In part 2 of my reporting season preview, I’ll break down how investors can interpret results with confidence, what to focus on across key sectors, and the signs to look for in a high-expectation market.For retail investors, the Australian reporting season can feel overwhelming. Dozens of reports land daily, and headlines fly about “beats” and “misses.” To stay up-to-date with when your companies report, use eToro’s Earnings Calendar.

Here are some concise tips to help cut through the noise and interpret the deluge of information:

- Focus on the forward outlook: One of the most important parts of any earnings release is management’s guidance and commentary about future conditions. Markets are forward-looking. A company’s outlook for the next 6-12 months often moves the share price more than last period’s profit number. Pay attention to outlook statements on revenue, margins, and any updated forecasts.

- Key indicators by sector: Each sector has its critical metrics. For banks, look at net interest margins and bad debt provisions; for retailers, same-store sales and cost inflation; for miners, production volumes and cash costs, and so on. By focusing on these core drivers, you can better judge whether a company’s results are genuinely strong or weak.

- Watch for macro clues: Use this reporting season as a window into the economy. For example, what are retailers saying about consumer spending? Are banks reporting more late loan payments? Are exporters seeing demand pick up or soften? These details can offer valuable insight into trends like consumer confidence or China’s appetite for commodities.

- Keep context in mind: A single earnings result doesn’t tell the whole story. Consider how the company is performing relative to expectations and peers. Sometimes a company will report a profit fall, but the stock jumps because the outcome wasn’t as bad as feared. In other cases, a firm can post record earnings yet fall sharply if investors expected more.

- Look at capital allocation: In addition to profits, see what companies are doing with their cash. Are they declaring higher dividends or initiating share buybacks? Strong capital returns can signal management’s confidence in the outlook and provide direct value to shareholders. On the other hand, if a usually generous dividend-payer suddenly cuts its dividend, that could be a red flag about future earnings or cash flow.

- Expect volatility and use it wisely: Reporting season often brings sharp price swings, as market reactions can be knee-jerk. Don’t panic if a stock you own dips on results day. Try to cut through the noise. Read the report, use market commentators to help understand why we’ve seen the move, and consider whether the market is overreacting. Conversely, if a stock soars, reassess its valuation in light of the new information. Volatility can create opportunities for the patient, well-informed investor.

@etoro_au ASX reporting season 2025: What to look for in company earnings.📊 #reportingseason #asx #investing

Sectors in Focus

#1 Resources (Energy and Mining):

