When most investors think of the ASX, casinos on the Las Vegas Strip don’t usually spring to mind. Yet Aristocrat Leisure is one of Australia’s most global success stories. A gaming giant with slot machines dominating Vegas floors and apps reaching millions of players worldwide. Aristocrat is positioning itself as more than just a pokie maker with moves into digital and online gambling.. Shares have returned around 25% annually for the last decade, but can that continue? Let’s find out.

- Aristocrat Leisure (ASX: ALL) is an Australian slot machine maker turned global gaming giant, dominating Vegas casinos and mobile gaming apps worldwide.

- Backed by strong cash flows and recent earnings growth, Aristocrat is defensive through cycles. The stock isn’t cheap, but quality justifies its premium valuation

- According to Bloomberg’s Analyst Recommendations, Aristocrat has 14 buy ratings, 1 hold, and 1 sell. The average analyst price target is AUD$73.86, signalling an 8% upside from current levels.

Explore Aristocrat Leisure

The Basics

Las Vegas’s flashing slot machines hide an Aussie secret, Aristocrat Leisure. It’s one of the world’s largest providers of casino gaming machines and content. The Sydney-based company is licensed in over 300 gaming jurisdictions and operates in more than 90 countries, supplying its slot games to casinos from Macau to the Vegas Strip. Aristocrat’s hit titles like Buffalo™ and Lightning Link™ have helped it capture about 42% of the North American slot market. It’s also the leader in participation slot machines, those placed on casino floors with revenue-sharing arrangements, which can earn far more than selling machines outright.

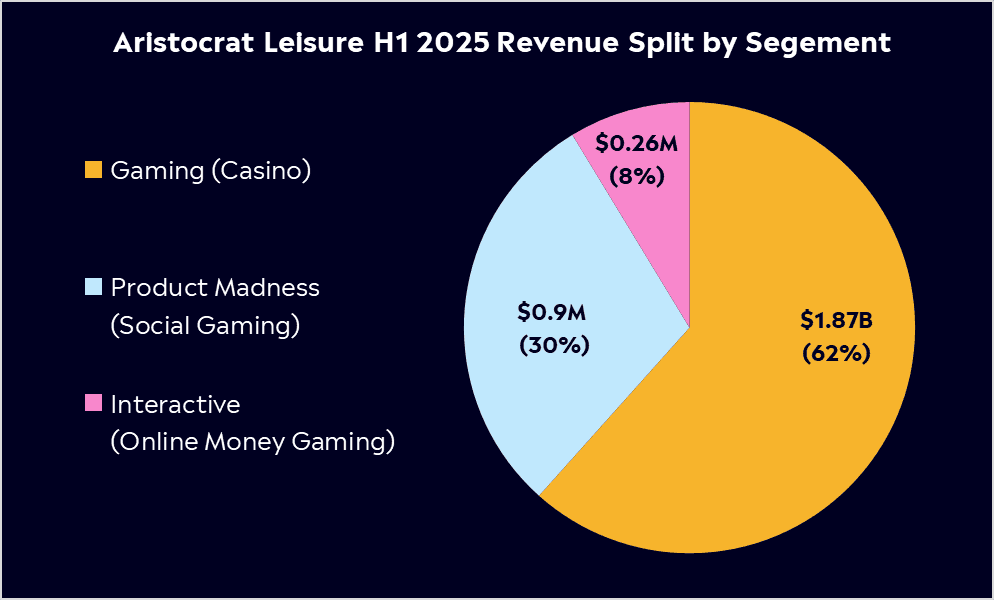

The company isn’t a one trick pony though. Beyond casino floors, Aristocrat has also become a force in digital gaming. It operates three business segments reflecting the businesses diversity. Aristocrat Gaming (land-based casino machines), Product Madness (social casino games), and Aristocrat Interactive (online real-money gaming). This unique mix of B2B casino products and direct-to-consumer games positions Aristocrat as a global entertainment powerhouse rather than a mere ‘pokie’ machine maker.

