Walmart stock is breaking out and hitting new record highs in the process. The Daily Breakdown takes a closer look at the charts.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

In Q3, the S&P 500 saw just one session where it fell more than 1% — a 1.6% drop on August 1. There were only three sessions with gains of more than 1%, making it a relatively calm quarter overall.

Fast forward to Q4, and it’s a very different story. Kicked off by last Friday’s 2.7% plunge, volatility has returned in force, with trading ranges widening in both directions. On Tuesday, the VIX closed at 20.80 — up nearly 21% from a week ago. Volatility is back. The question now is: how long will it stick around?

Earnings

At yesterday’s low, the financial sector ETF — the XLF — was down almost 1%, but ended the session higher by 1.1% as investors cheered on the bank earnings.

This morning’s earnings include ASML, Bank of America, Morgan Stanley, and Abbott Labs, while United Airlines reports tonight. Tomorrow’s earnings include Taiwan Semiconductor, Charles Schwab, and US Bancorp.

Want to receive these insights straight to your inbox?

The Setup — Walmart

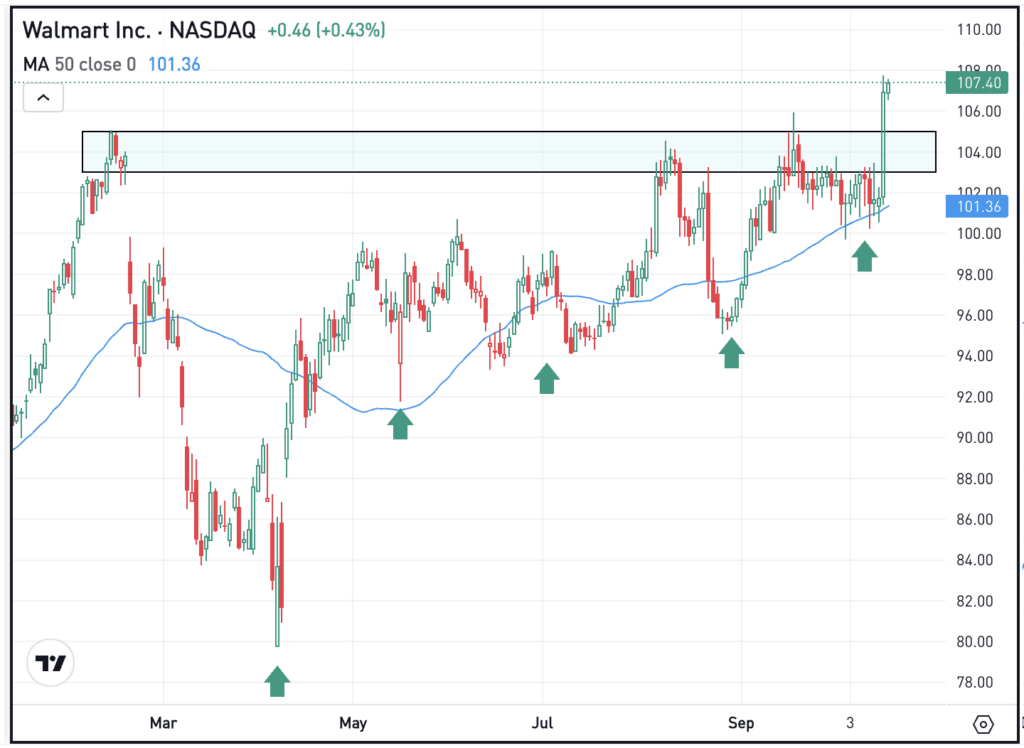

On Tuesday, shares of Walmart rallied 5% on news that it’s partnering with OpenAI to let customers shop and purchase items directly on the ChatGPT platform using Instant Checkout. That rally was enough to trigger a breakout over the $103 to $105 area, which had been resistance since February.

Notice how Walmart stock has been putting in a series of higher lows since April, marked on the chart by green arrows. The latest dip saw shares find support near the $100 mark and the 50-day moving average. Moving forward, bulls will want to see Walmart shares find support at prior resistance — in the $103 to $105 zone. If that’s the case, the technical setup can remain constructive and could lead to more bullish momentum in the days and weeks ahead.

Options

As of October 14th, the options with the highest open interest for WMT stock — meaning the contracts with the largest open positions in the options market — were the January 2026 $83.33 calls, the November $92.50 puts and the November $110 calls.

For some investors, options could be one alternative to speculate on WMT. Remember, risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and WMT rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

ASML

Shares of ASML have enjoyed a powerful rally, up more than 20% over the past month. The stock is now moving higher in premarket trading after the firm narrowly beat on earnings expectations and missed on revenue estimates, but management’s guidance helped reassure investors after providing an uncertain outlook over the summer. Refresh your knowledge of ASML with our recent Deep Dive on the stock.

BAC

Banks reported strong earnings on Tuesday and Bank of America continued that trend this morning, with earnings of $1.06 per share beating expectations of 95 cents per share, while revenue climbed 10.8% to $28.2 billion, beating expectations of $27.5 billion. The stock’s 52-week high is at $52.88 — just above where BAC is trading in the premarket session. Check out the chart for BAC.

Gold prices continue to climb, as the metal is trading near $4,200 an ounce. Silver prices have also been on the rise, now trading above $50 an ounce. The move in metals have ignited their ETF counterparts higher this year too, with the GLD and SLV each up more than 50% so far in 2025. Mining ETFs — like the GDX — have also done well, more than doubling so far this year.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.