Summary

73% DIY investors remain confident

Our unique global survey tracks the unsung DIY investor anchor of this market. The focus stays on domestic equities and the US, but is looking to Asia and even the UK. Tech is toppled as the favourite sector by energy, as investors develop a ‘barbell’ allocation of both commodities and ‘defensives’. Asset class diversification increases, with crypto now the 2nd most favoured asset, and commodities still on the rise. Geopolitical risks have soared, and economic concerns increased, but 73% remain confident and most have not changed their portfolios.

Markets weak but with some inflation relief

Markets volatile but with some relief on signs of peaking US inflation. Bond markets were weak and dollar rose. A poor Q1 bank earnings season start was balanced by ‘re-opener’ bright spots. Elsewhere Musk bid for TWTR, US natgas soared, and ECB reassured. We see markets sensitive to ‘less bad’ Q2 news. See latest presentation, video updates, and twitter @laidler_ben.

Stealth rally in utilities

We’ve seen a ‘stealth’ rally in utilities (XLU, @Utilities) as recession risks outweigh the bond selloff. Defensives are one leg of our allocation ‘barbell’, but we prefer healthcare.

Europe’s crisis of confidence

Europe is seeing an investor confidence crisis of stake sales and outflows, with volatility spiking to 3x history vs US. Is a opportunity for brave, with fundamentals stressed but secure.

Japan as an alternative to Europe

The Japanese Yen (JPY) has slumped on widening interest rate differences with the US. This is boosting Japan’s equity attractiveness, especially as a lower-risk alternative to Europe.

The resilience of thematic investing

Secular growth ‘thematic’ investing still booming despite tech and Growth headwinds.

Crypto now 2nd most-owned asset class

Volatile equity markets kept crypto under pressure. Shiba Inu was boosted by faster supply ‘burning’ and its addition to HOOD app. eToro Q1 investor survey shows crypto now the 2nd best owned asset class, after domestic equities. BTH and ETH popularity risen vs altcoins.

Natural gas prices break out

Brent oil near $100/bbl. on crosscurrents of IEA warnings Russia supply disruption barely started versus cooling China demand and US oil sales. US natural gas prices stole the show, surging to 13-year high prices on soaring LNG demand and well below-average inventories.

The week ahead: first of big-tech earnings

1) TSLA and NFLX lead first of big-tech earnings reports.

2) PMI from US, UK, EU, Japan give timely update of growth slowdown.

3) Sunday’s French presidential run-off comes at a crucial time for Europe.

4) Easter Monday holiday in much of the world, but US markets are open.

Our key views: Sensitive to less ‘bad news’

Markets have already absorbed a lot of negative news, on Fed and inflation to Ukraine and China. This makes them sensitive to the ‘less bad’ news, from Q1 earnings to ‘peak’ inflation data. Focus on a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, crypto, alongside healthcare, ‘big tech’, and high dividends. We are cautious on bonds.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.38% | -0.09% | -5.19% |

| SPX500 | -2.39% | -0.43% | -7.84% |

| NASDAQ | -3.93% | -1.94% | -14.66% |

| UK100 | 0.85% | 3.13% | 3.14% |

| GER30 | 0.61% | -1.56% | -10.83% |

| JPN225 | 0.40% | 0.99% | -5.90% |

| HKG50 | -1.33% | 0.08% | -8.03% |

*Data accurate as of 18/04/2022

Market Views

Markets see some inflation relief

- Markets volatile but with some relief on signs of peaking US inflation. Bond markets were weak and dollar rose. Whilst a poor Q1 bank earnings start was balanced by ‘re-opener’ bright spots. Elsewhere Musk bid for all TWTR, and US natgas prices soared. We see markets sensitive to incrementally ‘less bad’ news in Q2. Big-tech earnings and French election highlight this week. See Page 6 for our Resources guide of reports, presentations, videos, and twitter.

Stealth rally in utilities

- We have seen a ‘stealth’ rally in utilities (XLU, @Utilities) stocks this year. They are only lagging the high-flying energy sector. This reflects a recent stampede by investors into traditional defensive sectors as rising recession risks more than offset surging bond yields that are usually a big drag on ‘bond proxy’ sectors.

- Many utilities benefit from boost to renewables, and higher power prices. Defensives are one end our allocation ‘barbell’. We prefer cheaper, higher growth, less indebted healthcare sector.

