What’s the most crucial tech firm in the world? That’s a big call, and one that’s up for debate, but chances are it’s not a household name like Apple or Microsoft. In fact, it might be one you’ve never heard of. Yet if you’ve used a smartphone, laptop or even a car today, you’ve likely relied on this company’s products. Say hello to Taiwan Semiconductor Manufacturing Company, better known as TSMC, often dubbed “the most important tech company you’ve never heard of”. TSMC is the linchpin behind the chips powering devices from Apple’s iPhones to Nvidia’s AI supercomputers. With giants like Microsoft, Google and Amazon pouring billions into AI infrastructure, and TSMC expecting its AI-related chip revenue to double, demand isn’t slowing down. So what’s next for the world’s chipmaking powerhouse? Let’s find out.

- TSMC makes chips for Apple, Nvidia, and AMD, producing over 90% of the world’s most advanced semiconductors. The world’s biggest names rely on TSMC.

- Margins are strong, demand is solid, but a US expansion could put profits under pressure. But earnings are still set to grow 40% this year.

- According to Bloomberg’s Analyst Recommendations, TSMC has 29 buy ratings, 1 hold, and 0 sells. The average analyst price target is USD$216.64, signalling a 7% upside from current levels.

Explore TSMC

The Basics

Taiwan Semiconductor Manufacturing Company (TSMC) is arguably the world’s most important chip company, but you won’t see its name on the chips in your phone or laptop. That’s because TSMC doesn’t design or brand the chips at all. Instead, it manufactures chips on behalf of tech companies. Giants like Apple, Nvidia, AMD, Qualcomm, and many others rely on TSMC’s factories (called “fabs”) to build the processors they’ve designed. For example, Apple’s A-series iPhone chips and Nvidia’s AI graphics chips are made by TSMC, not by Apple or Nvidia themselves. While most of its customers are US tech giants, TSMC has also worked with Australian firm Archer Materials, supporting the development of its quantum computing chip. It’s a small example of how even Aussie innovators are tapping into the world’s most advanced chip foundry.

