The Daily Breakdown dials in after the Fed cut interest rates, and with Broadcom, Lululemon, and Costco set to report earnings.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

The Fed

Despite three dissenters, the Fed cut rates by 25 basis points with a 9-3 vote. While the committee’s median outlook calls for just one cut in 2026, the committee is nowhere near a consensus — an equal number of policymakers see no cuts, one cut, and two cuts, and that’s before accounting for the outliers.

Chair Powell pointed out that no policymaker’s base case calls for a rate hike moving forward. Keeping rate hikes off the table helps the Fed lean dovish and has investors looking at the next rate cut as a “when not if” scenario — even if that takes time to play out.

Rate cuts with stocks near all-time highs tends to be bullish for long-term investors. Coupled with expectations for higher earnings growth and the Fed’s improved economic outlook — which includes lower inflation, higher GDP, and stable unemployment — bulls have multiple catalysts to lean on as we enter 2026.

Earnings Lineup

With so much focus on the Fed, let’s not forget about earnings! Oracle and Adobe reported yesterday after the close — more on them below — while tonight’s trio has a combined market cap of $2.36 trillion. Admittedly, a bulk of that is from Broadcom, which hit another record high yesterday, but Costco and Lululemon will also be in focus tonight.

Want to receive these insights straight to your inbox?

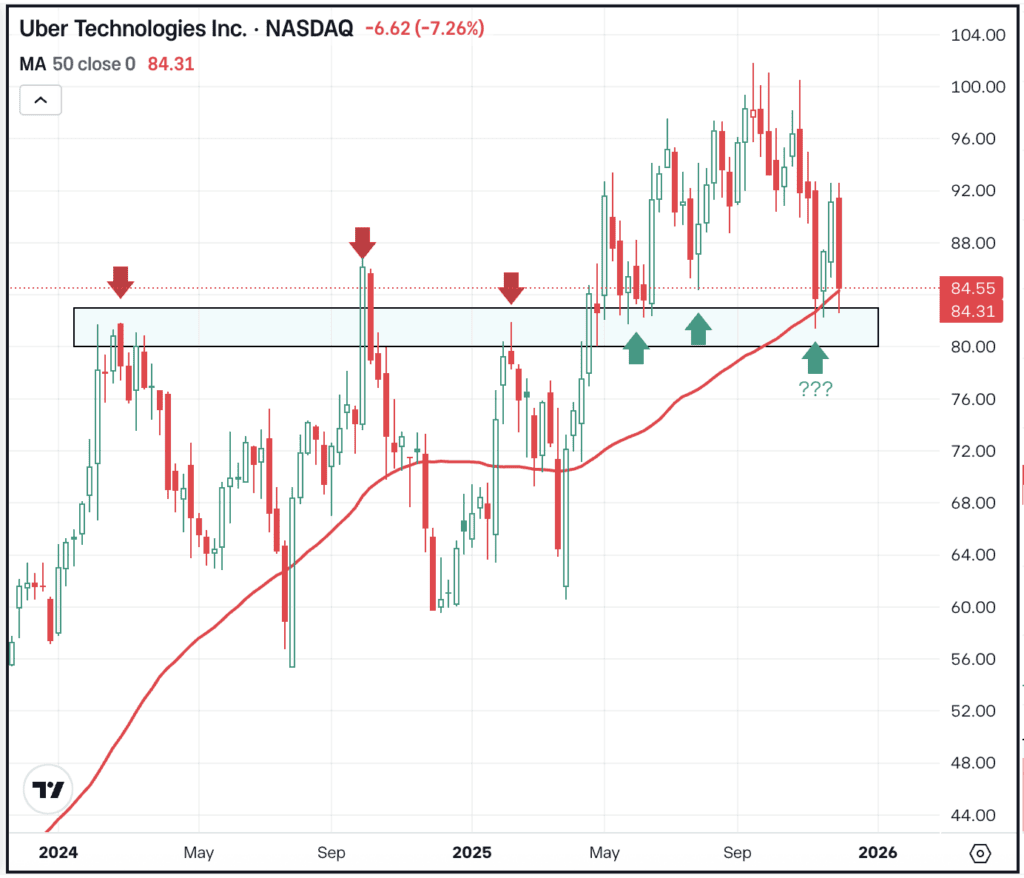

The Setup — UBER

It wasn’t too long ago that we looked at a similar technical setup in Uber, as shares dipped into the low-$80s and quickly bounced into the low-$90s. We’ve also done some deeper research into Uber, with a recent Deep Dive column. But now, shares are back in the low-$80s, where the stock finds recent support and the 50-week moving average.

Uber dipped to this zone a few weeks ago and is already back in it again. If support holds, bulls can look for another potential rebound, possibly back toward the $90 to $92 range. However, if this support zone fails to hold after such a quick retest, bearish momentum could accelerate and lower prices could be in store. Simply put, some investors will view this recent dip as an opportunity, while others will view it as a warning sign.

Options

As of December 10th, the options with the highest open interest for UBER stock — meaning the contracts with the largest open positions in the options market — were the January $100 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

ORCL

At one point this year, Oracle stock had doubled in price. Even after the stock fell more than 40% to its recent low, shares were still up substantially on the year (~34%) coming into yesterday’s quarterly report. However, shares are moving lower this morning after earnings of $2.26 a share beat expectations of $1.64 a share, but revenue of $16.06 billion missed estimates of $16.2 billion. Management also raised its spending outlook, which may be giving investors some pause. Dig into the fundamentals for ORCL.

ADBE

Shares of Adobe are roughly flat in pre-market trading, despite the firm delivering an earnings and revenue beat for its Q4 results. Further, management’s outlook for next year called for double-digit revenue growth, hoping to dispel fears that Adobe is being disrupted by AI. Current analyst price targets suggest about 33% upside in ADBE stock, similar to when we took our most recent Deep Dive.

Stocks rallied yesterday after the Fed’s announcement and while Bitcoin was mostly muted on the day, it held up pretty well overall. But it’s now down slightly today, off about 2% as investors digest the Fed’s latest update. Will this risk-off stance hold or will investors come back to BTC and ETFs like IBIT for a risk-on play? Check out the charts for BTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.