Europe’s crisis of confidence

- After outperforming the US earlier this year, Europe ex UK (EZU) equities have slumped under the weight of the Ukraine war and Russia sanctions, high oil prices and surging inflation, and a tightening French election. European equity outflows have soared, even as broader global equities enjoy strong inflows from the even more stressed bondmarket.

- This investor confidence crisis is worsened by major asset manager stake sales. From Germany’s largest listed banks, Deutsche Bank (DB) and Commerzbank (CBK.DE), to Airbus (AIR.PA) and E.ON (EOAN.DE), and the London Stock Exchange (LSEG.L) and Glencore (GLEN.L). But we think Europe’s fundamentals are stressed but secure, and the current volatility spike often offers opportunities for the brave.

Japan as an alternative to Europe

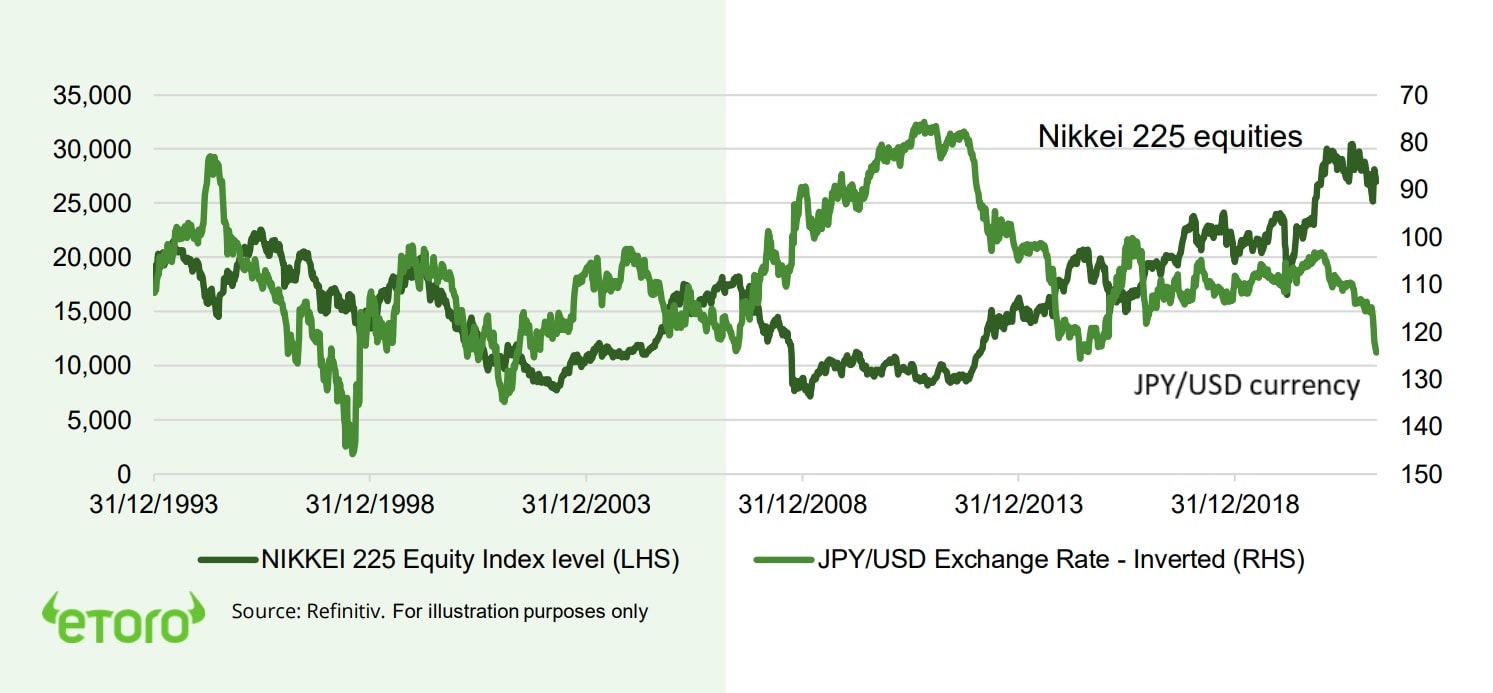

- The Japanese Yen (JPY) has slumped through 125 vs the USD, back to 2015 levels. The currency of the world’s no.3 economy and stock market has performed on par the Russian rouble (RUB) or Ukrainian hryvnia. The driver has been widening rate differences with the US.

