Summary

2022 was a historic year to forget

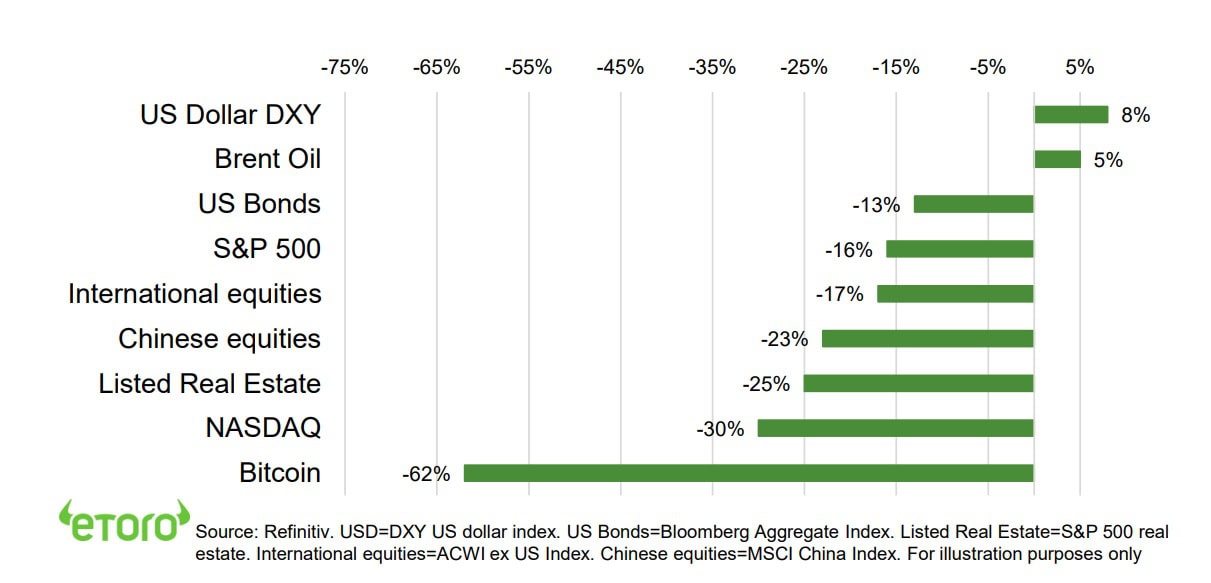

Unprecedented inflation and interest rates shock and geopolitics drove markets weaker in 2022. It was a year for the record books. With a massive bond sell-off. Historic gaps between sector and styles performance. Plus many reminders stock markets not economies. Dollar and oil the only big assets up, whilst bitcoin led losers. Valuations led equities down, with earnings resilient. 2023 set to be reverse. Good news is that big equity falls historically followed by big gains.

Market reality check arrives

Equities fell as US inflation relief offset by reality check of lower-for-longer hike talk from Fed and ECB. Weak retail sales stoked consumer concern, and China’s covid cases its policy relaxation. 10-yr bond yields a low 3.5% and dollar firm. AMGN buys HZNP and private equity COUP. Musk sold more TSLA. 2023 Year Ahead View HERE. See video updates, twitter @laidler_ben. We are back in January 2023. Happy holidays!

