Ferrari is one of the world’s most luxurious brands, built not only on speed but on scarcity. Investors don’t buy Ferrari shares for booming sales volumes, but for its unrivalled pricing power and the prestige that keeps customers waiting years just for the chance to get behind the wheel. That’s turned Ferrari into one of the most profitable automakers in the world. With Formula 1 roaring into Singapore, it’s a timely moment to look under the hood at Ferrari’s business model, its financial horsepower, and whether the stock can keep racing higher from here. Let’s find out.

- Ferrari’s success comes from scarcity, not volume. With its order book filled until 2027, the brand proves that exclusivity drives demand and pricing power few rivals can match.

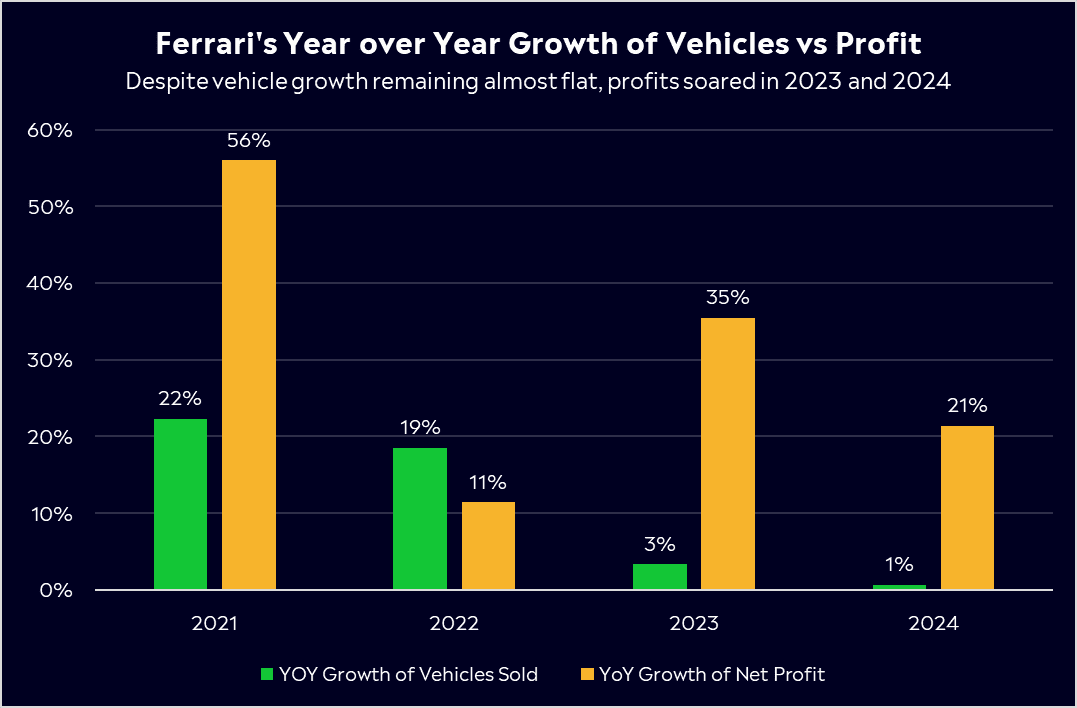

- Despite barely increasing car deliveries in 2023 and 2024, Ferrari’s profits surged. Operating margins above 28% make it look more like a luxury house than a traditional automaker.

- According to Bloomberg’s Analyst Recommendations, Ferrari has 18 buy ratings, 6 holds, and 2 sells. The average analyst price target is USD$518.14, signalling a 8% upside from current levels.

Explore Ferrari (RACE)

The basics

Ferrari is an Italian luxury sports car manufacturer founded by legendary racer Enzo Ferrari. He built the first car back in 1947, and his goal was to build a winning race car, and that’s exactly what he did. True to its roots, the company still runs the famed Scuderia Ferrari Formula 1 team and is still the most successful team in the history of the sport. The brand value on the track and Ferrari’s performance off the track has helped its shares jump by more than 130% in the last three years.

Enzo Ferrari’s passion was racing, and selling cars to the public was originally a way to fund his track ambitions. That meant limited production, a scarcity that only heightened the brand’s allure. Today, the business model remains the same; it’s about quality over quantity, allowing it to command higher prices. Ferrari limits production to keep demand high and the brand elite. You can’t just stroll in and buy a new Ferrari; in fact, they’re sold out until 2027. Owning a Ferrari isn’t just about having the money, the company sees owning one as a privilege.