- The Japanese policy interest rate is at -0.1% and inflation under 1%. Whilst the Fed is on a march to 3% interest rates, with 8% inflation. This is a recipe for further, slower, Yen weakness. Japan’s attraction is rising as an lower-risk equity alternative to Europe.

The resilience of thematic investing

- Secular growth ‘thematic’ investing has stayed popular despite the recent correction in high flying disruptive tech stocks, and Growth investing, as bond yields surged. But inflows continued, led by younger and female investors, and interest broadening from ‘tech’.

- Cleantech leads in our investor survey, and interest dwarfs current allocations 20-fold (see chart). Our six key themes for 2022 are carbon transition, EV’s, crypto, metaverse, economic re opening, and China. See 40+ smart portfolios.

Japanese equities vs the JPY/USD exchange rate (30-years)

Crypto now 2nd most owned asset class

- Crypto prices under pressure, with increased correlation to still volatile equitymarkets.

- Shiba Inu (SHIBxM) bucked downtrend among major coins, boosted by 1) pick up in ‘burned’ tokens cutting supply, and 2) demand pickup from ‘whale’ accounts, and entry to Robinhood (HOOD) app, along with SOL, MATIC, and COMP.

- eToro’s Q1 global DIY investor survey shows crypto now the 2nd best-owned asset class, after domestic equities and well ahead of bigger and longer-standing assets like FX and commodities. BTC and ETH picked up popularity vs altcoins, but ‘don’t knows’ are the most ‘popular’ coin!

Natural gas prices breakout

- Energy stayed in the spotlight, with brent oil regaining its price footing above $100/bbl. The International Energy Agency warned that Russia oil supply disruption has barely started, with full 3.0mbbl (3% global supply) impact only from May. Partly offsetting this is lower expected demand from the slowing Chinese economy, and record sales from the US strategic reserve.

- But volatile US natural gas prices stole the headlines, surging above $7 per million btu, a 13-year high, and up 50% in a month. US output has struggled to keep up with soaring global LNG demand. Whilst recent operational outages and seasonal maintenance have driven natgas inventories to well below-average levels.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.39% | 1.58% | -16.89% |

| Healthcare | -2.83% | 5.19% | -3.96% |

| C Cyclicals | -0.54% | 4.00% | -12.94% |

| Small Caps | 0.52% | 1.83% | -10.70% |

| Value | -1.05% | 3.08% | -2.27% |

| Bitcoin | -7.52% | 0.27% | -16.35% |

| Ethereum | -8.23% | 13.00% | -20.15% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: the first of big-tech earnings

- Global Q1 earnings season accelerates with big-techs on both sides of Atlantic: TSLA, NFLX, and SAP, ASML. Also consumer giants JNJ and PG, and remaining mega-bank BAC. Overall estimates 5% US and 25% Europe EPS growth.

- Timely health-check with PMIs in US, UK, EU, Japan. To see slower growth, and stubborn – but hopefully peaking – inflation pressure. Global leaders meet at the IMF/World Bank spring summit to discuss the macro outlook.

- Sunday, April 24 centrist Macron and far right Le Pen run off in French election. Polls are tight but betting sites give an 80% nod to a Macron victory at this crucial time for Europe.

- A short week with Easter Monday holiday in much of the world. US markets are open.

Our key views: Sensitive to ‘less bad’ news

- Markets have absorbed a lot of bad news this year. Stubbornly high inflation, more hawkish central banks, China weakness, Ukraine war. This makes them sensitive to any ‘less bad’ news, from Q1 earnings to ‘peak’ inflation data.

- Economies are reopening and growth is still robust. The aggressive Fed hiking cycle is increasingly well-priced and inflation trends near peak levels. Valuations are more attractive.

