Diversifying your portfolio can be done by allocating

Whilst there are different ways of diversifying your investment portfolio, the underlying aims are universal – to smooth out returns and reduced risk. These are the ways to carry out effective portfolio diversification, one of the most important golden rules of investing.

Diversifying a portfolio is about more than just buying lots of different instruments. It’s also about how those different assets complement each other and whether their price moves are likely to be correlated or not. Consider two of the most important factors when diversifying your portfolio: asset allocation and portfolio structure.

Diversifying Your Portfolio: A Step-by-Step Guide to Minimize Risk.

Tip: Asset allocation should be tailored to an individual’s circumstances. There are many variables to consider, including

What is asset allocation?

Asset allocation describes how an investor’s capital is spread across different assets, such as stocks and bonds. This is often represented as a percentage of the total value of your investment portfolio, with the exact split depending on your individual circumstances, risk appetite and investment aims.

As long as you understand the potential risks attached to over- or under-allocating to certain assets, there is not necessarily a right or wrong way to go about this process. However, a 70/30 split between

Tip: It is common market practice for investors to rotate into lower risk assets as they age and approach retirement.

What is diversification?

Allocating capital between stocks and bonds on a 70/30, 60/40 or 50/50 basis will be a good fit for many investors, but introducing more asset classes helps to mitigate risk and can have a range of other benefits.

Tip: Diversification doesn’t have to be “boring”. It could for example include an investor who holds only equities taking a small position in

Another advantage of diversification is that some of the assets in your investment portfolio can be expected to have low

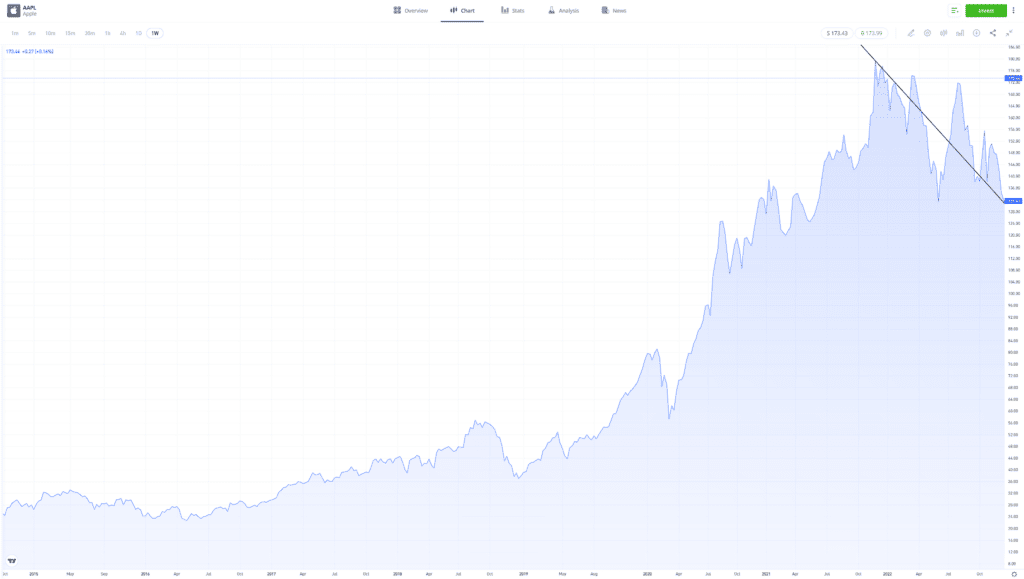

For example, imagine a portfolio made up of just one instrument: Apple Inc stock. While that stock has posted significant returns for some long-term investors, its increase in value hasn’t been in a straight line. In 2022, AAPL stock fell in value by more than 25%.