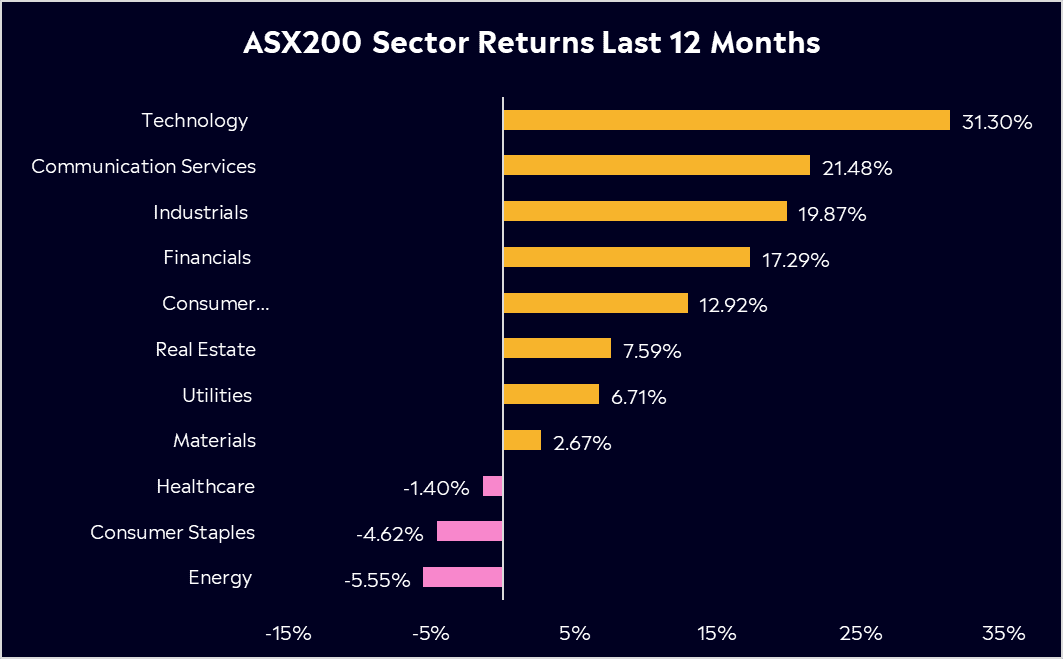

It might be a difficult reporting season for resource names. The mining and energy sector’s profits are forecast to plunge nearly 20% year-on-year, mainly due to lower commodity prices after last year’s boom. This will mark the second straight year of earnings contraction for miners. Investors will be watching if this marks a trough. Interestingly, resource stocks have lagged far behind financial stocks over the past year, and that performance gap remains wide. A recent update from BHP did show solid production numbers and operational efficiency. So watch for further signs of stabilising iron ore demand or cost-out successes that could spark a rotation back into beaten-down miners. On the other hand, continued caution from majors would reinforce the drag that this sector is placing on the broader market.

#2 Financials:

Banks are facing a tougher environment than a year ago, with credit growth slowing and net interest margins likely peaking as competition intensifies and the RBA begins easing. While overall credit quality remains solid, the softening economy may weigh on outlooks, and investors will be watching for any signs of stress, especially in mortgage books. CBA is the only major bank reporting this season, but given its size and influence, its result will be closely scrutinised. Its valuation has come under question after a strong run-up, and the market will look for reassurance through steady margins and benign bad debts.

#3 Technology:

In stark contrast to most sectors, tech and related companies continue to shine. Many tech firms are still benefiting from secular trends (cloud software, digitalisation, AI adoption) that drive high revenue growth. The theme of AI will also be front and centre: companies across various sectors have been highlighting investments in artificial intelligence. Earnings results within the last week from Microsoft, Alphabet and Meta show that the AI boom is in full swing and translating well into the bottom line. This is what Aussie tech companies will need to start delivering, with the market wanting to see double-digit profit increases, especially against their elevated valuations. In short, the bar is high for tech; any miss could trigger outsized sell-offs, while strong results will reinforce the sector’s status as a market leader.

#4 Healthcare:

The healthcare sector could be at an inflection point. After facing earnings headwinds (e.g. higher costs and pandemic-related disruptions) in prior periods, healthcare earnings are poised to improve. What we could be seeing is the ending of the downgrade cycle, with a number of healthcare stocks seeing broker upgrades ahead of reporting season. Watch for companies like CSL and Cochlear to potentially surprise on the upside if factors like plasma collection, elective surgery volumes, or new product sales turn out better than feared. If management commentary confirms that conditions are stabilising or improving through easing supply constraints or robust demand returning, it would support the view that healthcare may resume growing earnings after a dull stretch. This would be a welcome development for a sector that is typically seen as defensive and high-quality.

#5 Consumer & Retail:

Consumer-facing companies will reveal how Australians are handling cost-of-living increases and higher mortgage payments. Household spending has been under pressure as interest rate hikes remained elevated through the fiscal year, suggesting retailers, especially in discretionary segments, could report soft results. Discretionary names may show margin compression and sluggish sales, and we’ll be looking to big names like Wesfarmers to see if their size and scale can help them effectively navigate pressures. On the other hand, staples retailers like Coles and Woolworths might prove more resilient, as spending on essentials tends to hold up even in lean times. Investors will be attentive to any shifts in consumer behaviour, trading down to cheaper brands, reduced volumes, or changes in shopping frequency. Any outlook statements on consumer sentiment will carry extra weight this season. Overall, the consumer sector’s performance will give crucial insight into domestic economic conditions.

Explore Australian Shares

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.