The Daily Breakdown looks at the technical setup in gold and the GLD ETF, while Palantir makes new highs. Ford and GM dip on tariff worries.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Tuesday’s TLDR

- Gold tries to break out

- Palantir hits record highs

- NIO, Crowdstrike report earnings

What’s Happening?

Markets started off under pressure yesterday, but were able to shake off the worries yet again.

Maybe it’s because investors don’t view the latest tariff talks as a lasting risk, looking at them as a negotiation tactic rather than a lasting policy gaff. Perhaps they have simply grown tired of the relentless bombardment of tweets, threats and trade talk.

It’s probably both — and a few other considerations we’re leaving out.

The “why” doesn’t really matter, though. The “what” is that investors continue to buy the dip, whether that dip is big or small. That reaction can change in the future (just as we saw in Q1) and it certainly has the potential to ebb and flow once we get into summertime trading, when volumes tend to fall.

For today, Nio and Dollar General reported earnings this morning. Crowdstrike and Hewlett Packard Enterprise report after the close.

And at 10 a.m. ET, the first of this week’s three notable labor market updates will be released (that being the JOLTS report).

Want to receive these insights straight to your inbox?

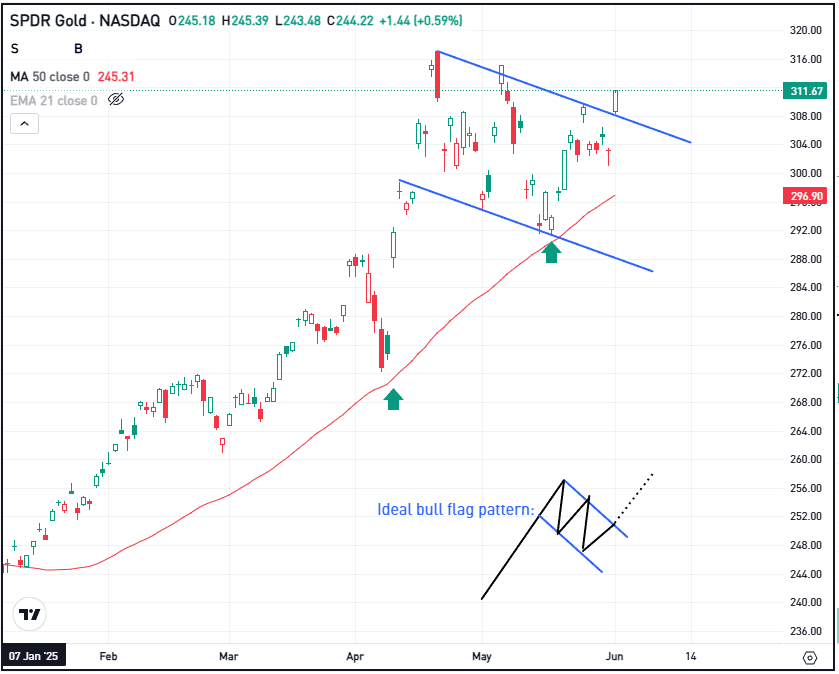

The Setup — GLD ETF

Gold has been on fire this year, up almost 28%, and has climbed more than 40% over the past 12 months. That’s helped propel the GLD ETF, the largest gold ETF in the US, to new heights as well.

Investors look to gold for a number of reasons. It’s considered a “safe-haven” asset, something investors flock to during periods of volatility and uncertainty. Further, it’s often looked at as a hedge on inflation and as something that gains amid devaluation of fiat currency (like the dollar).

Gold has generated a double-digit return in three of the last five years, with two of those years generating gains in excess of 24%. On an annual basis, it has outperformed the S&P 500 in three of the last five years and in four of the last seven years.

Gold topped $3,500 an ounce in April, while the GLD topped $316, with both pulling back in May. Pullbacks can be healthy, allowing an asset price to consolidate its recent gains, giving it a chance to rest before potentially moving higher.

That’s what investors are hoping to see with GLD, as it pulled back to the 50-day moving average and again held this measure as support. Now trying to gain momentum, a move higher could put it back up toward all-time highs and set up a potential breakout to new record highs.

On the flip side, more consolidation could continue, containing gold prices and stifling the gains in the ETF. If that happens, active investors may want to keep an eye on the 50-day to see if it remains support going forward.

Options

One downside to GLD is its share price. Because the stock price is so high, the options prices are high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

PLTR

Shares of Palantir eked out a gain yesterday, and while the 0.2% gain may not have been that impressive, bulls were certainly cheering the move as the stock hit a fresh record high in the session. Recall that PLTR recently set up for a potential breakout. Can it continue?

F

Ford and General Motors were under pressure yesterday, almost falling 4%. The decline comes amid further threats of increased tariffs, with the automakers in a vulnerable position to the ever-changing global trade policies set forth by the Trump administration. Check out the charts for Ford and for General Motors.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.