Past performance is not an indication of future results

Source: eToro

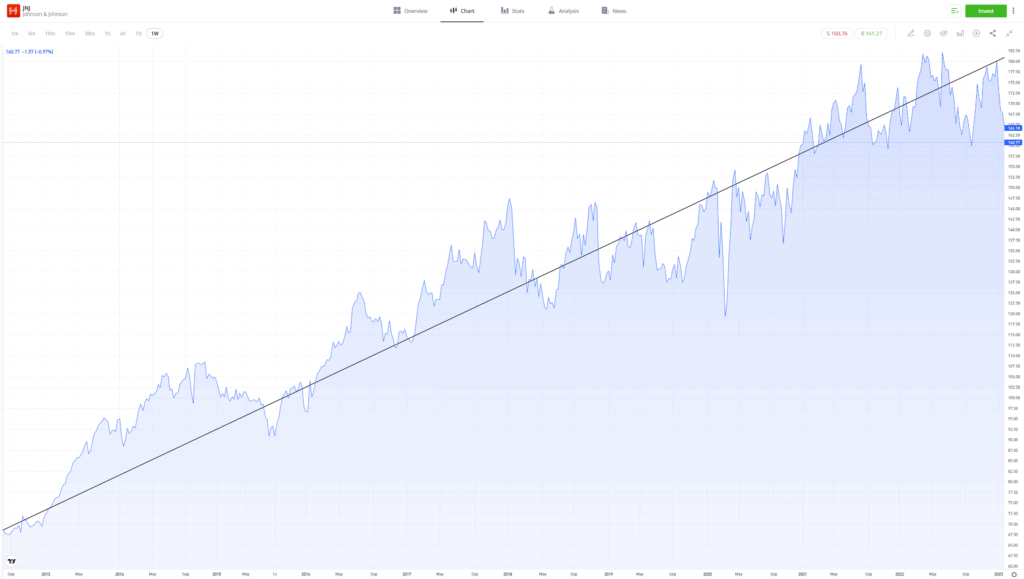

In the same year, the stock of healthcare giant Johnson & Johnson increased in value by approximately 5%. If the hypothetical portfolio had been split 50/50 between AAPL and JNJ, its lower volatility and averaged out annual loss would have been less difficult for a new investor to deal with, reducing the chance of them making emotional investment decisions. This is how a diversified portfolio helps investors manage risk and maintain a considered approach to investing.

Past performance is not an indication of future results

Source: eToro

The above example illustrates how diversification can smooth out performance, even between two relatively similar assets. This effect should also apply to a portfolio created with a wider range of asset types, but to a greater extent.

Some assets that naturally appear to be uncorrelated may, in fact, have a strong correlation. It is important to avoid making assumptions and instead, research the historical price performance of the

Tip: Copy trading allows you to look at which assets experienced traders have bought, and how their portfolios have benefitted from diversification.

Managing your portfolio

Over time, your portfolio will be impacted by unexpected events relating directly to the wider market and specific assets you hold. This can result in your portfolio needing rebalancing.

You might find that the volatility of the instruments you hold changes over time, which could alter the risk profile of your portfolio. For example, Amazon Inc. has developed its business model to expand into web hosting services (AWS). While this doesn’t necessarily make AMZN a bad stock in which to invest, this change would influence the risk score of that particular position in your portfolio. Rebalancing your portfolio, which involves reallocating assets, is a crucial part of ongoing portfolio management, although investors should avoid the temptation to “overtrade.”

A diversified portfolio helps investors manage risk and maintain a considered approach to investing.

Final Thoughts

The way you structure your portfolio is a highly important part of the investment process. Being aware that some events are outside of your control is part of portfolio management, but it’s still worthwhile giving serious thought to the factors that you can influence.

Visit the eToro Academy to learn more about how to create the best portfolio for you.

Quiz

FAQs

- What assets should I buy to diversify my portfolio?

-

In general, the greater the number of different assets you invest in, the higher the chance that you’ll benefit from reduced risk and smoother returns. Levels of diversification can be increased if you buy instruments which have low levels of price correlation.

- Can it ever be a bad idea to diversify a portfolio?

-

Diversification isn’t always the optimal route towards reaching your investment goals. If you’re close to using your investment to finance a life goal, such as retirement, rotating out of riskier assets and consolidating your capital in lower risk assets such as bonds will reduce the likelihood of a market shock negatively impacting your plan at the last minute.

- Are there easy ways to diversify my portfolio?

-

Some instruments, such as indices, Smart Portfolios and ETFs, are single products that hold a basket of different assets. For example, the ETF in the S&P 500 stock index contains small positions in each of the stocks of the largest companies listed on US exchanges. Although the S&P 500 represents an investment in a single asset class, it mitigates against single stock risk.

- Is it possible to be over-diversified?

-

There is a risk that too much diversification means your portfolio doesn’t align with your overall aims. If your sole intention is to generate income, then holding dividend stocks and bonds would make sense, but including non-income-generating assets such as commodities would not.

- How often should you rebalance a diversified portfolio?

-

Under normal conditions it might be appropriate to rebalance your portfolio once or twice a year. When carrying out those reviews establish if it would be prudent to adjust the frequency, and always consider rebalancing if your personal circumstances and overall investment aims change.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.