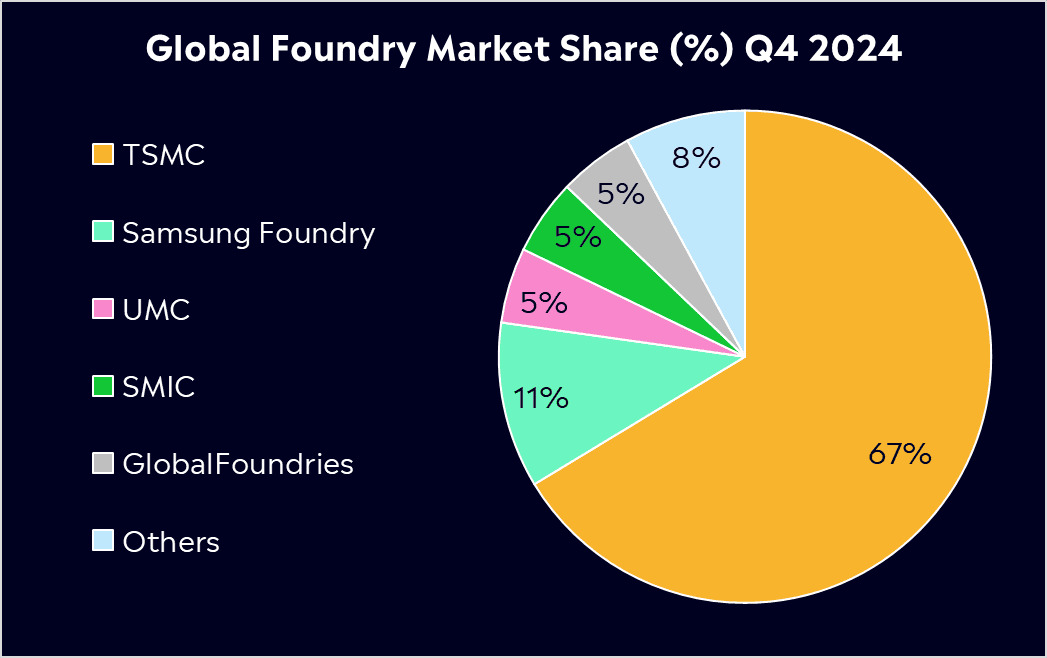

In simple terms, TSMC is a “chipmaker for hire”. It takes the blueprints/designs from its customers and fabricates the physical semiconductors that power devices from smartphones to data centres. This behind-the-scenes role means TSMC isn’t a household name, but it’s absolutely crucial in the global tech supply chain. It produces over 60% of the world’s contract chips and over 90% of the most advanced ones.

What makes TSMC unique is that it only manufactures chips and nothing else. Unlike some other semiconductor firms, TSMC doesn’t sell its own branded chips or devices; it’s purely a contract manufacturer, known as a foundry. It doesn’t compete with its customers, it just builds what they design. That neutrality, combined with a relentless focus on advanced manufacturing, has helped TSMC pull ahead of its rivals.

Right now, they’re at the forefront of cutting-edge chip technology: it’s already mass-producing chips with 3-nanometer circuitry (used in recent iPhones and high-end computers), and it’s on track to introduce even smaller 2-nanometer technology by 2025. For context, these “nanometer” numbers refer to the tiny scale of features on chips, smaller generally means more advanced and power-efficient chips. TSMC’s ability to reliably manufacture these state-of-the-art chips has made it the go-to supplier for any company pushing the envelope in computing.

All of that makes it arguably one of the most indispensable tech companies on the planet.

Fun Fact: TSMC’s most advanced fabs are so clean that their air is 10,000 times purer than a hospital operating room – even a single speck of dust can ruin a multi-million-dollar chip.

Competitor Diagnosis

TSMC’s biggest rivals are Samsung Foundry and Intel. While companies such as Further down the list, SMIC (China), UMC (Taiwan) and GlobalFoundries (US) compete in the lower-tech segment of chip manufacturing, mainly producing older, more mature chips focused towards automotive and industrial rather than high-performance AI or mobile chips.

Looking at TSMC, Samsung and Intel, the three operate with very different models.

- TSMC does not design or sell its own chips. It only manufactures for others.

- Samsung makes memory chips and processors for its own devices and also offers foundry services.

- Intel designs and manufactures its own chips, mainly CPUs for PCs and servers. But, as of now, its market share doesn’t worry TSMC in the slightest.

In the semiconductor world, TSMC stands virtually in a league of its own, despite Intel and Samsung being arguably more well-known to the everyday person. But, as mentioned earlier, TSMC is far ahead, with over 60% market share. I can hear you asking: How did TSMC pull so far ahead of two tech titans? A lot comes down to its business model and focus.

First, because TSMC never competes with its customers’ products, it is seen as a neutral partner. Chip designers like AMD or Nvidia can use TSMC’s factories without fear that TSMC will one day use that know-how to launch a competing chip. This strict neutrality among customers is a core tenet of TSMC’s model. Intel and Samsung, on the other hand, have to assure potential clients that their chip designs won’t be used to aid those companies’ own rival products, which is a tough sell in some cases.

Second, TSMC’s foundry-only focus means all its investment goes into advancing manufacturing tech. It has consistently been first (or very close to first) to commercialise each new generation of chip process technology. For many years, Intel led in chip technology for its own CPUs, but in the last decade, it stumbled as its manufacturing progress slowed, allowing TSMC to take the lead in making the smallest, fastest chips.

Samsung is also pursuing cutting-edge tech, but has had issues with manufacturing yields and scale. Meanwhile, TSMC has developed a reputation for both leading-edge technology and reliability, it delivers high volumes of chips at good yields on the latest nodes. This sheer scale can’t be matched by competitors right now. This is why almost every major chip developer, from Apple to small fabless startups, ends up at TSMC’s door. Even Intel has become a customer of TSMC for certain chips it designs.