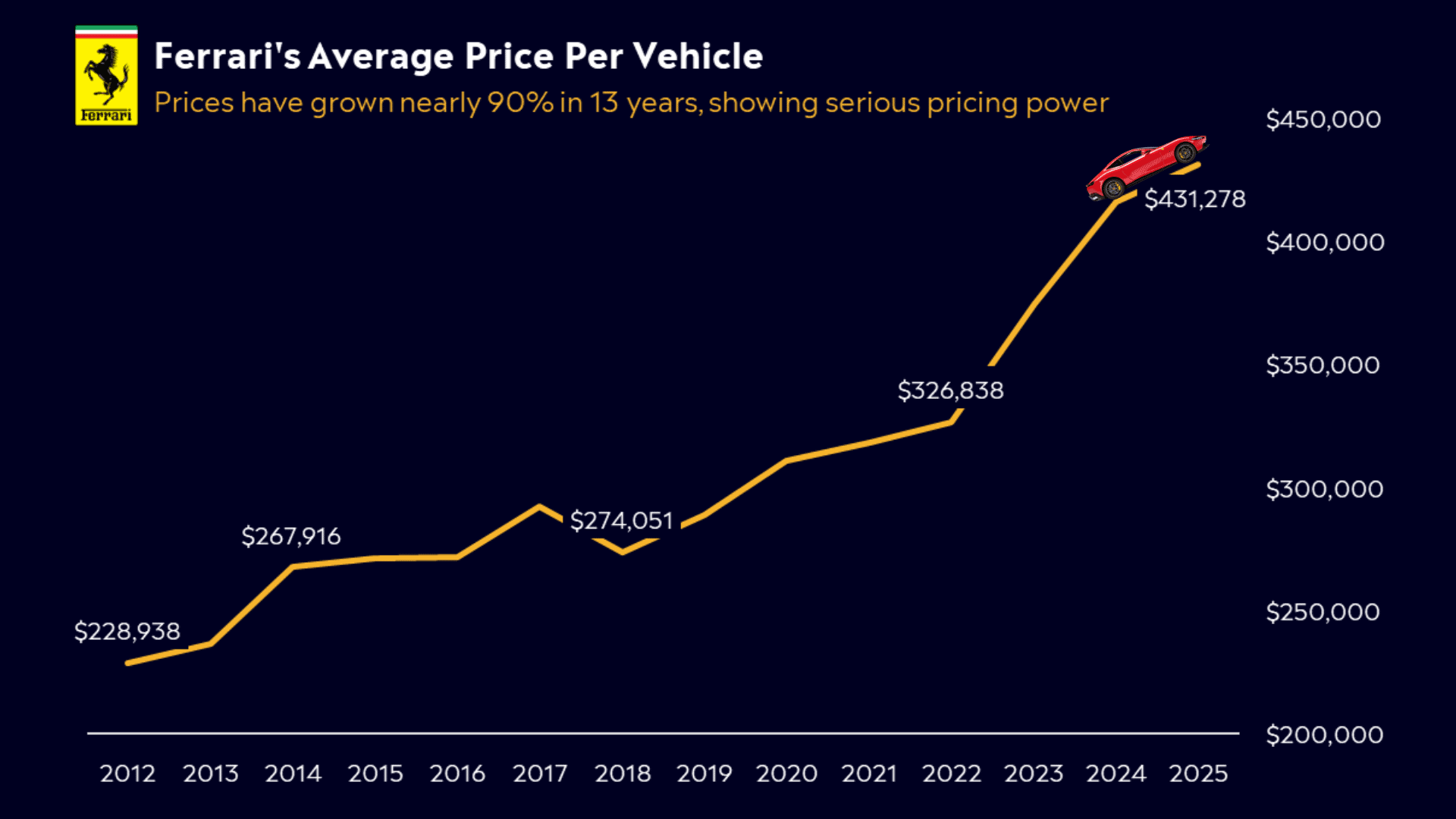

The average Ferrari now costs US$431,000, up from US$229,000 in 2012. That’s serious pricing power and shows the wealthy are willing to pay up for Ferrari’s engineering and luxury.

Ferrari’s product line consists of high-performance sports cars and grand tourers, many of which have waitlists. Recent moves show Ferrari balancing tradition with trend; it long resisted making an SUV, but finally introduced the Purosangue SUV in 2023. True to form, Ferrari capped its production and the Purosangue was sold out for two years upon launch. Now, its first fully electric Ferrari will be unveiled this October, with deliveries expected 12 months later, potentially widening Ferrari’s customer base while preserving exclusivity.

Fun Fact: Ferrari’s prancing horse emblem was first given to Enzo by an Italian fighter pilot’s family in 1923. It’s remained unchanged for over a century, a logo that’s truly timeless.

Competitor Diagnosis

In the rare world of ultra-luxury performance cars, Ferrari’s fiercest on-road rivals include Lamborghini, Porsche, Aston Martin, and McLaren, but none perfectly mirror Ferrari’s model. Lamborghini (owned by Volkswagen AG) has taken a different tack: it launched the Urus SUV in 2018, which quickly accounted for over half of its sales. By embracing higher-volume models like SUVs, Lamborghini reached record volumes and attracted new customers. Porsche, another Volkswagen-owned marque, straddles the line between sports cars and luxury daily drivers. Porsche sells over 300,000 cars a year, with SUVs like the Cayenne/Macan as bestsellers, a volume Ferrari would never attempt. Porsche’s strategy of offering more accessible models, including lower-priced sports cars, is fundamentally different from Ferrari’s “clients-only” approach. This gives Porsche far greater revenue, but its brand, while strong, isn’t as singularly exotic as Ferrari’s.