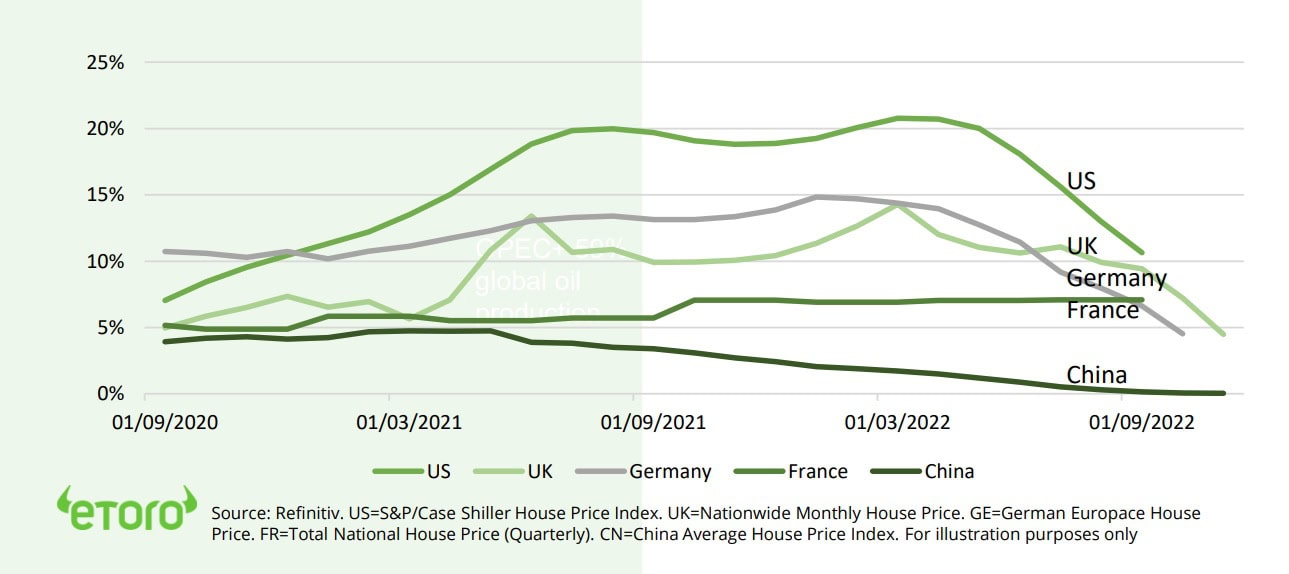

The global housing drag

Global real estate stocks have underperformed as interest rates soared. More fundamental pain to come but investors may start looking for lower rate winners. @RealEstateTrusts.

Renewables growth being super-charged

Renewable investment boom increasingly strong and visible. With both Paris deal 1.5C and energy security drivers. Is a key 2023 investment focus after poor 2022. @RenewableEnergy.

Making new year’s resolutions count

Our investor survey shows 43% to make 2023 financial resolutions. Are 2nd most popular type. 35% to start investing and 28% more.

Biggest volume day of the year

Friday was one of biggest market volume days of year. ‘Triple witching’ US futures and options (F&O) expiry sees volumes 5x normal.

Bitcoin resilience tested again

Bitcoin (BTC) again relatively resilient to broader crypto weakness, rising macro risks, and FTX contagion. Dogecoin (DOGE) led crypto weakness on the rising risk aversion and Twitter (TWTR) problems. Ex FTX CEO Bankman-Fried arrested. Binance saw big outflows. Ark Innovation (ARKK) bought more Coinbase (COIN) stock.

A better week for commodities

Brent oil prices rebounded after recent sharp weakness and with temporary Keystone pipeline shutdown. Heating oil prices soared 15% on cold weather. Industrial metals weaker, led by nickel and copper, as China covid cases surged. The broad Bloomberg commodity index up 13% this year, and only asset class positive.

The week ahead: Christmas slowdown

1) A quiet pre-Christmas week, but big stocks NKE, FDX, MU, GIS reporting. 2) Fed favourite PCE inflation (Fri) seen easing from 6.0% to 5.5%. 3) BoJ interest rate meeting to hold rates at a global outlier -0.1%. 4) Index rebalance day (Mon) for the NASDAQ-100 and FTSE 100.

Our key views: A gradual U-shaped recovery

Fed risks a policy mistake, with a high-for-longer interest rate outlook even as forward inflation and the growth outlook falls. Lower reported inflation is a relief. Recovery to be gradual and U shaped. Focus on cheap and defensive assets for now, like healthcare, and styles like dividend yield, and related markets like UK.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.66% | -2.45% | -9.41% |

| SPX500 | -2.08% | -2.85% | -19.17% |

| NASDAQ | -2.72% | -3.95% | -31.57% |

| UK100 | -1.93% | -0.72% | -0.71% |

| GER30 | -3.22% | -3.73% | -12.54% |

| JPN225 | -1.34% | -1.34% | -4.39% |

| HKG50 | -2.26% | 8.10% | -16.87% |

*Data accurate as of 19/12/2022

Market Views

Market reality check arrives

- Equities sold-off as lower US inflation relief was offset by a reality check of lower-for-longer rate hike talk from the Fed and ECB. Lower retail sales stoked concern over resilient US consumer, and China’s surging covid cases its zero-covid policy relaxation. 10-yr bond yields stayed a low 3.5% and US dollar index firm at 104. M&A activity saw AMGN buy HZNP and private equity buy COUP. Musk sold more TSLA. See our 2023 Year Ahead View HERE. We are back in January. Happy Holidays!

The global housing drag

- Real estate is under pressure world-wide as interest rates been aggressively hiked to levels not seen in over a decade. Global real estate stocks fallen 24% this year, worse than -17% for broader equities. Housing REITS been near the weakest. Rising rates worsened high housing prices, debt levels, partial pandemic rebounds.