TSMC can work with everyone and focus its R&D on staying ahead of the pack technologically. That’s why it handles chips for iPhones and the biggest AI rollouts. The result creates a great cycle: more customers bring revenue that TSMC reinvests into better factories.

Past performance is not an indication of future results.

Financial Health Check

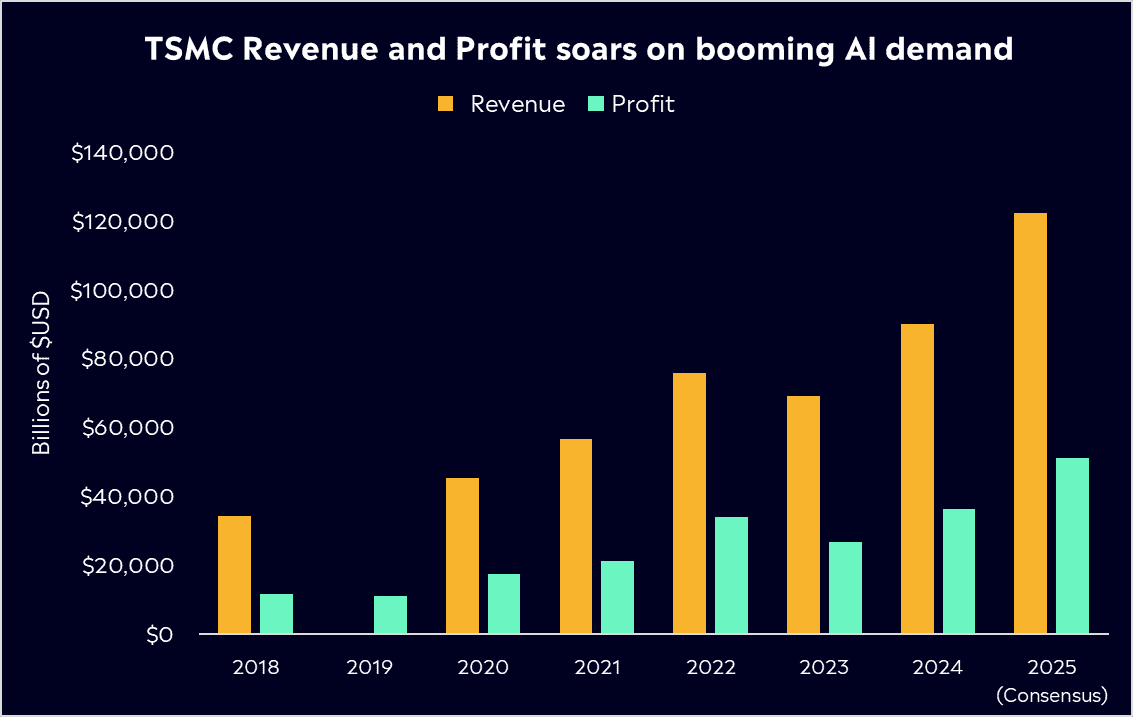

TSMC is a big beneficiary of the AI boom, led by Nvidia and hyperscale cloud clients, which continues to drive demand for advanced chips. Q1 2025 results showed exactly that, with profit up 60% YoY while offering strong guidance for the rest of the year. Let’s not understate that, 60% profit growth for a company of this size is impressive.

High-performance computing, think AI and data centres, is now TSMC’s largest business segment, overtaking smartphones. North America accounts for over 75% of sales, with Apple and Nvidia its two largest customers. Its impressive profit growth is thanks to its solid margins, which hit around 59% in Q1. These margins show TSMC’s pricing power and efficiency; its advanced chips command premium pricing, and it runs its fabs at high utilisation.