- Focus a ‘barbell’ of cheap cyclicals and select ‘defensives’: Value, commodities, crypto, with ‘big tech’ and healthcare. Cautious on bonds.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 4.76% | 7.35% | 33.54% |

| Brent Oil | 9.04% | 3.20% | 43.26% |

| Gold Spot | 1.38% | 2.90% | 8.02% |

| DXY USD | 0.71% | 2.31% | 4.72% |

| EUR/USD | -0.57% | -2.14% | -4.92% |

| US 10Yr Yld | 17.09% | 67.67% | 131.62% |

| VIX Vol. | -7.84% | -17.54% | -25.85% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: DIY investors holding the line

Our unique global survey tracks the unsung DIY investor that helps anchor this market

We publish our latest retail investor beat survey of 8,500 DIY investors in 12 countries. There are plenty of surveys on institutional investors but almost none on DIY investors. This is a huge gap, with retailer investors surging in importance, and a key anchor for markets. The good news is they are hanging tight in the face of volatility, with 73% confident in portfolios. But diversifying, with energy supplanting tech as most favoured sector, looking beyond US towards Asia and even UK, and to commodities and crypto.

Their focus remains on domestic equities and the US, but looking to Asia and even the UK

Investors are staying close to home with domestic equities by far the largest allocation. This natural ‘home bias’ driven by what investors know best. Investors remain most bullish on the US, whilst China and Japan have risen up the rankings. China is the only major market in the world able to cut interest rates, whilst Japan’s slumping currency is a key equity boost. The outperforming UK finally see’s a little love, rising from the bottom to be replaced by Europe, where recession risks have been rising driven by the Ukraine war.

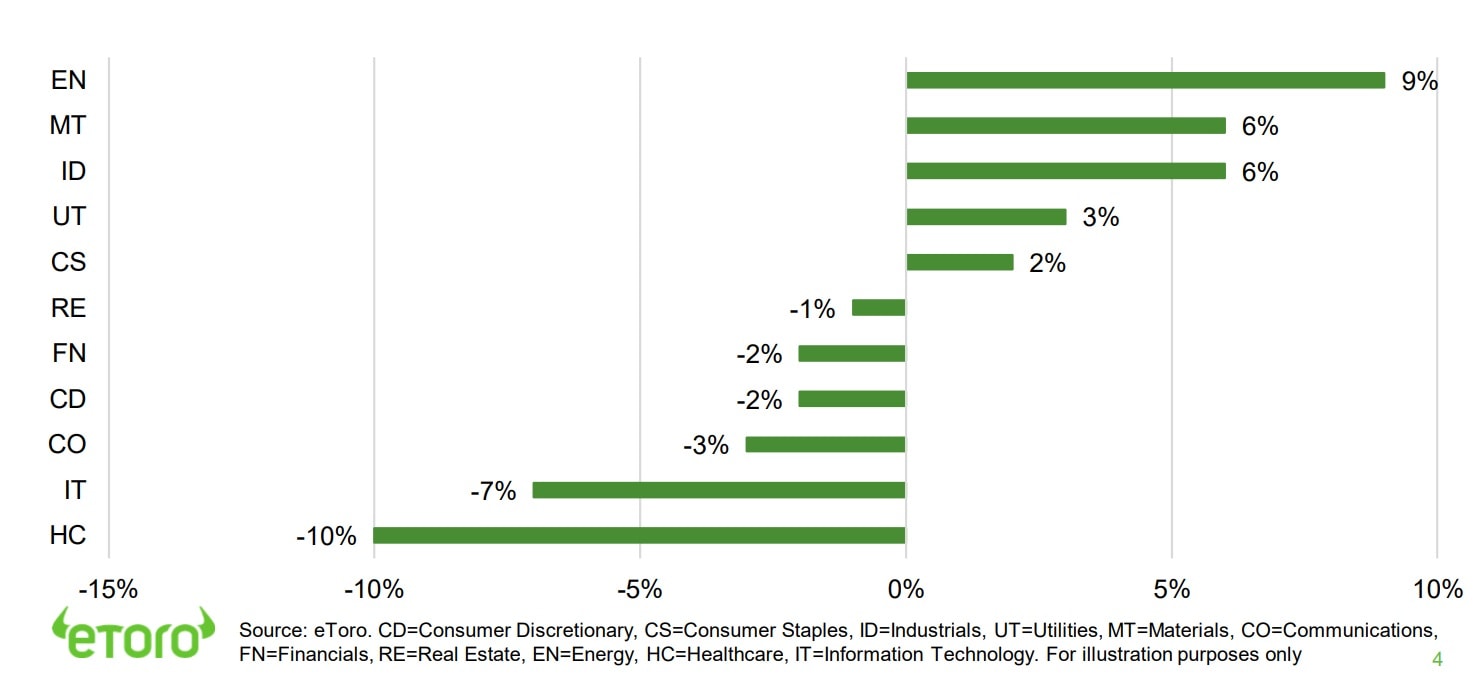

Tech is toppled as investors develop a ‘barbell’ allocation of commodities and defensives

