Nvidia reports earnings tonight and The Daily Breakdown takes a look at what analysts expect and how the charts look ahead of the event.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Nvidia stock is hovering near record highs as it approaches tonight’s earnings report. Not only is it the leader of the AI movement, but it’s weighing in with a $4.4 trillion market cap — the biggest of any public company.

Analysts expect the firm to earn $1.01 a share on revenue of $46.2 billion, representing year over year growth of 49% and 53.9%, respectively.

Many investors feel confident about the company’s most recent quarter. That’s as we’ve already heard from mega-cap tech giants like Amazon, Meta, Alphabet, and Microsoft — with their management teams maintaining or increasing their enormous spending outlooks for the year (this is called their CapEx guidance). That’s as these companies build out ther AI infrastructure plans.

Beyond the recent quarterly results, investors will be listening for two things from Nvidia. First, what is management’s outlook and tone for the future? Second, will Nvidia provide more clarity around its ability to export advanced chips to China, potentially opening up more revenue?

Other notable earnings

There are other earnings reports tonight too, including Snowflake and CrowdStrike.

Shares of SNOW are up 25.9% so far this year, but down 15% from the recent highs. Can bulls regain momentum or will earnings throw more cold water on the stock?

CrowdStrike found a way to shake off last year’s disastrous outage, but after a run to record highs near $518, shares have dipped, recently closing near $418. Will management tell a good story and reassure investors or will the pullback continue?

Want to receive these insights straight to your inbox?

The Setup — Nvidia

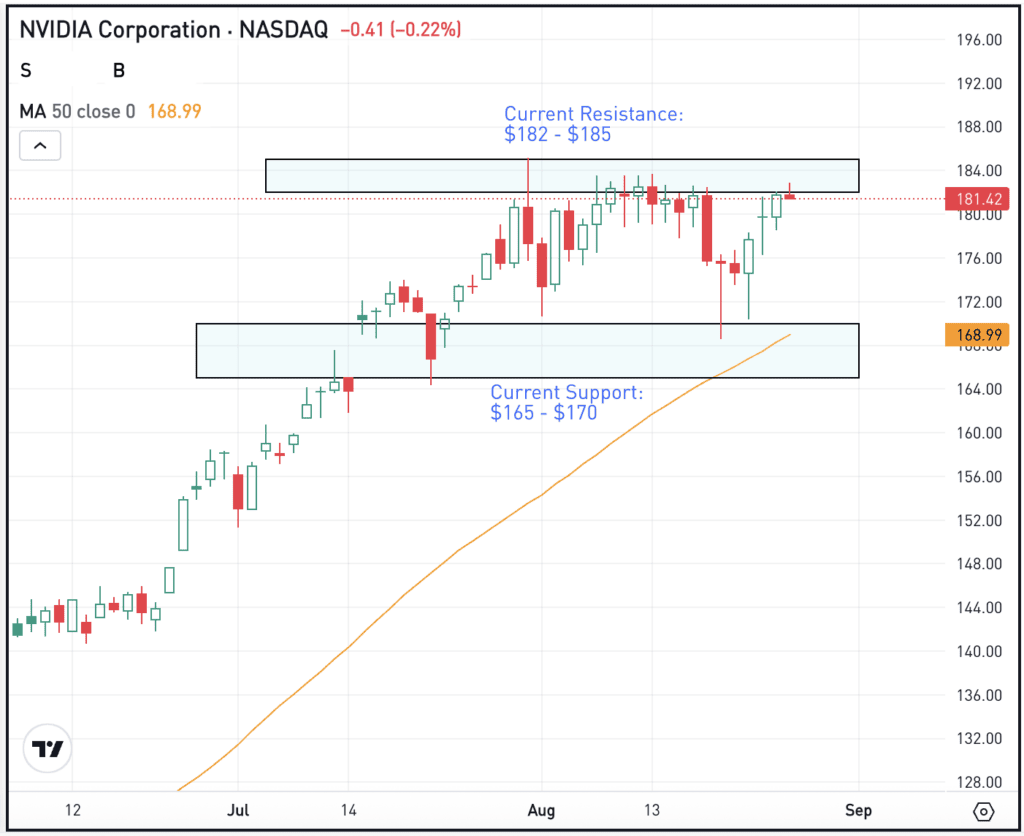

Before breaking out in late June, shares of Nvidia were rangebound between ~$90 and ~$150 for almost a year. Since then, the stock has been on a tear, rallying about 18% over the past two months. Now though, shares have been trading in a more narrow range, with support coming into play in the $165 to $170 zone and with resistance in the $182 to $185 range.

If shares pull back to recent support in the coming days or weeks — a dip of roughly 6% to 9% — bulls are hoping this area continues to act as support. Further, this area now contains the 50-day moving average.

On a rally, bulls are hoping for a close above $185. That would put NVDA into new highs and above recent resistance, potentially opening up even more upside in the weeks ahead.

Options

As of August 26th, the options with the highest open interest for NVDA stock — meaning the contracts with the largest open positions in the options market — were the September $200 calls.

Using options around big events — like earnings — tend to be more expensive. However, one advantage is that the total risk of the trade is tied to the premium paid when buying options or option spreads.

For options traders, calls or call spreads are one way for investors to speculate on more upside, while puts or put spreads allow them to speculate on further downside or allow bulls to hedge their long positions.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of AT&T are in focus after the company agreed to a $23 billion deal with EchoStar to buy its wireless spectrum licenses. Shares of EchoStar (ticker: SATS) soared more than 70% on the news. Meanwhile, AT&T bulls are still watching for a potential breakout over $29.

Shares of Cracker Barrel rallied more than 6% yesterday and are higher by more than 4% in today’s pre-market trading session. The firm announced it will keep its old logo after intense online backlash forced management to rethink its rebranding efforts. The rally snapped the stock’s seven-day losing streak. Dig into the fundamentals for CBRL.

Shares of MongoDB are flying higher this morning, up about 30% in pre-market trading after the firm reported earnings. The company beat on earnings and revenue expectations by a notable margin, with sales growing 24% year over year. Lastly, revenue guidance for the upcoming quarter was above analysts’ expectations. Check out the chart for MDB.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.