eToro fees, explained as simply as possible

Learn if and how eToro’s fee structure applies to your deposits, withdrawals, and trades.

Investment account fees

For withdrawals from local currency accounts to an external account, no fee is charged.

Local currency accounts may include GBP, EUR, or DKK, depending on your country of residence.

For withdrawals from a USD investment account to external accounts, eToro charges a fixed $5 fee to cover some of the expenses involved in international money transfers.

Minimum withdrawal amount: $30 from a USD account, and no minimum from local currency accounts.

GBP account is provided by eToro Money UK Ltd

EUR & DKK accounts are provided by eToro Money Malta Ltd

This monthly fee applies to accounts with no logins in the previous 12 months.

Conversion fees

With eToro, all clients can hold funds in a USD account. Eligible clients can also hold funds in a local currency account*, depending on their country of residence.

Local accounts currently available: GBP, EUR, AUD and DKK

Currency conversions may be required in the following scenarios:

- Trading assets using funds from your local currency account when the asset is denominated in a different currency.

- Transferring funds between your USD account and your local currency account

- Depositing or withdrawing funds in a currency different from your eToro account

Conversion fees may vary depending on location, payment method, and Club level.

GBP account is provided by eToro Money UK Ltd

EUR & DKK accounts are provided by eToro Money Malta Ltd

Recurring Investment Conversion Fees

We’re excited to announce that we have received approval to waive all conversion fees on recurring investments for all Club members — across every tier – until the end of 2025.

Learn more about our FX fees here

Stocks

A commission fee of $1 or $2 may apply when opening and closing a stock position, depending on your country of residence and the stock exchange on which the asset is traded.

Positions opened before the fee implementation date in your country will not incur a fee when closing.

Stock commission fees in USD

Please note that commission fees:

– Are calculated in USD, regardless of the base currency of the stock being traded

– Do not apply to CFD positions

– Do not apply to ETFs

– Do not apply to Copy trading or Smart Portfolios

– Do not apply to Recurring investment plans on opening a position (may apply on closing position)

You can view commissions and other fees by tapping “estimated cost” on the trade execution screen.

A market spread is the difference between an asset’s buy (bid) and sell (ask) prices when trading, without any additional markups by eToro (Spread fee). It is not a separate charge by eToro, rather a reflection of current market conditions.

Stamp duty is a regulatory transaction tax levied by the UK government on the electronic purchase of all UK-listed stocks.

Short-selling orders and leveraged positions on stocks are executed as CFDs and incur CFD spreads and overnight fees.

Due to product restrictions, some non-leveraged BUY positions in stocks are also executed as CFDs, and these positions incur CFD spreads. CFD positions on stocks do not incur a commission fee.

Any CFD trade will be marked “CFD” in the trade execution window.

Stock Margin

Stock Margin allows clients to buy stocks using borrowed funds from eToro, increasing their market exposure while maintaining ownership of the underlying asset. This feature enables greater flexibility through leverage while incurring specific fees related to the borrowed amount.

A commission fee of 0.15% of trade value will apply when opening and closing a stock position. The Trade Value formula is the Execution Price multiplied by the number of shares.

Stock Margin positions incur an overnight fee, which reflects the cost of borrowing funds to maintain the position. Overnight fees for Stock Margin are charged only on the borrowed loan amount.

Click here for a full list of Stock Margin overnight fees.

Stock Lending

Many factors influence the amount of payment you may receive from stock lending, making it difficult to estimate how much someone can earn from the process.

When opting in, you allow eToro to consider your entire portfolio for lending. Shares are lent according to market demand. It’s possible that none of your shares are loaned during a particular month, which would produce no payment, but it’s also possible that your entire portfolio is lent, and you receive a larger payment that month.

There are no additional fees for participating in the stock lending programme, other than the facilitation and maintenance costs.

If your shares are in demand and lent out, the general formula for calculating the gross daily amount earned (prior to any deduction of facilitation and maintenance costs, revenue shared with eToro etc.) on a lent position is as follows:

Daily gross revenue amount = asset closing price × number of units × (lending fee rate % / 360)

If you wanted to calculate the lending revenue for Tesla Inc., assuming the following data doesn’t change for the duration of a 112-day loan:

Asset closing price = $350

Number of Units = 2,000,

Lending Rate (%) = 1%,

Price = $350,

Facilitation and maintenance cost (%) = 15% ,and

Days on Loan = 112.

