The Daily Breakdown dives into what makes up Algorand and Mantle, and then takes a closer look at the technicals for MNT.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors become more familiar with the 110+ cryptoassets offered by eToro. Today we’ll discuss Mantle and Algorand.

Mantle (MNT): Currently trading near $1.25 with a market cap of roughly $4 billion

Mantle is an Ethereum Layer-2 network launched in 2023 that uses Optimistic Rollups and a modular design to deliver lower fees and higher throughput while inheriting Ethereum’s security. Execution occurs on Mantle L2, while data availability is handled by EigenDA. The MNT token powers gas fees, governance, and staking within the Mantle DAO, which evolved from BitDAO and manages one of the largest community treasuries in crypto. Mantle is EVM-compatible, supports liquid staking via mETH, and hosts a growing ecosystem of DeFi, GameFi, and NFT applications.

Algorand (ALGO): Currently trading near $0.12 with a market cap of roughly $1 billion

Algorand is a high-speed Layer-1 blockchain created by MIT professor and Turing Award winner Silvio Micali, designed for secure, low-cost transactions and instant finality. It uses Pure Proof-of-Stake (PPoS), a decentralized consensus model that randomly selects validators to prevent centralization. The ALGO token powers transaction fees, staking, and governance through the Algorand Foundation. Algorand supports smart contracts, asset tokenization, and institutional use cases — including CBDCs — and maintains a carbon-negative footprint through sustainability partnerships.

Want to receive these insights straight to your inbox?

The Setup — MNT

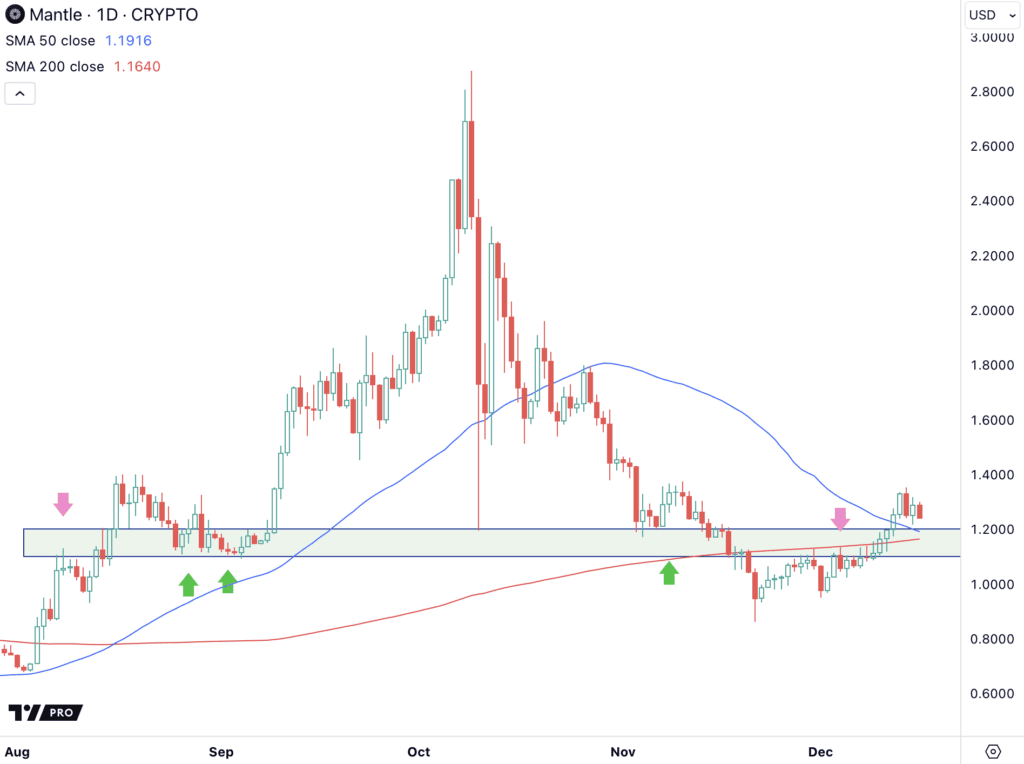

Big and small, the crypto space is in a bit of a funk right now — including Bitcoin, Ethereum, Solana and others. Mantle is no exception, as it has come down hard from its peak in early October. However, it’s trying to make some strides on the chart.

That’s as MNT recently regained its 50-day and 200-day moving averages, as well as the pivotal $1.10 to $1.20 area, which has been a key support/resistance area for nearly a year. Bulls want to see this observation hold, and if it does, more upside could be in store. However, a break back below these measures could put sub-$1 prices back in play.

What Wall Street’s Watching

Investors are dialing in this morning as the retail sales report for October and the monthly jobs report for November will both be released at 8:30 a.m. ET. These reports could have major implications on how investors — and the Fed — see the economy as we navigate toward 2026. Other ETFs in focus include the VOO and the QQQ, among others.

Shares of Ford are climbing this morning after the automaker said it expects to record about $19.5 billion in special items charges tied to a shift in business priorities and a pullback in its EV investments. Most of those charges will be recognized during the fourth quarter. Through yesterday’s close, shares are up about 38% so far this year. Check out the charts for F.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.