The Daily Breakdown takes a closer look at Netflix’s earnings miss and as Tesla gears up for its quarterly results.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening

Netflix Slips

Netflix delivered its third-quarter results, missing earnings expectations and reporting roughly in-line revenue results. Earnings of $5.87 a share missed expectations of $6.94 per share due to a tax dispute in Brazil. While management said it doesn’t expect this to be an issue going forward, investors are taking issue with the earnings miss this morning.

On the sales front, revenue rose about 17% year over year to $11.5 billion, as trends like membership growth and increased ad revenue helped drive growth. Even when accounting for this morning’s dip, NFLX stock is still up about 29% so far this year.

Tesla’s Turn

General Motors mustered a rally to record highs on Tuesday and now investors are hoping that the momentum within the auto space can continue. That’s as Tesla reports earnings on Wednesday after the close and Ford reports on Thursday after the close.

Specifically for Tesla, all eyes are on low-cost model updates, the robotaxi rollout, and Optimus progress. The company’s better-than-expected delivery numbers might have investors optimistic about this quarter. Analysts expect earnings of $0.54 a share on revenue of $26.4 billion, with sales up 4.7% year over year, according to Bloomberg.

Want to receive these insights straight to your inbox?

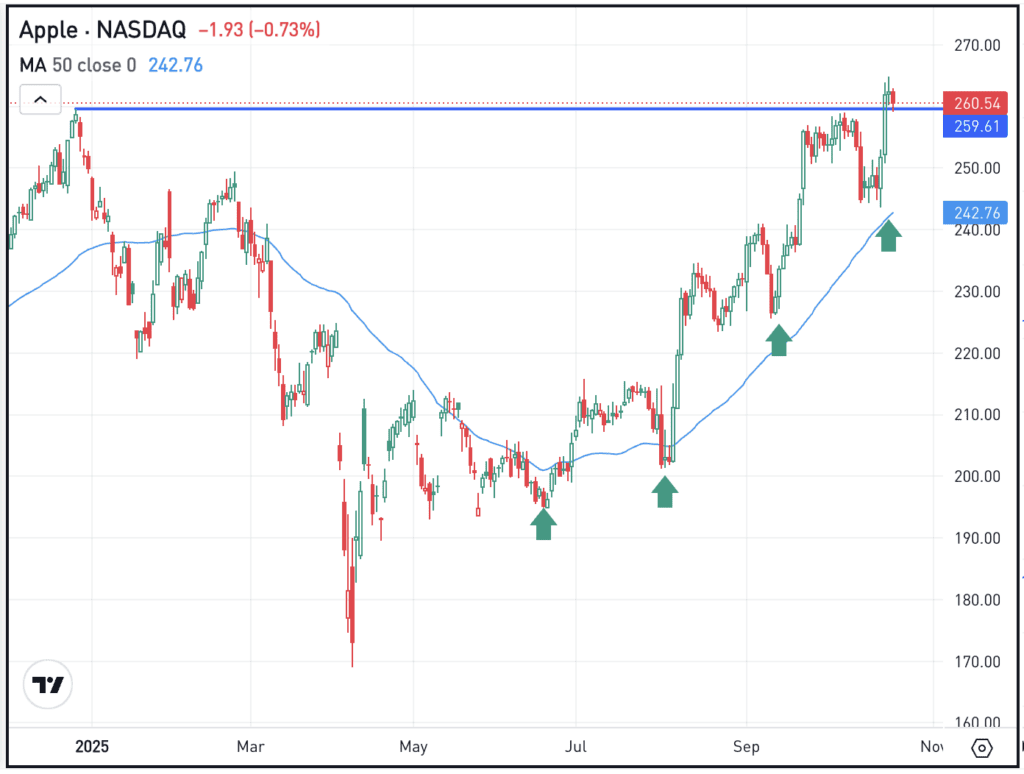

The Setup — Apple

Apple stock hit new record highs this week, something that many doubters may be surprised about. The stock is up 55% from the April low and has climbed 23% over the last three months. That said, shares are up less than 5% so far for 2025, leaving some investors to wonder whether the stock may have more room to run.

Notice the series of higher lows we’ve seen in Apple since the summer (the green arrows on the chart) showing that each dip has been bought. Now that the stock has made new highs, bulls will want to see two things: that this trend remains intact and that the stock is able to stay above its prior high near $260. If it can do both, more upside is possible. If not, a pullback may ensue.

Options

As of October 21st, the options with the highest open interest for AAPL stock — meaning the contracts with the largest open positions in the options market — were the January 2026 $270 calls, followed by the January 2026$290 calls.

For options traders, calls or call spreads could be one way to buy the dip in AAPL if and when it does pull back. In these scenarios, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock. Conversely, investors who expect downside could speculate with puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

After peaking in January, shares of Intuitive Surgical have been in a slump, down about 25% coming into earnings. Now up more than 15% in pre-market trading and bulls are cheering the company’s quarterly results, where earnings of $2.40 a share beat estimates of $1.99 a share, while revenue of $2.5 billion grew 22.9% year over year and beat estimates of $2.4 billion. Dig into the fundamentals for ISRG.

We have talked a lot about gold lately, but it’s hard not to. That’s amid its historic rally over the last few weeks, followed by yesterday’s painful tumble. Gold prices fell more than 7%, its worst one-day decline in more than a dozen years. Still, gold prices are up more than 50% so far this year. Check out the charts for gold.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.