Daily gross revenue = $350 × 2,000 × (1% / 360) = $19.44

Facilitation and maintenance total cost = $19.44 × 15% = $2.92

Net lending revenue = $19.44 – $2.92 = $16.52

Retained by eToro = $16.52 × 50% = $8.26

Your daily net revenue = $16.52 × 50% = $8.26

Your net revenue for a 112-day loan = $8.26 × 112 = $925.12

* The facilitation and maintenance total cost is 15% but may change in the future.

Note that the lending fee rate can change for the same lent shares over the duration of the loan. In securities lending, the fee rate is often variable and can be adjusted periodically based on market conditions, supply and demand for the shares, and other factors. For example, if the lending fee rate starts at 1% and then changes to 1.2% halfway through the loan period, you would calculate the revenue for the first half using the 1% rate and for the second half using the 1.2% rate, then sum the two amounts to get the total revenue.

There are no additional fees for participating in the stock lending programme.

ETFs

We charge zero commission for ETF trades. This applies to any transaction regardless of size and the way in which your order was entered: manually, via CopyTrader, or Smart Portfolios.

*The general account fees mentioned above will apply.

A market spread is the difference between the buy (bid) and sell (ask) prices of an asset when trading, without any additional markups by eToro (Spread fee). It is not a separate charge by eToro, rather, a reflection of current market conditions.

Short-selling orders and leveraged positions on ETFs are executed as CFDs and incur CFD spreads and overnight fees.

Due to product restrictions, some non-leveraged BUY positions in ETFs are also executed as CFDs, and these positions incur CFD spreads. Any CFD trade will be marked “CFD” in the trade execution window.

Crypto

eToro’s crypto pricing is built for clarity: spreads are highly competitive, commissions are shown separately from your balance, and fees are fully transparent — so your P&L reflects only market movements, with no hidden charges.

The market spread is the difference between the bid and ask prices, and can vary depending on market conditions, although this is not a cost charged by eToro.

A fee is applied when you transfer your cryptoassets to your eToro Money crypto wallet.

- If you transfer cryptoassets from the eToro platform, a fee of 2% is applied.

- If you transfer cryptoassets from or to an external source, eToro does not charge you. The only fee applied is the blockchain fee.

Note: The fee has a minimum/maximum cap, details here.

eToro Crypto Wallet

For all information about eToro Money crypto wallet fees and limits, click here

Limits: Transactions of all supported cryptoassets have a permitted maximum of $50,000 per transaction, and an overall daily maximum limit of $200,000.

A fee is applied when you sell crypto for GBP, EUR or USD on the eToro crypto wallet.

You will be shown an estimated fee before you complete the sale.

Club discount:

- Silver members: 1% fee

- Gold & Platinum members: 20% discount, reduced fee of 0.8%

- Platinum+ and Diamond members: 40% discount, reduced fee of 0.6%

Short selling and leveraged positions on crypto are executed as CFDs. Due to regulatory requirements, some non-leveraged BUY positions in crypto may be executed as CFDs.

Crypto CFD positions do not entail ownership of the assets and incur overnight fees, as detailed here.

Non-leveraged CFD crypto positions opened by German clients will not incur overnight fees.

Any CFD trade will be marked ‘CFD’ in the trade execution window.

Following Terra’s implementation of a 0.2% tax burn mechanism, an operational fee of 0.1% will be added to eToro’s bid and ask prices for LUNC, on top of the standard 1% fee that is calculated when buying or selling cryptoassets on eToro. More information here.

For all users eligible to receive further distributions of Flare tokens: Please note that eToro retains a service fee on each periodic distribution to cover the various operational, technical, and legal costs involved.

For customers residing in Germany: Cryptoasset transfers and associated fees are processed and charged by Tangany GmbH. Please refer to Tangany GmbH’s terms and conditions, which are available on our website.

CFDs

CFDs (Contracts for Difference) are regulated derivatives, an agreement between you and eToro based on the price movement of an underlying asset. They enable a range of trading strategies, including leverage and short selling, giving you greater flexibility in how you trade.

For CFDs on Stocks, ETFs, and Crypto, an opening/closing spread is charged from the available balance, and the trades open and close at raw market prices.

Opening/Closing spread from the available balance.

Applies only to CFDs on stocks, ETFs, and crypto. eToro does not add an additional spread to these assets. Instead, the opening/closing spread of 0.15% (CFD on stocks & ETFs) and 1% (CFD on crypto) is charged on opening and closing the position. This is based on the position value and deducted from your available cash balance. It is itemised in your trade screen and statements.

Not applicable to Forex, Commodities, or Indices CFDs.