McLaren, an independent British supercar maker, more directly mimics Ferrari’s focus on two-seater sports cars and F1 heritage. But McLaren has struggled with financial stability and expanded production quickly, which arguably diluted its exclusivity and led to oversupply of certain models.

Perhaps the starkest contrast is with Aston Martin. This British luxury sports car brand has a storied name, think of those beautiful cars in the James Bond movies — but has historically been a financial rollercoaster. Despite new leadership and models, Aston Martin has struggled to turn consistent profits and has required multiple bailouts. Shares have collapsed, falling 78% in the last five years. Even though both companies sell high-end sports cars, Ferrari has found a way to translate its brand into sustainable cash generation, whereas Aston has not. Ferrari stands in a class of its own. No direct competitor has managed to replicate Ferrari’s blend of racing pedigree, strict exclusivity, and financial success. Its formula of high-price, low-volume, high-prestige is a tough one to beat

Financial Health Check

Ferrari’s financials are as finely tuned as one of its V12 engines. The company has enjoyed steady growth without abandoning its volume discipline. In 2024, Ferrari delivered 13,752 cars, only up 0.7% vs 2023, yet revenue grew 11.8% to €6.68 billion and 21% higher net profit than the year prior. This is a key point. Ferrari can increase earnings without huge jumps in unit sales by raising prices, offering more ultra-exclusive models, and personalisation options. It comes back to the pricing power mentioned earlier, Ferrari has continously increased the price of its vehicles every year without any slowdown in demand.

Profitability is Ferrari’s strong suit. In 2024, its operating margin was 28.3% and EBITDA margin a whopping 38.3%, which is extraordinarily high for any automaker. In fact, it’s one of the highest operating marrgins of any car manufcaturer in the world, making it argubly closer to a luxury fashion house than a car company.

Ferrari converts a good chunk of earnings to free cash flow, over €1 billion in 2024, which it uses to fund innovation, pay dividends, and stay debt-light. It’s balance sheet is very healthy. At the end of 2024, Ferrari’s Net Debt to EBITDA ratio was 0.4, put simply, that indicates a very strong financial position. Essentially, the company carries almost little debt, a rarity in the capital-intensive auto sector. This gives Ferrari flexibility to invest in new technology, like electrification, and return cash to shareholders with a 0.7% dividend yield.

However, it’s not just its cars that are expesnive, it’s shares come with a pretty large price tag as well. Investors clearly prize Ferrari’s stability and brand strength and Ferrari currently trades at around 45× earnings, a rich multiple that bakes in years of growth. By comparison, most mass-market automakers have P/E ratios in the single digits or teens, Ferrari trades at one of the highest multiples in the automotive sector.

It’s valuation reflects what the market sees as a resilient luxury goods business with a strong moat. But it also means the stock price leaves little room for error, any stumble in growth could cause a re-rating. So far, Ferrari has deftly navigated challenges, even in economic downturns, demand for its cars tends to outstrip supply, its clientele of ultra-wealthy enthusiasts provides a cushion in tough times.

Ferrari’s financials get top marks across the board, it’s volume growth isn’t anything to write about but its profitability and financial stability are some of the best in class.

Buy, Hold or Sell?

There’s no question that Ferrari has an outstanding business model, a nearly recession-proof luxury brand, loyal high-end clientele, expanding earnings, and disciplined management. Ferrari’s brand equity and pricing power give it a durable advantage that few companies can match.

But that doesn’t mean the period ahead is without risks. On October 9th, Ferrari will hold an investor day where they it will set new 2024–29 targets and unveil its new EV, making it a cruical watchpoint. The transition to electric vehicles will test how Ferrari’s ethos translates to a battery-powered era, expanding its model range risks testing the very exclusivity that underpins its margins. The market’s lofty expectations leave little margin for error, even with Ferrari’s impeccable execution.

According to Bloomberg’s Analyst Recommendations, Ferrari has 18 buy ratings, 6 holds, and 2 sells. The average analyst price target is USD$518.14, signalling a 8% upside from current levels.

The investor takeaway?

The company’s ability to consistently expand margins means Ferrari is still in pole position. It is a world-class business with a unique, high-octane strategy that has rewarded shareholders handsomely. It’s the ultimate example of quality over quantity in automaking. However, just as not everyone can buy a Ferrari on a whim, not every investor needs to rush into Ferrari shares at it’s current valuation. Patience, like ownership, is a privilege and for investors, timing Ferrari right could be just as rewarding as driving one

Explore Ferrari (RACE)

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.