Aristocrat’s global appeal taps into booming trends. Casino tourism and new gaming jurisdictions worldwide are driving demand for modern slot machines. Meanwhile, the rise of online gambling and digital apps provides new growth avenues. Despite being listed on the ASX, Aristocrat’s fortunes are tied to worldwide gaming and casino habits, giving investors exposure to the “house always wins” narrative on a global scale.

Fun Fact: Aristocrat’s installed base of machines hit 73,603 machines in North America this year, after adding around 2,500 new units to casino floors.

Competitor Diagnosis

In the casino gaming equipment arena, Aristocrat stands among a small circle of global heavyweights, and it’s often at the top of the leaderboard. Aristocrat has built this lead by consistently churning out hit games and innovative cabinets that keep gamblers putting in their dollars. It competes with US rivals like International Game Technology and Light & Wonder in this segment, who remain challengers, but Aristocrat has shown it still has the edge after decades in the business.

Aristocrat’s Product Madness, the unit focused on social casino games, has fared well, securing the number one spot globally in social casino slots by market share, but it must continuously innovate to keep fickle mobile gamers engaged. Now, through its Anaxi division and NeoGames acquisition, it’s pushing into online real-money gaming, competing with DraftKings, Flutter and other iGaming providers. Unlike those consumer brands, Aristocrat plays behind the scenes as a B2B partner, leveraging its regulatory expertise to supply platforms and content.

Aristocrat’s competitors span old-school and new-school: from legacy slot makers to mobile app developers and online betting behemoths. The good news for investors is that Aristocrat has proven capable in both arenas. It enjoys scale and brand strength to fend off traditional rivals in casinos, and it has shown agility in digital expansion to ensure it isn’t left behind by the online gambling wave.

Financial Health Check

Aristocrat’s financials paint the picture of a high-quality business with steady growth and robust cash generation. In its most recent results, the company delivered solid numbers despite a tough global backdrop. For the first half of FY2025, net profit rose 5.6% year-on-year to AUD $733 million. Group revenue climbed about 8.7% to AUD $3.03 billion, driven by growth across all segments.

Strong free cash flow underpins shareholder returns, with A$533m handed back in dividends and buybacks in the half, alongside a new A$750m program, a testament to its high-margin gaming operations and digital scalability. Its dividend yield is on the low side, around a 1.2% yield, but that’s due to prioritising growth and buybacks over a high payout.

Gaming remains the engine hub of the business. Recently, we’ve seen softer digital numbers that briefly pulled shares back, but management frames this as an investment in future growth. With strong cash flow and buybacks underway, Aristocrat is using its balance sheet to plant seeds for tomorrow while still rewarding shareholders today. It’s early days, with new acquisitions still being integrated, but they have the potential to become significant earnings drivers in the coming years.

Buy, Hold or Sell?

Aristocrat Leisure combines global growth with defensive resilience, making it an attractive long-term option for investors. It dominates the high-margin slot machine market while expanding into digital and online gambling, giving it exposure to both Vegas casinos and the online gaming boom. Recent divestments and acquisitions have sharpened its focus on reliable profits.

It’s valuation does remain something of a question mark, at 28x forward earnings, Aristocrat isn’t cheap. But investors are paying for a defensive, high-quality business with strong digital momentum that has returned on average 25% annually over the last decade. Hard to argue with those returns.

According to Bloomberg’s Analyst Recommendations, Aristocrat has 14 buy ratings, 1 hold, and 1 sell. The average analyst price target is AUD$73.86, signalling an 8% upside from current levels.

The investor takeaway?

It’s hard to find a ‘defensive’ business with solid returns. But Aristocrat shares are up 20% in the last 12 months and have more than rewarded investors over the last 10 years, nearly 10x in that period. Gambling spending tends to hold up through cycles, giving the stock a defensive edge. In the “house always wins” story, Aristocrat is the house, a blue-chip gaming champion offering investors both steady returns and long-term growth.

Explore Aristocrat Leisure

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.