CFD positions in US-listed stocks & ETFs priced at $3 or less (based on the closing price available on the eToro platform for the last trading day of the previous week) will incur an opening/closing spread of 2 cents per unit.

Applies only to CFDs on Forex, Commodities, and Indices. The eToro spread fee is a markup added to the raw market rate of an asset. This markup represents eToro’s fee for executing the trade and may vary by asset type and market conditions. You can view the spread cost for opening or closing a trade by tapping “Estimated Opening/Closing Cost” on the Open/Close screens.

Click here for a full list of CFD spreads.

Not applicable to Stocks, ETFs, or Crypto CFDs.

The market spread is the natural difference between the bid and ask prices set by the market. It can vary with market conditions and is not a fee charged by eToro. It may affect the price at which your order is executed across all CFD instruments.

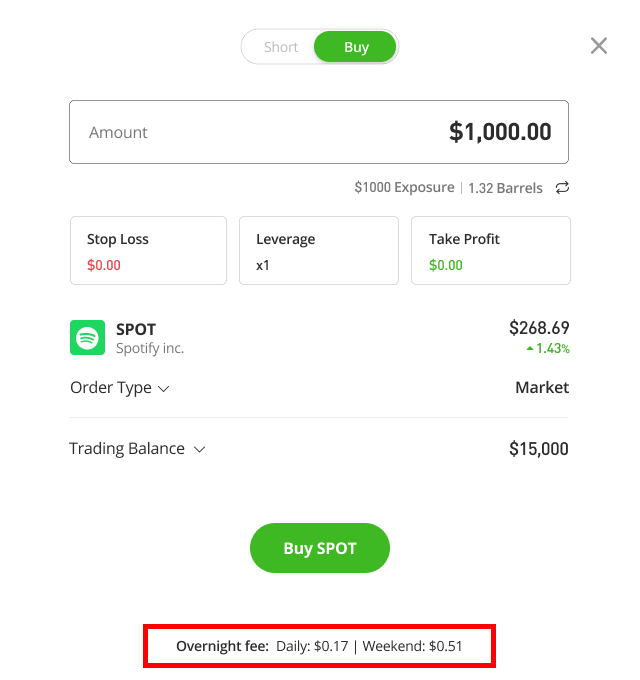

CFD positions that stay open overnight may incur a financing (overnight) fee relative to the value of the position. This is the interest paid for holding the leveraged CFD position.

Click here for a full list of overnight fees

When opening a trade, any applicable commission, spread, and overnight fees will be listed at the bottom of the execution screen.

* From August 2, 2024, in line with guidance from the National Securities Market Commission (CNMV), new users from Spain will not be able to trade CFDs.

Futures

Futures trading involves buying or selling contracts to purchase popular assets at a predetermined price on a future date.

Futures is currently in beta for a limited audience only. Registered eToro users will be notified when futures trading is available in their region. The following fee structure is relevant during the beta launch phase and is subject to change.

Micro futures:

Micro E-mini S&P 500: $1.37

Micro E-mini Nasdaq 100: $1.37

Micro E-mini Russell 2000: $1.37

Micro Nikkei: $1.45

Micro WTI Crude Oil: $1.52

1-Ounce Gold: $1.27

Micro Henry Hub Natural Gas: $1.62

Micro Gold: $1.62

Micro Silver: $2.02

10 Year Yield: $1.32

Micro SoyMeal : $1.52

Micro EUR/USD: $1.26

Micro GBP/USD: $1.26

Micro AUD/USD:$ 1.26

Micro Dow 30: $1.37

Micro Bitcoin: $2.17

Micro ETH: $1.12

Micro XRP: $2.17

Micro SOL: $2.17

- Fee is calculated in USD and applied on open and close of position.

- The commission fee partly reflects exchange fees. eToro may charge extra fees on positions left open for expiry.

Spot-Quoted Futures:

Index futures: $1.22 per contract

Crypto futures: $1.22 per contract

- This is a flat fee per contract.

- Fee is calculated in USD and applied on open and close of position.

- The commission partly reflects exchange fees. eToro may charge extra fees on positions left open for expiry.

You can preview the commission fee calculation by clicking on the estimated cost tooltip in the trade screen.

A market spread is the difference between an asset’s buy (bid) and sell (ask) prices when trading, without any additional markups by eToro (spread fee). It is not a separate charge by eToro, rather, a reflection of current market conditions.

Micro Futures: Free

Spot-Quoted Futures: Varies

To ensure price consistency between Spot-Quoted Futures and the underlying spot market, CME uses a daily adjustment mechanism. Each day, an Adjustment Amount (ADJ) is applied to open positions, accounting for real-world factors such as dividends, interest rates, or funding costs.