But, to stay ahead of the competition and remain the most desired in the industry, you’ve got to spend to innovate. For 2025, it has budgeted USD$38–42 billion in CapEx, a huge sum aimed at new factories in the US and Japan, particularly due to its biggest customers wanting chips made locally. This brings execution and supply chain risks, but also an increase in costs.

The problem? Its new Arizona plant is 30% more expensive to run than its Taiwan equivalents. TSMC expects a 3% hit to gross margins over five years due to these higher costs. That number could rise to 4% as construction ramps up. But, TSMC is confident of its long-term gross margin target staying unchanged at 53%+, with the view that they’re likely to pass on costs to clients, showing its pricing power due to its critical role.

Tariffs also remain a big consideration for investors. In its Q1 earnings, the company has said it’s too early to assess the impact of proposed US import tariffs, but Taiwan could face duties of up to 32%. Political negotiations are ongoing, and TSMC says outcomes remain uncertain. The outlook may look slightly brighter, particularly with Trump’s willingness to negotiate over recent months.

On its investor day just recently, TSMC said it expects only a limited impact from proposed US tariffs, thanks to the strong demand for AI chips. Despite facing higher costs and political uncertainty, the company reaffirmed its 2025 outlook, citing robust orders from AI customers as a key support.

Its R&D spending remains strong, topping USD$5 billion annually, and its balance sheet is in excellent health. Debt is modest, and despite elevated capital spending, it continues to generate strong cash flow with huge revenues and impressive margins. It also pays a 1.7% dividend that’s grown 10% in the last 5 years.

* Past performance is not an indication of future results. Data via Counterpoint Research.

Buy, Hold or Sell?

TSMC shares haven’t had an exciting 2025 so far, with its share price basically flat due to tariff uncertainty and ongoing geopolitical tensions. Zooming out, though, shares have jumped more than 250% in the last 5 years.

The growth drivers for TSMC are very compelling. The world’s demand for computing power is only increasing, and TSMC sits at the heart of that trend. TSMC expects its revenue from AI-related chips to double, and big firms like Microsoft, Google, and Amazon are pouring money into new data centres, which ultimately means more orders for TSMC. In its most recent earnings call, TSMC said: ‘Based on our planning framework, we are confident that our revenue growth from AI accelerators will approach a mid-40s percentage CAGR for the next five-year period starting from 2024’

On the flip side, there are risks.. TSMC is headquartered in Taiwan, and it concentrates its most advanced manufacturing there. The political tension between China (which considers Taiwan a wayward province) and the U.S./Taiwan means there’s an ever-present risk of disruption – even the threat of conflict or trade sanctions could spook TSMC’s customers or investors. I also mentioned above the rising costs, potential margin pressure and tariff concerns. The good news is that TSMC is probably better positioned than anyone to weather what’s ahead; it can raise prices to counteract, but these are still risks that provide uncertainty for the business. We should also talk about the potential of the AI boom levelling out. While a strong driver now, cloud companies could slow their data centre build-outs after an initial rush if the economic backdrop changes.

With all of that being said, TSMC expects earnings growth of 30% this year, which speaks to the sheer demand we’re seeing across AI and technology. It’s currently trading around 21x forward earnings, which is a pretty compelling valuation for a tech giant with strong margins, 30% earnings growth, and world-leading tech.

According to Bloomberg’s Analyst Recommendations, TSMC has 29 buy ratings, 1 hold, and 0 sells. The average analyst price target is USD$216.64, signalling a 7% upside from current levels.

The investor takeaway? TSMC’s long-term story remains attractive. It’s hard to find another company that is critical to so many fast-growing tech fields, yet operates somewhat behind the scenes with limited direct competition at its level. Its scale and know-how form a formidable moat, but it doesn’t come without a few clouds. For now, they’re doing all the right things, investing in capacity and pushing technology forward, which bodes well for their future. It may not be a household name, but TSMC is the house the tech world is built on.

Explore TSMC

*Data Accurate as of 06/06/2025eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.