- With more rate hikes to come these fundamental pressures will only rise. But investors may look to pivot to traditional interest rate sensitives like REITS, if Fed rate cuts start to come into focus later in 2023. See @RealEstateTrusts.

Renewables growth being super-charged

- Renewable investment boom increasingly strong and visible. Underpinned by the Paris Agreement goals to limit global temperature rise to 1.5 °C. And accelerated by energy security focus after Russia’s invasion of Ukraine and energy ‘weaponization’. Drove big response, from the US Inflation Reduction Act to the REPowerEU plan.

- The IEA just raised its renewables growth outlook by 30%. This stronger growth combines with the tech-led valuation derating seen this year to make renewables a key investment focus for 2023 and potentially set to regain performance ground versus oil stocks. @RenewableEnergy.

Making new years resolutions count

- 2022 has been one to financially forget for most. But our global investor survey shows 43% will make financial resolutions for 2023. These are gaining in popularity and financial resolutions are now the 2nd most popular type, behind health/wellbeing.

- 43% plan to keep a budget next year, 35% to start investing, and 28% are planning to invest more. US, UK, and Romanian investors lead on new investing plans for 2023. Whilst financial goals are often some of the hardest to keep, 60% managed to keep them even during a difficult 2022.

Biggest volume day of the year

- Friday was one of the biggest market volume days of year. ‘Triple witching’ US futures and options (F&O) expiry typically drives market volumes five times normal. This has become even bigger as retail-driven options activity has surged in recent years, and major stock indices rebalance on the same day. This came at the end of a very volatile week and before low-volume Christmas holidays.

- ’Triple witching’ can add to short term volatility, and takes away from later week performance, but usually with little longer lasting impact.

The global house price slowdown (%, year-on-year)

Bitcoin resilience continues

- Bitcoin (BTC) remained relatively resilient and holding above recent $15,800 low. Was despite escalating contagion from the bankruptcy of major crypto exchange FTX. And with darker global macro clouds as both the Fed and ECB highlighted more interest rate hikes to come.

- FTX ex-CEO Bankman-Fried was arrested, whilst biggest crypto exchange Binance reportedly saw over $1.4 billion of client fund withdrawals.

- Dogecoin (DOGE) led crypto asset weakness as broader risk aversion rose, and Twitter (TWTR) remained under pressure. Elsewhere Ark Innovation (ARKK) announced it had bought more shares of exchange Coinbase (COIN).

A better week for commodities

- A rebound in Brent oil prices supported the broader Bloomberg commodity index, which is up 13% this year. Even as more hawkish US Fed and ECB stoked global recession concerns.

- Brent rebounded from recent sharp losses, and helped by supply disruption with the temporary shutdown of the Canada/US Keystone pipeline. Heating oil surged 15% as cold weather arrived.

- Industrials metals were weaker, led by copper and nickel. Dominant buyer China saw its covid cases rise sharply after the easing of its zero tolerance policy and as its retail sales fell -5.9% and property prices -1.6% versus last year.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -2.51% | -3.94% | -32.29% |

| Healthcare | -1.51% | 1.61% | -7.87% |

| C Cyclicals | -3.64% | -6.17% | -35.06% |

| Small Caps | -1.85% | -4.84% | -21.46% |

| Value | -1.57% | -1.59% | -9.46% |

| Bitcoin | -1.34% | 2.16% | -64.42% |

| Ethereum | -4.79% | -0.12% | -67.81% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: the Christmas slowdown

- A quiet week with some surprisingly big stocks reporting like apparel giant NKE, chip maker MU, shipper FDX, consumer staples GIS, software FDS, plus meme stock BB.

- After last week’ US inflation surprise comes the Fed’s favourite PCE report, with price rises seen easing from 6.0% to 5.5%, and hopefully reinforcing the recent inflation downtrend.

- Bank of Japan (BoJ) is a global outlier with interest rates anchored at -0.1%. It’s Tuesday meet will see no change. but it may be one of the biggest changes in 2023 as inflation rises.

- Monday index implementation for annual changes to NASDAQ-100, and quarterly for UK’ FTSE 100 index. Also look for pre-Christmas US Congress deal to stop Government shutdown.