For eToro users, the impact of the ADJ will be reflected by the application of a daily overnight fee.

Indicative daily overnight fees (ADJ Equivalent)

- Long positions: “eToro Holding Rate” + benchmark = annualised Rate / 365

- Short positions: “eToro Holding Rate” – benchmark = annualised Rate / 365

“eToro Holding Rate”: can vary as it is calculated based on the daily ADJ of the CME.

The rates shown above are annualised rates, divided by 365 to reflect a daily charge.

Copy trading

Replicate the investment moves of other traders in real-time, automatically.

The same spreads and overnight fees apply to positions opened via CopyTrade as with regular manual trades.

Investing in leading, thematic ready-made portfolios.

Other than those applied with assets comprising each portfolio. Stock portfolios are commission-free.

eToro Local Currency Account

Local currency accounts give you the freedom to deposit and trade using both your local currency and USD. You can trade local currency-denominated assets with no conversion fees and hold cash in your local currency and USD to better manage your currency exposure.

Local accounts currently available: GBP, EUR, AUD and DKK.

The eToro Visa debit card is available to eligible UK and EU Club members. Check availability here.

GBP account is provided by eToro Money UK Ltd

EUR & DKK accounts are provided by eToro Money Malta Ltd

| Account Fees | Green (Non-club & Silver-Platinum Tiers) | Black (Platinum+ & Diamond Tiers) |

|---|---|---|

| Account Opening / Closing | Free | Free |

| Account maintenance | Free | Free |

| SEPA Transfers (In and Out) | Free | Free |

| Card Fees | Green (Silver-Platinum Tiers) | Black (Platinum+ & Diamond Tiers) |

|---|---|---|

| ATM (GBP account) | £2,000 p/m free – 1% after | £10,000 p/m free – 1% after |

| ATM (EUR account) | €2,500 p/m free, 1% after | €12,000 p/m free, 1% after |

| FX | No FX fees* | |

| Card issue & maintenance fee | Free | Free |

| Card payment fees | Free | Free |

| Replacement card fee (GBP account) | Free, up to max. 3 cards/yr | Free, up to max. 3 cards/yr |

| Replacement card fee (EUR account) | N/A | Free, up to max. 3 cards/yr |

| 1st Card delivery Regular | Free | Free |

| 1st Card delivery Urgent | Free | Free |

| Replacement Card delivery regular | Free | Free |

| Replacement Card delivery urgent | Free | Free |

| Chargebacks – if fails | Free | Free |

| Chargebacks – if not fails | Free | Free |

| POS Domestic | Free | Free |

Click here for information about Account Activity Limits

Get Your Local Currency AccountCost & Charges Examples

Download PDF

- Is eToro free?

-

You can join eToro for free and any registered user receives a $100,000 demo account for free.

However, like all online platforms, eToro charges various spreads and fees for some trades and withdrawals, as mentioned on this page.

- How does the crypto fee work?

-

In your portfolio, the displayed P&L includes the 1% buy fee that you just paid and the 1% sell fee you will pay when you close the position.

Note: When you close the position, the sell fee is adjusted to reflect the market price of the cryptoasset at that time.

Read more. - What is a bid/ask rate for CFDs?

-

Bid and ask rates are equivalent to BUY/SELL prices on eToro. When a position is long (BUY), the ASK rate is applied. When a position is short (SELL), the bid rate is applied.

- What are overnight fees for CFDs?

-

CFD positions that stay open overnight may incur a small fee, also known as a rollover fee, relative to the value of the position. It is essentially an interest payment to cover the cost of the leverage that you use overnight. Learn more here.

- What are weekend fees for CFDs?

-

Weekend fees are overnight fees that are charged for keeping positions open over the weekend, and are triple (x3) the overnight fee.

- When do I pay overnight/weekend fees?

-

Overnight fees are charged every night between Monday and Friday at 22:00 UK time for open CFD positions.

Weekend fees (x3) are charged either on Wednesday or Friday, depending on the asset: Wednesdays for most commodities and currencies and Fridays for most stocks, ETFs and indices. Weekend fees for oil and natural gas are charged on Fridays

Overnight fees for cryptocurrencies are charged daily.

- Can daily overnight/weekend fees, on CFDs, change?

-

Overnight fees change from time to time based on global market conditions. When this happens, we will implement the changes. Please be aware that fee changes always apply to open positions. We encourage you to keep up to date with the current overnight fees/refunds by checking this page. Please note that fees may change without advance notice.