The energy sector has risen to be the most popular with investors, despite its tiny size. This is alongside traditional ‘defensive’ sectors like utilities and staples. This is unsurprising with inflation and recession risks rising in recently. These have also been headwinds to the tech-related sectors which have all declined in popularity. This barbells of offense and defence and relative caution on tech is like our broad view.

Asset class diversification increases, with crypto now 2nd favoured asset, and commodities to rise

The diversification continues across asset classes. Crypto is now the 2nd best owned asset class, remarkable for an asset that did not exist a decade ago. Similarly, commodities is the only asset class set to see stronger allocations, as it remains in a sweet spot of decent demand, tight supply, and inflation hedge demand. Thematic investments continue to boom, led by cleantech, with potentially a long way to go.

Geopolitical risks have soared, and economic concerns increased, but 73% remain confident

Geopolitics surged to the greatest concern, alongside a weakening of economic confidence, given the ‘cost of living’ crisis and rising interest rates. But job security is high. DIY investors remain comfortable with their investment allocations, with only 41% making changes, and 73% investing the same or more. The attached presentation has more, including on the increasingly youthful and female investor and how they invest somewhat differently. Plus, how investors analyse investments and trade (a little) and monitor them (a lot).

Change in survey respondents sector investment outlook (Q122 survey vs Q421)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Geopolitical risks, the Fed hiking cycle, and China concerns have boosted uncertainty and weakened markets. We see this ultimately fading, the global growth outlook secure, and valuations now more compelling. This still supports a rare consecutive double-digit positive return outlook for the year despite the weak start. Focus on a ‘barbell’ of cyclical assets (Value equities, commodities, crypto) and select defensives (‘big tech’, healthcare). Cautious on fixed income. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing strong c4% GDP growth and with room for more earnings upside surprises. Valuations have now fallen back to average levels, and are well supported by still-low bond yields and high company profitability. Fed interest rate risks are now well-priced. See cyclicals and value catch-up, after a decade of underperformance, whilst big-tech is supported by its structural growth outlook. Now see overseas markets leading. |

| Europe & UK | Region is being buffeted by proximity and exposure to the Ukraine crisis. See secure outlook with 1) Europe’s strong macro ‘buffers’ of rising fiscal spending (defence and refugees), zero-bound interest rates (‘dovish’ ECB), and a weak Euro (50%+ company sales from overseas). Equity markets helped by 2) a greater weight of cyclical sectors, and lack of tech, 3) 25% cheaper valuations vs US, 4) decade of underperformance make under-owned by global investors. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China outlook improving as cuts interest rates (opposite of rest of world) reducing slowdown and property sector risks, focuses on stability ahead of 20th Party Congress, and with valuations now 45% cheaper than US and market heavily out of favour. Will support EM, but is exposed to Fed tightening. China recovery also helps global sectors from luxury to materials. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, parts of consumer discretionary (Amazon, Tesla), dominate US and China. Expect more subdued performance as bond yields rise. But are structural stories with good growth, high margins, fortress balance sheets that justify high valuations. ‘Big-tech’ the new defensives. ‘Disruptive’ tech more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. But also sensitive to bond yields. Healthcare most attractive, with cheaper valuations, more growth, some cost protection. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead performance. Are most sensitive to re-opening economies, resilient GDP growth, and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and out-of-favour for years. |

| Financials | Financials will benefit from resilient GDP growth, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech themes. |

| Traffic lights* | Other Assets |

| Currencies | USD well-supported for now by rising Fed interest rate outlook and ‘safer-haven’ bid on virus fourth wave virus. This is likely more modest than prior USD rallies as rest of world growth recovers and virus fears ease. A strong USD traditionally hurts EM, commodities, US foreign earners, such as tech, but helps EU and Japan exporters. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | In ‘sweet spot’ of robust GDP growth, ‘green’ industry demand, years of supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil helped by slow return of OPEC+ supply and Russia 10% world supply problems. Gold helped by risk-aversion but held back by rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.