Our key views: A gradual U-shaped recovery

- Fed risks a policy mistake, with a high-for-longer interest rate outlook even as forward inflation and GDP growth outlook falls. Market bottomed but recovery to be U-shaped. Gradually lower inflation will be a bumpy ride but will eventually start to de-risk markets and allow risk assets, from equities to crypto sustainably recover.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage still high risks. Sectors, like healthcare, defensive styles like div. yield, and related UK to Japan markets.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 0.87% | -1.82% | 13.65% |

| Brent Oil | 3.81% | -9.66% | 1.69% |

| Gold Spot | -0.35% | 2.91% | -1.50% |

| DXY USD | 0.03% | -1.96% | 9.24% |

| EUR/USD | 0.50% | 2.53% | -6.91% |

| US 10Yr Yld | -9.52% | -33.84% | 197.52% |

| VIX Vol. | -0.92% | -2.16% | 31.36% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: truly historic year in review

Inflation and geopolitics drove markets weaker, taking cue from the US

US inflation surged from 7% at the end of 2021 to a June 9.1% peak. Russia’s February invasion of Ukraine drove oil prices over $125/bbl. Whilst a strong US labour market saw unemployment fall to a generational low 3.5%. This led the Fed to drive the sharpest increase in interest rate in fifty years and propelling the stronger US dollar. They hiked rates from 0% in March to a 15-year high 4% by Christmas. This in turn saw US 30-year fixed mortgage rates surge to 7% and US house prices start to fall, by 4% from peak levels.

Europe was the worst impacted and Asia the global exception as look to 2023

Europe saw a double-impact of Russia cutting off gas supplies, with energy increasingly ‘weaponised’, and this driving double-digit inflation. This was only partly buffered by the Euro falling below parity and more fiscal spending on defence, renewables, and immigration. The ECB moved cautiously in raising interest rates, caught between energy-driven inflation and near-recession economy. Asia was the global exception. China’s economy slowed under the weight of its self-imposed zero-covid strategy, property sector crackdown, and one of the few countries in the world with interest rates above its low 2% inflation rate.

A year of historic divergences between sectors, styles and economies. Next year usually a lot better

The year saw a huge 90% gap between best (energy) and worst (communications) performing S&P 500 sector. And a big 20% outperformance of Growth by Value. It was a year for stock pickers with S&P 500 lagging its equal-weight version by a 12-year high 6%. Markets reminded they are not economies. UK was best performing large market, outperforming US by 20%, despite ‘stagflation’ with an economy in recession and 11% inflation. China was the worst performer despite avoiding an inflation and interest rate shock. US equities have fallen over 10% ten times in a year since 1937. The average next year return has been 18%.

Valuations led markets down, whilst earnings were resilient. 2023 could be the reverse

Stock markets were led down by plunging valuations, especially hurting tech and ‘themes’. The S&P 500 P/E ratio fell from 22x to its long-term average 18x, as interest rates soared. Earnings expectations were rock solid, down only 1% in the year. They are on track to grow 6% this year, though lag inflation. 2023 may be the opposite, as slowing economies hurt earnings, but outlook for interest rate relief helps valuations.

Bonds saw one of their worst performance years ever as diversification failed

Bonds saw an unprecedented rout, falling 15% overall, with long-duration bonds down 25%, with the shock of surging inflation and interest rates. This saw a diversified 60/40 portfolio have one of its worst years ever. Real estate stocks, which have highest debt of any sector, underperformed as rates soared, and property values started to fall. Crypto led asset classes weaker, pummelled by both global macro and self inflicted risks as the bankruptcy of leading exchange FTX followed the collapse of leading stable coin Terra.

Major asset performers year-to-date (%)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle and stubborn inflation boosted uncertainty, recession risk, and hit markets. We see this gradually fading in 2023, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now below average levels, and are supported high company profitability and near peaked bond yields. Fast Fed hiking cycle boosted recession risks. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among cheapest of any major market, benefit from weaker JPY and with low inflation, offsetting structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Higher risk cyclical sectors, like discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive if see a ‘slowdown not recession’ scenario. Are select but high risk opportunities from energy to financials stocks. With often depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from high bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and with room for large dividend and buyback yields. But can be outweighed by high recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) the least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by rising Fed interest rates and ‘safer-haven’ bid. Many DM currencies hurt by still low interest rates and struggling growth. ‘Reverse FX war’ interventions ineffective. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. Stabler USD outlook as near top of Fed cycle. |

| Fixed Income | US 10-year bond yields risen above prior 3.5% peak, as Fed hikes continue aggressively and balance sheet runoff accelerates. Set to ease as recession risks rise and inflation expectations fall. Additionally US has a wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, low productivity. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | In the latest ‘crypto winter’ (16th crash for bitcoin) with dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size under $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.