. With the stock trading near its lowest forward valuation in over a year, a successful launch could put Apple back on an upward trajectory. In short, the next few weeks will test whether Apple can wow the market or if its recent lull will continue.

Explore Apple

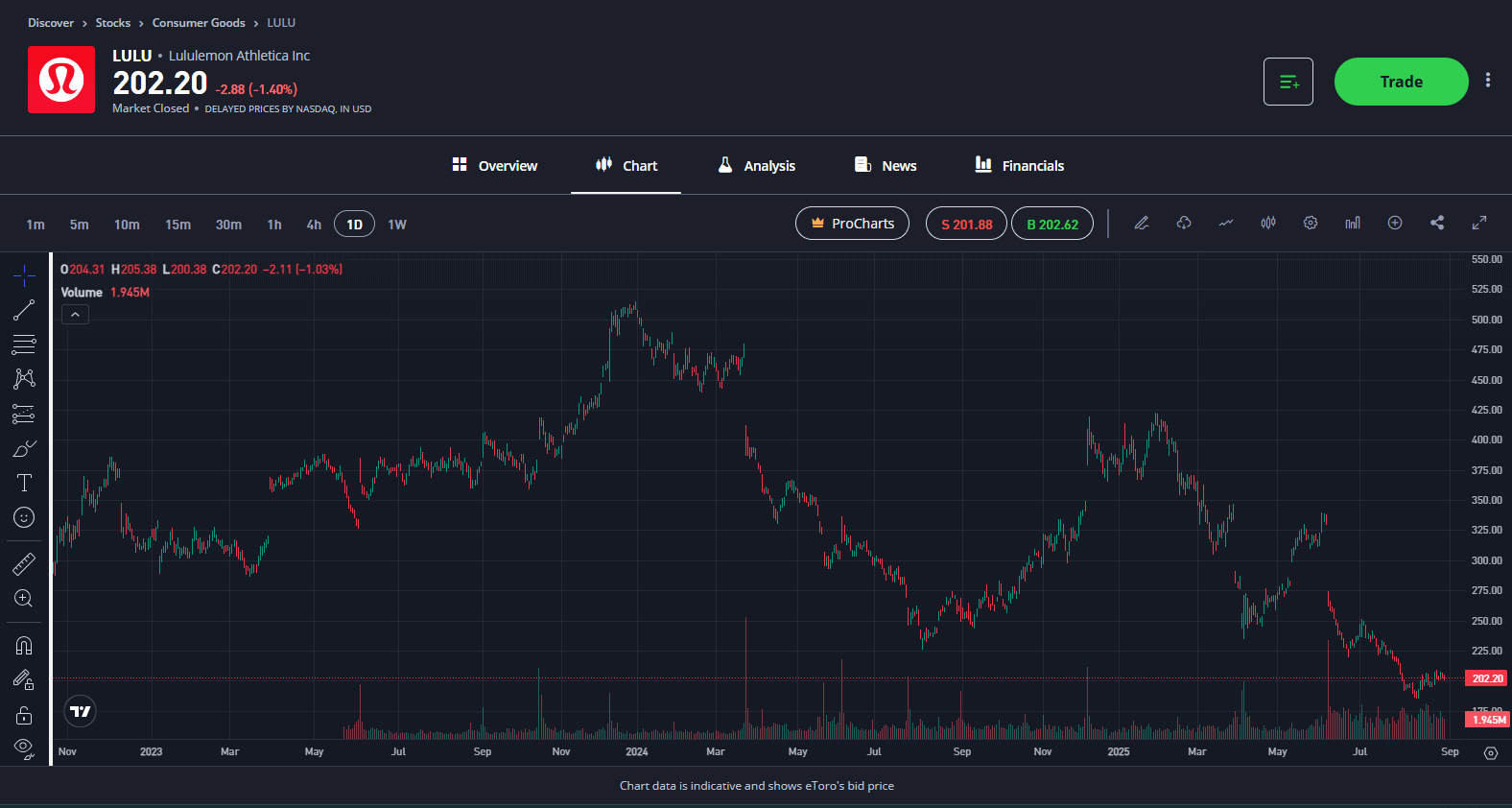

Stock #4: Lululemon Athletica (LULU)

Sector: Consumer (Apparel)

Once a market darling, the yoga wear retailer has been in a stretch of underperformance, but September could be a turning point. Lululemon’s shares currently trade near USD$200, down more than 50% from their post-pandemic highs above and down 45% year-to-date. The slide reflects a comedown from heady growth rates: in its most recent quarter, revenue grew a modest 7% and North American same-store sales actually dipped slightly. For Lululemon, tariffs remain the major overhang. Earlier this year, trade concerns rattled its supply chain outlook, and investors will be keen to hear whether management has a clearer handle on costs. The stock is known for its volatility, but its strength lies in its fiercely loyal global customer base and brand positioning at the premium end of the activewear market. That resilience has often kept Lululemon a step ahead of competitors, even in tougher operating conditions.

Importantly, Lululemon’s growth runway outside North America looks promising. International sales (led by China) are rising double-digits, and the brand is expanding into new categories like footwear and menswear. Analysts note that Lululemon’s web search trends are accelerating globally, a sign that demand remains strong even if U.S. consumers have cooled off a bit.

Any signs of margin pressure or cautious guidance would rattle investor confidence. With an implied earnings move of around 12%, markets are clearly braced for a big swing either way.

Explore Lululemon

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.