- How are overnight fees calculated for different base currencies?

-

Interest rates vary between currencies. We apply a different benchmark rate depending on the currency of the CFD your position is held in. Learn more here.

- Where can I see the overnight fees on CFDs that I have to pay?

-

Overnight fees appear at the bottom of the trade window when opening a new trade.

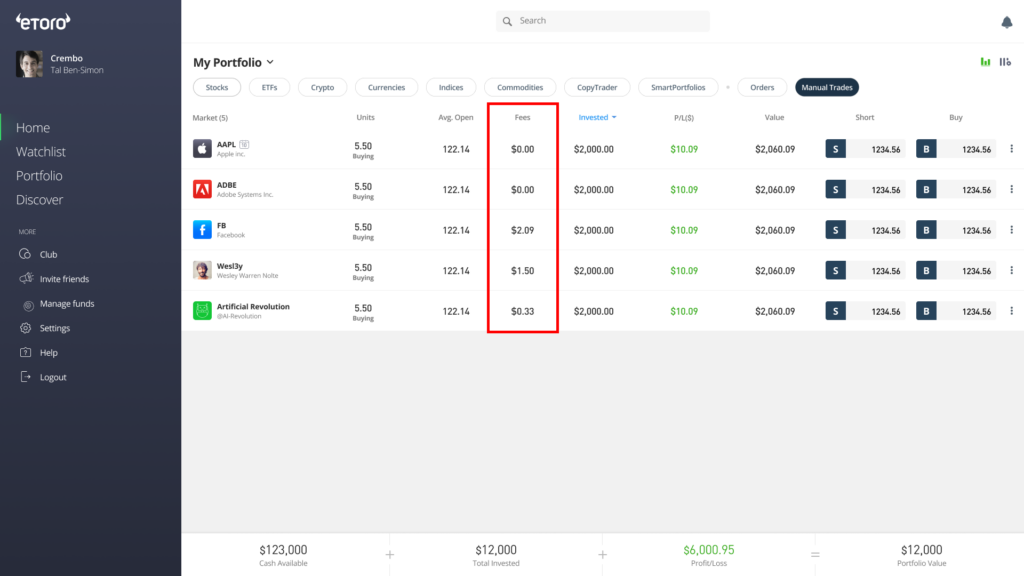

- Where can I see the fees that I paid?

-

In your portfolio page, on the history tab, you can see the fees that were paid for each trade as well as aggregated fees for different periods.

- In regards to CFDs, when do I pay the spread?

-

As soon as you open a new trade, you will see a “loss” in the position — this is due to the spread. However, the final calculation of the spread is made when you close the position and it is adjusted at that moment, according to the closing price.

Find more FAQ’s here.

- How are fees, on CFDs, calculated?

-

Spread:

Spread * Price in USD * Number of units

Overnight fees (per night):

Fee * amount of units

- What is leverage for CFDs?

-

Leverage is a temporary loan given to the trader by the broker, enabling the trader to open a trade of a larger size with a smaller amount of invested capital. Leverage is presented in the form of a multiplier that shows how much more than the invested amount a position is worth.

For example: If you trade with no leverage at all and invest $1,000, for every 1% move in the market, you can gain or lose $10, which equals 1% of $1,000. However, if you were to invest the same $1,000 and trade using x10 leverage, the dollar value of your position would be equal to $10,000.

For further details and examples click here.

- What is a “bid/ask market spread”?

-

The market spread arises from the difference for which a product can be bought and sold (bid and ask). This difference does not arise from eToro and is not incurred as a cost when you buy or sell a real stock on eToro.

- What other fees apply?

-

When depositing and withdrawing in non-USD currencies, a conversion fee will be incurred. Diamond members are automatically exempt from FX conversion fees. Platinum and Platinum+ members receive a 50% discount. There is also a low fixed $5 fee for withdrawals and a $10 monthly inactivity fee after 12 months with no login activity.

Although not a fee that is levied by eToro, each transaction is subject to a market spread upon opening and closing. This is determined by the market and is a characteristic that is consistent across all banks and brokers.

- What is Stamp Duty and who needs to pay it?

-

We will be passing a Stamp Duty Reserve Tax on to clients who open new positions in UK-listed stocks. Stamp Duty is a regulatory transaction tax levied by the UK government on the electronic purchase of all UK-listed stocks. It is currently set at 0.5% of the value of the stock purchase (SDRT is also normally charged at 0.5% but is rounded up to the nearest 1p). This is a mandatory regulatory transaction tax that applies to all clients trading UK-listed stocks, regardless of their country of residence.